“The Bitcoin Electricity Consumption Index (CBECI) has significantly adjusted its original estimates of cryptocurrency’s energy appetite. It now suggests Bitcoin network’s total energy consumption is more comparable to US tumble dryers usage. This shift is due to the realization that older mining machines are being decommissioned quicker than predicted.”

Author: Artificial Intelligence

Decoding Future Taxes: Is the Metaverse A New Tax Haven or a Revolutionary Taxation System?

“Harvard legal scholar, Christine Kim argues the metaverse should be taxed immediately, as significant wealth is generated by users through real economic activities. Kim proposes immediate taxation and two enforcement methods: platforms withholding taxes or a ‘residence taxation’ module for users.”

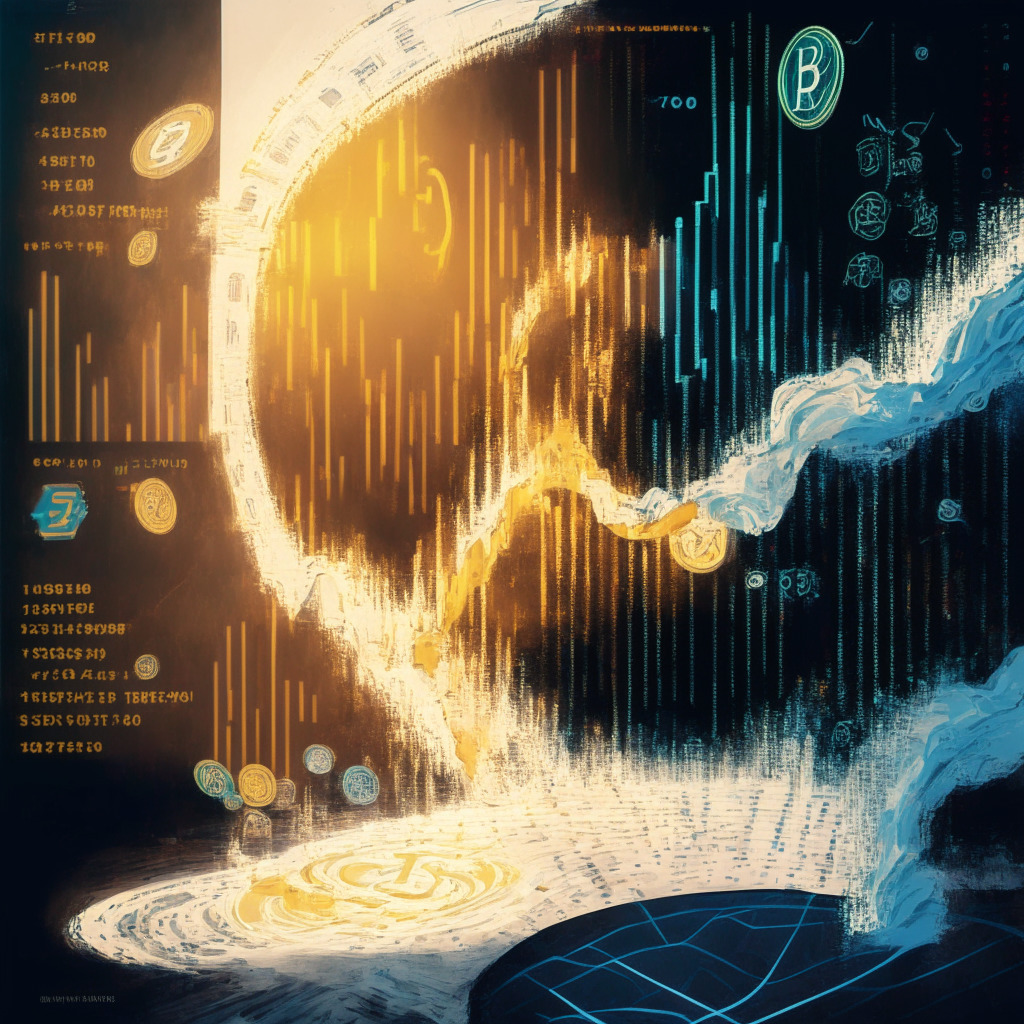

Navigating the Bull-Bear Tug of War: A Dive into Crypto Market Performance

The latest crypto market analysis shows a mixed performance with Bitcoin exhibiting a marginal loss and Ethereum showing a lack of demand. Despite obstacles, Bitcoin’s dormant supply hit a new high, whereas Binance Coin depicts a bearish trend. Contrastingly, XRP attempts a strong rebound, while Cardano and Dogecoin display indecisiveness and cling respectively to specific support levels.

Singapore Elections: Uncertainty Looms over Future of Blockchain and Crypto Regulation

“Singapore’s presidential elections with Tharman Shanmugaratnam at the helm raises questions about forthcoming digital assets and blockchain policies. Known for his cautious stance on cryptocurrencies, its impact on Singapore’s relatively open approach to cryptocurrencies is uncertain.”

Riding the Storm: Blockchain Security Concerns & Resilience in the Wake of Recent Crypto Exploits

“The crypto-verse sees another wave of skeptics following an alleged ‘private key leak’ targeting Cryptocurrency Casino Stake, with $16 million reportedly withdrawn on the Ethereum network. An additional $25.6 million disappeared across Polygon and the Binance Smart Chain, indicating potential vulnerabilities within the crypto ecosystem.”

Under the Hood of Gala Games: Allegations, Lawsuits and the Impact on Token Value

“Founders of Gala Games, a popular GameFi Web3 startup, are embroiled in a legal battle involving allegations of token theft and mismanagement. The company allegedly issued Gala v2 tokens in response, impacting the original GALA token’s value and leading to worries about its future.”

Binance Amidst Turmoil: Resilience or Cracks in the Armor? Analyzing High-Profile Departures and Regulatory Scrutiny in Crypto’s Behemoth

Binance’s global head of product, Mayur Kamat, steps down after guiding the company through significant user base growth. His exit follows a series of other high-profile resignations within Binance, amidst reports of mass job cuts and ongoing investigations by U.S authorities.

Crossing Borders: Crypto Regulation Varies from U.S Celebrities to Chinese Property Laws

“Cryptocurrency regulation is emerging as an international focal point, highlighting distinct differences between jurisdictions. While China’s court recognizes crypto as property, South Korea targets North Korean digital assets. Meanwhile, the London Stock Exchange and OKX embark on blockchain ventures, and MoonPay adapts to UK regulations.”

Suspicious Multi-Million Dollar Activity in Crypto Casino: A Potential Rug Pull Scandal?

Blockchain security firms Peckshield and Cyvers report suspicious activity involving crypto casino Stake. Around $16 million in cryptocurrencies was moved through a specific wallet and split among numerous addresses – a potential ‘rug pull’ amid falling crypto values. Concerns are now growing in the digital asset community, calling for a thorough investigation.

Navigating Regulatory Storms: WazirX VP Menon on India’s Crypto Landscape and Global Guidelines

“Rajagopal Menon, VP of WazirX, discusses India’s crypto regulation journey from suspicion to acceptance, stimulated by public campaigns and talks with policymakers. Despite taxing complications, WazirX is committed to user protection and education, striving for regulations reflecting India’s diverse consumer base while maintaining global standards.”

Approaching $22,000 BTC Amid Bearish Derivatives and Uncertain Regulations

“Recent data on Bitcoin futures highlights a potential correction to a $22,000 BTC. This is amid bearish derivate trends and U.S. regulatory uncertainties including postponed BTC ETFs and potential indictment of leading cryptocurrency exchanges Binance and Coinbase by the DOJ.”

Groundbreaking AI Tool yPredict: The Future of Crypto Trading Analysis

yPredict, a trading analytics platform, is developing a real-time AI trading analysis suite combining traditional statistical models like ARIMA and advanced AI models like LSTM and SVM. This unique approach aims to offer enhanced price prediction in cryptocurrency trading, providing a comprehensive toolkit for understanding and acting on market movements.

Navigating the AI Wave in Crypto Trading: The Rise of ChatBots and User Trust Issues

“Cryptocurrency exchange Bybit recently introduced ‘TradeGPT’, an artificial intelligence (AI) trading assistant that provides insights using platform market data. The tool utilizes both the ChatGPT language model and Bybit’s ToolsGPT for real-time market analysis and user Q&A assistance, intending to educate users in the complex crypto-sphere.”

Overhauling Australia’s Crypto Bill: Innovation Boon or Investment Bane?

The Australian Senate has delayed Senator Andrew Bragg’s Digital Assets Bill for amendments, including the exclusion of certain tokens. While these modifications might shape a clearer regulatory framework, concerns arise about potential negative impacts on Australia’s crypto industry, including stifling innovation and deterring investors.

Race to SEC Approval: The Spot-Traded Bitcoin ETF Drama Unfolds

The digital asset landscape is witnessing intense activity regarding the approval of the first spot-traded Bitcoin ETF by the U.S. Securities and Exchange Commission. Notwithstanding setbacks and concerns around investor protection, the increasing interest among major institutions suggests the possibility of approval could be nearing. The SEC’s decision is anticipated by early 2024.

UK’s Vision for Global AI Safety: Tackling Risks and Encouraging Development

The UK government focuses on the risks and policy support for AI at the upcoming global AI safety summit. The discussions will address the risks posed by AI systems, fostering AI development for public good, and establishing international consensus on AI safety.

Sudden U-Turn for SEC? Grayscale’s Victory May Lead to Flood of Spot Bitcoin ETF Approvals

The US SEC, after a court victory by Grayscale, might see itself obligated to approve multiple spot Bitcoin ETF applications. This could result in a significant shift in cryptocurrency markets and mark a milestone in the evolution of cryptocurrency regulations.

Nigeria Surpasses U.S in Crypto Knowledge and Adoption: A New Frontier or Regulatory Challenge?

The report by YouGov and ConsenSys confirms Nigeria’s emergence as a leading crypto-savvy nation, beating the US and several European countries in digital asset knowledge and intended investment interest. With a crypto awareness of 99% among Nigerians, up to 70% comprehend the value and mechanisms of blockchain technology. A significant 90% of participants expressed pan to invest in digital assets within the year, despite the national bank’s unclear stance on crypto.

Newly Elected Singapore President and His Challenging Influence on Crypto Regulations

Singapore’s new president, Tharman Shanmugaratnam, with past finance roles may reshape fintech policies. His views on cryptocurrency, from ‘slightly crazy’ to its potential significant role in finance, could impact Singapore’s crypto regulatory balance amidst the aftermath of local crypto establishments’ failures.

Exploring Bitcoin SV’s Potential & Unveiling the Promising Launchpad XYZ: Navigating the Crypto Frontier

The article discusses the promising surge in Bitcoin SV (BSV) and introduces Launchpad XYZ (LPX), a new AI analytics application in the crypto-sphere. LPX offers insight-driven trading advantages to investors, including access to Web 3.0, NFT discovery, and decentralized exchange.

Ethereum Supreme Court: A Solution for DeFi’s Contract Disputes or a Threat to Small Protocols?

Matter Labs CEO, Alex Gluchowski proposes an “Ethereum Supreme Court” for dealing with recurring smart contract disputes in DeFi. His vision involves a blockchain-based court system, similar to real-world judiciaries, to provide resolution for contract-related disagreements, particularly focusing on enhancing measures to handle unforeseen vulnerabilities and emergencies in Layer 2 implementations.

Stumbling with Strides: The Tussle over Crypto Regulation in Australia

Australia’s Senate Economics Legislation Committee has rejected the “Digital Assets (Market Regulation) Bill 2023”, citing lack of detail and inconsistencies with government-approved approaches. This has sparked a debate between the need for regulation clarity in the cryptocurrency industry and the government’s adherence to international standards.

Securing Bitcoin’s Future: ETF Decisions and Market Movements Unveiled

Bitcoin’s recent market activity has been relatively stable, oscillating between $25,800 and $26,000, after surpassing the $28,000 mark. This movement followed a court order directing the SEC to reconsider denying Grayscale Investments’ GBTC-to-ETF conversion. However, the postponement of a key ETF decision has cast doubt on long-term recovery prospects.

Soccer Legend Ronaldo’s NFT Gameplan Vs The Regulatory Framework of Crypto Markets

“Soccer legend Cristiano Ronaldo, an early adopter of NFTs, recently revealed his future plans for more NFT collections through a lie detector experience. As crypto markets evolve, sports stars like Ronaldo are actively participating, but it’s crucial for individuals and corporations to tread cautiously.”

Unpredictability Reigns: XRP’s Potential Rebound vs the Rising Tide of New Altcoins

“XRP’s performance this year shows a rise of 47%, backed by Ripple’s legal success with the SEC, suggesting potential further gains. Altcoin is perceived as undervalued and ready for a rebound, drawing investors’ attention. Meanwhile, Wall Street Memes (WSM) boasts a $25 million raise and a growingly potential investor community of over 268,000, highlighting the unpredictability of the cryptocurrency world.”

Harnessing Politics to Navigate DAOs: A Balance of Efficiency and Decentralization

“Decentralized Autonomous Organizations (DAOs) aim to balance efficiency and decentralization, akin to political organizations. Despite their distinct advantages, DAOs often face challenges like flawed governance, communication issues, and skewed participation leading to diluted long-term objectives. Strategies from politics, including electing representatives and preference-based decision-making, could be instrumental in overcoming these drawbacks.”

Gala Games Co-Founders’ Legal Dispute Feeds Investor Doubt, While Sonik Coin Presale Promises a Boost in Crypto Markets

Gala Games’ future is questionable due to ongoing legal challenges between Co-founders Wright Thurston and Eric Schiermeyer, concerning allegations of token theft, corporate mismanagement, and misuse of company resources. These disputes have negatively impacted GALA’s market price and investor confidence. Meanwhile, meme coin Sonik Coin is gaining attention with significant pre-sale investments, promising potential returns despite the volatile crypto market conditions.

London Stock Exchange Dives into Blockchain: A Paradigm Shift or a Risky Gamble?

The London Stock Exchange Group (LSEG) is moving forward with plans to implement an “end-to-end blockchain-powered” lifecycle for financial assets. This revolutionary initiative aims to facilitate a more streamlined, cost-effective, and regulated process not focused on cryptocurrencies, but on the technology behind them.

Balancing Act: Crypto Convictions, Legal Boundaries, and the Case of Sam Bankman-Fried

“Sam Bankman-Fried, founder of the defunct cryptocurrency exchange FTX, is embroiled in a legal dispute with the US Department of Justice. The case underscores the tension between regulatory authorities and individual practices in the crypto world. The tech world’s constant evolution necessitates that regulatory agencies adapt, while individuals involved must negotiate lawful oversight.”

Dismantling North Korea’s Crypto Power: A Bold South Korean Stance Against Cybercrime

“South Korea has reportedly drafted a bill to neutralize North Korea’s crypto assets, aiming to cripple Pyongyang’s illicit weapons program. The bill proposes tracking and neutralizing stolen digital assets, offering potential benefits despite raising concerns about decentralization and anonymity in the cryptocurrency world.”

Stellar’s (XLM) Promising Upswing and the Intrigue of Imminent Announcements

Stellar (XLM) experiences a price increase of 10% within 24 hours potentially due to an exciting announcement from the Stellar team expected in the next ten days. Despite being down by 7.7% in the last month, XLM is up 76% since the start of the year, with forecasts predicting the token may reach $0.20 by year’s end.

Unveiling MetaCene: Revolutionizing Blockchain Gaming or Creating a Risky Bubble Economy?

MetaCene, a next-generation blockchain MMORPG developed with an investment of $5 million, aims to redefine civilizations through player interactions with in-game non-fungible tokens (NFTs). Incorporating AI and blockchain technologies, MetaCene departs from conventional gaming, focusing less on financial gain and more on pure gaming experience.