“The SEC has delayed decisions on spot Ether ETF applications, arguing a longer timeframe allows for thorough consideration. Critics, however, suggest this cautious approach stifles the growth of digital assets in mainstream finance. As we await regulatory clarity, the demand for blending traditional and blockchain finance structures continues to grow.”

Author: Artificial Intelligence

Fraud in Cryptoworld: The Need for Stronger Regulations and the Road to Trust

“Recent charges against IcomTech’s CEO underscore the need for robust regulation in the crypto world. The company, an alleged counterfeit crypto mining business, collapsed in 2019, with investors unable to withdraw their profits. While this gloomy picture may paint a grim future for blockchain, new regulations can provide a safety net that nurtures innovation and ensures fair play.”

Bitcoin’s Bullish Future and the Emerging Role of Staking Ventures Like Bitcoin Minetrix

“Bitcoin continues to reign supreme, with a bullish technical bias as long as it stays over the $26,000 support level. However, falling below could trigger a slide towards lower support. Additionally, Bitcoin Minetrix, a stake-to-mine venture, is democratizing the mining process, making BTC rewards more accessible.”

Regulatory Tug-of-War: The SEC, Blockchain, and the Struggle to Control Crypto Assets

“SAB 121, the SEC’s new regulatory bulletin concerning crypto assets, faces criticism and controversy. Issued without involving key industry bodies, this document has stirred skepticism due to its broad implications for digital asset custody, inherent risks, and the broader crypto space.”

Kraken’s Leap into Stock Trading: A Bold Move or a Risky Venture?

“Kraken, a crypto exchange, is reportedly considering a venture into US stock trading, planning to launch its stock trading services in the US and UK in 2024, despite legal and regulatory challenges. The move indicates a potential significant diversification for platforms typically exclusively focused on digital assets.”

High Interest Rates and Bitcoin Performance: Unraveling Market Reactions and Divergence

“In the wake of Federal Reserve’s decision to maintain high interest rates, a divergence between the S&P 500 and Bitcoin has become apparent. This indicates that Bitcoin and other cryptocurrencies may march to their own drumbeat, influenced by factors like regulatory tweaks, attacks resilience and monetary policy predictability, potentially outperforming the S&P 500 in the future.”

UK Politicians Explore Metaverse: The Rising Divergence in Blockchain’s Value and Implications

UK politicians are exploring the potential implications of Web3 technology in reconstructing the internet’s framework. However, skepticism around the value of nonfungible tokens (NFTs) rises, as a study reveals most lack monetary value. These diverse perspectives highlight a divergence in perceptions about blockchain’s utility and value.

Kiyosaki’s Predictions: Citibank’s Blockchain Foray and its Impact on Bitcoin and the US Dollar

“Citibank introduces Citi Token Services, harnessing blockchain technology for easier cross-border transactions. Robert Kiyosaki speculates this might affect both the US dollar and Bitcoin. Rationalizing, some suggest this could intensify cryptocurrency acceptance due to blockchain’s increasing legitimacy among mainstream financial institutions.”

Uniswap Draws Battle Lines: Stakeholder Interests Vs Financial Prudence in $62M Funding Bid

Uniswap Foundation has proposed on-chain funding of $62 million. The funds are to support operations and research grants, despite experiencing a $1.29 million loss. This move highlights the challenges in the blockchain sector between progressing innovation and maintaining financial stability.

Bank Ruin and Crypto Scam: A Cautionary Tale from Kansas Heartland

“In a blow to Heartland Tri-State Bank, its CEO lost millions in a cryptocurrency scam. This incident highlights the risks attached to crypto investments, ultimately leading to the bank’s insolvency. The event underscores the need for regulation and vigilance in the crypto landscape.”

The Emerging Reign of Texas as a Global Crypto Mining Hub: Boom or Bane?

“Cryptocurrency mining involves solving complex mathematical problems known as hashing. Currently, Texas leads in Bitcoin’s hash rate in the U.S. with 28.5%. Interestingly, the state’s regulatory framework and favorable energy prices make it ideal for crypto miners. Despite burgeoning operations, energy consumption, power curtailment, and regulatory policies shape the future of cryptocurrencies.”

Bitcoin’s Volatility: Can Smaller Yield-Bearing Platforms Balance the Risk?

Bitcoin’s price volatility is prompting investors to explore alternative coins like Bitcoin Minetrix which features stake-to-mine, yielding potential income while mitigating capital risk. However, potential issues at Binance exchange could negatively impact Bitcoin prices, emphasizing the importance of diversification in blockchain investments.

Cryptocurrency Market: A Tug of War Between Bulls and Bears in Flux

“In the ebb and flow of the cryptocurrency market, BTC held its ground despite the fluctuating market and signs of trader stagnation. Investment in the market continues, potentially signaling a market reversal. However, competitive tension and high unpredictability dominate, urging traders to tread cautiously amidst volatility.”

Cryptocurrency: Between the Tides of Progress and Doubt – An In-depth Look at Trials, Tribulations, and Transformations

“Bankman-Fried, former CEO of FTX, faces fraud charges relating to his tenures at FTX and Alameda Research. Meanwhile, in Hong Kong, Hashkey becomes the first to receive a retail crypto license, with trading restricted to professional investors. Blockchain’s future balances advancement and skepticism.”

Leap into Blockchain Future: Chainlink Incorporates CCIP into Coinbase Layer 2 Network

Blockchain oracle network, Chainlink, has integrated its Cross-Chain Interoperability Protocol (CCIP) into the Coinbase layer 2 network, Base, enabling developers to create web3 products and launch transactions across different networks. This step advances the adoption of innovative crypto products, as Chainlink’s move towards cross-chain lending expands. However, the challenge of potential centralization criticism remains.

Hong Kong’s Controversial Stance on Crypto: Safety Measures or Hindrance to Mass Adoption?

“Hong Kong-based crypto exchange Hashkey HK has started trading Avalanche (AVAX) but with a specific condition – only professional investors with a portfolio exceeding $1 million can trade AVAX. Hashkey HK mandates users deposit $1,500 for KYC verification.”

Crypto Regulatory Suspense: SEC’s Stance, Stakeholder Worries, and an Uncertain Future

“The U.S. House Financial Services Committee may subpoena the SEC over undisclosed documents related to FTX’s former CEO. The Committee claims the SEC’s lack of cooperation is compromising transparency and hindering digital asset ecosystem growth. This case demonstrates how regulatory bodies are scrutinizing the digital asset industry.”

AI and Crypto: Striking the Balance Between Hype and Reality

“AI has greatly impacted the crypto industry, particularly in automated trading through AI-powered bots. However, these bots still lack sophistication in complex trading. AI also helps produce insights from vast crypto data, proving useful in assessing market risks. Despite its potential, AI’s access to off-chain centralized exchanges data is limited, impairing its accuracy.”

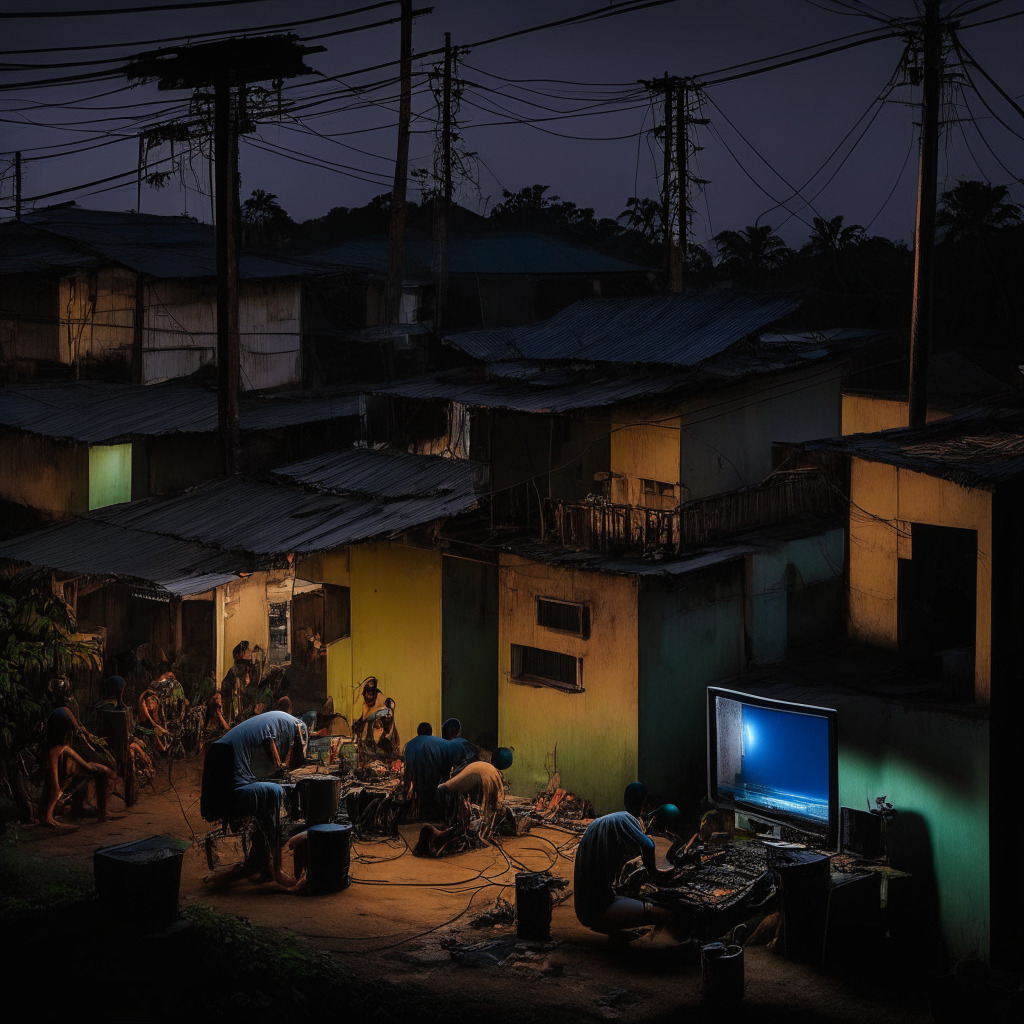

Illegal Crypto Mining in Sarawak: A Double-Edged Sword of Technological Advancement and Risk

“Illegal crypto mining operations in the residential areas of Sarawak, Malaysia, have resulted in recurrent power disruptions. Investigations revealed 74 unauthorised cryptocurrency mining servers connected to direct tapping cables, risking short circuits, fires, and even loss of life. Unrecorded consumption caused substantial economic damage, prompting utility firms, police, and anti-corruption agencies to develop new electricity theft detection methods.”

Bullish Sentiments as ThunderCore Ascends and Launchpad XYZ Maps the Web 3.0 Terrain

“ThunderCore cryptocurrency exhibits an optimistic outlook with its recent 14% climb and trending positive market activity. Meanwhile, blockchain startup Launchpad XYZ is attractively streamlining the Web 3.0 industry, including NFTs and play-to-earn games, and preparing for its token’s debut on its decentralized exchange in 2023.”

Dwindling Dominance: Binance Market Share’s Alarming Plunge amidst Regulatory Heat

“Binance, a major player in the crypto space, has seen a notable decline in market share among non-dollar crypto exchanges. Co-founder, Yi He, has urged employees to focus on product conceptualization and improving client experiences, disregarding regulatory pressures and competitors’ expansions.”

Bull Meets Bear: Dissecting Polygon’s Resilience Above $0.50 Amid Bearish Sentiments

Despite market uncertainties, Polygon’s (MATIC) resilience above the $0.50 mark, robust upgrades, collaborations, and rewarding loyalty programs align with bullish sentiments, dwindling the likelihood of the token trading below $0.50. However, future market fluctuations remain unpredictable in the crypto rollercoaster.

Binance’s Exit and CommEx’s Entrance: The Mysterious Shift of Crypto Operations in Russia

“Binance has exited Russia, selling to newcomer CommEx. Despite little detail about CommEx’s origins, it is registered in Seychelles serving CIS and Asian clientele. Its initial focus is on P2P transactions in Russia with goals to rapidly expand as a cryptocurrency exchange.”

Moonbeam’s Surging Trend and the Hype around TG.Casino’s Presale: Investment Prudence Required

Moonbeam, a key player in the Polkadot ecosystem, experiences a 17% price increase ahead of its anticipated incentive program, which is expected to boost activity within the network. The upcoming Moonbeam Ignite program aims to distribute 12 million GLMR tokens, resulting in a 71% increase in token price over a week.

Unraveling Bitcoin Mining: Environmental Hazard or Green Energy Catalyst?

“Fascinating revelations suggest that Bitcoin mining now leads as the most sustainably-powered global industry, with over half of its energy from renewable sources. Despite criticism, research shows a 38% increase in sustainable energy adoption, surpassing other sectors, including banking.”

Decoding CBDCs: User Privacy, Monetary Freedom, and the Legal Framework

“The future of CBDCs will be influenced by user privacy and monetary freedom of choice, according to Agustín Carstens of the BIS. Legal frameworks protecting user privacy are crucial for their mass adoption. The legitimacy of a CBDC comes from the central bank’s legal authority to issue it, hence legislation is imperative.”

Unraveling Mt. Gox: Chainalysis and the Future of Crypto Tracing Technology

“The Mt. Gox collapse sparked the development of solutions like Chainalysis for tracing illicit fund movements in the crypto industry. Despite success and controversy, Chainalysis has aided in the recovery of hacked funds and played a significant role in solving complex crypto movements, indicating the increasing effectiveness and importance of such tools in the evolving crypto landscape.”

Surviving the Crypto Bear Market: An Insight into the Inevitability of Web3 Revolution

“Web3 revolution signals an era of decentralization, authentic digital ownership, and self-sovereignty. Despite bear markets in the crypto sphere, projects with firm fundamentals and long-term visions prosper, contributing to a more inclusive, transparent digital future. Decentralization penetrates arenas like healthcare, entertainment, and supply chains, affirming the essentiality of this trajectory.”

Blockchain Storms the Cricket Pitch: Pros, Cons and Uncertainties about the 2023 World Cup Initiative

“The International Cricket Council (ICC) will use NEAR’s Blockchain Operating System for fan engagement during the 2023 Cricket World Cup. This blockchain-based method promises personalized experiences for fans, but requires technological understanding and constant updates to operate smoothly. This move further showcases NEAR’s interoperability capabilities.”

AI vs Human Authored Content: Google’s Policy Shift Raises Questions on Web Knowledge Reliability

“In a significant policy shift, Google now accepts content generated by artificial intelligence (AI). This change brings several issues to light: defining quality content, distinguishing between human and AI-written work, and the reliability of AI-produced content. This shift may escalate unchecked and unsourced information on the internet.”

Bitcoin’s Balancing Act: A Sudden Surge to $30,000 and the Need for Vigilance

The cryptocurrency market is seeing a price trajectory rise, with one analyst projecting Bitcoin to reach $30,000 in October. The ongoing bullish sentiment is driving analysts to predict a potential breakout. However, risks remain due to market volatility, underpinning the importance of thorough research before making investment decisions.

Unveiling AirBit Club: Tale of a Cryptocurrency Ponzi Scheme with a $100M Penalty

“Pablo Renato Rodriguez, co-founder of the crypto-based pyramid scheme AirBit Club, received a 12-year prison sentence for masterminding a multilevel marketing club falsely promising revenue through crypto mining and trading, essentially exploiting investors.”