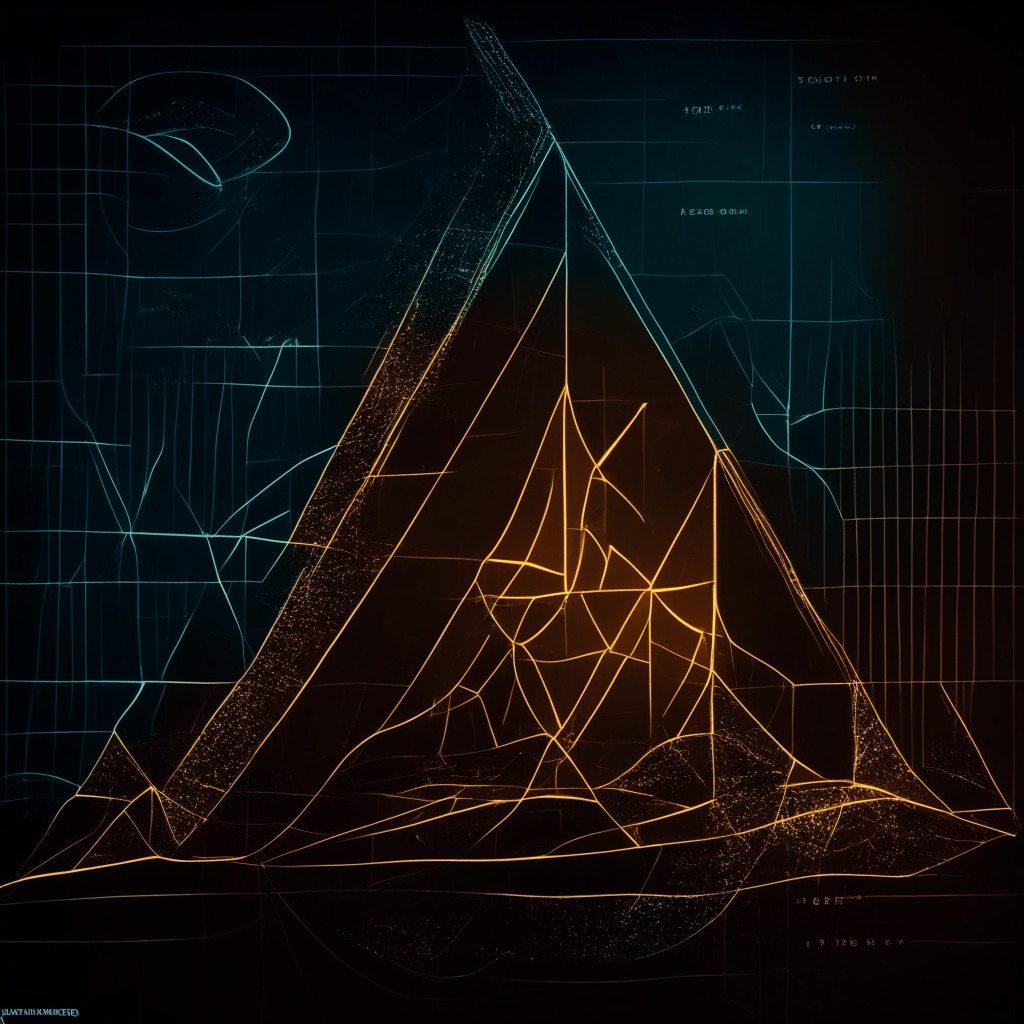

The Cardano coin price is adhering to a downsloping trendline and crucial support at $0.377, forming a descending triangle pattern. The future trend will depend on a breakout from either side of this triangle. The recent 0.8% gain highlights the altcoin’s potential consolidation phase within the pattern, while a bearish crossover in the market could encourage sellers towards the $0.377 support level.

Search Results for: MACD

Floki Coin’s Rounding Bottom Pattern: A Bullish Reversal and Potential 61% Increase

The Floki coin price recently formed a bullish reversal rounding bottom pattern with potential for a massive rally. Aided by a 73% gain in trading volume and listing on Binance cryptocurrency exchange, the Floki coin price has surpassed local resistance, indicating a new recovery cycle.

Pepe Coin’s Strength Amid Binance Delay: Market Impact and Meme Coin Viability

Pepe Coin remains strong despite Binance postponing its listing, showcasing a $1.2 billion market cap and trading on multiple exchanges. Meme coins like PEPE, SPONGE, and AiDoge demonstrate potential, but investors must consider sustainability and performance longevity.

Ethereum Price Surge: Analyzing Factors and Potential Impact on the Market

Ethereum experienced a 6.3% price increase on May 5th, attributed to traders converting Pepecoin profits into Ethereum. Breaking a resistance trendline and staying above the 50% Fibonacci retracement level indicates a bullish market trend, with potential for further recovery in Ethereum’s price.

Ethereum, Ripple, Cardano, Pepe, and Tron: Analyzing Key Price Levels and Market Volatility

Ethereum seeks retest of $2,000 level while Ripple faces key support at 43 cents. Cardano forms bearish pattern with key support at 38 cents. Meme coin Pepe surges, but caution advised. Tron’s price increases by 6.3% as momentum indicators turn positive. Market conditions remain fluid; thorough research and caution essential for investments.

Unpredictable Crypto Market: Analyzing Bitcoin’s Recent Gains and Projected Outcomes

The cryptocurrency market’s unpredictable nature persists as BTC/USD extends gains, with experts cautiously optimistic about Bitcoin’s future. Increasing buying pressure signifies positivity, but investors should consider both upside and downside price objectives, exercising caution with technical support and resistance levels. Mixed signals arise from 4-hour and 60-minute charts, urging meticulous navigation of the fluid crypto market.

The Impending USD Short Squeeze: A Threat to Bitcoin and Ether’s Rally? Pros, Cons & Conflicts

This excerpt highlights the potential impact of a short squeeze in the U.S. dollar on leading cryptocurrencies, such as BTC and ETH. Singapore-based QCP Capital warns that this squeeze could result in significant drops, as the negative correlation between the dollar index and cryptocurrencies intensifies.

Crypto Coaster: Sally Ho’s BTC/USD Analysis Unravels the May 2nd Market Dip, Humor Included

The crypto coaster continues as Sally Ho’s BTC/USD technical analysis unveils the market dip on […]

Navigating the Bitcoin Rollercoaster: Sally Ho’s Insightful Technical Analysis for May 1st, 2023

Navigating the Bitcoin Rollercoaster: Sally Ho’s Insightful Technical Analysis for May 1st, 2023 Bitcoin (BTC/USD) […]