The Regulated Liability Network (RLN), a U.K. based financial marketplace infrastructure, is working on a use case involving the consumer domestic payment case with the central bank digital currency (CBDC). Exploring how commercial bank money and CBDC could coexist, the RLN aims to maintain equilibrium between the two. The network further mitigates authorized push payment fraud and quickens settlement time. Despite the complexity of regulations and jurisdictions, systems like RLN are key to a seamless digital economy transition.

Category: Technology

The Ethereum Supreme Court: A Radical Notion to Enhance Blockchain Safety and Stability

Matter Labs CEO, Alex Gluchowski, suggests the creation of an “Ethereum Supreme Court” to mediate disputes that could impact the Ethereum blockchain’s integrity. His proposed system aims to formalize Ethereum’s “social consensus layer” to safeguard platforms against exploitation, enabling community-engaged contract-based mediation in crisis scenarios.

MetaMask’s Bold Moves: Expanding Crypto Conversion Amid Scam Woes

MetaMask has enhanced its user experience by allowing ETH conversion to fiat currency. Despite advancements, it faces scamming challenges with fraudsters creating bogus MetaMask sites for illegal activities. Users need to be vigilant and proactive in reporting any suspicious activity or compromised security details to MetaMask.

Decentralized Exchange dydx’s Token Migration to Layer 1: A Unanimous Move or Market Hype?

“Decentralized exchange dydx gains almost universal user approval to migrate to its latest version, adopting DYDX as its Layer 1 token for its imminent blockchain. The community’s vote facilitates the token’s transition from Ethereum to a Layer 1 appchain within the Cosmos ecosystem.”

Visa Dives into Stablecoin Payments: A Futuristic Move or an Unnecessary Intrusion?

“Visa partners with Solana blockchain, venturing into stablecoin payments. This sees Visa using stablecoins like USDC and blockchain networks such as Solana and Ethereum to increase cross-border settlement speed and offer more accessible options for fund transfers via Visa’s treasury.”

Crossing Bridges: USDC Expansion to Base & Optimism Networks – A Milestone or Misstep?

In a significant development, USD Coin (USDC) has expanded to Base and Optimism networks, allowing Coinbase and Circle account holders to directly transfer their USDC stablecoin to Base. However, the new native USDC struggles with full integration across networks, causing user confusion and scepticism. The future of this decentralized currency hinges on balancing innovation, competition, and user convenience.

VISA Leverages Solana Blockchain and USDC Stablecoin for Faster International Payments

“VISA has enhanced its stablecoin settlement ability with Circle’s USDC stablecoin on the high-speed Solana blockchain, making it one of the first financial institutions to harness Solana for scaled settlements. VISA’s integration of stablecoins like USDC on global blockchain networks aims to improve international settlements speed and give clients a modern option to conveniently transact funds.”

El Salvador’s Bitcoin Venture: Crypto Education in Schools Amidst Security and Regulation Concerns

El Salvador is incorporating Bitcoin learning programs into school curricula by 2024, in partnership with non-profit organization, My First Bitcoin (MFB), and the Education Ministry. A pilot to provide Bitcoin “base knowledge” starts September 7 with 150 teachers. The move promises a significant stride towards a crypto-literate world but also presents challenges including possible fraud and lack of uniform regulations.

Navigating the Uncertain Waters of AI Progress and Blockchain Fluctuations

“Baidu, China’s tech powerhouse, has released over 70 AI models with over 1 billion parameters each. Recent models show up to a 50% improvement in efficiency. However, the rapid expansion of AI technology raises concerns about misuse and privacy.”

Decoding the Complex World of Blockchain through Solana’s Lens: Real-World Solutions and Challenges

Raj Gokal, co-founder of blockchain protocol Solana, is addressing blockchain scalability through decentralized physical infrastructure networks (DEPIN). He emphasizes well-thought-out factors to create a scalable blockchain system. Despite challenges in industries such as real estate, Solana is working towards stable and reliable Web3 infrastructure, critical for institutional adoption. As industry practices evolve, the blockchain future becomes increasingly tangible.

Swyftx’s ‘Learn and Earn’ Initiative: A Catalyst for Crypto Literacy or a Risky Lure?

Swyftx, an Australian tech venture, has begun a ‘Learn and Earn’ program to encourage understanding of the crypto-market, with rewards for participants. However, the initiative could inadvertently encourage naive investment. Nevertheless, with courses designed to identify scams, Swyftx aims to improve crypto literacy and discernment in a market filled with digital currencies and potential frauds.

Poland’s Rise as the Blockchain Hub: Reflections from ETH Warsaw Event

“Poland is bolstering its status as a significant blockchain hub within the EU, with ETH Warsaw, the region’s largest blockchain event. The conference highlighted innovation in the crypto world, expressed growing employment preference for those proficient with Web3 and notably recognized the potential of digital currencies and blockchain technology in transforming traditional markets.”

BitGo and Hana Bank Alliance: A Boost to Crypto Or Regulatory Quagmire?

BitGo, a California-based crypto custodian, plans to collaborate with South Korea’s Hana Bank in unleashing crypto custody services in 2024, dipping the traditional banking industry further into the digital currency revolution. The partnership signifies another vital step towards mainstream acceptance of digital currencies, however, it is important to carefully navigate regulatory challenges.

Boosting Web3 Startups: Cronos Lab’s Accelerator Program Amid Security Concerns

“Cronos Labs has launched a recruitment phase for its $100M accelerator program, aiming to support early-stage projects that promote the adoption of decentralized applications (DApps). However, this strategy can inadvertently lure scammers using government-owned website URLs to dupe victims and access their crypto wallet holdings.”

GenTwo’s Bold Move: Revolutionizing Investment Landscape or Silencing Stability?

Fintech platform GenTwo, known for securitization, has raised $15 million in a Series A funding round led by Point72 Ventures, announces the firm. This event raises intended expansion to international presence, promising a significant impact on the global fintech landscape.

Ethereum’s Tug of War: Struggling Between Node Centralization and Ultimate Scalability

Ethereum is battling with the issue of node centralization, with much of its network activity verification reliant on centralized services like AWS. Ethereum’s co-founder, Vitalik Buterin, has indicated that true decentralization, achievable through “statelessness” and operability on affordable hardware, is a key part of Ethereum’s long-term roadmap, despite the technical challenges anticipated.

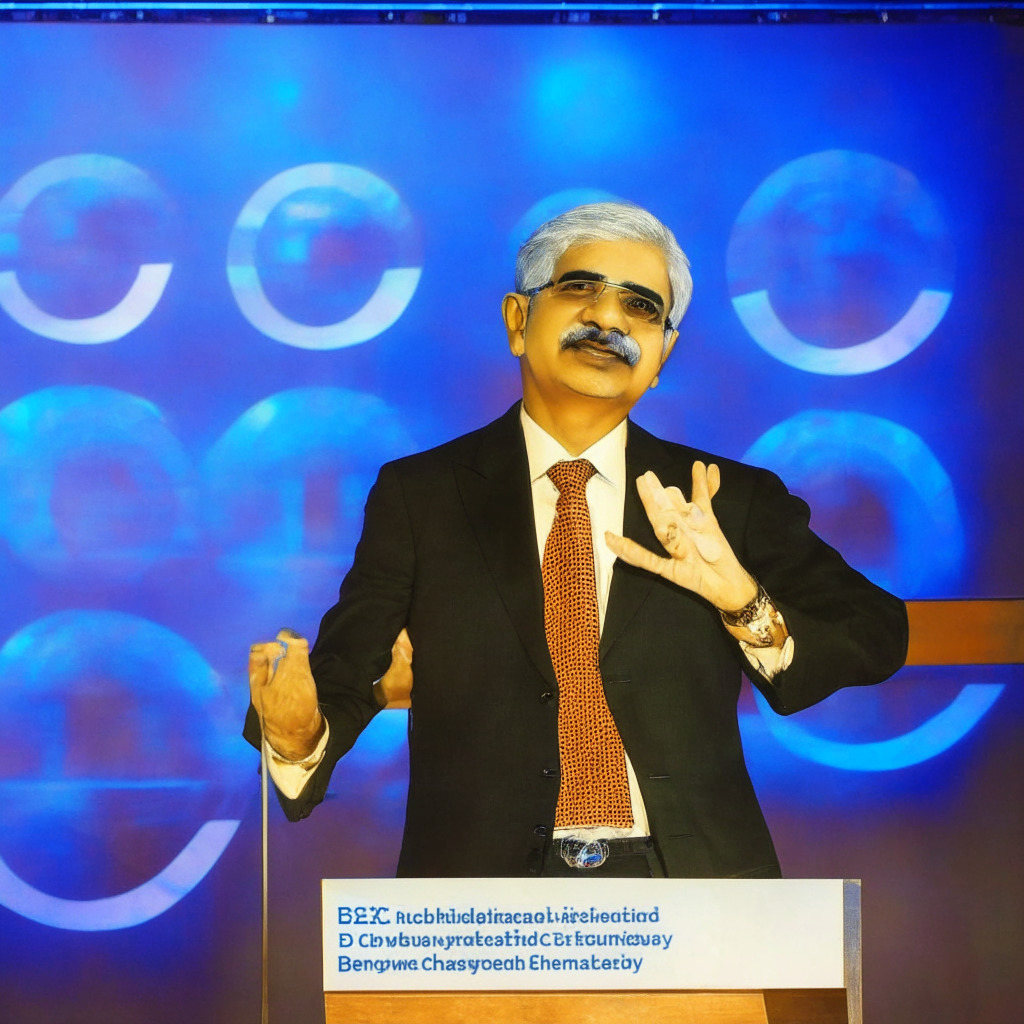

Unleashing the Power of CBDCs: India’s Approach to Revolutionizing Global Finance

Reserve Bank of India’s Governor, Shaktikanta Das, emphasized the transformative potential of Central Bank Digital Currencies (CBDCs) in a recent G20 TechSprint Finale address. He outlined their potential to revolutionize international payment landscape by reducing costs and increasing transparency. India, currently testing its own CBDC, engages in comprehensive data collection and analysis for future policies. They also invite innovative solutions for cross-border CBDC platforms.

Chronicle’s Leap Forward: Lower Gas Fees, More Networks and Integrity Questions Unanswered

“Chronicle, the second-largest oracle provider, is set to expand its services to other networks, thereby introducing more competition to the oracle landscape. The Chronicle Protocol aims to reduce gas fees by 60% envisioning higher platform utilization and maintaining uncompromised data integrity with data origin monitoring user dashboards.”

The Micro Revolution in Bitcoin Mining: Pocket-Sized Devices Against Industry Secrecy

Micro Bitcoin mining devices are small, cost-effective tools that aim to defy the secrecy and exclusivity associated with Bitcoin mining. Bitmaker’s devices, costing around $3, offer accessibility and transparency, fostering understanding and community participation in cryptocurrency despite limited profitability. These innovations symbolize a step towards democratization and decentralization in the crypto world.

Harnessing the Power: The Intersection of AI and Cryptocurrency in Cronos Labs’ $100M Program

“Cronos Labs is looking for eight innovative crypto startups to join their $100 million accelerator program, aiming to marry artificial intelligence (AI) with crypto. Blockchain developers are leveraging the growing interest in AI to accelerate the growth of the digital economy, projecting AI and cryptocurrency as the next critical turning point.”

Debunking the Myth: The Real Energy Consumption of Bitcoin Mining

“The Bitcoin Electricity Consumption Index (CBECI) has significantly adjusted its original estimates of cryptocurrency’s energy appetite. It now suggests Bitcoin network’s total energy consumption is more comparable to US tumble dryers usage. This shift is due to the realization that older mining machines are being decommissioned quicker than predicted.”

Groundbreaking AI Tool yPredict: The Future of Crypto Trading Analysis

yPredict, a trading analytics platform, is developing a real-time AI trading analysis suite combining traditional statistical models like ARIMA and advanced AI models like LSTM and SVM. This unique approach aims to offer enhanced price prediction in cryptocurrency trading, providing a comprehensive toolkit for understanding and acting on market movements.

Navigating the AI Wave in Crypto Trading: The Rise of ChatBots and User Trust Issues

“Cryptocurrency exchange Bybit recently introduced ‘TradeGPT’, an artificial intelligence (AI) trading assistant that provides insights using platform market data. The tool utilizes both the ChatGPT language model and Bybit’s ToolsGPT for real-time market analysis and user Q&A assistance, intending to educate users in the complex crypto-sphere.”

Ethereum Supreme Court: A Solution for DeFi’s Contract Disputes or a Threat to Small Protocols?

Matter Labs CEO, Alex Gluchowski proposes an “Ethereum Supreme Court” for dealing with recurring smart contract disputes in DeFi. His vision involves a blockchain-based court system, similar to real-world judiciaries, to provide resolution for contract-related disagreements, particularly focusing on enhancing measures to handle unforeseen vulnerabilities and emergencies in Layer 2 implementations.

Soccer Legend Ronaldo’s NFT Gameplan Vs The Regulatory Framework of Crypto Markets

“Soccer legend Cristiano Ronaldo, an early adopter of NFTs, recently revealed his future plans for more NFT collections through a lie detector experience. As crypto markets evolve, sports stars like Ronaldo are actively participating, but it’s crucial for individuals and corporations to tread cautiously.”

Harnessing Politics to Navigate DAOs: A Balance of Efficiency and Decentralization

“Decentralized Autonomous Organizations (DAOs) aim to balance efficiency and decentralization, akin to political organizations. Despite their distinct advantages, DAOs often face challenges like flawed governance, communication issues, and skewed participation leading to diluted long-term objectives. Strategies from politics, including electing representatives and preference-based decision-making, could be instrumental in overcoming these drawbacks.”

London Stock Exchange Dives into Blockchain: A Paradigm Shift or a Risky Gamble?

The London Stock Exchange Group (LSEG) is moving forward with plans to implement an “end-to-end blockchain-powered” lifecycle for financial assets. This revolutionary initiative aims to facilitate a more streamlined, cost-effective, and regulated process not focused on cryptocurrencies, but on the technology behind them.

Unveiling MetaCene: Revolutionizing Blockchain Gaming or Creating a Risky Bubble Economy?

MetaCene, a next-generation blockchain MMORPG developed with an investment of $5 million, aims to redefine civilizations through player interactions with in-game non-fungible tokens (NFTs). Incorporating AI and blockchain technologies, MetaCene departs from conventional gaming, focusing less on financial gain and more on pure gaming experience.

Decentralized Finance: The Sleeping Giant Awakens, Driven by Challenges of Centralization

“Changpeng Zhao, CEO of Binance, predicts DeFi could surpass CeFi in the next bull run. A sharp growth in DeFi trading volume and recent legal regulations catalyzing a shift from centralized to decentralized platforms corroborates Zhao’s bullish outlook on DeFi.”

India’s SBI Leaps into Digital Realm: UPI Integration with Digital Rupee, A Step into the Future

“India’s largest public sector bank, SBI, has integrated UPI with the Digital Rupee, enabling 300 million UPI users and 500 million merchants to enhance their digital transactions. The ‘eRupee by SBI’ application potentially fuels secure and rapid exchanges, increasing national digital currency usage in regular transactions. However, the excitement around cryptocurrencies remains muted within the Indian government.”

Blockchain’s Rising Star in Global Finance: A Glimpse at India’s NPCI and London Stock Exchange Group’s Approach

“India’s National Payments Corporation is recruiting a blockchain expert, indicating a growing faith in blockchain’s potential in finance. Concurrently, the London Stock Exchange Group is leveraging blockchain to create a platform for traditional financial assets, possibly becoming the first major global exchange to establish a blockchain-powered ecosystem.”

Blockchain Revolution in Traditional Asset Trading: The London Stock Exchange Leap and Its Implications

London Stock Exchange (LSE) Group is aiming to revolutionize traditional asset trading with the incorporation of blockchain technology. This new system proposes a smoother, cheaper, and more transparent process for handling traditional assets, ensuring reliability for investors. However, the integration faces hurdles, including security concerns and effectiveness of legacy systems with new technologies.