The crypto market remains unstable as Bitcoin fluctuates beneath the $26,000 barrier. While potential drops towards $24.3k are predicted, the market’s course remains unsure due to inconsistent regulatory responses and market responses. However, a bullish comeback is also possible, but deemed “less likely”. Investments should be preceded by in-depth analysis and research to navigate the volatile cryptocurrency market.

Author: Artificial Intelligence

Financial Misconduct Scandal at Crypto Exchange FTX: Ripple Effect on the Crypto Industry

“Recent filings at the United States Bankruptcy Court indicate financial irregularities at crypto exchange FTX. Documents suggest misuse of company funds by executives, with transactions aimed to enrich the top brass at FTX and Alameda Research.”

Unpacking the Crypto Turbulence: Breakthroughs, Setbacks, and the Future Uncertain

“This week in crypto saw Grayscale Investments move closer to transforming its Bitcoin Trust into an ETF, despite SEC concerns. Meanwhile, turmoil rocked the BitBoy Crypto brand due to allegations against Ben Armstrong. The SEC delayed decisions on multiple Bitcoin ETF applications while Robinhood recovered 55M shares from ex-FTX CEO. These events underscore the balance needed between celebrating advancements and managing challenges in the blockchain and cryptocurrency world.”

Navigating the Future: Ripple vs SEC and the Implications on Crypto Regulation

“The ongoing Ripple versus SEC lawsuit opens up debates about future cryptocurrency regulations. Recent developments suggest that if token sales through exchanges are found not to infringe U.S securities laws, it could limit the SEC’s appeal scope and drive towards settlement, significantly influencing the future of crypto operations and security laws.”

Bitcoin’s Resilient Stand Against Bearish Momentum: A Market Overview

Bitcoin currently holds a value of $25,904.23, with an impressive $8.4 billion trading volume, making it king on CoinMarketCap. However, recent analysis points to a potentially bearish trend, suggesting investors closely watch the $25,400 pivot point for future Bitcoin trajectory.

Unmasking the Powerplay: The Convergence of Bitcoin and AI and the Surge of DeFi

“Cathie Wood, CEO of Ark Invest, and Changpeng “CZ” Zhao of Binance express optimism about the future of Artificial Intelligence (AI) and Bitcoin, and the potential of decentralized finance (DeFi). Despite high volatility, regulatory uncertainties and potential misuse of AI, Wood and Zhao see transformative potential and investment opportunities in these areas.”

Deciphering the Path to Digital Finance: DeFi Supremacy or CeFi Resilience?

“Binance CEO Changpeng “CZ” Zhao asserts that decentralized finance (DeFi) may surpass centralized finance (CeFi) in the next market buoyancy or ‘bull run.’ Despite holding only 5-10% of CeFi’s volumes, DeFi is poised for significant growth. Legal disputes involving centralized exchanges and the global push for cryptocurrency adoption contribute to this potential shift.”

Alameda Co-CEO’s Lavish Yacht Purchase: A Look at Cryptocurrency Transparency and Ethics

“The court documents reveal undisclosed financial transactions made by FTX and Alameda Research executives, including a $2.51 million yacht purchase. This raises questions about transparency within blockchain-based corporations. While crypto markets offer high rewards, the potential lack of regulations and transparency can be treacherous.”

Ripple’s XRP at a Precipice: A Deep Dive into Emerging Trends and Future Predictions

“Ripple’s XRP currently hovers at a tense $0.497, with speculations regarding whether its descent will persist or rejuvenate. The cryptocurrency is undergoing a consolidation phase, trapped between 0.4900 and 0.550011. Varied movements in factors like the RSI and MACD reflect this uncertainty. Projections suggest that if XRP tumbles below 0.4900, the next solid ground might be near 0.4500.”

Navigating the Ripple Effect: SEC’s Token Tug-of-War and Its Broader Implications

Ripple Labs objects to the SEC’s appeal of a judge’s ruling on the XRP token’s nature. The SEC wants to reclassify XRP as a security when sold to the public. Their appeal is paused until a resolution, highlighting the potential implications for future cryptocurrency lawsuits. Arguments involve whether selling XRP equates to an investment contract and jurisdiction over sales to institutional investors. Ripple’s response promises to challenge classifications of these sales as securities transactions.

Ethereum’s Staking Limit, Argentina’s Bitcoin Surge, and Blockchain Security: Weekly Crypto Roundup

“In an evolving crypto landscape, Ethereum staking providers limited their ownership to 22%, towards decentralization. Bitcoin adoption rises in Argentina contrasting El Salvador’s caution. Binance addresses regulatory environment while security concerns persist despite OpenZeppelin’s Defender 2.0 upgrade. NFTs, CBDCs progress, and stricter crypto regulations emerge.”

Blockchain Vs. Hollywood: Decentralizing the $200 Billion Streaming Video Market

“Blockchain-based video distribution could be a solution to the unbalanced value distribution in the streaming video industry. Replay, a decentralized streaming protocol, aims to bring fairness and transparency to content creators by utilizing blockchain’s traceability and accountability properties.”

Surging Waves in XRP Market: Major Transfers, Legal Fights and Potential Price Prospects

“In a swift series of events, the XRP cryptocurrency market experienced major activity, with 66,666,659 XRP transferred from Binance to an undisclosed wallet. This coincides with Ripple’s legal proceedings and its action of placing substantial amounts of XRP into secure escrow accounts.”

Two Key Paradigm Executives Step Down Amid Regulatory Standoff with SEC

“Paradigm’s CFO and General Counsel are set to step down, with Chief Legal Officer, Katie Biber, taking the legal reins. The firm challenges the SEC’s authority to regulate secondary crypto markets and advocates for penalizing companies that haven’t complied with existing regulations. This brings a needed discussion on crypto regulatory ambiguity to the forefront.”

Bitcoin Stumbles as Wall Street Memes Rise: Navigating the Crypto Rollercoaster

Bitcoin’s price fell over 5.5% following SEC’s delay on Bitcoin ETF application approvals. High volatility continues with emerging meme coins such as Shiba V Pepe (SHEPE) and Wall Street Memes (WSM). These developments evidence the evolving and high-risk nature of cryptocurrency investments.

Navigating Crypto Regulations: Binance Australia’s Unfolding Narrative Amid Trials and Triumphs

“Binance Australia faces regulatory challenges and halted transactions due to high scam risks. Despite this, they remain committed to working with local authorities and resuscitating services for their customers. The Australian Treasury seeks to establish a token classification framework by 2024, marking a significant step towards a regulated crypto market.”

UK Proposes Global Alliance to Combat Misuse of AI: The Power Struggle Unfolds

The UK’s Science, Innovation and Technology Committee advocates for a global alliance to tackle potential misuse of AI, involving democratically similar nations. A proposed summit could position the UK as a central regulation hub, outlining guidelines for AI security, innovation and cultural impact. Potential AI threats include deepfakes and misuse in weaponry development.

Navigating the Web3 Era: Exploring the Potential and Pitfalls of NFTs in Various Sectors

“Adidas has launched a digital artist-in-residency program in its Web3-based Triple Stripes Studio promoting creative talent within the NFT sphere. However, with the potential risks associated with Web3 and NFTs, volatility and speculation, thorough research and cautious participation are advised.”

MakerDAO’s Blockchain Future: Exploring a Forked Solana Codebase and Risks Involved

MakerDAO’s co-founder, Rune Christensen, proposes the use of a forked Solana codebase to build ‘NewChain’, MakerDAO’s prospective blockchain. Despite connections with Ethereum, this has generated interest and skepticism within the decentralized finance domain. This marks a possible change in direction for MakerDAO’s projects.

Infamous Chisel Malware: A Wake-Up Call for Crypto Security on Android Devices

New malware, Infamous Chisel, targets Android users involved in cryptocurrency transactions, extracting private keys and information from applications such as Binance, Coinbase, and others. Its ability to access extensive data, though not highly sophisticated, emphasizes the importance of robust security measures.

Bitcoin Plunge and Emerging Altcoins: Prospects and Pitfalls in Today’s Market

“The recent increase in Bitcoin’s exchange net flow coincides with a decrease in price, suggesting that long-term holders are selling their reserves. Also, a decline in Bitcoin velocity indicates a weak market. Analysts suggest seeking refuge in altcoins like PARROT, ANUBIS, and SOJU which are showing promising growth.”

Robinhood’s $605.7M Share Reclaim: Unraveling The Complex Tale of Bankruptcy and Legal Challenges

Robinhood’s $605.7 million share buyback agreement reclaims shares seized by the US government amid FTX’s bankruptcy—a move linked to SBF’s legal challenges and potential market shifts. It also underscores the intertwined nature of corporate separations, bankruptcy, and legal challenges in the crypto sector.

Ripple vs SEC Showdown: Debating XRP Token’s Status and Impact on Crypto Landscape

In Ripple’s ongoing legal tussle, their legal representatives dismissed an appeal by the US SEC on the status of its XRP token. This dismissal is based on a July court ruling stating the XRP token did not majorly qualify as a security for retail sales. The expected jury trial date for this lawsuit is set for 2024, suggesting potential long-term implications for Ripple and the broader crypto industry.

Revising Crypto History: Runefelt’s Battle between Reality and Attraction Law

Crypto influencer Carl “The Moon” Runefelt, previously claimed to be a co-founder of cryptocurrency payment platform Kasta, but now insists that he was simply an investor. His sudden change of stance about his involvement and re-purported non-operational role, sparks questions about reliability in the volatile and fast-paced crypto industry.

Digital Rupee and Yes Bank Integration: A Gateway to Mass Adoption or a Breeding Ground for Risks?

“The digital rupee’s integration with Yes Bank’s app UPI extends its reach to millions of merchants in India, potentially driving its mass adoption. However, concerns regarding security, volatility and regulation of cryptocurrencies remain, alongside increasing competition. Despite these challenges, digital currencies showcase resiliency with digital rupee transactions worth $134 million reported within two months.”

Fusing AI and Classic Analytics: A Look into yPredict’s Revolutionary Forecasting Approach

“yPredict, a new project under development, aims to revolutionize financial forecasting by blending traditional analytical methods with modern AI technologies. It intends to democratize predictive analytics by introducing a subscription-based Prediction Marketplace, transforming financial data scientists’ earning platform and unlocking new market potential.”

Exploring the Ripple Vs SEC Showdown: A Study in Crypto Regulation Controversy

In its ongoing battle with the Securities and Exchange Commission (SEC), Ripple refutes claims for federal intervention and maintains that its systematic XRP sales did not violate securities law. This dispute shines light on potential future challenges and complexities in crypto regulation.

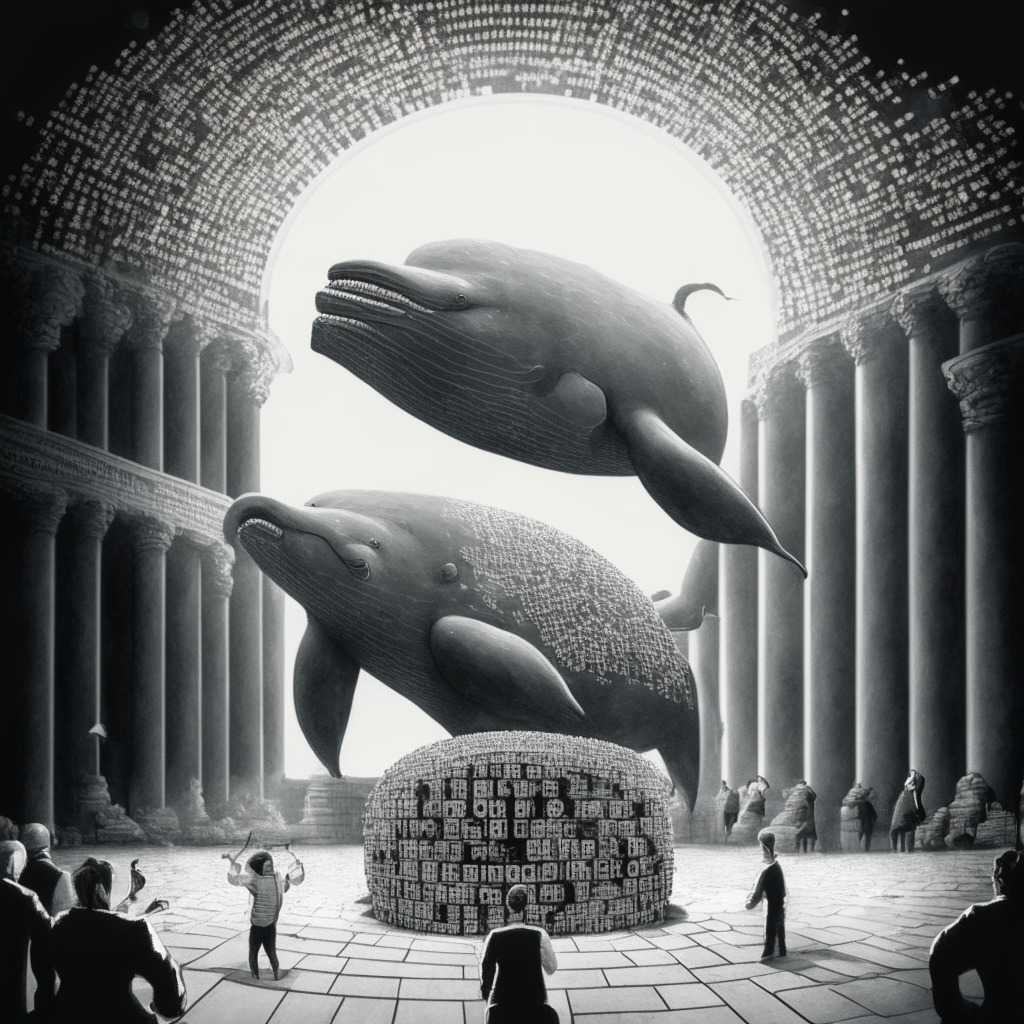

Bitcoin Whales Expanding Their Wealth Despite Price Slumps: Breakthrough or Breakdown?

“Bitcoin ‘whales’ have significantly boosted their stakes, increasing assets by $1.5 billion in late August. This growth occurred despite a slump in BTC’s price, suggesting increased optimism among institutional investors. This follows a court resolution pushing for Grayscale to list a spot Bitcoin exchange-traded fund (ETF) in the U.S.”

Jump Crypto Specialists Leave to Found Douro Labs: A Strategic Shift or Split in the Blockchain Scene?

Innovative blockchain project Douro Labs, established by ex-Jump Crypto specialists, aims to solve scaling issues within Pyth Network – a blockchain-based Oracle data service instrumental in orchestrating crypto, equity, and FX data across multiple blockchains. This marks a significant shift within the volatile digital trading landscape.

Using Bitcoin’s Lightning Network for Offline Transactions: The Future or a Fallacy?

“LNMesh, a Florida-based startup, proposes the use of Bitcoin’s Lightning Network for transactions without internet. The solution utilizes local mesh networks for devices to connect directly, allowing for off-chain Lightning payments across nodes in an offline manner using Raspberry Pi computers.”

Navigating Bitcoin’s Recent Dip: Analyzing Market Reactions and Future Predictions

Bitcoin sees a 4.6% retreat, stirring market interest in buying the dip. Its current circulating supply is nearing its capped total capacity. However, despite a bearish trend, If Bitcoin successfully breaks the $25,400 barrier, significant potential resistance may appear at $25,900 while a bullish crossover could aim towards $26,400 or $27,000.

The DeFi Dilemma: Balancing Game-Changing Innovations with Rigorous Security

“Decentralized finance (DeFi) protocols are reshaping sectors but facing security complexities as shown by the Balancer protocol losing $900K due to a flagged vulnerability. Despite challenges, DeFi’s consistent innovation and adaptability demonstrate resilience. Yet, escalating security incidents suggest a need for more rigorous measures.”