A luxurious brownstone once linked to former FTX CEO Sam Bankman-Fried is awaiting a new owner, following FTX’s bankruptcy and Bankman-Fried facing criminal and civil charges. With FTX’s downfall, the crypto community is urged to stay cautious and informed, as the industry rapidly shifts.

Category: Breaking News

Blockchain Breakthrough: Innovation vs Environmental Impact and Market Risks

The blockchain industry’s future is promising yet uncertain, with a recent breakthrough igniting debates on its potential and controversies. Crypto enthusiasts must stay vigilant, monitoring market shifts and discussing implications of advancements, navigating challenges and opportunities ahead.

How Revealing Hinman Documents in Ripple-SEC Case May Benefit Ethereum and the Crypto Sphere

JPMorgan analysts believe that the release of the Hinman documents in the Ripple vs SEC legal battle could benefit Ethereum. Internal SEC messages from 2018 suggest ether did not resemble a security, which could create a “regulatory gap” for decentralized tokens. This may influence US congressional efforts to regulate the cryptocurrency industry, potentially enabling ether to dodge the security designation.

Crypto Controversy: Bankman-Fried, FTX, and the $3M DC Property Mystery

A Washington D.C. townhouse previously linked to defunct crypto exchange FTX and its former CEO, Sam Bankman-Fried, may soon change ownership. This comes amid heightened skepticism towards crypto exchanges, increased regulatory scrutiny, and concerns regarding user fund protection following FTX’s collapse.

Unmasking Kyle Roche: The Scandal That Shook the Crypto Law World and Its Implications

Crypto lawyer Kyle Roche’s career crumbled after an international setup exposed his corrupt ties to Avalanche founder Ava Labs and involvement in spurious lawsuits against competitors. This event raises concerns about ethical practices in the cryptocurrency law community and the lengths influencers will go for profits and connections.

Nigeria’s SEC Crackdown on Binance & US Regulatory Battle: What it Means for Crypto’s Future

The Nigerian SEC ordered a cease and desist notice against Binance Nigeria Limited, a “scam entity” claiming association with Binance. This development occurs amidst regulatory scrutiny in Nigeria, lawsuits in the US, and ongoing legal battles between exchanges and regulatory agencies, raising crucial conversations about the future of the crypto market.

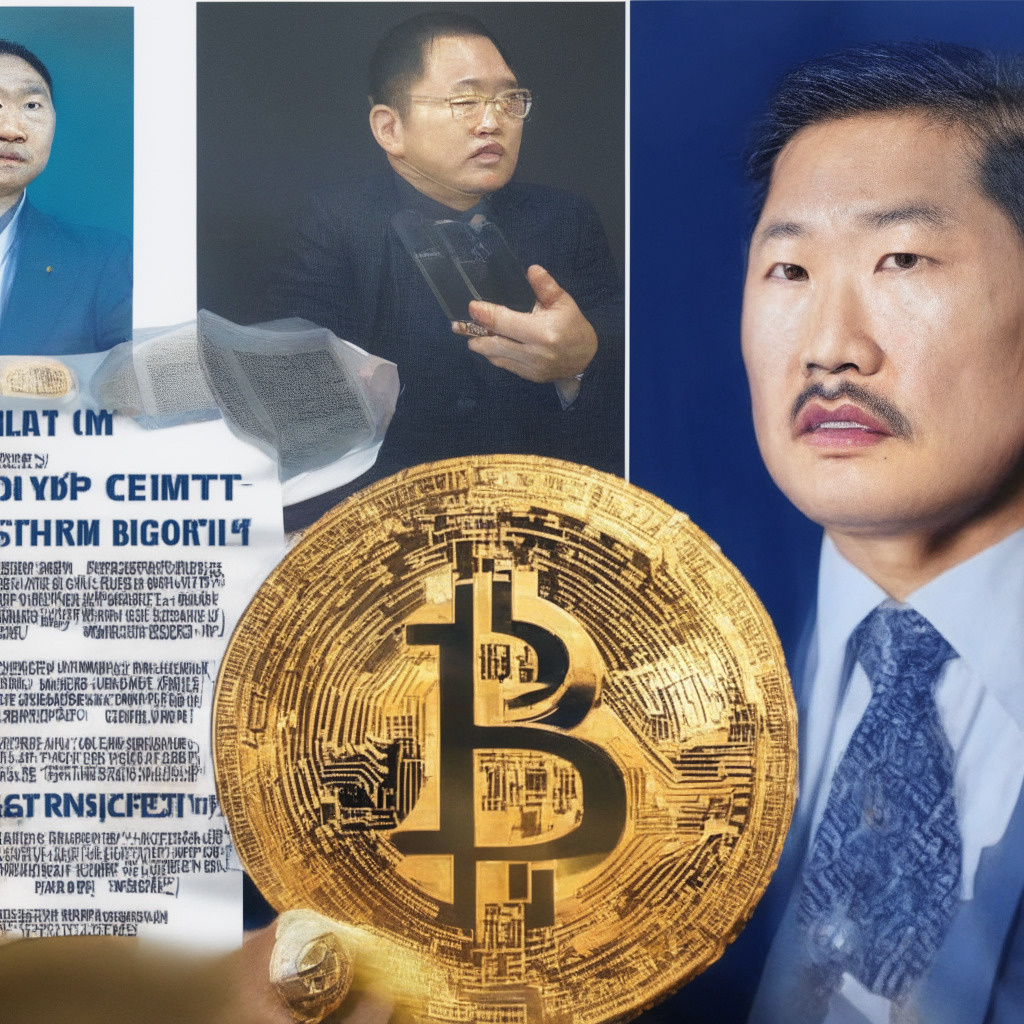

Crypto Industry’s Integrity Debated after Terraform Labs Founder Conviction

Terraform Labs founder Do Kwon’s conviction for document forgery highlights the importance of decentralization and regulatory oversight in the crypto industry. This incident raises concerns but also underscores the potential benefits of blockchain technology, emphasizing the need for addressing challenges and instilling greater trust.

Wyre’s Closure Raises Questions for Crypto Payments Firms: A Decade’s Worth of Lessons Learned

Crypto payments firm Wyre is winding down operations due to market conditions, ensuring the security of customer assets as it processes withdrawals until July 14th. Wyre’s closure raises questions about the future of crypto payment firms and related infrastructure, amidst ongoing industry uncertainties.

Terraform Labs Scandal: Examining Crypto’s Plunge and the Fake Passport Controversy

Terraform Labs co-founder Do Kwon denies allegations of utilizing forged passports and insists on his innocence. Kwon and former CFO Han were arrested in Montenegro with potentially forged documents following the 2022 Terra ecosystem collapse that led to an extended crypto winter.

Terraform Labs Founder Denies Forgery and Ties to European Party Leader: The Ongoing Conflict

Terraform Labs founder Do Kwon denied forging travel documentation and having financial ties to Europe Now party leader Milojko Spajić in a Montenegro court hearing. Facing prosecution, Kwon’s future and that of Terraform Labs and its Terra ecosystem remain uncertain.

AI

Twitter suspended AI-bot account “Explain This Bob” after Elon Musk accused it of being a “scam crypto account.” Linked to Bob Token (BOB), the account’s suspension led to a 30% price decline. Despite disagreement over the suspension, caution is advised when investing in crypto projects, and it’s important to recognize the positive contributions of AI-powered tools and decentralized technologies.

Crypto CEO’s Fake Passport Fiasco: Exploring Third-Party Risks & International Prosecution

Terraform Labs founder and CEO Do Kwon blames a “Chinese-named agency” for providing him with forged travel documents, leading to his arrest in Montenegro. With ongoing legal proceedings and requested extradition, the future of Terraform Labs and LUNC prices hang in the balance.

Elon Musk, Dogecoin Lawsuit, and the Truth: Debunking Misconceptions and FUD

Elon Musk’s lawyer, Alex Spiro, clarified in the recent million-dollar class action lawsuit that Musk doesn’t own any Dogecoin wallets involved in price manipulation. The suit accuses Musk of benefiting from a pump-and-dump scheme, but Spiro states the wallets in question don’t belong to the billionaire entrepreneur.

Binance Layoffs and New Hires: Examining the Crypto Industry’s Growth Challenges

Binance.US confirms layoffs amidst SEC investigation, while other crypto firms like Eden Block and Public make strategic hires. Crypto industry sees experienced professionals joining, but also faces legal challenges leading to job losses.

Elon Musk’s Dogecoin Lawsuit: Market Manipulator or Innocent Twitter Troll?

Elon Musk faces a $258 billion lawsuit, accusing him of market manipulation and securities fraud in relation to Dogecoin. With allegations of selling 1.4 billion DOGE through two wallets, the lawsuit claims Musk engaged in “transparent cryptocurrency market manipulation” using his Twitter presence and media appearances.

Hinman Speech Fallout: Ripple vs SEC and the Future of Crypto Regulation

The release of Hinman speech linked documents in the US SEC vs XRP lawsuit has raised questions about the SEC’s authority to regulate crypto. Ripple’s CEO Brad Garlinghouse criticized the SEC for its lack of transparency and consistency in regulating the digital asset industry.

On-Chain Detective Sued for Defamation: Uncovering Crypto Scams vs Reputation Damage

Prominent on-chain detective ZachXBT is being sued by NFT trader MachiBigBrother (Jeffrey Huang) for defamation, following an article alleging Huang embezzled millions in crypto from NFT users. Huang claims significant reputational and monetary harm, while ZachXBT defends free speech and seeks donations for legal fees. The case highlights the importance of responsible reporting and free speech in the crypto community.

NFT Trader Sues Blockchain Detective: Legal Battle Highlights Trust & Accountability Issues

NFT trader MachiBigBrother sues blockchain detective ZachXBT for defamation, claiming reputational and monetary harm. This high-profile legal battle raises questions about independent investigators’ role in the crypto space and potential consequences of their findings, influencing future investigations and community-driven oversight.

Blockchain Sleuth Sued for Libel: Analyzing the ZachXBT vs. MachiBigBrother Case

Blockchain investigator ZachXBT is sued for libel by Jeffrey Huang after accusing him of embezzling funds from a project. The lawsuit raises concerns about the balance between providing valuable information and potentially harming individuals’ reputations in the growing crypto and blockchain industry.

Wyre’s Collapse: Lessons Learned for Crypto Companies and Investors in a Shifting Landscape

Cryptocurrency payments company Wyre announces shutdown due to market conditions and financial challenges. Despite efforts to implement compliance safeguards and ensure customer asset security, its closure highlights the need for constant evolution and adaptation in the competitive crypto landscape.

Navigating Cryptocurrency News: Reliability, Market Impact, and the Role of Trust

Cryptocurrency enthusiasts emphasize the importance of accurate and reliable information for maintaining trust and credibility in the rapidly evolving market. News sources play a crucial role, but occasional errors can lead to doubt and speculation. It’s essential for readers to exercise caution, cross-verifying information for informed decisions, and supporting a transparent cryptocurrency ecosystem.

Failed Terra Project’s Legal Fallout: Examining Crypto Fraud Cases & Industry’s Future

Do Kwon, the founder of the failed Terra blockchain project, faces an extended detention in Montenegro amidst South Korea’s extradition request. Kwon is facing eight counts of fraud, including securities, wire, and commodities fraud. The case highlights the potential for similar incidents and raises debates on the balance between market innovation and tighter control to prevent fraud in the crypto space.

BlackRock’s Bitcoin ETF Move Amid SEC Crackdown: Strategic Play or Recipe for Disaster?

Financial giant BlackRock files for a spot-Bitcoin ETF with Coinbase as custodial services provider amidst US regulatory crackdown. Crypto community speculates on implications if approved by the SEC, potentially affecting the future of cryptocurrencies.

FTX Founder’s Double Trial: Implications for Crypto Exchange and Regulatory Future

FTX founder Sam Bankman-Fried faces two criminal trials involving 13 offenses, including fraud and bribery. Charges affect the cryptocurrency exchange and Alameda Research, with wider implications on the crypto industry and increased regulatory scrutiny. The outcome may shape future regulatory decisions, urging vigilance in assessing market players and continuous education on digital assets for the community.

Terraform Labs Co-Founder’s Legal Woes: A Turning Point for Crypto Industry Trust and Regulations

Terraform Labs co-founder Do Kwon faces legal troubles in Montenegro over document forgery allegations. His prolonged detainment and potential extradition to South Korea has the global crypto community concerned about its impact on the legitimacy and stability of the emerging crypto industry.

Crypto Drama Unfolds: Terra Co-Founder Extradition, $40 Billion Losses, and Political Ties

Terra Labs co-founder, Do Kwon, faces extradition in Montenegro over alleged ties to a local political figure and financial fraud charges. His case, dubbed “the largest financial fraud or financial securities fraud in South Korea,” intertwines politics and cryptocurrencies, with potential repercussions for the crypto community.

Depegging Dilemma: Tether’s Turbulent Times Amid Loan Saga and NYAG Revelations

The depegging of stablecoin Tether (USDT) is linked to the loan saga on DeFi platform Curve. Tether Holdings Ltd reveals concerns over sensitive commercial information shared by the Office of the New York Attorney General to Coindesk. The crypto community now fears potential implications from the released documents.

Trump NFTs: To Burn or Not to Burn – Analyzing the Impact on Value and Future Market Trends

The Trump Digital Collectible Cards project, which offers NFTs of former President Donald Trump, allows winners to “burn” the NFT for rewards, causing debate over their potential value. With an uncertain market response to burning NFTs, enthusiasts must weigh the decision to hold or burn their digital assets.

Cryptocurrency Enters US Presidential Race: Will It Define Campaign Platforms?

The upcoming US presidential elections feature candidates recognizing cryptocurrency potential in their platforms. Miami’s pro-bitcoin mayor Francis Suarez and Democratic candidate Robert F. Kennedy Jr. discuss embracing digital assets, while Republican candidate Sen. Tim Scott aims to develop a framework for them. This shift highlights digital currencies’ growing prominence in political strategy and future campaigns.

Crypto in the 2024 US Presidential Race: Analyzing Francis Suarez’s Candidacy and Challenges

Pro-Bitcoin candidate Francis Suarez has entered the 2024 US presidential race, stirring buzz within the crypto community. While the Miami mayor’s pro-crypto stance excites enthusiasts, regulatory scrutiny around digital currencies raises questions about the feasibility of his policies.

Crypto Enthusiast Mayor’s Presidential Bid: A Push for Blockchain or Risky Move?

Miami’s “Bitcoin Mayor” Francis X. Suarez has filed to run for U.S. presidency, which could stimulate growth and adoption of digital currencies and blockchain-based services. His presidential bid may prompt a profound conversation on cryptocurrency’s role in shaping America’s economy, but also raise concerns about potential risks, vulnerabilities, and conflicts of interest.

Bankrupt Voyager Set to Reopen: A Hopeful but Cautious Moment for Crypto Investors and Markets

Voyager’s platform is set to reopen between June 20 and July 5, allowing creditors to withdraw about 35% of their crypto following bankruptcy proceedings. This comes after the company’s core business lines were shuttered and customer transactions halted last year. The ongoing litigation involving Three Arrows Capital and FTX could potentially boost Voyager’s recoverable assets and impact the amount customers can reclaim.