A Satoshi-era Bitcoin wallet containing over $29 million worth of Bitcoin awoke after 13 years of dormancy, stirring curiosity within the cryptocurrency community. Blockchain researcher Kirill Kretov suggests this could be a strategic move by a long-term holder, and has noted similar past awakenings involving vintage Bitcoin.

Category: Breaking News

Coinbase Gets Green Light for Crypto Futures: A Market Disruptor or Flash in the Pan?

“In a significant advancement for the U.S. cryptocurrency market, leading exchange platform Coinbase has received approval to introduce crypto futures. This places Coinbase as the first crypto-centered platform to offer regulated crypto futures alongside traditional spot trading in the US.”

BitGo’s Big Boost: A $100M Shot of Confidence or A Stark Warning for Blockchain Businesses?

BitGo, a leading crypto custodian, has raised a significant $100 million, boosting its overall worth to $1.75 billion, and further demonstrating the financial stability and investor interest in blockchain technology. However, as the industry evolves, financial and regulatory challenges persist, highlighting the need for vigilance, adaptability, and innovation within the sector.

Trump’s Crypto Eminence Amid Skepticism: A Juxtaposition or A Strategy?

Former US President Donald Trump reportedly holds over $2.8 million in Ethereum, with his total crypto-related ventures amounting to about $7.6 million. This disclosure comes despite Trump’s past skepticism towards cryptocurrencies, creating a thought-provoking disparity between his public stance and personal investments. His newfound crypto wealth raises questions about his prospective return to politics and its impacts on the crypto-sphere.

Binance Connect Shutdown: Strategic Decision or Lost Potential for a Crypto-Friendly Future?

“Binance, a leading global cryptocurrency exchange, is winding down its buy-and-sell feature, Binance Connect. The decision, aimed at refocusing efforts on core products and strategies, marks the end of the versatile platform supporting 50 cryptocurrencies and traditional payment methods. While seen as a step back, this could be a strategy for sustainable growth.”

Binance Connect Shutdown: A Major Blow or Fresh Opportunities on the Horizon?

Binance Connect’s anticipated shutdown on August 16 has left the crypto community questioning the reasons behind this decision. According to Binance, the shutdown is a response to the evolving market landscape and user needs. However, this move raises concerns for the community and creates potential opportunities for competitors, reflecting the dynamic nature of the crypto world.

Hedera Hashgraph’s Explosive Growth Post FedNow Integration and the Potential of Launchpad XYZ

“Hedera Hashgraph rocketed up 20% following the announcement of its FedNow integration. While achieving significant growth through partnerships with giants like Kia, Hyundai, and Microsoft, its formal connection with the Federal Reserve has caused stand-out market surges. However, future seismic price shifts are being eyed in the emerging project, Launchpad XYZ, designed to demystify Web 3.0.”

Dasset’s Voluntary Liquidation: Does it Haunt Future of Cryptocurrency Exchanges?

Cryptocurrency exchange Dasset is in voluntary liquidation, trapping assets between NZ$3000 and NZ$40,000, leaving hundreds of users unable to access their funds. Dasset didn’t update about the liquidation and new accounts are still being created. Liquidators from audit firm Grant Thornton New Zealand are now securing and safeguarding Dasset’s assets.

Bankruptcy of Crypto Custodian Prime Trust: A Wake-Up Call for the Crypto Community

“The bankruptcy filing of crypto custodian Prime Trust has revealed the importance of community vigilance in the crypto space. Prior suspicions about the trust’s instability grew after it declared bankruptcy with liabilities of up to $500 million, raising questions about perceived trustworthiness and accountability of custodians and exchanges.”

When Crypto Exchanges Liquidate: The Case of New Zealand’s Dasset & the Urgency for Better Regulation

New Zealand’s crypto exchange, Dasset, has entered liquidation, locking customers out of their funds. This development raises questions about the security and regulation of the crypto industry. Despite the current turmoil, efforts towards greater global crypto integration continue, exemplified by Binance’s expansion into the New Zealand market.

Crypto-friendly Libertarian Candidate’s Surprise Victory in Argentina: A Shift or a Risk?

“Libertarian candidate Javier Milei, known for endorsing Bitcoin and advocating for abolition of central banks, surprisingly won the preliminary presidential election in Argentina with 30.5% of votes. His success may affect Argentina’s crypto adoption and policy-making considering prevalent economic issues like the high inflation rate.”

Prime Trust’s Bankruptcy: Crisis or Catalyst for the Emerging Crypto Industry?

Prime Trust, a major custodian of digital assets, has filed for Chapter 11 bankruptcy due to a deficit in customer funds. This raises questions about financial risks in the largely unregulated cryptocurrency landscape and emphasizes the need for stronger regulation.

Crypto Celebrity’s Lawsuit Withdrawal: Embezzlement Allegations, Community Support, and Lingering Doubts

“In a surprising turn, Taiwanese music celebrity Jeffrey Huang withdrew a defamation lawsuit against internet investigator ZachXBT, after revisions to an article sparked tensions. This incident underscores the crypto community’s volatility, the importance of reliable information, and raises questions about truthfulness.”

Former President Trump’s Surprising Foray into Cryptocurrency and NFTs: A Paradigm Shift or Sheer Opportunism?

“Former US President Donald Trump reportedly owns digital assets worth between $250,000 and $500,000, largely boosted by sales from his NFT trading cards. This comes despite previous comments disparaging cryptocurrencies. Trump’s decision amidst divisive views on digital assets could potentially influence the upcoming White House bid for 2024.”

Anthropic Secures $100M Investment from SK Telecom: Assessing the Future of AI in Telecom Industry

“AI developer Anthropic secured a $100 million investment from South Korean corporation, SK Telecom, to create a multilingual large language model for the Telco AI platform. This move represents SK Telecom’s aspirations to revolutionize the telecom industry leveraging AI technology.”

Former President’s Hidden Crypto Treasures: Legitimacy or Distraction for Digital Assets?

“Former U.S. President, Donald Trump, may own up to $500,000 in Ethereum according to a recent report from the U.S. Office of Government Ethics. Despite his skepticism towards cryptocurrencies, Trump has effectively capitalized on the NFT trend with his own collection of NFT cards.”

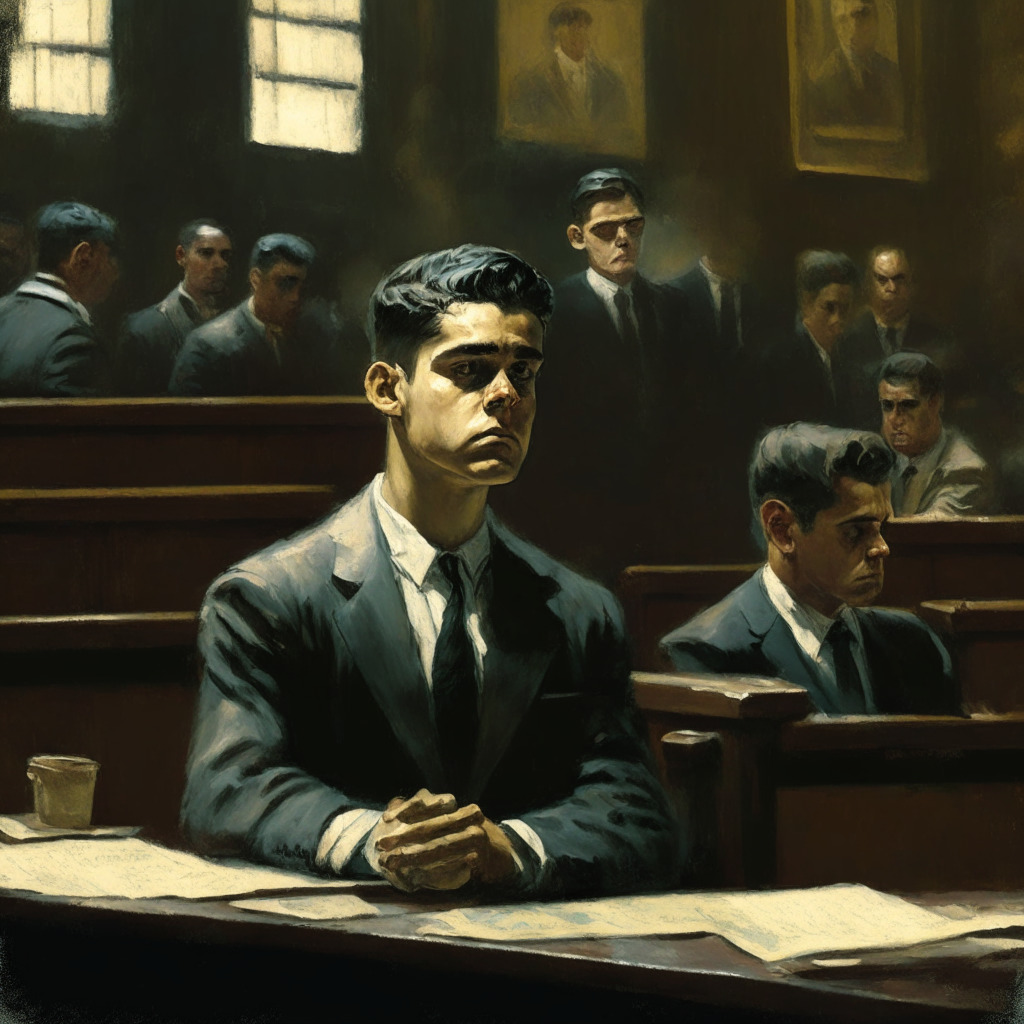

From Crypto Millionaire to MDC Inmate: The Trials and Tribulations of Sam Bankman-Fried

“Former CEO of FTX, Sam Bankman-Fried, finds himself in the Metropolitan Detention Center in Brooklyn following a judge’s revocation of his bail. His legal troubles came to light after allegations of intimidating potential witness, former Alameda Research CEO, Caroline Ellison by leaking her diary.”

Bitcoin Advocate Leading Argentine Primary Elections: Implications for Economic Future

Javier Milei, a libertarian candidate known for supporting Bitcoin and criticizing central banks, is leading in Argentina’s primary presidential election. Despite his enthusiasm for Bitcoin, Milei doesn’t advocate for its adoption as legal tender, instead promoting “dollarization” to combat rampant inflation.

Legal Wrangles in Crypto: FTX’s Bankman-Fried’s Fallout and Ripple Effects on Blockchain Future

“The ongoing legal battle of Sam Bankman-Fried, ex-CEO of FTX, and its implications on the cryptocurrency market has garnered attention. New developments like PayPal’s launch of a U.S dollar-linked stablecoin may overhaul market trends, demonstrating innovation in blockchain technology.”

Navigating Blockchain: Innovations, Challenges, and the Intriguing Future of Cryptocurrency

“A telling report by Glassnode indicates that long-term crypto holders are showing tenacity, with Coinbase and Binance creating waves in the sector. Coinbase launched its Ethereum layer-2 blockchain, whereas Binance became the first fully licensed crypto exchange in El Salvador.”

The Downfall of FTX: A Tipping Point for Crypto Industry’s Fragility and Future

The former CEO of FTX, Sam Bankman-Fried, faces potential incarceration amid allegations of witness tampering in a case concerning a massive $3 billion defrauding of customers and investors. His situation has shaken public faith in the crypto industry and prompted tightened regulations.

Former FTX CEO’s Bail Revoked: An Unfortunate Twist for the Crypto World

“Former CEO of FTX, Sam Bankman-Fried, arrested by federal authorities in New York, accused of fraud related to his FTX operations. Allegations of witness intimidation led to bail cancellation, suggesting complex legal challenges faced by individuals in the cryptocurrency world.”

U.S. Government Debt Downgrade: A Storm Ahead for Bitcoin or A Silver Lining?

The U.S. Government’s debt downgrade by Fitch Ratings may impact the digital investment market, including Bitcoin. Investors are being driven from traditional assets into safer short-term instruments. Amidst this uncertainty, the potential lies for investors to shift towards decentralized avenues like cryptocurrencies.

FTX Founder Sam Bankman-Fried’s Legal Duel: Ethics, Law, and the Crypto Future

“FTX founder Sam Bankman-Fried faces serious charges including securities fraud, wire fraud, and money laundering. Allegations of bond violation and witness tampering are under scrutiny. His troublesome situation serves as a stark reminder of the importance of upholding rules and integrity in the ever-evolving crypto industry.”

Binance Labs’ $5M Pledge to Curve DAO: A Growth Bet or Security Paradox?

“Binance Labs invests $5 million into Curve DAO Token (CRV), the operating token for Curve decentralized exchange. Despite recent hacking losses, Binance co-founder, Yi He, sees this partnership as crucial for the future growth of the DeFi ecosystem.”

Chasing Shadows and Rainbows: Blockchain Challenges and Triumphs Unveiled

U.S. crypto exchange Coinbase has unveiled its new Ethereum layer-2 network, Base, potentially causing shifts in the blockchain landscape. Meanwhile, the sector faces challenges around credibility of newly launched stablecoins, possible regulation, and risks from open-source code misuse. Despite these, crypto initiatives continue to grow globally, suggesting a maturing industry.

Fantom’s Quagmire: SpiritSwap Closure Hints at Multichain Risks and Opportunities

“SpiritSwap, a DEX on the Fantom blockchain, plans to cease operations following a Multichain crisis that emptied its treasury, impacting operations and dropping TVL drastically. The co-founder’s arrest and subsequent issues have raised questions about the future of projects associated with Multichain protocols.”

Saddle Finance Shutdown: A Portentous Shift in Blockchain dynamics or a Necessary Precaution?

“The recent announcement of Saddle Finance, an Ethereum-based crypto trading protocol, to cease operations and disburse its treasury to its investors, paints an intriguing picture of the changes in the blockchain space. This incident, following a major hack on Curve, serves as a stark reminder of the ever-present threat of exploitable bugs in the blockchain universe, and stresses the importance of investor vigilance.”

Cryptocurrency Developments: Binance Licenses, Coinbase Buybacks, and More Unraveled

“Binance receives licenses from Central Reserve Bank and National Commission of Digital Assets in El Salvador fostering financial inclusion. Coinbase proposes buying back $150m of its bonds eliciting mixed investor sentiment. Bitstamp seeks to expand operations, reminding of crypto investment risks.”

Power Play in Crypto: Bitmain and Anastasia Digital’s Equity Stakes in Core Scientific

“Bitmain and Anastasia Digital potentially plan to acquire equity stakes in Core Scientific, the world’s second-largest publicly listed bitcoin miner, amid its imminent bankruptcy. Core’s funding for acquiring Bitmain Antiminer units comprises of $23 million cash and $54 million in equity, hinting Bitmain’s first interest in a publicly listed miner.”

Scaling Up: Bitstamp Exchange’s Bold Global Expansion Strategy and Its Market Impact

Bitstamp, a prominent crypto exchange, is reportedly fundraising for an aggressive growth strategy that includes launching new products and services, scaling operations, and expanding in the European, Asian and UK markets. However, the exchange emphatically declares it isn’t for sale.

DeFi App Steadefi’s $334K Exploit: Unsettling Consequences and Lessons Learned

“The decentralized finance (DeFi) application, Steadefi, was exploited, putting $334,000 at risk, causing its total value locked (TVL) to plummet. The unsettling event prompts questions about the safety measures in the DeFi space, highlighting the need for vigilant monitoring of investments.”