“Tesla has refrained from buying or selling any bitcoin for four consecutive quarters, maintaining a digital assets stash of $184 million. Accounting rules prevent asset valuation increase unless assets are sold, creating questions about Tesla’s conservative crypto approach amidst market volatility.”

Search Results for: tesla

Tokenizing Teslas: Decentralizing Car-Sharing through Blockchain and the Future of Web3

ELOOP, a Vienna-based car-sharing service, is tokenizing 100 Teslas via Web3 network peaq, allowing users to own a fractional part of the fleet and share generated revenue. This innovative approach decentralizes and democratizes car-sharing services, paving the way for blockchain integration in various industries and creating new opportunities.

Tesla’s Dogecoin Adoption: Boon or Bane for Crypto Market and Token Value?

A recent Twitter discovery revealed a dedicated page on Tesla’s official website focusing on Dogecoin payments, indicating Tesla’s recognition of Dogecoin as a legitimate payment option. The impact on DOGE’s value and the market remains uncertain, emphasizing the importance of cautious decision-making and thorough market research among investors.

Nvidia Surpasses Meta and Tesla: AI Boom Ushers in Golden Age or Pitfalls Ahead?

The rapid rise of Nvidia’s market capitalization and AI investment signals a turning point for the tech industry, transforming gaming through AI-powered tech like Nvidia Avatar Cloud Engine. However, potential consequences, ethical questions, and societal implications must be addressed alongside embracing AI-driven innovation.

Tesla Bots: A Leap Forward in Robotics or a Threat to the Workforce? Pros, Cons, and Conflicts

Tesla’s recent advancements in its humanoid robot project showcase impressive capabilities, such as walking steadily, object recognition, and manipulation. However, the integration of robots like Tesla Bots raises concerns about job displacement and workforce division. A balanced approach and proactive measures are essential to address the challenges while ensuring ethical and practical technology implementation.

Unveiling Kabosu: How Dogecoin Transformed Into Cultural Icon Amid Market Volatility

“Doge enthusiasts are raising funds for a bronze statue of Kabosu, the Shiba Inu dog behind the Dogecoin meme, with plans to unveil it on the dog’s 18th birthday on November 2nd. PleasrDAO, a collective of high-value NFT enthusiasts, is leading the effort. The event will offer unique opportunities for NFT owners, alongside a documentary tracking Kabosu’s life and the meme’s rise in popularity.”

Battling Deception vs Embracing Anonymity: The Digital Dilemma Surrounding Satoshi ‘X’

Crypto advocates are calling for Elon Musk to deregister a profile that falsely identifies as the Bitcoin pioneer, Satoshi Nakamoto. This profile, Satoshi ‘X’, is seen as deceptive, fascilitating potential misuse of identities. The debate raises issues of authenticity, operational integrity, and societal trust in digital currencies.

Draper’s Vision vs Reality: Bitcoin’s $250,000 Future Hindered by US Government Regulation

Tim Draper, a notable venture capitalist, contends that the U.S. government’s approach to blockchain regulation is obstructing the growth and adoption of this technology. Despite regret for his misfired prediction of Bitcoin hitting $250,000 by 2022, Draper sees a promising future for blockchain and crypto markets.

The Suspended Projection of Apple into Stock Trading Arena: A Revisit in The Making?

“In 2020, Apple and Goldman Sachs aimed to introduce a stock trading feature in Apple’s ecosystem. However, due to financial volatility, this was suspended. Despite Goldman Sachs pulling out of consumer banking, the groundwork for this feature remains, with potential for revisit. Incorporating stock trading positions Apple against established platforms like Robinhood, SoFi, and Square. Crypto trading expansion by these platforms indicates possibilities for future digital trading, but Apple’s participation is still uncertain.”

Google’s Digital Futures Project: A Beacon for Ethical AI or Deflection Strategy?

Google’s Digital Futures Project aims to promote the secure, responsible use of AI through research and collaboration with think tanks and academic institutions. However, skeptics question potential conflicts of interest, highlighting the need for transparency in its operations.

New FASB Standards Redefine Corporate Cryptocurrency Adoption: A Boon or a Bane?

“The Financial Accounting Standards Board (FASB) in the U.S. greenlit new standards requiring firms to apply a fair-value approach to certain cryptocurrencies. These standards promise more transparency for investors and could potentially facilitate broader corporate cryptocurrency adoption despite potential earnings volatility for businesses with substantial crypto assets.”

Bankrupt Crypto Lender’s Struggle to Recover Assets meets New Accounting Rules for Crypto-native Companies

The bankrupt crypto lender, Celsius Network, seeks to recover its properties from EquitiesFirst Holdings, following a failed collateral retrieval. Meanwhile, the Financial Accounting Standards Board approves the fair value of companies’ cryptocurrency holdings starting in 2025, generating mixed industry responses.

Implications of Cryptocurrency Inclusion in US Accounting Rules: The Triumphs & Tribulations

The adjustment to the FASB accounting rules extends fair value accounting to include cryptocurrency holdings, impacting all organizations that align with U.S. GAAP. This realignment redefines the understanding of discriminatory aspects like fair value, potentially encouraging more corporate adoption of crypto. However, the change also heightens the volatility risk in earnings.

Dwindling Exchange Balances Foreshadow a Maturing Cryptocurrency Market

“The shrinking balance of Bitcoin on centralized exchanges, now at its lowest in half a decade, could signal a new phase in the crypto market. This decreasing reserve signifies growing investor confidence in long-term prospects of cryptocurrencies and a trend towards self-custody. The changing paradigm necessitates exchanges to reevaluate their business models for maintaining profitability.”

Social Media Giant X Dives into Crypto: Speculations, Implications, and the Elon Musk Factor

“Social media giant, X, has earned a regulatory license to process cryptocurrency payments in the United States, by obtaining the Rhode Island Currency Transmitter License. This move, supported by several states, strengthens X’s potential to facilitate virtual transactions, possibly expediting the mainstream adoption of digital currency.”

Robinhood’s Alleged $3B Bitcoin Stake: Shaking Up Cryptocurrency Landscape or Inviting Risk?

“Robinhood, a digital financial services platform, has reportedly amassed $3B in Bitcoin within three months, making it the third-largest Bitcoin holder. If true, Robinhood’s involvement in the crypto market indicates that Bitcoin’s success is not solely dependent on large institutional investors, highlighting the potential influence regular traders can have on the cryptocurrency landscape.”

Navigating the Tokenization Wave: Growing Value and Unique Challenges in Blockchain-based Assets

Tokenization uses blockchain to monetize tangible and intangible assets, making them tradable and transparent. Despite cryptos’ ridicule for lack of tangible value, blockchain’s potential to transform assets is increasing. There’s even exploration of derivative, swap, and fixed income security systems. Companies like Pendle Finance and Dinari are demonstrating this potential, while concerns rise about tokenizing user engagement. Elsewhere, Central African Republic is aiming to tokenize its fiat money, a move that could inspire other countries.

Dinari Revolution: Embracing Blockchain Stock Tokenization Against Regulatory Challenges

“Dinari, a blockchain-based stock trading platform, has gained preliminary regulatory approval to tokenize stocks. This is a significant step forward in asset tokenization. Dinari’s plans are to simulate the US stock market within securities laws criteria.”

Presidential Hopeful Vivek Ramaswamy Banks on Crypto: Innovating Campaign Funding or Legal Liability?

“Up-and-coming US Republican presidential candidate, Vivek Ramaswamy, known for his pro-crypto stance, is accepting Bitcoin contributions for his campaign, reflecting the increasing influence of digital currencies in the financial landscape. However, his political journey faces potential setbacks due to legal issues with previous employees.”

Bitcoin’s Tumble in the Shadow of SpaceX: Evaluating Elon’s Crypto Influence

“A significant downfall in the crypto market, with over $1 billion in liquidations in 24 hours, is allegedly linked with Elon Musk’s SpaceX company and its reported “write down” in Bitcoin value. Amidst this chaotic market condition, the complex interrelation within the crypto universe is emphasized.”

Elon Musk’s Enigmatic Ventures into Cryptoverse: Impact, Uncertainty, and Infinite Possibilities

“The intriguing saga of billionaire wunderkind, Elon Musk’s unpredictable ventures into the crypto landscape continues, with revelations of his company SpaceX’s discreet disposal of approximately $373 million worth of Bitcoin. Despite a volatile market, technology and financial institutions remain unfazed by blockchain technology’s potential risks and uncertainties, appreciating its futuristic vision.”

Twitter to X.com: The Great Migration of Crypto Enthusiasts and the Rise of Decentralized Platforms

“The rebranding of Twitter to X.com signals a shift in the cryptocurrency and social media worlds, spurred by Elon Musk. However, its decline and restrictive actions are leading crypto enthusiasts to consider alternate platforms, indicating a complex transition underscored by the importance of personal networks accrued over time.”

The Cryptosphere Revolution: How Elon Musk’s Vision for Twitter Could Reshape Crypto Payments

Tech billionaire Elon Musk’s vision of transforming Twitter and its potential of becoming a platform for payments, including cryptocurrency, has sparked speculation. Despite questions about Musk’s commitment to promoting crypto, incorporating crypto payments into Twitter might indicate a wider use initiation.

Dogecoin’s Unexpected Surge: Twitter Rebranding Effects and Market Instability Ahead

“Dogecoin (DOGE) recently experienced a 10% hike, seemingly due to trading activity on South Korean exchange UpBit. Speculation surrounding Twitter’s rebranding to the app X accepting DOGE payments seems to fuel the surge. However, these developments pose questions about stability in the volatile crypto market.”

Elon Musk’s Cryptic Cues: Dogecoin & Twitter’s Future or Hype Amid Binance Legal Challenge?

Elon Musk’s Twitter profile update led to speculations that Dogecoin might play a part in Twitter’s future payment infrastructure. It suggests that Dogecoin might give Musk “zero execution risk” and assist global payments. However, experts advise caution amid such speculations and urge to focus on long-term market trends.

Elon Musk’s Latest Venture Fuels Crypto Speculation: Dogecoin and Bitcoin Take Center Stage

“Elon Musk’s latest venture “X” may transform Twitter into a global marketplace driven by AI, accepting both fiat and crypto transactions. Dogecoin and Bitcoin, both closely tied to Musk, pose potential trading opportunities. Yet, investing in crypto remains a high-risk activity.”

Arkham Intel Exchange: A Peek into the Blossoming Bounty Marketplace and Emerging Controversies

“Arkham Intel Exchange, a crypto intelligence bounty marketplace, sees active interaction with the majority bounties from Tron DAO and Arkham Admin. Bounties emphasis on identifying public addresses and associating with larger assets. However, its practice of incentivizing identification of individuals behind anonymous blockchain addresses faces criticism.”

Cryptocurrency Market: Navigating the Storm Amid Bitcoin’s Price Instability and Fear Index

Bitcoin’s price struggles around $30K, reflecting apprehension in the market. External factors like Elon Musk’s comments and a strengthening dollar impact both Bitcoin and the wider crypto market. Additionally, other key cryptos experience a downward trend, except LINK from Chainlink due to an interoperability protocol release. This uncertain climate highlights an interesting interplay between traditional and digital financial worlds.

Crypto Market’s Uncertain Waltz: Bitcoin Dances with Decline, Chainlink Surges Amidst Musk-Linked Sell-Off

On Thursday, Bitcoin and Ethereum experienced a downward slide, with Bitcoin grappling with the $29,500 level. Meanwhile, Chainlink’s LINK saw a 15% surge after unveiling a new interoperability protocol, highlighting the evolving dynamics within the crypto sphere.

Rising Against the Odds: The DOGE Rally and the Implication of Cryptocurrency Presales

“In recent trading, DOGE has outperformed the broader crypto market, including Bitcoin and Ether, with a 3.5% increase. Despite Elon Musk’s endorsement, DOGE’s future remains uncertain as formidable resistance looms. Investing in DOGE carries inherent risk, so diversification and caution are advised.”

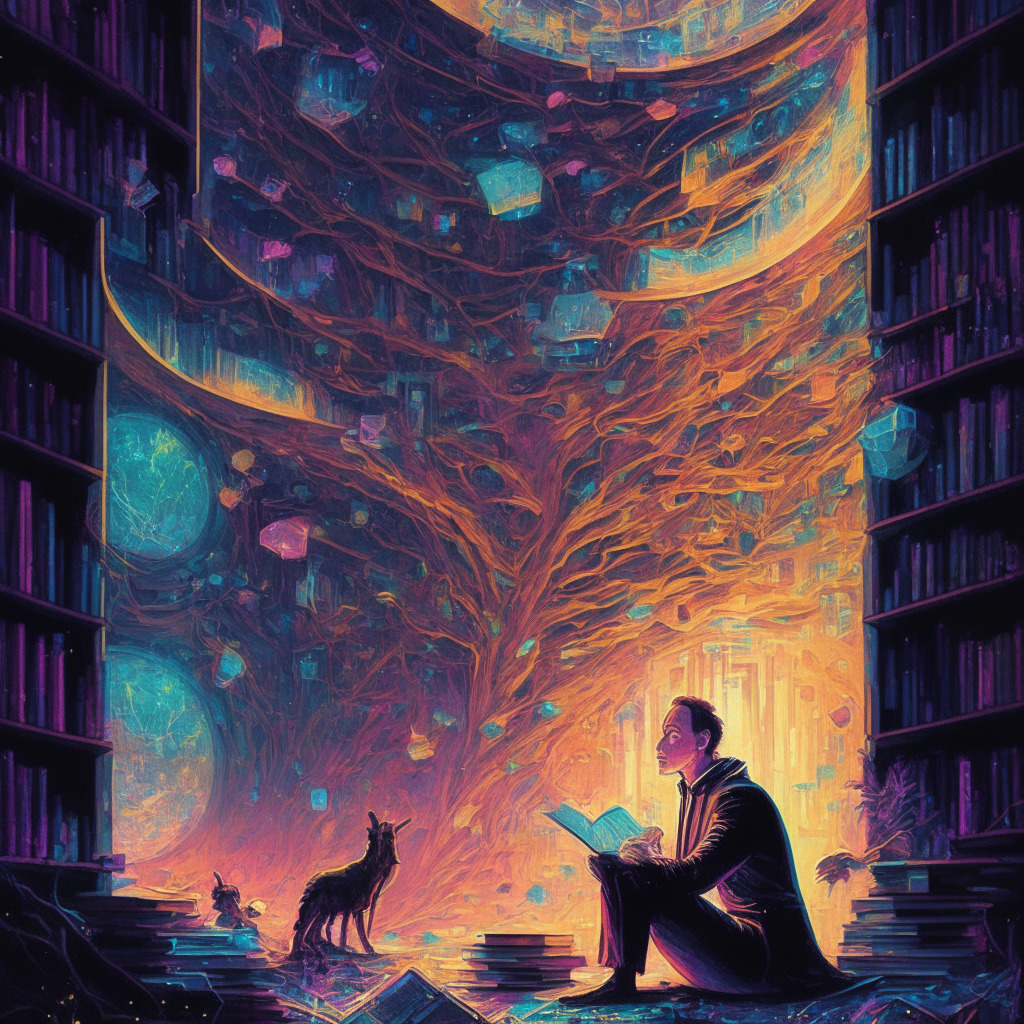

Unveiling the Future of Blockchain: Disruptive Force or Privacy Threat?

“Blockchain technology, despite skepticism and several hurdles like user apprehensions, regulatory uncertainties, and scalability issues, is seen as the future of secure data management. It promises decentralization, transparency, and immutability, which can boost consumer trust and reduce costs. However, it must overcome vulnerabilities, privacy and security concerns, and regulatory uncertainties for wider adoption.”

Green Blockchain: Shaping Bitcoin Mining Towards Greater Sustainability and Fewer Emissions

“Bitcoin mining, criticized for high power consumption, might be becoming environmentally sustainable. Initiatives include utilizing hydro-cooling mining farms, small hydropower plants, and prevention of gas flaring in oil drilling. This transition, along with migration to countries offering cheaper renewable energy, could redefine Bitcoin mining’s environmental impact.”