The SEC’s proposal requiring investment firms to safeguard client assets, including cryptocurrencies, with approved custodians faces pushback from organizations like JPMorgan and the Small Business Administration. Critics argue the rule is “illegal, infeasible, and dangerous,” with concerns over unique custody logistics for crypto assets and potential limitations on service options.

Search Results for: RSI

Cboe’s Third Attempt at Bitcoin ETF Approval: Will the SEC Finally Give In? Pros, Cons, and Conflict

Cboe Global Markets has filed its third proposal to list and trade a spot Bitcoin ETF, despite previous rejections by the SEC amid concerns over fraud and manipulation. The SEC has approved Bitcoin futures ETFs, sparking criticism and calls for a more balanced approach to investor protection and market innovation.

Growing Uncertainty for US CBDC Future: Political Divides and Privacy Concerns at Stake

The future of Central Bank Digital Currencies (CBDC) in the US faces uncertainty due to growing bipartisan opposition, with concerns regarding increased surveillance power and privacy at the center of the conflict. The CBDC Anti-Surveillance State Act aims to enhance oversight and prohibit the Federal Reserve from issuing a CBDC.

Congressional Testimonies Clash: Balancing Crypto Regulation and Innovation

Top legal officers and a former regulator will testify in front of US congressional committees on cryptocurrency regulation, discussing improvements in regulatory interaction and proposing Congress directs the SEC to develop joint rules for crypto. The testimonies highlight differing opinions on finding a balance between proper oversight and fostering innovation in the constantly evolving digital asset market.

Bittrex Bankruptcy: A Lesson in Crypto Evolution, Self-Custody & Regulatory Uncertainty

Bittrex, a once-popular crypto exchange platform, files for bankruptcy protection due to an untenable regulatory and economic environment in the US. The rise of decentralized finance (DeFi) and platforms like Uniswap have contributed to its decline, while regulatory uncertainty looms over the crypto industry.

Debating Anonymity in Digital Pounds: CBDCs vs Cryptocurrencies in the UK

At a recent Financial Times Cryptocurrency and Digital Assets Summit, Tom Mutton, the Bank of England’s head of fintech, discussed the UK’s plans for a central bank digital currency (CBDC) focusing on privacy and anonymity. While emphasizing privacy, Mutton stated that anonymity would not be intended for the digital pound and it would not be interoperable with cryptocurrencies. The Bank of England’s approach raises questions on the role of anonymity, privacy, and interoperability in the financial ecosystem.

Cardano’s Future Amid Market Turbulence: Growth, Challenges, and the Role of DeFi

Cardano (ADA) garners attention with unique features and growth opportunities, despite recent turbulence and capacity issues faced by its blockchain. Holding above the 200-Day Moving Average, ADA’s DeFi ecosystem liquidity and exponential growth opportunities could shape its promising future.

Landmark Insider Trading Case: Crypto Regulation vs. Decentralization Debate

In a landmark case, former Coinbase employee Ishan Wahi has been sentenced to two years imprisonment for insider trading, setting a legal precedent for the SEC to crack down on similar offenses in the crypto industry. This case highlights the need for increased vigilance, regulatory transparency, and strict compliance measures to ensure a fair and reliable market for all players.

Central Banks’ Role in Crypto: Innovation vs Regulation & the Global Cryptocurrency Debate

As we reach mid-2023, the role of central banks in the growing cryptocurrency market sparks debate among enthusiasts. Topics include active involvement in adopting digital currencies versus a hands-off approach, establishing a global cryptocurrency, and potential repercussions on worldwide economic balances. The future of blockchain relies on innovation, collaboration, and risk consideration.

Crypto Market Dips: XRP, Chainlink, Cardano’s Potential for Rebound and Future Growth

The crypto market has experienced a sharp sell-off, with XRP, Chainlink (LINK), and Cardano (ADA) among the top cryptocurrencies forecasted to rebound soon. Despite market turmoil, these coins show promising signs of potential recovery, but experts advise conducting personal market research before investing.

Paxful Resumes Operations Amid Controversy: Lessons in Crypto Platform Stability and Security

Paxful, a leading P2P cryptocurrency exchange, has resumed operations after a month-long suspension due to technical issues. The platform faced controversies during the suspension, including allegations of money laundering and avoiding US sanctions. As crypto markets evolve, security and stability remain top concerns for users.

Soaring Bitcoin Fees Push Africa Towards Lightning Network and Stablecoins: Boon or Bane?

Bitcoin users in Africa increasingly adopt the Lightning network and stablecoins as transaction fees soar to a two-year high. The shift in demand results from rising costs on the base layer, leading customers to prefer stablecoins like USDT or opt for faster, low-volume Lightning network transactions. However, challenges persist with instability in wallets, limited exchange support, and congestion. Despite setbacks, this situation could encourage further integration of the Lightning network and growth in the long-term.

The DAO Hack: A Formative Moment for Ethereum, ICO Boom & Security Lessons Learned

The DAO hack was a formative moment for Ethereum, leading to increased focus on security and alternative funding mechanisms like ICOs. It tested the community’s resilience and set precedents for today’s success. While security breaches still occur, balancing innovation and safety is essential to build a stronger, more reliable crypto ecosystem.

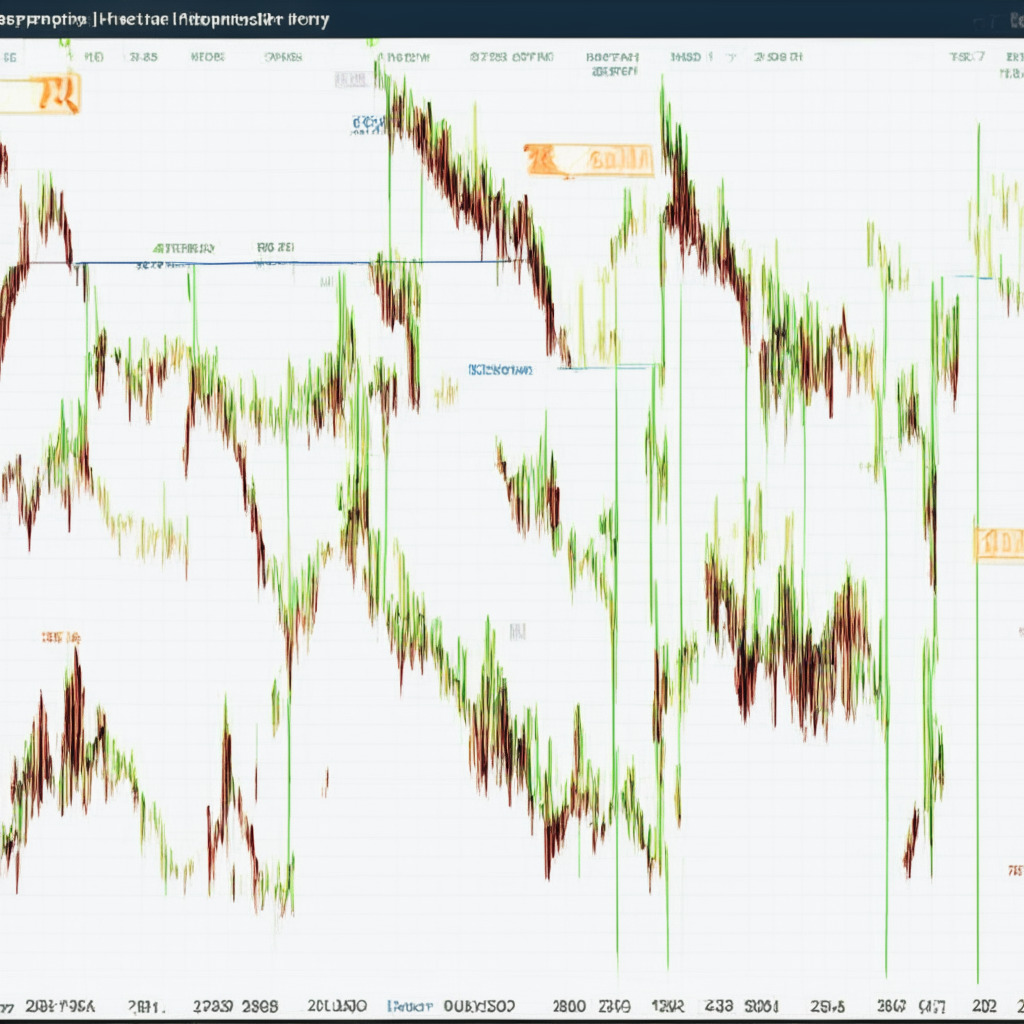

Bearish Breakdown in Cardano Coin Price: Short-Selling Opportunities and Resistance Levels

The Cardano coin price experienced a bearish breakdown, plunging 3.5% to $0.367 due to rising selling pressure in the cryptocurrency market. A potential rally could face multiple resistance levels, while the daily Relative Strength Index indicates high bearish momentum. Traders may be able to take advantage of short-selling opportunities with this pattern.

Billion-Dollar Cheetos Tin: Unraveling Blockchain’s Double-Edged Sword & Future Security Concerns

James Zhong’s $3.4 billion Bitcoin heist from Silk Road’s Ross Ulbricht highlights the security and traceability concerns of cryptocurrencies and the double-edged sword of blockchain technology. While blockchain provides privacy and security, it can also foster illicit activities, raising the need for greater oversight and regulation.

Pudgy Penguins NFTs Rise from Controversy: Analyzing the $9M Seed Funding and Future Prospects

Pudgy Penguins NFT collection secured a $9 million seed funding round led by 1kx, marking substantial progress since overcoming its founders’ controversies. With an expanding brand presence, live events, and merchandise, the project aims to make a significant impact in the NFT space, but its long-term success remains uncertain.

US Crypto Exchanges Face SEC Heat: Balancing Regulation and Innovation

Several U.S. crypto exchanges may have listed tokens deemed unregistered securities by the SEC, violating investor-protection laws. Of the 76 identified security tokens, nearly half were involved in suspected fraudulent activities, leading to delistings on major exchanges like Coinbase and Kraken.

XRP Price Analysis: Bullish Continuation Pattern Amid Selling Pressure – A Reversal or Trap?

The XRP price has plunged to a support trendline of a bullish ‘Flag’ pattern, indicating potential accumulation and reversal. However, skepticism remains, as market moves are unpredictable. Investors should approach predictions cautiously and conduct their own market research before investing in cryptocurrencies.

Crypto Market Rebound: Analyzing Galaxy Digital’s Q1 2023 Turnaround and Future Sustainability

Galaxy Digital reports a net income of $134 million for Q1 2023, a significant improvement from previous losses, highlighting the recovering cryptocurrency market. With assets under management rising, the industry’s potential for sustainable growth relies on cautious optimism, learning from past fluctuations, and emphasizing oversight and transparency.

Binance Listing Impact on Floki Inu and PEPE Coin: Popularity vs Credibility Debate

Binance recently listed Floki Inu and PEPE Coin due to growing demand for meme coins. Although Floki Inu’s price surged, it couldn’t sustain momentum. These listings highlight the influence of external factors on cryptocurrency volatility and the importance of conducting extensive market research before investing in such assets.

Investor Sentiments Divide in the Blockchain and Digital Assets Industry: Shift or Solidify?

The Goldman Sachs report “Family Office Investment Insides” reveals that 32% of family offices hold investments in digital assets, with 19% driven by their belief in blockchain technology. However, interest in potential crypto investments has sharply decreased to 12% in 202>Title

Blockchain Future: Exciting Prospects, Potential Pitfalls, and the Ongoing Debate

The recent disruptive blockchain event in New York highlighted the promising nature of blockchain technology, its prospects, and obstacles. Participants discussed opportunities brought about by the blockchain revolution, addressing skepticism about limitations, and emphasizing the potential benefits in various sectors such as supply chain management and financial services.

Lightning Network: Revolutionizing Speed and Efficiency in Crypto Transactions

The Lightning Network (LN) aims to address Bitcoin’s slow transaction speed by enabling high-volume micropayments with near-instant times, minimal fees, and a capacity of 1 million transactions per second. However, concerns like manual address entry errors and ongoing refinement warrant caution. LN has garnered attention from companies like Kraken and Coinbase, but debates on LNURL adoption persist.

FTX Founder Faces Criminal Charges: Market Collapse or Fraud to Blame?

Sam Bankman-Fried, founder of the defunct cryptocurrency exchange FTX, faces 13 criminal charges including money laundering and wire fraud. His defense seeks dismissal of ten charges, alleging legal shortcomings and extradition process violations. The case’s outcome may impact future cryptocurrency industry regulations and investor enthusiasm.

AI-Generated Music on Spotify: Fraud Concerns vs Creative Exploration

Spotify removes 7% of AI-generated music by startup Boomy amid concerns of fraudulent activity and copyright issues. While the industry is apprehensive about the technology, some artists are eager to explore its potential. This conflict may shape AI’s future role in the music industry.

XRP

The XRP price dropped 2.5% amid a declining cryptocurrency market, but Ripple’s recent report on central bank digital currencies (CBDCs) emphasizes the potential role of XRP in the future economy. Despite current downtrend, Ripple’s stablecoin partnerships and growth in the global value of CBDCs offer positivity and long-term growth possibilities.

Bitcoin Ordinals on the Rise: Exploring Pros, Cons, and Market Impact

Bitcoin non-fungible tokens (NFTs) gain popularity in the Web3 space, with major exchanges like Binance and OKX supporting them. The expansion of the multichain NFT ecosystem is vital for the broader cryptocurrency market but remains a controversial subject within the crypto community.

New York’s Blockchain Hotspot: Milestone or Risky Endeavor in the Financial Hub?

New York, a financial hub, is gaining attention in the blockchain and cryptocurrency space with developments possibly positioning the industry as a focal point of innovation. However, skepticism persists, raising concerns over volatility, security issues, and regulatory challenges in this nascent market.

FTX’s Legal Battle: Examining Challenges in the Crypto-Blockchain Space & the Need for Regulation

The ongoing legal battle involving FTX founder Sam Bankman-Fried highlights the challenges faced in the crypto industry, including potential fraud, hacking, and market manipulation. As the sector matures, it must navigate growing pains to achieve widespread adoption, emphasizing the importance of education, transparency, and sensible regulations.

Hong Kong’s Crypto Regulation: Balancing Innovation and Market Integrity

Hong Kong is establishing a robust regulatory framework for its growing crypto industry, including a new licensing regime for crypto service providers starting June 1. With tightened regulations and guidance for banks, the city aims to strike a balance between promoting financial innovation and market integrity, positioning itself as Asia’s primary crypto hub.

Estonia’s Crypto Crackdown: Balancing Tech Adoption and Regulatory Compliance

Estonia enhanced its AML laws, impacting 400 Virtual Asset Service Providers (VASPs) that voluntarily shut down or lost authorizations. Despite stricter regulations, Estonia hosts 100 active crypto firms, showcasing the challenge of balancing safety and innovation in the crypto ecosystem.

SEC’s Crypto Custody Rule Change: Balancing Innovation vs. Investor Protection

The SEC has proposed tighter crypto custody rules which are met with strong opposition from the Blockchain Association and Andreessen Horowitz. They argue the rules would curtail investment, exceed the SEC’s authority, inhibit advisors, and risk assets. Balancing innovation, growth, investor protection, and compliance remains a core conflict.