“Squid2.0, a new iteration of the infamous Squid Game crypto scam, has surfaced, promising to correct previous errors and offer a scam-free platform. However, skepticism remains due to its predecessor’s fraudulent history and a general volatility in the meme coin market.”

Search Results for: SWIFT

Emerging Demand for AI Prompt Engineers: Skills, Education & Opportunities

“AI prompt engineers are professionals specializing in designing efficient prompts that customize and fine-tune AI models. They rely on profound understanding of NLP, machine learning, and AI, ensuring optimal outputs and enhanced control. This emerging niche demands continuous learning, hands-on experience, and active networking for success.”

Navigating the Turbulent Waters of Crypto: Mainstream Uptake vs Trust Deficit Challenges

“BlackRock’s CEO shows unexpected enthusiasm for Bitcoin, highlighting a leap in mainstream acceptance. Contrasting, Gemini’s trust issues reveal potential systemic issues within crypto. Despite high-profile incidents, Binance’s CEO predicts a Bitcoin bull run. Meanwhile, scrutiny grows over top crypto exchanges amid low employee morale concerns.”

The Graph: Revolutionizing Blockchain Data or Risky Investment?

“The Graph is a decentralized indexing system that simplifies the development of decentralized applications (DApps). Using a protocol and open-source APIs called “Subgraphs”, it arranges blockchain data, enhancing the speed and efficiency of data retrieval. Despite offering revolutionary prospects for data exchange, it requires staking GRT tokens, posing potential financial risks.”

Erroneous Crypto Deposits: A Case for Stronger Regulations or a Gamble of Digital Currency?

The case of Crypto.com inadvertently depositing $50,000 into a user’s account underlines the urgent need for stronger regulation within the crypto-sphere. This incident stresses the importance of robust system checks to prevent such mishaps, ensuring user’s confidence and transaction safety.

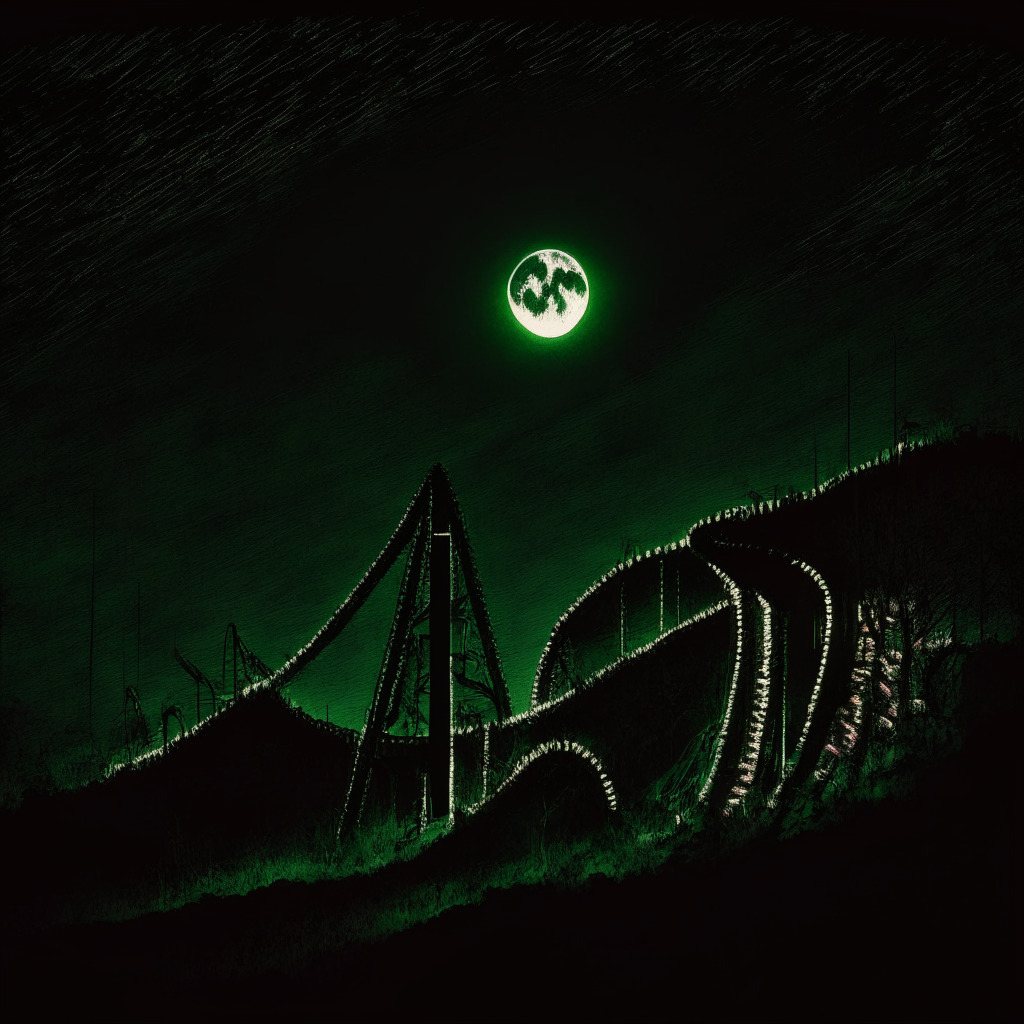

Roller Coaster Ride for XRP: Dips, Highs, Optimism, and the Emerging $WSM Token

The XRP token experienced a drop to monthly lows, struggling to break its downward momentum despite high trading volumes. Still, XRP supporters remain optimistic amid Ripple’s ongoing SEC lawsuit. If outcome is favorable, XRP might become a leading player in the crypto market for 2023.

Emerging Legislative Storm: Namibian Crypto Regulations and Their Potential Impact

Namibia’s National Assembly is taking steps towards regulating cryptocurrencies and their service providers, with penalties for non-compliance including a N$15 million fine or 10-years jail. The proposed legislation establishes a Regulatory Authority aimed at safeguarding consumer interests, preventing market manipulation and fostering innovation in virtual assets.

Navigating the Crypto Landscape: Insights from a Blockchain Expert on Digital Asset Investing

“Sarah Morton, a crypto expert, emphasizes on the emerging interest of current and future generations in digital assets. She addresses key concerns around investing in crypto and offers opportunities for financial advisors to meet client needs in this sprouting terrain. Challenges like security and volatile market dynamics are diverse but navigable through apt guidance.”

NFL Legend’s NFT Startup Reinvents Amid Market Downturn: A Cautionary Tale in Crypto Investments

NFT start-up Autograph, co-founded by NFL legend Tom Brady, faces challenges amid bearish market forces, resulting in significant layoffs and strategic shifts. Once focused on selling NFTs, the company now aims to foster celebrity-fan loyalty. Brady’s crypto involvement, specifically with now-bankrupt FTX, have also come under scrutiny, highlighting the volatile nature of the digital asset market.

Shifting Financial Fulcrum: Bitcoin’s Rise and the Fall of the Dollar Dominance

BlackRock CEO, Larry Fink, highlights Bitcoin’s potential as a hedge against inflation, perceiving it as a digital avatar of gold. Meanwhile, global leaders propose a shift from dollar dependencies, favoring the adoption of digital assets, potentially giving Bitcoin a stronger foothold.

How Federal Reserve Meetings Impact Cryptocurrency & Up-and-Coming Meme-Based Tokens

“The crypto markets are currently retreating somewhat, with Bitcoin and Ether slightly down. Market volatility is affected by various factors including macroeconomic considerations and the dynamics of ‘meme’ coins. Formulating a balance and understanding potential risks and rewards is key in this unpredictable investment landscape.”

India’s Digital Rupee: A Cross-Border Game Changer against Dollar Deficiency

The Reserve Bank of India’s digital rupee initiative aims to simplify trade for countries with scanty US dollar reserves, potentially boosting India’s exports. This fast and cost-effective cross-border payment system could provide an economic solution for nations struggling with dollar deficiencies.

Aptos Cryptocurrency’s Bullish Surge and The Boom of Thug Life Token Presales

Aptos (APTO), a cryptocurrency powering a new blockchain protocol, is experiencing a trading volume surge of approximately $300 million. Increased transactions on the Aptos network and recent technical bullish momentum may ignite further growth. Diversification through crypto presales, such as recently launched Thug Life Token, could provide substantial returns for investors.

Rocket Rise of ROGAN Token: A Flash in the Pan or A Sustainable Upward Thrust?

“The Joe Rogan meme token, ROGAN, experienced a 20,000% rally within 24 hours after its integration to Uniswap. Critics question the sustainability of meme tokens due to their lack of identifiable communities, but some like THUG token are strategically building community-centric holders while in pre-sale stage. High-risk yet potentially high-reward, these tokens are changing the cryptocurrency landscape.”

Resubmitting Bitcoin ETF Applications: SEC Standards vs Crypto Market Ambitions

Last week, high-profile finance establishments were found lacking in their spot Bitcoin ETF filings, triggering a swift response from several firms to revamp and re-file their applications. Despite initial inconsistencies, these efforts reflect a drive towards a more compliant crypto market, bolstering Bitcoin’s resilience in the midst of market challenges.

Coinbase’s Bold Plan: Redefining ACH Deposits with Blockchain-Based Settlements

Coinbase unveils a plan to redefine traditional Automated Clearing House (ACH) deposits by replacing them with blockchain-based stablecoin settlements. Benefiting from faster confirmation times, increased security, cost savings, and reduced price volatility, it aims to make financial transactions efficient, globally, while aligning consumer rights and security.

Navigating Through the Storm: Cryptocurrency Regulation, Security, and the Future of Blockchain Innovation

South Korea recently approved its first standalone digital-asset bill aiming to protect investors, integrating 19 crypto-related bills and defining digital assets. Thailand’s SEC imposed rules on digital asset service providers, focusing on investor protection, but potentially hampering financial innovation. Blockchain’s security issues remain prominent with instances of stolen NFTs and crypto miners diversifying into high-end chip demand.

Generative AI and Blockchain: A Harmonious Match or Uneasy Alliance?

Generative AI’s integration with Web3 and the idea of a blockchain specifically for generative AI is gathering interest, given the centralized control concerns of AI foundation models. Open-source models might ease their adoption on Web3 platforms, making blockchain architectures a promising solution for transparency issues. However, constructing a specialized blockchain for generative AI comes with challenges that need thoughtful consideration and collective action.

Surge of FLOW Coin and the Rising Influence of AI on Crypto: A Glimpse into the Future

Despite US SEC skepticism, the NFT-oriented FLOW cryptocurrency is recovering from lows, showing a significant trading activity. FLOW’s potential and emerging web3 projects like yPredict, an AI-driven cryptocurrency prediction platform, are shaping the future of the crypto landscape. However, note the volatility of the crypto market.

Meme Tokens: Rising Stars or Falling Meteors in the Crypto Universe?

“The success story of Wall Street Memes (WSM) underscores the importance of a robust community for the survival of meme tokens. With over 256,000 Twitter followers, WSM’s proactive promotion and substantial following contrasts with the ill-fated performance of Luck Token (LUCK).”

Cryptocurrency High Drama: Decentralized Azuki NFT Community Battling Over Potential Scam

After disappointments from an NFT mint venture, Azuki holders rallied and are considering injecting retrieved funds into a DAO to bolster the Azuki ecosystem. Amidst clashes over funds allocation and accusations against Azuki’s creator, the AzukiDAO meets questions about its legitimacy.

Emerging Trend of Crypto Salary: Power Shift or Risky Business?

“Employees are increasingly interested in Bitcoin compensation amid economic uncertainties. Factors like crypto acceptance, education, and advanced technology encourage considering crypto salaries. However, despite the allure of decentralized payroll systems, challenges include regulatory issues and the unpredictability of cryptocurrency.”

Decoding the Aftermath: $4.5 Billion BTC & $2.3 Billion ETH Options Contracts Expiration

Approximately 150,000 BTC options contracts, equivalent to $4.5 billion, expired on Deribit recently, accounting for over 85% of global crypto options activity. The event caused less upheaval than anticipated in spot price movements, indicating that market adjustment to such large contract expirations can be minimal. The cryptocurrency market, however, remains rife with strategic considerations.

Insider Trading Shadows in the Crypto World: A Crypto-Evolution Stalemate?

Blockchain intelligence firm, Solidus Labs, finds about 56% of new ERC-20 tokens are involved in suspicious transactions before they debut on centralized exchanges. Insiders exploit this anonymity to profit from unexpected token price spikes, creating a market manipulation trend that jeopardizes the trust, efficiency, and integrity vital for a robust financial ecosystem in the crypto world.

Dawn of Smart Contracts in Finance: A New Era or Just Another Technology Step?

Smart contracts are poised to transform the financial sector, with research indicating almost half of IT decision-makers plan to utilize these digital agreements. They offer benefits such as business process efficiency and increased cybersecurity. Despite obstacles like a lack of skilled personnel and legal concerns, technological solutions may ensure adherence to data protection regulations, promising a bright future for smart contracts in finance.

Grounded Flights: The Obstacles AI Faces in Revolutionizing Travel Bookings

“AI chatbots like Bard and ChatGPT are being optimized to handle flight and hotel bookings, offering automation and convenience. However, inconsistencies and errors reveal the technology still needs refinement. While offering potential, reliability issues hinder immediate practical use.”

Unmasking the Chibi Finance Rug Pull: A DeFi Scam Masterclass and Wake-Up Call for Investors

The Arbitrum-based project Chibi Finance conducted a rug pull scam, stealing over $1 million worth of tokens using a malicious contract. This highlights the challenges and pitfalls in decentralized finance (DeFi) and the need for investors to exercise caution and conduct due diligence.

Binance vs SEC: Ongoing Legal Battle, Court Rulings, and Future Implications for Crypto

A U.S. District Court judge denied Binance’s motion to hinder the SEC from publicizing statements related to their ongoing legal dispute. The case involves allegations, including securities law violations and commingling of user funds. Binance is set to present its defense on September 21.

Sudden Banking Cutoff Stuns Binance Australia: Effects on 1 Million Users and Crypto Industry

In May, Binance Australia faced a sudden suspension from the country’s banking system, impacting around 1 million customers. The banking changes also affected the larger Australian crypto industry, emphasizing the urgent need for sensible regulation, licensing, and growth-friendly environments in the crypto space.

Bitcoin Outperforms S&P 500 and Nasdaq: Are Speculators a Boon or Bane for Crypto Markets?

Bitcoin has surged 83% year-to-date, overtaking the S&P 500 and Nasdaq Composite, and attracting institutional investors with ETFs like ProShares Bitcoin Strategy ETF (BITO). However, as Bitcoin’s supply moves toward speculative investors, it signals increasing mainstream trading interest, which could impact market stability. Investors are encouraged to research and approach cautiously.

El Salvador’s Bitcoin Adoption: A Boon for Crypto or Road to Regulatory Challenges?

Samson Mow, CEO of JAN3, emphasizes the need to educate more people about the crypto market as El Salvador’s progress in developing the Bitcoin ecosystem garners global attention. Their actions could potentially influence other economies and lay the foundation for political measures in favor of cryptocurrency.

Crypto Market Surges with $199M Inflows: Bitcoin Dominance and ETF Impact on Altcoins

Crypto market witnesses largest weekly inflows since July 2022, totaling $199 million, with Bitcoin claiming $187 million. The total assets under management of crypto investment products surpassed $37 billion, amid a spike in ETF applications submitted to the SEC.