The Federal Reserve’s intensified scrutiny of banks’ cryptocurrency activities has sparked criticism from Republican lawmakers who argue this deters institutions from participating in the digital asset landscape. The Fed’s new requirements may potentially suppress the progress of decentralized finance. Amidst this, U.S. regulations on digital assets remain unclear, pushing some crypto companies to explore alternative markets overseas. The discourse focuses on balancing effective supervision with fostering blockchain innovation.

Category: Regulations

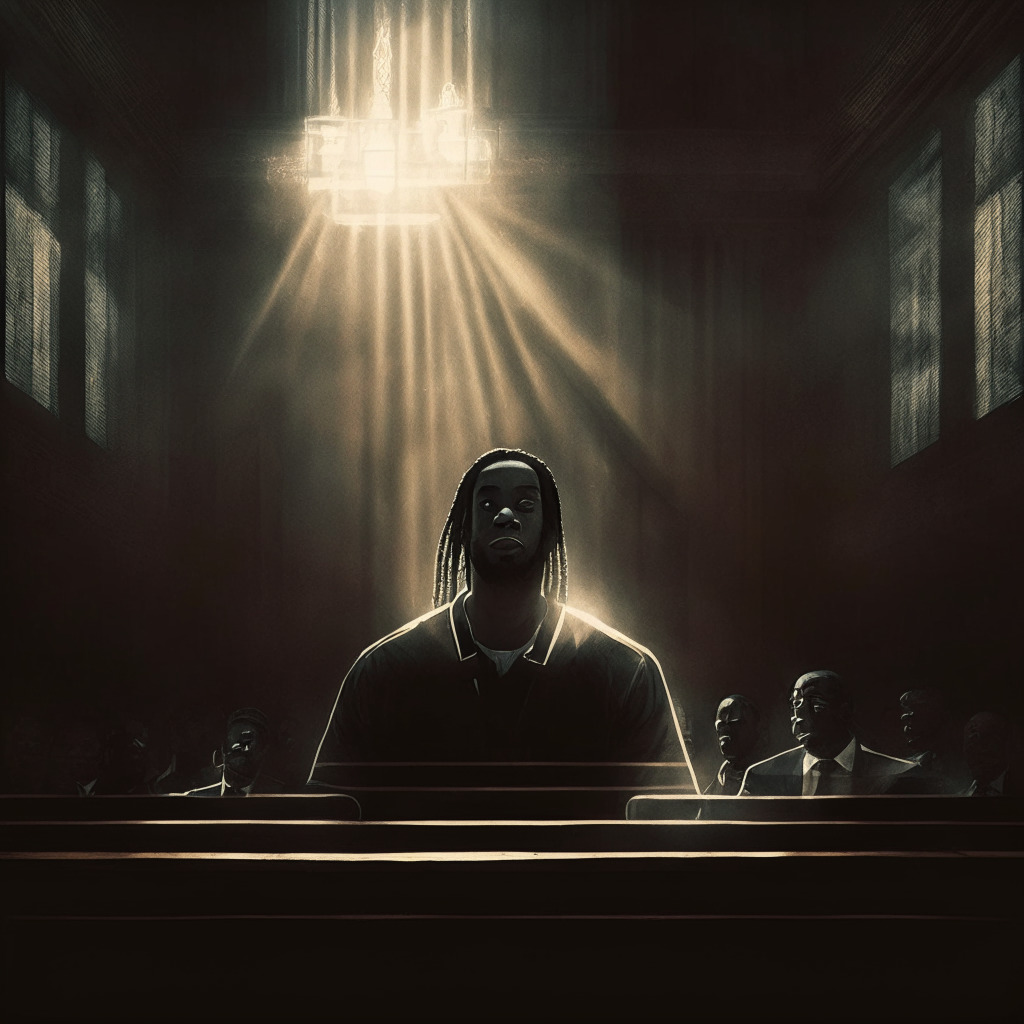

Locked Up Blockchain CEO and the Fight for Right to Defense: A Deep Dive into the FTX Legal Battle

The legal counsel for Sam Bankman-Fried, former CEO of FTX, has requested his temporary release from the Metropolitan Detention Center to actively participate in his defense. His capacity to defend himself is severely impaired due to infrequent communication with legal team, limited access to work data, poor internet connectivity and excessive discovery data from the prosecution. His attorneys stress his Sixth Amendment rights of a fair trial and effective legal counsel.

Swinging Scales of Justice: The Battle Over Expert Witnesses in the FTX Trial

The DOJ contests the validity of the witnesses proposed by FTX founder Sam Bankman-Fried for their trial, stating the insufficiency of their disclosures and potential confusion their testimonies might cause. Simultaneously, Bankman-Fried’s defense aims to dismiss DOJ’s financial analysis expert, causing a tug of war. This controversy emphasizes the line between enlightening and misleading expert testimonies in court.

SEC’s Tumultuous Path to NFT Regulations: Impact Theory Tangles and Divergent Views

“SEC Commissioners Hester Peirce and Mark T. Uyeda express concerns over broad-sweeping regulation of the diverse NFT market, citing potential complications for creators and the need for more scrupulous consideration before enforcement attempts.”

Federal Reserve’s Tightened Grip on Crypto Sparks Republican Lawmakers’ Concerns

Republican lawmakers express concerns over the Federal Reserve’s intensified oversight on crypto and stablecoin activities, arguing it might block the progress of a legislative proposal aimed at regulating stablecoins. Lawmakers believe the increased scrutiny might dissuade financial institutions from entering the digital asset ecosystem.

SEC’s Maiden NFT-Related Enforcement Action: A Curbing Move or Growing Pains?

U.S. regulators have asked Impact Theory, a Los Angeles firm, to repay investors for an illegal, unregistered securities offering related to non-fungible tokens (NFTs). This ruling, the SEC’s first NFT-related enforcement action, doesn’t imply all NFTs are securities. The company must create a fund to reimburse investors and pay a $6.1 million penalty.

Regulatory Spotlight on Impact Theory: An Examination of NFTs as Crypto Asset Securities

Los Angeles-based Impact Theory recently raised nearly $30 million via non-registered sale of non-fungible tokens (NFTs). Considered as crypto asset securities by the SEC, the company has allegedly violated federal securities regulations. Now under SEC scrutiny, the company is obliged to pay over $6.1 million as part of a settlement.

Navigating the Regulatory Labyrinth: New Rules and Fluctuating Tides in Crypto Sphere

“The United States Internal Revenue Service (IRS) is proposing new tax policies for the sale/exchange of digital assets by brokers, attracting criticism from crypto figures. Meanwhile, Gemini, a cryptocurrency exchange, faces a SEC lawsuit on potential regulatory violations. These developments reflect the ongoing struggle to balance regulation with innovation in the emerging field of cryptocurrency.”

Urgent Anticipation: SEC Verdict on Major Bitcoin ETF Applications and the Crypto Industry’s Future

The U.S. SEC’s impending response to Bitcoin ETF applications from top financial firms like BlackRock, VanEck, Invesco, Bitwise, and WisdomTree represents a crucial phase in integrating cryptocurrencies with conventional financial markets. The SEC’s decision could indicate some significant implications for the crypto industry’s future.

The Battle of Blockchain: Ethical Boundaries vs. Legal Sanctions in the Crypto World

Cryptocurrency regulations are often filled with controversies, as shown in Sam Bankman-Fried’s recent legal predicament. His pre-trial detention ties to alleged witness tampering, resulting in heated court arguments. His predicament invites questions around the balance between defending oneself and crossing ethical boundaries in the crypto world.

Crypto Regulation: Candidates’ Stances and Upcoming Election Implications

“Crypto regulation has become a significant issue in U.S. presidential campaigning. Candidates’ positions vary widely, from skepticism to enthusiastic adoption, yet the subject of digital assets regulation was absent from the recent Republican debate. This highlights the increasing importance of cryptocurrencies in our socio-political landscape, and suggests a need for informed legislation.”

Navigating Regulatory Hurdles: Binance Continues Belgian Operations via Poland Amid EU Changes

Binance will continue serving Belgian users despite previous AML and CFT violations by transferring operations to its Polish entity, Binance Poland. Belgian users will now adhere to Poland’s KYC regulations. This comes amid upcoming EU crypto regulations in 2024.

Decentralization Versus Sanctioned Russian Banks: The P2P Dilemma in Crypto Exchanges

Crypto exchanges including OKX and Bybit have delisted Russian banks Tinkoff and Sberbank, due to Western sanctions following the Ukraine invasion. Despite this, the decentralized nature of P2P transactions makes complete enforcement challenging. The delistings highlight the growing reliance on cryptocurrencies amid Russia’s economic instability due to these sanctions.

Evolution of Blockchain: Prospects, Regulatory Challenges, and Invisible Integration

“In a recent interview, Circle CEO Jeremy Allaire conveys optimism towards the evolution of digital assets. He highlights the transition from speculative to utility value as a major advancement, mentioning his company’s launch of USD Coin, a stablecoin designed to reduce price fluctuations and improve payment processing. Allaire underscored the importance of a federal regulatory framework for stablecoins to avoid financial downturns, and projected a future where money transfers instantaneously and freely on the internet.”

Unravelling the Blockchain Future: Justice, Global Sanctions, Charity Initiatives, Twitter Vulnerability, and Investment Trends

“In the face of persistent complications, the future of blockchain teeters precariously between pathbreaking transformation and a potential bubble. Blockchain’s breathtaking scope and opportunities invariably throw up a set of challenges for us to navigate. Our choices shape the blockchain of tomorrow.”

Navigating the Tightrope: Google’s Compliance with EU’s Digital Services Act – A Blessing or Burden?

Google is revamping its service policies in line with the EU’s Digital Services Act (DSA), expanding its Ads Transparency Center and making data more accessible. Yet, this move triggers debates about potential drawbacks, with fears that information could be manipulated to spread harmful misinformation. Additionally, despite Google’s compliance efforts, the complexity of adhering to DSA guidelines underscores the difficulty of executing such well-intentioned regulations without stifling innovation or compromising safety online.

Laos Electric Company Curbs Crypto Mining Amidst Energy and Environmental Concerns

“Electricite du Laos (EDL) announces a significant cut to crypto mining firms’ operations, due to rising concerns on electricity production & environmental impact. This comes after Laos’ attempt to become a digital assets mining hub following China’s stringent regulation.”

Binance Regulations and Its Impact on Russian Cryptocurrency Traders: An Analytical Perspective

“Binance introduces new P2P trading restrictions specifically targeting its Russian clients, limiting them to only using the Russian ruble. While narrowing choices, this strengthens local control over RUB in the Russian crypto sphere. However, Russians abroad face difficulties as their usage of other currencies has been banned on the platform.”

Stricter Crypto Regulations in South Korea: Balancing Investor Protection and Market Survival

South Korean crypto exchanges like Upbit and Bithumb are mandated to uphold a reserve fund of at least 3 billion won to enhance user security. This evolved regulatory measure, part of the “Virtual Asset Real-Name Account Operation Guidelines,” aims to address potential risk events. Limits are set on these reserves to ensure financial stability. The regulations also aim to strengthen KYC processes and optimize fund transfer rules. Despite these measures promising a more secure experience, concerns arise for smaller exchanges possibly facing unsustainable financial burdens.

Global Harmony in Cryptocurrency and AI: Prime Minister Modi’s Call to Action at B20 Summit

“Prime Minister Narendra Modi calls for a universal framework for cryptocurrencies and ethical AI solutions at the B20 Summit India 2023. He highlighted the need for cryptocurrency regulations and AI strategies that aren’t just about financial stability but also consider the concerns of emerging economies and ethical considerations. India’s G20 presidency has actively advanced discussions about crypto’s impact on emerging markets.”

Removing Sanctioned Russian Banks from Crypto Exchanges: A Double-Edged Sword for Global Compliance

Crypto exchanges OKX and ByBit have excluded sanctioned Russian banks, including Tinkoff Bank and Sberbank, from their payment options. Despite their removal, private transactions through these banks continue. The development highlights the friction between user services and adhering to international financial regulations in the crypto industry.

Laos’ Crypto Mining Halt: A Wake-Up Call for Sustainable Growth and Regulatory Standardization

Laos has suspended electricity supply to crypto mining projects due to a drought, reminding of the environmental impact of blockchain and the need for sustainable growth. The situation highlights the crypto industry’s vulnerability to environmental instability and the importance of infrastructure diversification. This event may prompt reassessment of crypto’s energy consumption patterns.

Navigating the Crypto Paradox: India’s Call for Global Regulations Amidst Local Regulatory Hurdles

“India’s Prime Minister Narendra Modi calls for global collaboration in cryptocurrency regulation at the G20 summit. India, holding the G20 presidency, advocates for a global framework for managing cryptocurrencies, mirroring the universal guideline strategies of the aviation industry.”

Digital Rights in Jail: FTX Founder’s Legal Battle Raises Questions about Cryptocurrency, Justice, and Internet Access for Inmates

Legal defenders for FTX founder, Sam Bankman-Fried, are arguing for his temporary release or increased consultation dates, citing an infringed right to participate in his defense process through digital resources. This case highlights the possible need for digital inmate rights in the increasingly digital world of contemporary trials, especially in cryptocurrency-related matters. The balancing act between these digital access rights and potential risks of digital forensics manipulation represents a new legal battlefield.

Ronaldinho’s Crypto Controversy: Is Football in a Blockchain Dilemma?

Brazilian football legend Ronaldinho faces scrutiny from lawmakers for his potential involvement in cryptocurrency pyramid schemes linked to platforms 18kRonaldinho and LBLV. Accused of misleadingly baiting potential investors, Ronaldinho could face incarceration if he defies a hearing order. A collective loss claimed by investors totals around $61 million. The outcome of the case could impact future athletes’ crypto investments.

Ronaldinho Entangled in Crypto Fraud: A Lesson on Investment Caution and Insight

“Former football star Ronaldinho may face detainment in Brazil due to his failure to testify in an ongoing crypto scam probe. The case relates to a pyramid scheme promising clients daily profits via crypto investments linked to ’18kRonaldinho’, a company associated with Ronaldinho. The incident underscores the need for robust regulation in crypto markets to prevent fraudulent practices.”

The Great Debate: U.S. Crypto Development Hiatus or Reinvention?

Antonio Juliano, founder of dYdX, suggests a hiatus for US-focused crypto development due to the austere regulatory framework. He encourages startups to explore non-US markets for less regulatory ambiguity and swifter growth. However, the CEO of Coinbase, Brian Armstrong, is confident in US adaptability, contradicting Juliano’s decade-long pause suggestion.

Biden’s Crypto Tax Regulations: A Threat to Innovation or a Step Towards Transparency?

“Recently, the crypto market experienced a significant ripple due to new proposed crypto tax reporting regulations by President Joe Biden. Critics argue these regulations could stifle innovation and make crypto firms reluctant to operate within the United States.”

Crypto Courtroom Drama: Sam Bankman-Fried’s Future Hanging by a Trade and Pepecoin’s Insider Trading Scandal

“Sam Bankman-Fried is contending with serious allegations and a voluminous amount of newer evidence in an impending trial. Separately, controversies surrounding Pepecoin highlight the risks and need for regulation in the crypto world, for safety and community trust.”

Bankruptcy Judge’s Hesitation on Crypto Tokens as Securities: A Case Study of Celsius

The bankruptcy judge recently declined to classify CEL, Celsius’s native token, as a security amid Ripple Labs and SEC’s ongoing legal issues. CEL’s business model significantly deviated, being referred to as “insolvent since inception” by a court-appointed examiner, who suggested CEL was part of a problematic scheme. The rising token value benefits the company but raises concerns about ethical considerations and customer implications.

Binance and the Minefield of Sanctions: Navigating the Russian Crypto Landscape

“Binance is under scrutiny for potential ties with five sanctioned Russian banks, raising questions about compliance and potential sanctions violations. Critics claim Binance facilitated ruble trades and peer-to-peer transactions with these banks. However, Binance denies these allegations, stressing adherence to international sanctions rules.”

Navigating U.S. Crypto Regulations: Retreat or Stand Ground for Long-Term Survival?

Antonio Juliano, founder of dYdX, suggests crypto developers should shift their focus from the convoluted U.S. regulatory environment to friendlier overseas markets for the next five to ten years. His perspective sheds light on the industry perception that U.S. lacks definitive digital asset regulations. However, views differ, with some believing that despite current regulatory obscurity, pioneers can seek clarity and establish a safe, legal operating ground in the U.S.