The crypto market recovery accelerated following BlackRock’s Bitcoin spot ETF application to the SEC, potentially signaling a critical step towards cryptocurrency mass adoption. The bullish trend affected the top thirty cryptocurrencies, while global movements indicate steady crypto adoption worldwide, with regulatory decisions remaining crucial.

Category: Market Overview

Terra Classic’s Bullish Comeback: Analyzing LUNC Price and Its Impact on Crypto Markets

The Terra Classic project sees a 2.57% rise with LUNC prices surging from $0.000086, hinting at a potential challenge to the resistance trendline. Increasing bullish momentum suggests a possible prolonged buying phase with a target of $0.0000994. However, investors should conduct thorough research as the likelihood of a breakout remains minimal.

Crypto Markets: Gains, Losses, and Stablecoins – Navigating the Volatile Landscape

Cryptocurrency markets exhibit notable volatility, presenting both significant gains and losses. This snapshot highlights the contrasting performance of various digital assets, emphasizing the importance of caution and due diligence when participating in the unpredictable world of digital assets.

Ethereum’s Struggle at $1939: Market Slowdown or Golden Buying Opportunity?

The crypto market has witnessed significant recovery, with Bitcoin gaining 15.65%. However, altcoins like Ethereum, which managed an 8.6% jump, face potential short-term slowdown as investors take profits. Ethereum currently struggles to surpass resistance at $1,939, hinting at a possible market reversal.

FTX 2.0 Revival: Crypto Exchange’s Restructuring Attracts Big Players and Controversy

FTX Debtors plan to revive the troubled crypto exchange FTX through a bankruptcy restructuring, with notable 363 Sales Parties like Nasdaq, Ripple Labs, and BlackRock expressing interest. FTX 2.0 aims to relaunch amidst traditional financial firms’ growing involvement in the cryptocurrency industry.

Bitcoin ETF Hopes Fuel Rally: Can Bullish Momentum Sustain or Is a Pullback Imminent?

Bitcoin price experienced a remarkable recovery, rising 25.4% in two weeks, driven by the possibility of a US spot Bitcoin ETF. The rally reflects a bullish momentum, but a minor pullback might occur before continuing the upward trend. Key indicators project a strong bull trend, but investors should consider potential market fluctuations before making decisions.

Crypto World Update: Scandals, Legal Battles, Innovations, and Safety Concerns

This week in crypto, deception and legal battles intertwined with ambitious innovations. Key highlights include Crypto.com’s internal teams trading tokens for profit, Valkyrie Funds filing a Bitcoin ETF application, and global governments exploring digital currency regulations. Safety remains crucial as crypto crime and hacks persist.

Bitcoin’s Bullish Surge: ETFs, Skepticism and Crypto Future Insights

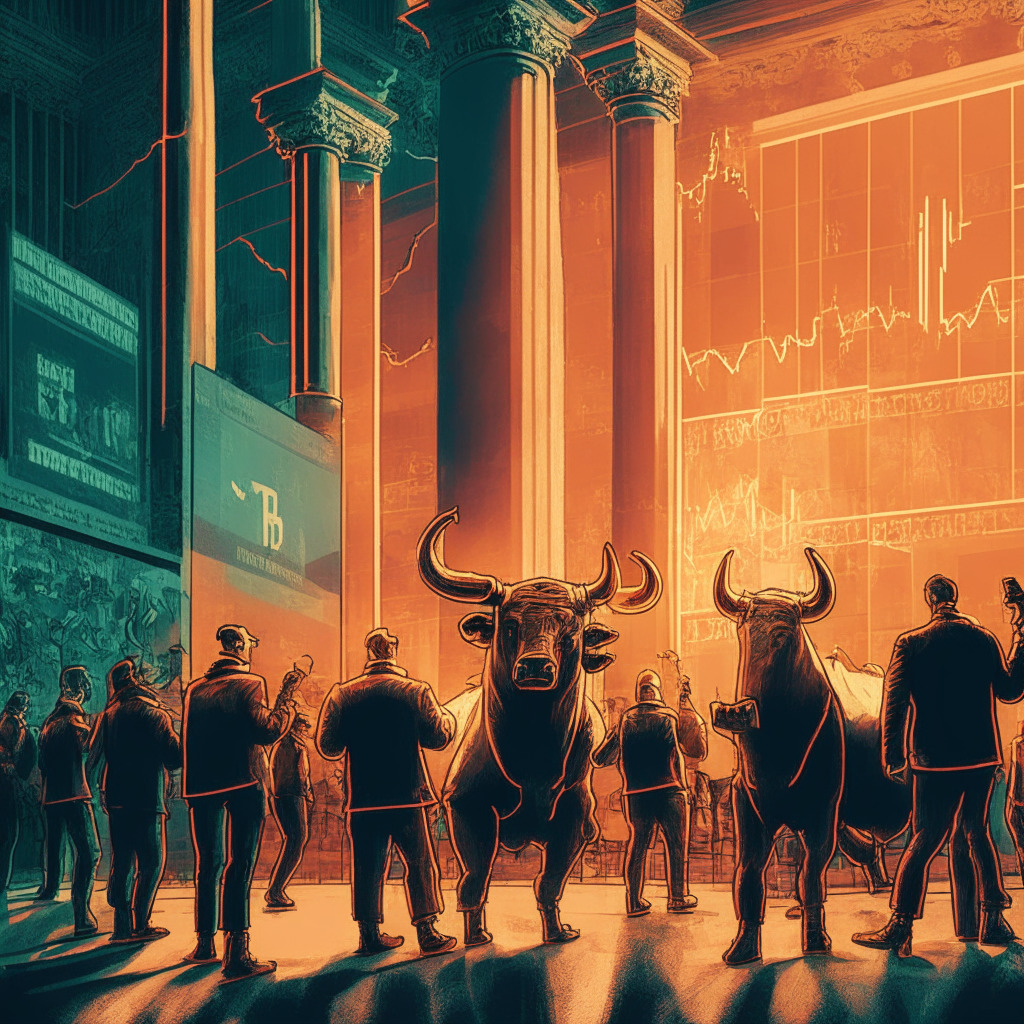

The cryptocurrency market is buzzing as Bitcoin surpasses $31,000, attributed to a Bitcoin ETF and the entry of financial giants like Charles Schwab, Fidelity Digital Assets, and Citadel Securities. However, experts advise caution and close monitoring of key Bitcoin price points due to overbought conditions and potential pullbacks.

Trader’s $4M Short on TUSD: Analyzing Stablecoin Stability Amid Issuer Challenges

A trader took a $4m short position on stablecoin TrueUSD (TUSD) after its issuer temporarily halted mints and redemptions through banking partner Prime Trust. This highlights the importance of vigilance among cryptocurrency enthusiasts, as regulatory scrutiny and operational challenges can affect the value and stability of digital assets like TUSD.

Bitcoin’s Struggle to $40K: Analyzing Barriers and Market Influencers Amid Economic Uncertainty

Bitcoin hit a one-year high of $31,400, but Bloomberg Intelligence’s Mike McGlone cautions headwinds could impede progress towards $40,000. Factors like the potential US recession, equity bear market, and hawkish central banks could influence Bitcoin’s performance.

Mixed Results in Crypto Market: Analyzing Gains, Losses, and Investor Perspectives

The cryptocurrency market showcases mixed results, with varied percentage gains and losses of numerous tokens. BTC and Ethereum experienced decent gains, while Ripple’s XRP, AAVE, and Crypto.com Coin saw slight declines. Investors should watch market trends and remain cautious before making financial decisions in the volatile crypto world.

The Intensifying Race for a Bitcoin ETF amid Rising Regulatory Uncertainty

The race for the first Bitcoin spot ETF intensifies as investment firms, including BlackRock, seek permission from the SEC. Although the regulatory landscape remains uncertain, interest in crypto markets is growing, leaving enthusiasts to navigate the complex environment while seeking opportunities and overcoming challenges.

First Leveraged BTC Futures ETF: A Milestone or Cause for Concern?

Volatility Shares Trust filed with the SEC for a leveraged Bitcoin futures ETF under the ticker symbol BITX. If approved, this would be the first leveraged BTC futures ETF in the United States, marking a significant milestone in the cryptocurrency market. However, the SEC has historically shown hesitancy in approving such products due to investor safety and market manipulation concerns.

Crypto Rally Ignites Debate: Bearish Forecasts vs SEC-Approved ETFs and Institutional Interest

The SEC has granted approval for the 2x Bitcoin Strategy ETF (BITX), marking a milestone as the first-ever leveraged crypto ETF to receive approval. This, along with industry heavyweights’ ETF applications, has fueled a price rally in Bitcoin and altcoins, showcasing growing institutional interest and paving the way for further developments in the crypto market.

Bitcoin Rally Above $31K: Can It Withstand Inflation and Recession Threats?

Bitcoin’s rally above $31,000 has raised questions about its ability to hold this level amid economic recession and central bank activity. Inflation concerns persist, but Bitcoin derivatives show modest improvement and investor optimism. External factors, such as regulatory uncertainty and legal issues involving Binance, could impact BTC futures contracts and market sentiment.

XRP’s Bullish Recovery: Can It Break the $0.55 Multi-Month Resistance? Pros & Cons

XRP price broke through the $0.487 resistance level on June 19th, showing bullish recovery. The altcoin’s value hovers around $0.49, with potential to surge 9.6% and retest the substantial $0.55 resistance barrier. An ascending triangle pattern formation strengthens the bullish momentum, but proper market research is essential before investing.

Financial Giants Enter Crypto Space: Can Bitcoin Hit the $1 Million Milestone?

Bitcoin’s future looks exciting as traditional finance players like Citadel, Fidelity, and Charles Schwab enter the crypto space, fueling speculation of prices reaching $1 million. EDX Markets enables trading of top crypto assets, while BlackRock’s spot Bitcoin ETF application further bolsters optimism.

Sequoia’s FTX Debacle: Striking a Balance in High-Risk Crypto Investments

Alfred Lin from Sequoia Capital addressed the firm’s $213.5 million investment in now-bankrupt crypto exchange FTX at Bloomberg’s Tech Summit. Despite the financial loss and legal challenges, Sequoia remains committed to the cryptocurrency space, reiterating the importance of striking a balance between supporting innovation and minimizing exposure to failure in this dynamic market.

PepeCoin vs Dogecoin: Ultimate Memecoin Battle or Passing Trend in Crypto World?

PepeCoin recently gained prominence in the memecoin sector, challenging Dogecoin’s dominance. With native Ethereum integration and a fixed supply, it shows potential for growth, but it must overcome Dogecoin’s first-mover advantage and network dominance to become a mainstream memecoin contender.

Bitcoin ETFs: Boosting Prices or Risking Crashes? The Tussle Between Bulls and Bears Explained

The rush to apply for a Bitcoin ETF has rejuvenated the bulls, but this news may only boost the price to a certain distance. Bitcoin remains the center of attraction with its market dominance near 50%. K33 Research analysis found that Bitcoin investment outperforms altcoin portfolios in the long term.

Bitcoin’s Surge to $31K: Leveraged ETF Impact, Future Outlook, and Potential Risks

The recent surge in Bitcoin price to around $31,000 is driven by positive market sentiment following the approval of a new leveraged Bitcoin ETF in the US. Despite potential risks, experts are optimistic about the upward trend.

BitGo-Prime Trust Deal Collapse: Impacts on Crypto Industry and Payment Partners

BitGo’s sudden cancellation of Prime Trust acquisition leaves the struggling company searching for alternative solutions amidst bankruptcy challenges, withdrawal suspensions, and legal disputes. The fate of Prime Trust remains uncertain, impacting the crypto market, customers, and partners.

First Leveraged Crypto ETF: Exciting Milestone or Risky Investment? Debating BITX’s Impact

The SEC recently approved the first-ever leveraged crypto ETF, 2x Bitcoin Strategy ETF (BITX), set to launch on June 27, 2023. Amid Bitcoin’s price recovery, major financial firms show renewed interest in crypto markets, with plans for more Bitcoin ETF funds. Investors must understand inherent volatility and risks before entering this emerging asset class.

Cardano’s Recovery Rally: Sustainable Growth or Looming Correction?

Cardano’s recent recovery rally resulted in a 17.6% surge in prices, hitting the psychological barrier of $0.3. The coin’s current price trades at $0.29, wavering below the $0.3 resistance. Investors should carefully consider their moves, taking into account market sentiment and potential buyer sustainability at higher prices.

Bitcoin’s Monthly Loss, Mining Stocks Surge, and VC Investment: A Crypto Market Analysis

In May, Bitcoin experienced its first monthly loss since December 2022, but indicators like the futures market and VC investment reveal underlying optimism. Mining stocks showed notable gains, while VC investment surpassed $1 billion for the first time since September 2022. Increasing network activity and recent feature additions suggest the crypto market may be gradually regaining momentum.

NFT Floor Price Plunge: Impact of Blur Marketplace and Future of Blue Chip Collections

The floor prices of top Ethereum NFT collections such as Bored Ape Yacht Club and CryptoPunks have plunged over the last 24 hours, with Bored Ape seeing its lowest floor price since November 2021. Some traders attribute this to the influence of NFT marketplace Blur, as trading volumes decrease and users farm tokens on the Blend lending platform, resulting in suppressed prices.

IMF’s Stance on Crypto and CBDCs in Latin America: Accelerated Adoption vs. Regulations

The IMF discusses the accelerated adoption of cryptocurrencies and CBDCs in Latin American and Caribbean countries, stating that well-designed CBDCs could simplify remittances and financially include more citizens. However, they emphasized the need for proper regulation and consider crypto to be risky overall.

Bitcoin Bulls Eye $35,000 While ETFs Gain Traction: Analyzing Market Drivers

Bitcoin bulls hold onto the $30,000 level as BTC price consolidates after a recent rally, with sentiment high for a potential rise to $35,000. Increasing interest in crypto assets and Bitcoin ETF filings, along with the upcoming 145,000 BTC options expiry on June 30, are key market events to watch.

First Leveraged Crypto ETF: Boon for Investors or Gateway to Excessive Risk?

The U.S. SEC has approved the launch of Volatility Shares’ 2x Bitcoin Strategy ETF (BITX), the first leveraged crypto ETF in the country, potentially expanding the range of interested investors. However, skeptics argue that introducing leveraged exposure to the volatile cryptocurrency market may cause excessive risk-taking, with concerns surrounding long-term sustainability and stability due to lack of regulation and security.

Bitcoin’s Purpose Debate: Digital Gold vs Activist’s Tool and the Impact on Regulatory Policies

The rise of institutionalization in the cryptocurrency world has prompted debate regarding Bitcoin’s purpose. Wall Street may adopt the “digital gold” narrative, representing Bitcoin as an asset independent of monetary policy. However, the chosen narrative could influence regulatory policy and may indirectly curtail Bitcoin’s usage growth, impacting privacy and KYC rules.

Bitcoin’s $30,000 Struggle: Conflicts Between Optimistic and Cautious Market Predictions

As Bitcoin’s price hovers around $30,000, traders predict its next targets amid market uncertainty. Some traders are optimistic about reaching a yearly high of $31,000, whereas others anticipate a snap drop in value. Market sentiment remains divided as the cryptocurrency industry struggles to determine Bitcoin’s future direction and its impact on other digital assets.

Ether ETFs: A Real Possibility or Just Publicity Stunts? Analyzing SEC’s Stance on Approval

The fate of not-yet-filed ether funds depends on the SEC’s treatment of the latest wave of spot bitcoin ETF filings. A bitcoin ETF approval might encourage fund issuers to try ether next, while regulatory clarity could increase ether ETF’s chances in the future.