The unfolding FTX crypto exchange saga, involving ex-CEO Sam Bankman-Fried facing numerous charges related to misuse of customer funds, highlights the complex nature of crypto regulations and the precarious relationship between crypto companies and their users. This case emphasizes the urgent need for robust crypto regulations to protect investors and preempt misuse, while allowing room for innovation.

Search Results for: RSI

Blockchain Meets Traditional Finance: A Tale of Progress and Caution from Hong Kong Stock Exchange

The Hong Kong Stock Exchange (HKEX) is integrating blockchain technology via a new platform, “Synapse,” using smart contracts to enhance operational efficiency in financial markets. However, the growing adoption of blockchain also highlights the urgent need for robust security measures and stronger oversight due to risks such as fraud.

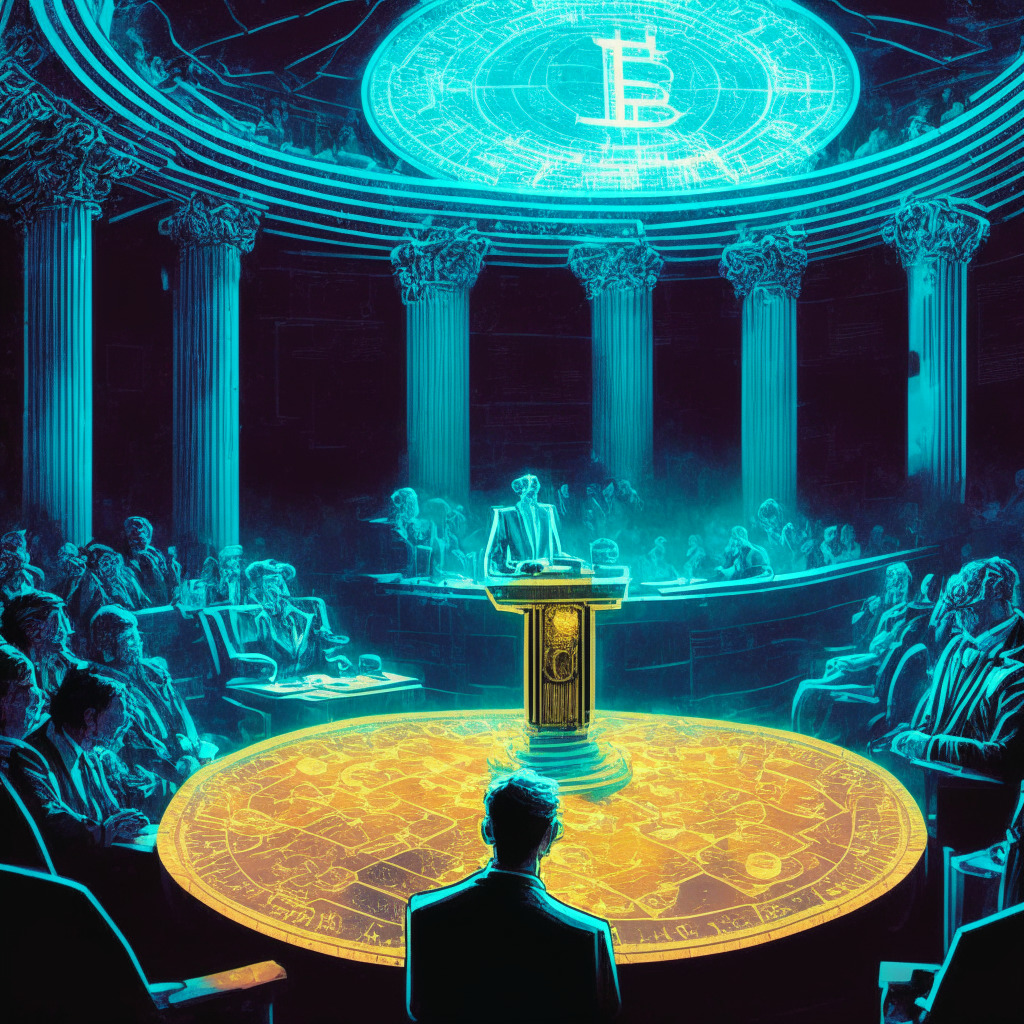

Coinbase vs SEC: A Case of Interpretation in Crypto Regulation Compliance

The SEC accuses Coinbase of non-compliance in the registration as a securities exchange, an accusation Coinbase counters by declaring cryptocurrency transactions don’t resemble traditional investment contracts. The lawsuit’s pivot point is the interpretation of the “Howey test” for classifying assets as securities. Coinbase maintains the assets on its platform are not securities and exist outside SEC’s jurisdiction.

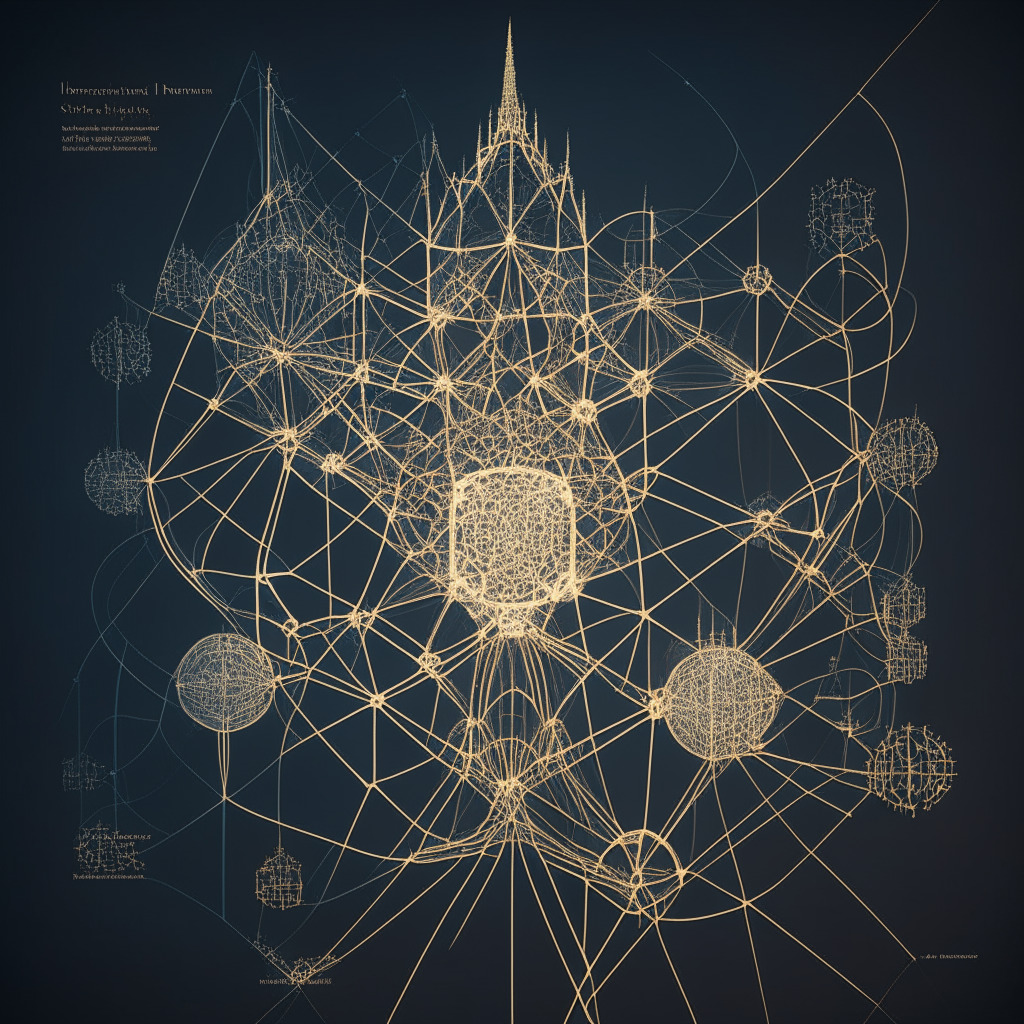

Exploring the Impact and Probable Consequences of Project Atlas on Crypto Tracking

“Project Atlas, launched by the Bank for International Settlements (BIS) and four European central banks, aims to revolutionize financial authorities’ management of crypto assets by tracking global asset movements. It melds data from crypto exchanges with data from public blockchains, providing tools for accurate assessment of crypto markets’ economic significance.”

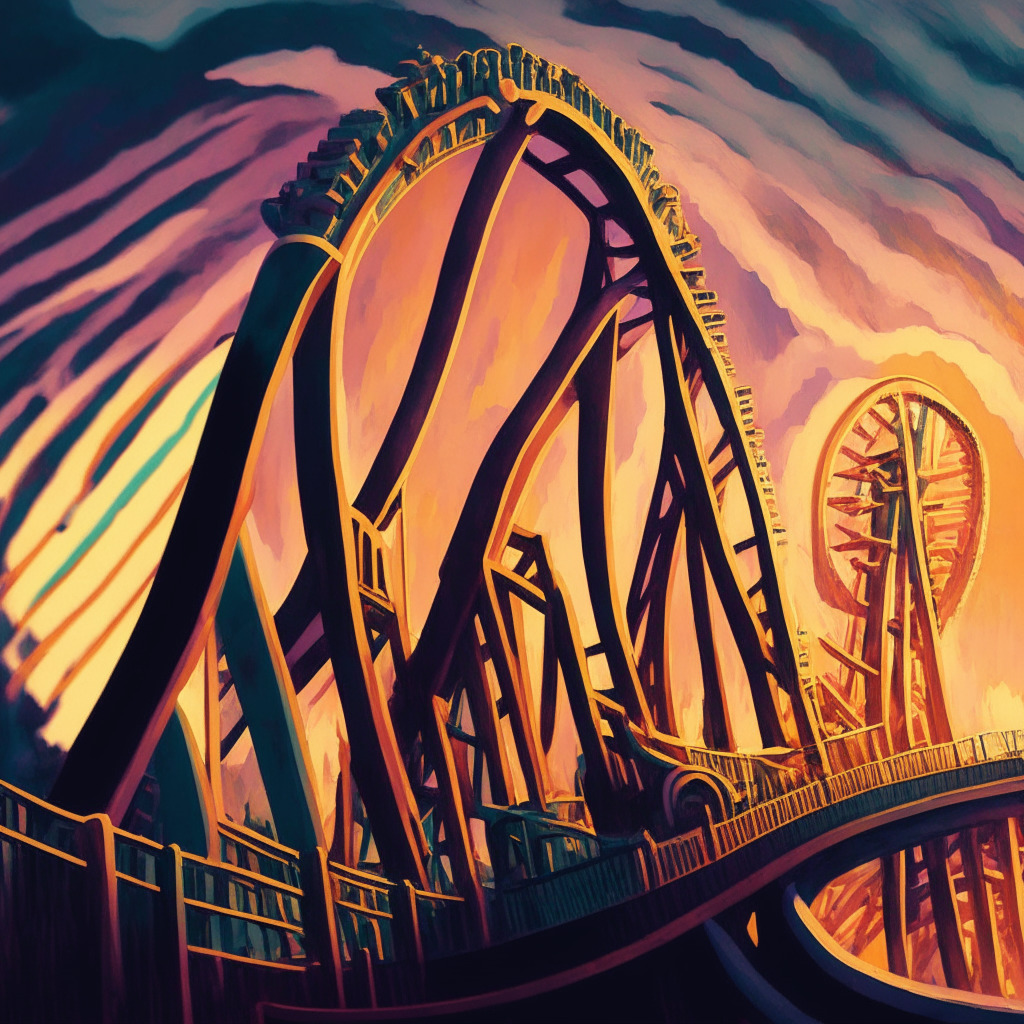

The Remarkable Ascent of Bitcoin BSC: Stellar Debut or Crypto Roulette?

“Bitcoin BSC, a new crypto, has kicked off on PancakeSwap, surging 50% and securing a market cap of $30m. With 2,310 token holders just after debut and an audited smart contract, it shows promise for future performance, although risks remain high.”

Alameda’s Dubious Token Transfers and FTX’s Collapse: A Case for Crypto Regulation

Alameda Research transferred a massive $4.1 billion in FTT tokens to FTX exchange before its bankruptcy. This move, along with other dubious on-chain activities and the substantial control over FTT token supply, may have fueled their mutual financial balance sheets. These alarming transactions highlight the urgent need for transparent, comprehensive financial disclosures and tighter regulations in the blockchain networks.

Bitcoin’s Resurgence and Emergence of TG.Casino: A Double Whammy in the Crypto World

“Polygon has seen a 17% increase in high-value transactions, in line with the unveiling of key governance proposals. However, its Relative Strength Index indicates potential need for consolidation. Additionally, TG.Casino emerges as an exciting entity, linking casino industry with decentralized blockchain capabilities, offering both opportunities and challenges in the cryptocurrency future.”

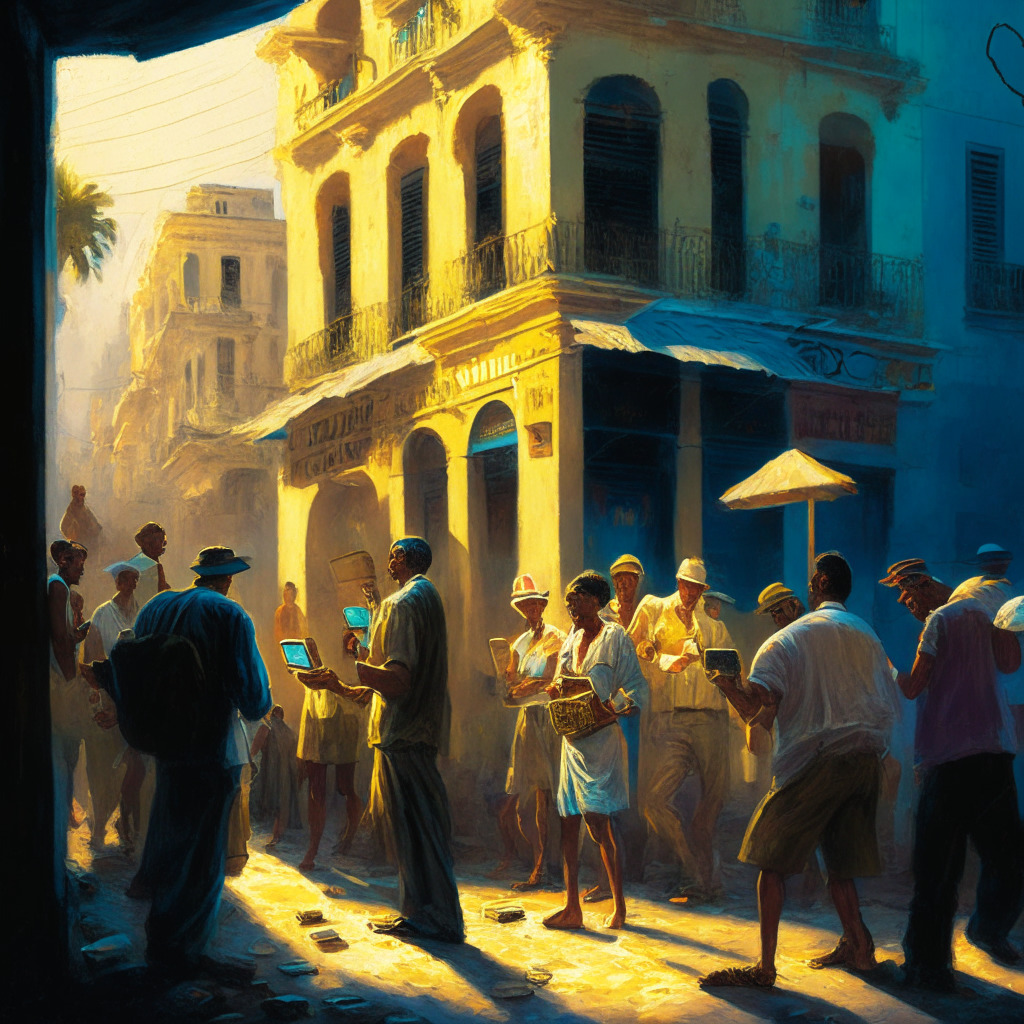

Bitcoin Awareness Rises in Cuba amid Fears of National Currency Decline

Amid devaluation of the Cuban peso and inflation, the crypto community in Havana, Cuba is turning to Bitcoin due to its relative financial stability. Despite governmental restrictions, Cubans have developed ways to buy and sell Bitcoin, hoping for a more economically secure future.

Navigating the High-Stakes Landscape: The Bold Moves of DWF Labs in Crypto Venture Capitalism

“DWF Labs, a crypto investment firm, has made significant strides in token investing, changing industry norms by focusing on token value to projects. Their strategy targets nine macro-categories for risk diversification, concentrating on potential market adoptions and project team success. Investments include TON, EOS, and recent addition, Crypto GPT, as part of their risk mitigation strategy.”

Ripple Effect: The Rise of XRP and The Advent of Meme Kombat in Crypto Markets

“The surge in XRP’s value, a solid 4.5% gain in 24 hours, has aroused excitement in the crypto world. With an overall increase of 57% since the year’s start, there are expectations for more gains. A recent market recovery and technical indicators validate this positive trend, all pointing towards XRP’s potential breakout.”

Hong Kong’s Emergence as Regulated Crypto Haven: Implications for Beijing’s Stance on Digital Assets

“Hong Kong, despite Beijing’s clampdown on digital assets, has emerged as a leader in the regulated cryptocurrency market due to crypto-friendly policies. This shift, characterizing a potential softening stance from Beijing, occurs as transaction volumes in China significantly fall, hinting at a tentative approach towards cryptocurrency.”

The FTX Drama: How Crypto Complexity Can Challenge Real-World Justice

This article discusses the challenging role of explaining the complex crypto world in the ongoing court case against Sam Bankman-Fried, ex-CEO of FTX. It portrays the differing trial strategies regarding how to present cryptocurrency, from simplifying it with analogies to intensifying its intricacies.

Navigating the Storm: Bitcoin Cash’s Market Struggles and the Rise of Bitcoin Minetrix

“Bitcoin Cash (BCH) tests the 20DMA support line as trading volume slips 48.19% to $246k. Meanwhile, Bitcoin Minetrix, an emerging Bitcoin cloud mining presale is drawing attention with its Stake-to-Mine model, which leverages token-staking to offer efficient, secure BTC mining.”

Unleashing the Bull: Bitcoin’s Prospects Amid Rising U.S Treasury yields and Looming Economic Unrest

Recent developments in the US economy, such as rising treasury yields and national debt, suggest a bullish future for Bitcoin. Former crypto exchange CEO, Arthur Hayes, speculates this could lead to mass liquidity injections, possibly triggering a Bitcoin bull run. However, the volatile interplay between these economic factors also warrants caution.

AirBit Club Fallout: Navigating the Tightrope Between Regulation and Innovation in Crypto

This article discusses the infamous AirBit Club Ponzi scheme that swindled investors out of their funds through misuse of crypto technology. It underscores the need for comprehensive international blockchain regulations without stifling the decentralizing benefits of this revolutionary technology.

Shadows Over Crypto: Fentanyl Sanctions, Regulatory Barriers, and the Future of Bitcoin

Bitcoin saw a slight downturn recently amid challenges such as the US Treasury’s move to outlaw cryptocurrency wallets and a crackdown on illicit substances like fentanyl. Additional regulatory barriers in the US are hindering crypto innovation, leading to concerns over future Bitcoin prices and investor sentiment.

Emerging NFT Powerhouse: Exploring OpenSea Studio’s Potential and Future Challenges

OpenSea introduces OpenSea Studio, a comprehensive tool for creators of NFT projects offering full control over the NFT drop process, direct minting, and compatibility with multiple blockchains. The platform’s intuitive interface eliminates the need for technical expertise, facilitating easier NFT project creation and acquisition through credit or debit cards.

Crypto Regulation Variance: SEC vs Coinbase and Argentina’s Proposed Digital Currency

“The SEC and Coinbase are in court, debating securities registration for crypto assets. Meanwhile, Argentina’s presidential candidates propose differing cryptocurrency solutions to economic issues: introducing a digital currency or supporting Bitcoin and abolishing the central bank.”

Crypto Race in the East: Japan’s Deregulatory Push vs. South Korea’s Cautious Approach

“Japan is pushing to deregulate the crypto market to create a more conducive environment for crypto businesses possibly making it a ‘crypto and Web3 El Dorado’, while South Korea leans towards stricter regulation. International crypto companies are reportedly eyeing the Japanese market, signalling a burgeoning ‘crypto race’ in East Asia.”

Rescuing Argentina’s Economy: Central Bank Digital Currency vs. Bitcoin Adoption

Argentina’s second-leading presidential candidate, Sergio Massa, plans to launch a national central bank digital currency (CBDC) if elected, aiming to combat the country’s escalating inflation. Massa believes that a strong digital economy, supported by a CBDC, offers a better solution than relying on the U.S. dollar, a strategy that is in direct contrast with competitor Javier Milei, who favours a pro-Bitcoin, anti-central bank approach.

Introducing DRAM: Dirham-Backed Stablecoin Aims for Global Impact Amidst Regional Restrictions

Swiss company DTR presents a Dirham-supported stablecoin, DRAM, aiming to facilitate global value transfer. Despite its non-availability in UAE and Hong Kong, the token, developed by Dram Trust is listed on decentralized exchanges like Uniswap, PancakeSwap trading with Binance Coin.

AI-Powered Analytics Venture yPredict: A Promising Contender or Just Another Crypto-Flash?

yPredict, a rising contender in cryptocurrency and blockchain technology, offers AI-powered analytics solutions via its utility token, YPRED. It’s aiming to integrate AI with cryptocurrency, a blossoming sector, and provide tools like AI-assisted content generation and trading signals. However, its challenge to secure a substantial market share in a crowded space remains.

Navigating Cryptocurrency Uncertainty: Impact of US Economic Trends and Emerging Altcoins

“Behind Bitcoin’s dramatic rate fluctuations is an unanticipated rise in US yields, which could decrease its appeal compared to risk-free assets like government bonds. However, risk-tolerant traders are shifting towards less liquid meme coin markets for potential profits. Exercising caution and strategic planning are crucial in this high-risk crypto asset market.”

Navigating Bitcoin Investments Amid U.S. Government Shutdown Fears: Strategies and Risks

Bitcoin’s rise towards $28,000 was linked to U.S. debt limit uncertainty. Despite skirting an immediate shutdown, risks of recession persist due to factors like inflation and surging oil prices. Bitcoin investors are bracing themselves for potential volatility as the debt ceiling decision nears, with strategic trading moves critical in this climate of uncertainty.

Former FTX CEO’s Multi-Layered Legal Saga: Impact on Blockchain & Insurance Industries

The embattled ex-FTX CEO, Sam Bankman-Fried, initiates a lawsuit against Continental Casualty, claiming the insurance company failed to cover defense costs under a D&O policy. This policy should protect executives from personal losses and should’ve provided subsequent coverage after the $10-million primary protection had been exhausted. This complex legal issue heightens tension in insurance and blockchain sectors and underscores the need for clear policy terms.

Navigating the Crypto Legal Labyrinth: The High-Profile Case of Celsius’ Ex-CEO Alex Mashinsky

The high-profile legal proceedings against Alex Mashinsky, former CEO of Celsius Network, highlight the regulatory challenges in the cryptocurrency sphere. The case emphasizes the crypto industry’s vulnerability to fraud, raising concerns about the need for a balanced approach to regulations that protect investors while fostering innovation. The outcome could shape future crypto regulatory trends.

Navigating the Cosmos: The Pros and Cons of Bitcoin Integration Through nBTC Interchain Upgrade

Developers are integrating Bitcoin into the Cosmos network via Osmosis, a prominent decentralized exchange (DEX). The result is Nomic Bitcoin (nBTC), an IBC-compatible token that expands Bitcoin’s use across over 50 Cosmos-linked app chains. Despite transaction fees, crypto-investors can self-custody nBTC, use it as collateral, and engage in lending within the ecosystem. However, the initial cross-chain bridge limit could frustrate high-volume investors.

Unraveling the Paradox of Increased Decentralization: The Optimism Network’s Stride and Binance’s Unexpected Move

The Optimism network has launched its testnet version of a fault-proof system aimed at increasing the efficiency and decentralization of the Superchain. Typically reliant on centralized sequencers, the new system offers modular options to prevent fraud. However, co-founder of Ethereum, Vitalik Buterin, asserts the importance of user-submitted fraud proofs to maintain true decentralization.

Understanding the Recent Bitcoin Price Plunge: Navigating the Crosscurrents of Rising U.S. Bond Yields and Bullish Market Sentiment

Bitcoin’s recent price drop is attributed to several factors including a spike in U.S. bond yields, which strengthened the dollar and negatively impacted Bitcoin. Despite bearish indicators, some bullish market sentiment remains due to long position holders still paying for short positions.

Crypto Turmoil in Kazakhstan, Cracking Down Criminal Networks: A Week in the Crypto World

Eight cryptocurrency mining operators in Kazakhstan have protested over high electricity costs, possibly resulting in some businesses halting operations. Meanwhile, cryptocurrency transactions in China and Hong Kong have significantly dropped due to ongoing market slump and Beijing’s attempts to suppress digital assets.

Kazakhstan’s Crypto Crisis: A Plea to Survive Amidst Soaring Energy Costs

In an open letter to President Kassym-Jomart Tokayev, Kazakhstan-based digital asset miners, including eight major entities, urgently request a decrease in energy prices. They warn of industry-wide dessertion caused by untenable fees and increasing operational challenges, threatening an extinction of the country’s thriving mining ecosystem.

Predicting Bitcoin’s Fall: Bearish Outlook Vs Market Resilience Amidst Crypto Scams

Despite the recent uplift in cryptocurrency markets, some analysts, including prominent trader CryptoBullet, predict a fall in Bitcoin (BTC) price to the $20,000 level due to indications of a potential downward trend. In contrast, others doubt such a significant drop. Market resilience, showcased by successful scam prevention collaborations like “Trust No One”, is deemed crucial for maintaining the integrity of the digital asset ecosystem.