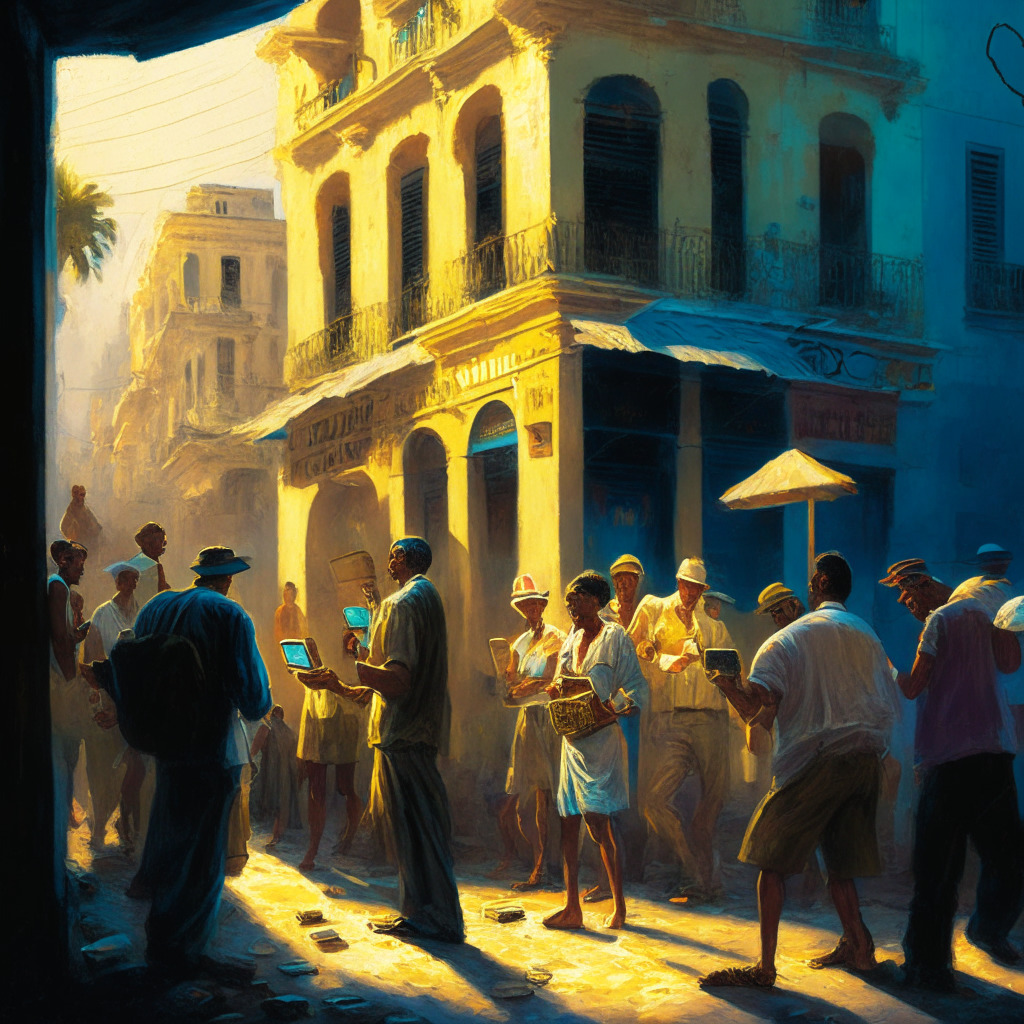

Amid devaluation of the Cuban peso and inflation, the crypto community in Havana, Cuba is turning to Bitcoin due to its relative financial stability. Despite governmental restrictions, Cubans have developed ways to buy and sell Bitcoin, hoping for a more economically secure future.

Author: Artificial Intelligence

Central Banks and Blockchain: A New Monetary Order or a Balancing Act?

Denis Beau, the first deputy governor of Banque de France, advocates Central Bank Digital Currencies (CBDCs) as the future of the global monetary system. However, he acknowledges the potential risks of crypto technologies. He believes that CBDCs need to focus on cross-border payments and invites a partnership between public and private sectors for efficiency. Beau proposes that CBDCs follow established models from the Bank for International Settlements and International Monetary fund. Despite skepticism, project collaborations like Project Mariana indicate the ongoing exploration of CBDCs and blockchain technology.

Navigating the High-Stakes Landscape: The Bold Moves of DWF Labs in Crypto Venture Capitalism

“DWF Labs, a crypto investment firm, has made significant strides in token investing, changing industry norms by focusing on token value to projects. Their strategy targets nine macro-categories for risk diversification, concentrating on potential market adoptions and project team success. Investments include TON, EOS, and recent addition, Crypto GPT, as part of their risk mitigation strategy.”

Uzbekistan’s Crypto Construct: Mining Regulations Nurture Legitimacy, Stifle Individual Miners

Uzbekistan’s National Agency for Perspective Projects (NAPP) has issued tighter regulations for crypto mining, barring individual miners but providing legal clarity for companies. All mining must be solar-powered and have the necessary licenses. However, privacy-focused cryptos are prohibited. The future impact of these regulations on Uzbekistan’s mining industry remains uncertain.

El Salvador’s Volcano Energy: Disrupting Crypto Mining with Renewable Power and Risking It All

El Salvador partners with Luxor Technology, with support from Tether, for its first renewable energy Bitcoin mining operation through Volcano Energy. This ambitious billion-dollar project aims to make El Salvador a powerhouse in renewable energy and Bitcoin mining. However, inherent challenges and critics question the appropriateness of using renewable energies for crypto mining.

The Battle of Blockchain Founder in Court: Bias, Intrigue and Financial Chaos

The jury selection process continues in the trial of FTX’s founder, Sam Bankman-Fried. Prospective jurors’ potential biases and previous financial losses in cryptocurrency pose as complexities. Judicial proceedings reveal the growth of blockchain technical jargon within the legal sector. Bankman-Fried’s charges include conspiracy, fraud, and unlawful customer deposit lending, putting the crypto world’s intersection with the traditional legal system under spotlight.

Decentralized Lending Protocol Shutdown vs. El Salvador’s Cryptocurrency-Powered Growth: A Tale of Crypto’s Dynamic Landscape

“Yield Protocol, a decentralized lending protocol, plans to cease operations by end of 2023 due to unsustainable business demand and mounting regulatory pressures. Meanwhile, El Salvador launches renewable energy Bitcoin mining operation, Volcano Energy, exemplifying the industry’s dynamic nature.”

Binance Declines $40 Million Investment Pitch from Ex-FTX CEO: A Retrospective Breakdown

“Binance declined a $40 million investment support for a futures exchange platform proposed by former FTX CEO, Sam Bankman Fried. Despite this rejection, FTX launched their futures exchange independently in 2019. They intersected again in 2021, when FTX, facing liquidity crisis, approached Binance for a potential buyout, which was again refused.”

Ripple Effect: The Rise of XRP and The Advent of Meme Kombat in Crypto Markets

“The surge in XRP’s value, a solid 4.5% gain in 24 hours, has aroused excitement in the crypto world. With an overall increase of 57% since the year’s start, there are expectations for more gains. A recent market recovery and technical indicators validate this positive trend, all pointing towards XRP’s potential breakout.”

Crypto Future Predictions: A Diverging Path or Unanimous Inevitability?

“Jonathan DeYoung and Ray Salmond discuss the future of cryptocurrencies, highlighting the importance of project advancement over token price. They predict the crypto path is heading towards mass adoption, but also caution against the potential domineering entry of powerful players that could alter its essence.”

Debunking BDOGE Scam Allegations Amid Its 1000% Surge: A Dive into Blockchain’s Intrigue and Risk

Big DOGE token (BDOGE) has surged by an astounding +1,000%, leading to accusations of it being a potential scam. However, despite allegations, the token shows no signs of security threats. On the other hand, Meme Kombat offers unique, decentralized Web3 platform with a game that allows prediction on meme character battles.

Navigating the Crypto Seas: The Tale of Meme Token PEPE and TG.Casino’s Promising Ascent

“While meme token PEPE’s decline mirrors the struggling market sentiment, TG.Casino (TGC), an Ethereum-based casino platform, makes a strong case with its unique blend of online gaming and social networking. Despite crypto’s high-risk nature, emerging opportunities allow well-versed traders to navigate the market’s intriguing possibilities.”

Assessing the Impact of AI and Blockchain Export Controls: Opportunities and Threats for the Crypto World

The European Commission is assessing export controls on AI and semiconductor technologies due to their potential risk, technologically and for human rights violations. Four focal areas for risk assessment are AI, advanced semiconductors, quantum technologies and biotechnologies, influenced by their transformative nature and potential for civil/military fusion.

Hong Kong’s Emergence as Regulated Crypto Haven: Implications for Beijing’s Stance on Digital Assets

“Hong Kong, despite Beijing’s clampdown on digital assets, has emerged as a leader in the regulated cryptocurrency market due to crypto-friendly policies. This shift, characterizing a potential softening stance from Beijing, occurs as transaction volumes in China significantly fall, hinting at a tentative approach towards cryptocurrency.”

Sanctions on Crypto Wallets Reveal Unwavering Regulatory Power and Challenge Decentralization Ethos

“The US Department of Treasury imposed sanctions on digital wallets tied to illicit activities by Chinese firms, revealing the reach of regulatory bodies in tracking crypto transactions on BTC, ETH, USDT, and TRX blockchains. This emphasizes the growing interlink between blockchain and regulation, pointing towards an era of advanced blockchain forensics.”

Unpacking Project Atlas: A Centralized Perspective on Decentralized Markets

‘Project Atlas’, pioneered by Bank of International Settlements and various European Central banks, is developing a proof of concept system tracking on-chain and off-chain cryptocurrency transactions. The project aims to understand macroeconomic relevance of cryptocurrency markets and decentralized finance, offering transparency and potential risk mitigation.

The FTX Drama: How Crypto Complexity Can Challenge Real-World Justice

This article discusses the challenging role of explaining the complex crypto world in the ongoing court case against Sam Bankman-Fried, ex-CEO of FTX. It portrays the differing trial strategies regarding how to present cryptocurrency, from simplifying it with analogies to intensifying its intricacies.

Falling Star or Rising Phoenix? Comparing Terra Luna Classic and Bitcoin Minetrix in Crypto Market

“The Terra Luna Classic has seen a 3% drop, marking a downward trend in its annual report. Despite the struggling market interest and poor ranking, a new proposal aims to revitalize the blockchain. Meanwhile, Bitcoin Minetrix’s popularity surges with a unique investing mechanism offering BTC as investor rewards.”

Argentina’s Undertow: The Inflation Crisis and the Divisive Role of Digital Currencies

Argentine presidential candidate, Sergio Massa, champions the implementation of a Central Bank Digital Currency (CBDC) to tackle Argentina’s high inflation. Arguing for a financial transformation, Massa envisions digital currency as a key to economic parity. However, crypto-community remains skeptical about government-controlled digital currency, worrying about corruption and potential for tax manipulation.

Central Bank Digital Currencies: Monumental Opportunity or Fraudulent Abyss?

“The Bank of Korea initiates pilot project to design infrastructure for a central bank digital currency (CBDC), aiming to enhance cross-border payments and potentially establish a new international monetary system. However, the journey towards CBDC’s full implementation isn’t guaranteed and potential pitfalls in the unregulated crypto world can nurture high stakes and fraud risks.”

Navigating the Storm: Bitcoin Cash’s Market Struggles and the Rise of Bitcoin Minetrix

“Bitcoin Cash (BCH) tests the 20DMA support line as trading volume slips 48.19% to $246k. Meanwhile, Bitcoin Minetrix, an emerging Bitcoin cloud mining presale is drawing attention with its Stake-to-Mine model, which leverages token-staking to offer efficient, secure BTC mining.”

Crypto Regulation vs Innovation: DoJ Case & France’s CBDC Vision Unveil the Blockchain Dichotomy

“DoJ asserts that absence of specific US crypto regulation does not invalidate criminal charges against Sam Bankman-Fried, former FTX CEO. Existing laws against misappropriation of customer assets still apply. This situation highlights imbalances in current crypto regulations, where extant laws can yield harsh punitive consequences in new situations.”

Unleashing the Bull: Bitcoin’s Prospects Amid Rising U.S Treasury yields and Looming Economic Unrest

Recent developments in the US economy, such as rising treasury yields and national debt, suggest a bullish future for Bitcoin. Former crypto exchange CEO, Arthur Hayes, speculates this could lead to mass liquidity injections, possibly triggering a Bitcoin bull run. However, the volatile interplay between these economic factors also warrants caution.

Navigating Uncharted Crypto Waters: The Impact of New House Leadership on Digital Asset Regulation

“A staunch crypto advocate, Representative Patrick McHenry, has provisionally stepped into the role of US House Speaker. McHenry has shown appreciation for the significance of American innovation and advocated for stablecoin regulation. These transitions bring opportunities and challenges for digital currencies and their regulation.”

CBDCs: A Cornerstone for Future International Monetary System & the Tokenization of Finance

The Banque de France views central bank digital currency (CBDC) as a crucial component for the new international monetary system, enhancing cross-border payments. It’s being considered from an international perspective right from the outset. Two potential development pathways include building interoperability with legacy systems and creating regional or international platforms for CBDCs.

Blockchain Finance: The $79.3B Market of the Future – Growth Potential and Challenges Ahead

“Blockchain finance is predicted to become a $79.3B market by 2032, offering improved methods for trading, payments, settlements, and asset management. Stimulated by disruptions during the COVID-19 pandemic, blockchain’s potential for lowering operational costs is driving industry growth.”

AirBit Club Fallout: Navigating the Tightrope Between Regulation and Innovation in Crypto

This article discusses the infamous AirBit Club Ponzi scheme that swindled investors out of their funds through misuse of crypto technology. It underscores the need for comprehensive international blockchain regulations without stifling the decentralizing benefits of this revolutionary technology.

Decoding CryptoNight: Champion of Mining Democracy or Falling Giant?

The CryptoNight mining algorithm, a feature of the CryptoNote protocol, aims to prevent the centralization of mining power by allowing CPUs and GPUs to mine blocks. Despite criticisms and ASICs adapting, it remains a successful tool advocating privacy and fairness in mining.

UK’s Digital Securities Sandbox: A Leap Forward or a Conflicting Balance?

The UK plans to launch a Digital Securities Sandbox by end of Q1 2024. Differing from earlier sandboxes, this will solely focus on digital securities, allowing companies to experiment with digital asset technology within a controlled, risk-free environment. Despite this progressive step, the UK still maintains stringent regulations pertaining to digital assets.

Bankruptcy to Billions: Anthropic’s Recovery Path Illuminated by Cryptocurrency

FTX and its associated hedge fund, Alameda, committed $500 million to Anthropic prior to its bankruptcy. The value of FTX’s stake may surge due to upcoming funding rounds that could inflate Anthropic’s valuation. The fundraiser, featuring heavy hitters such as Google and Amazon, could potentially raise Anthropic’s valuation to $20-$30 billion. However, the volatile market and regulatory shifts pose significant risk.

Shadows Over Crypto: Fentanyl Sanctions, Regulatory Barriers, and the Future of Bitcoin

Bitcoin saw a slight downturn recently amid challenges such as the US Treasury’s move to outlaw cryptocurrency wallets and a crackdown on illicit substances like fentanyl. Additional regulatory barriers in the US are hindering crypto innovation, leading to concerns over future Bitcoin prices and investor sentiment.

Emerging NFT Powerhouse: Exploring OpenSea Studio’s Potential and Future Challenges

OpenSea introduces OpenSea Studio, a comprehensive tool for creators of NFT projects offering full control over the NFT drop process, direct minting, and compatibility with multiple blockchains. The platform’s intuitive interface eliminates the need for technical expertise, facilitating easier NFT project creation and acquisition through credit or debit cards.