Hong Kong-based venture capital firm CMCC Global has launched a $100M fund targeting blockchain startups in Asia. Despite falling global investment trends, this fund is committing to advancing blockchain infrastructure, highlighting a compelling future for crypto investment amid regulatory changes and associated risks.

Search Results for: ape

Hong Kong’s Synapse Program: Automation Innovation or Vulnerability Invitation in the Crypto Sphere?

“Synapse, an augmented version of HKEX’s Stock Connect program, introduces smart contracts for improved operational efficiency in equities settlement. The initiative offers enhanced real-time visibility and scalability, underlining HKEX’s commitment to capital markets’ efficacy. However, it raises questions about reliance on technology and the potential security risks it might bring.”

Unwrapping the Mystery: The Power and Pitfalls of Wrapped Tokens in Blockchain

‘Wrapped’ crypto tokens are cryptocurrencies linked to another coin or asset, often native to a certain blockchain. They allow for cross-chain interoperability and decentralised finance applications, enhancing liquidity and accessibility. However, they also raise centralisation risks, potential security issues and regulatory uncertainties.

Navigating Change: The Dynamic Shifts in Polygon’s Leadership and Impact on Blockchain Future

“Polygon, a renowned Ethereum layer 2 scaling solution, is entering a new phase of development, marked by significant shifts in its leadership. Co-founder Jaynti Kanani steps back, while Marc Boiron becomes CEO, in sync with Polygon’s transition to Polygon 2.0, which bring substantial technological innovations in blockchain systems.”

South Korea’s Journey to a Central Bank Digital Currency: Anticipation, Advancement and Ambiguity

The South Korean central bank, BOK, is advancing towards a Central Bank Digital Currency (CBDC) pilot, scheduled for late 2024. By testing a wholesale CBDC model first, it aims to streamline inter-bank settlements while preparing for retail use. The bank collaborates with domestic institutions and international bodies like the BIS, though it remains undecided on fully endorsing a digital won.

The JPEX Saga: An Unsettling Dive into DAOs, Dividends, and User Authorisation Debacle

Cryptocurrency exchange JPEX’s controversial transition into a decentralized autonomous organization (DAO) and its DAO Shareholder Dividend Scheme have led to allegations of unauthorized operations and duping, prompting regulatory scrutiny. This situation underscores cryptocurrency’s dynamic opportunities and potential risks, highlighting the need for education, vigilance, and prudent regulation in this evolving digital landscape.

Crypto Drama: The Unfolding Controversy Surrounding JPEX’s DAO Stakeholder Dividend Plan

JPEX, a controversial Hong Kong-based crypto exchange, is pushing ahead with its Decentralized Autonomous Organization (DAO) Stakeholder Dividend Plan amidst a $191 million financial scandal. Despite approval from 68% of users, the plan, which lets investors convert holdings into DAO dividends, has raised suspicions due to unclear exchange rates and restrictions on withdrawals. Critics question the plan’s economic tenability as arrests and investigations continue.

Navigating through Hong Kong’s Shift in Cryptocurrency Regulation: The Crypto Task Force Era

The Hong Kong Police Force and the Securities and Futures Commission have formed a task force for increased scrutiny of crypto exchanges. This comes after allegations against JPEX, a Dubai-based exchange, of operating without a permit. This body aims to regulate cryptocurrency activities in Hong Kong, providing a safer trade environment despite potential impact on the digital currency’s comparative freedom.

Navigating the Obstacles: Advancing Financial Inclusion via CBDCs and Blockchain

“The development of Central Bank Digital Currency (CBDC) faces multifaceted challenges before achieving universal financial inclusion. Achieving this involves managing financial, digital and practical accessibility aspects, with unestimated demographic barriers. Elderly, disabled individuals, and others with limited internet access can hinder blockchain technology and CBDC’s broad adoption.”

Decentralization Test: The SBF SRM Saga and What It Means For Crypto Authority

“In 2021, Sam Bankman-Fried extended the lockup period for his employees’ SRM holdings, sparking debate about the ethos of decentralization in crypto markets. This controversial move coincided with the rise and fall of the SRM token, further leaving the crypto community questioning the control in decentralized markets, and the tricky balance between regulation and restrictive control.”

Navigating the Crypto Landslide: SEC Scrutiny, DeFi, and the Quest for Regulatory Balance

David Hirsch from the SEC’s Crypto Assets and Cyber Unit warns of an impending increase in charges against crypto exchanges and DeFi projects suspected of securities law violations. Expert Brandon Zemp advises caution and strategic action, noting regulatory pressures can influence DeFi evolution but also foster a healthier market and developer ecosystem.

Ripple’s Legal Wrangle: Reshaping XRP’s Future Amid Crypto Market Uncertainties

“A US judge recently rejected the Securities and Exchange Commision’s appeal against Ripple Labs, disagreeing with the SEC’s claim that Ripple Labs sold unregistered securities. Doubts about XRP’s status as a potential security are rapidly diminishing, boosting its adoption prospects.”

Bitcoin’s Downward Spiral Despite Optimistic Events in Crypto World: A Market Analysis

“Despite positive developments like the introduction of Ether ETFs and a UAE Dirham-based stablecoin, Bitcoin continues to decline, now valued below $28,000. Influenced by declining US bond yields and overbought signals, the crypto market fell 0.90% over 24 hours. While Bitcoin sees substantial investments, Ether suffers consistent outflows, clouding the future of digital assets.”

PayPal and the NFT Market: Innovative Strides or Potential Disaster?

“PayPal has lodged an application for an NFT marketplace patent, hinting at a system facilitating the transfer and purchase of NFTs. However, the volatility of NFTs and regulatory gray areas surrounding digital assets pose potential risks and challenges.”

Exploring the Impact and Probable Consequences of Project Atlas on Crypto Tracking

“Project Atlas, launched by the Bank for International Settlements (BIS) and four European central banks, aims to revolutionize financial authorities’ management of crypto assets by tracking global asset movements. It melds data from crypto exchanges with data from public blockchains, providing tools for accurate assessment of crypto markets’ economic significance.”

The Remarkable Ascent of Bitcoin BSC: Stellar Debut or Crypto Roulette?

“Bitcoin BSC, a new crypto, has kicked off on PancakeSwap, surging 50% and securing a market cap of $30m. With 2,310 token holders just after debut and an audited smart contract, it shows promise for future performance, although risks remain high.”

Navigating the Dichotomy of Blockchain’s Future: Innovation vs Regulation

“Yield Protocol’s decision to cease operations, impacted by decreased demand and strict regulations, juxtaposes with Wirex’s launch of W-Pay, a bridge for decentralized applications and traditional payment infrastructures. The future of blockchain remains uncertain amid these contrasting developments.”

Bitcoin’s Calm Amid Stormy Legacy Markets: A Tale of Contrasting Market Conditions

Bitcoin’s price stability recently contrasted with a volatile U.S. dollar, almost mirroring a stablecoin. Despite these calm conditions, the U.S. dollar’s strength can cause market turbulence. Amid potential economic fluctuations, Bitcoin manages to maintain steadiness, prompting questions about the benefits of investing in traditional markets over emerging ones like Bitcoin.

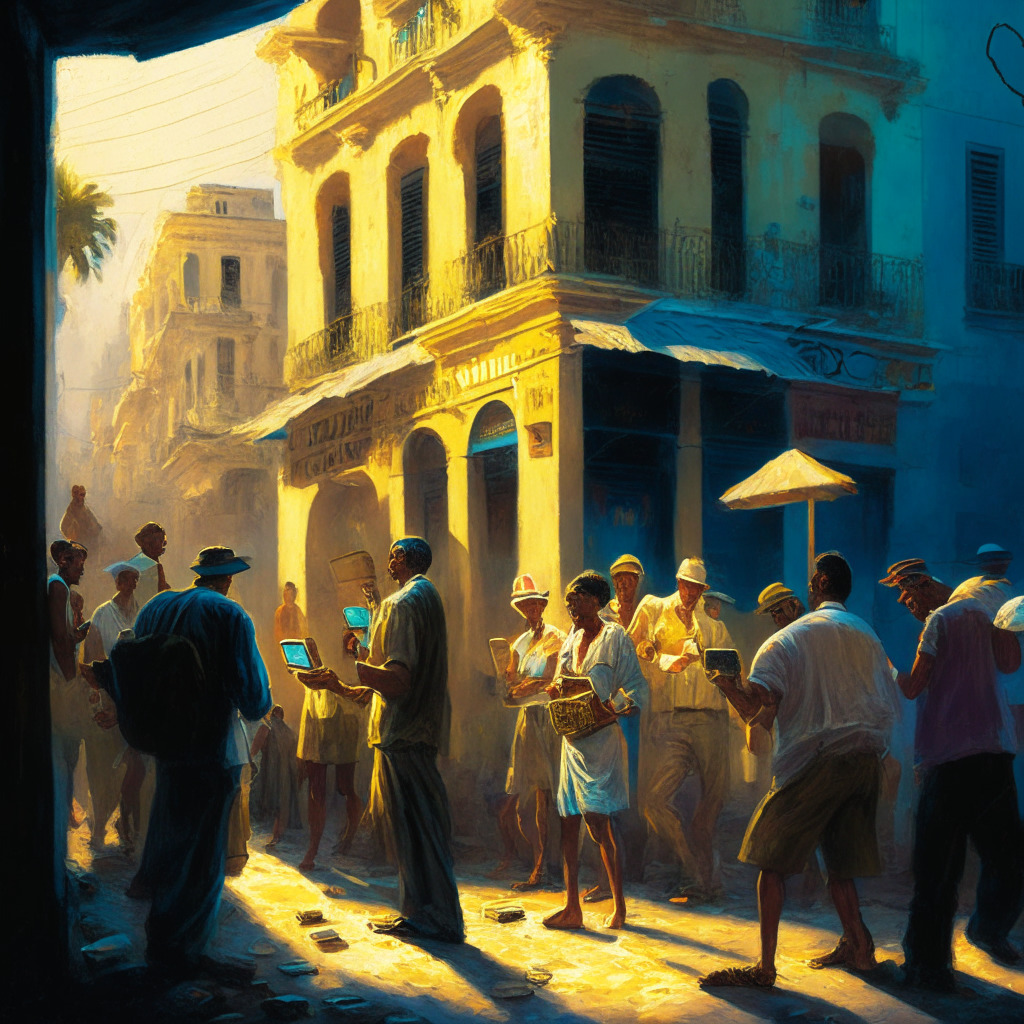

Bitcoin Awareness Rises in Cuba amid Fears of National Currency Decline

Amid devaluation of the Cuban peso and inflation, the crypto community in Havana, Cuba is turning to Bitcoin due to its relative financial stability. Despite governmental restrictions, Cubans have developed ways to buy and sell Bitcoin, hoping for a more economically secure future.

Debunking BDOGE Scam Allegations Amid Its 1000% Surge: A Dive into Blockchain’s Intrigue and Risk

Big DOGE token (BDOGE) has surged by an astounding +1,000%, leading to accusations of it being a potential scam. However, despite allegations, the token shows no signs of security threats. On the other hand, Meme Kombat offers unique, decentralized Web3 platform with a game that allows prediction on meme character battles.

Navigating the Storm: Bitcoin Cash’s Market Struggles and the Rise of Bitcoin Minetrix

“Bitcoin Cash (BCH) tests the 20DMA support line as trading volume slips 48.19% to $246k. Meanwhile, Bitcoin Minetrix, an emerging Bitcoin cloud mining presale is drawing attention with its Stake-to-Mine model, which leverages token-staking to offer efficient, secure BTC mining.”

Navigating Uncharted Crypto Waters: The Impact of New House Leadership on Digital Asset Regulation

“A staunch crypto advocate, Representative Patrick McHenry, has provisionally stepped into the role of US House Speaker. McHenry has shown appreciation for the significance of American innovation and advocated for stablecoin regulation. These transitions bring opportunities and challenges for digital currencies and their regulation.”

CBDCs: A Cornerstone for Future International Monetary System & the Tokenization of Finance

The Banque de France views central bank digital currency (CBDC) as a crucial component for the new international monetary system, enhancing cross-border payments. It’s being considered from an international perspective right from the outset. Two potential development pathways include building interoperability with legacy systems and creating regional or international platforms for CBDCs.

Blockchain Finance: The $79.3B Market of the Future – Growth Potential and Challenges Ahead

“Blockchain finance is predicted to become a $79.3B market by 2032, offering improved methods for trading, payments, settlements, and asset management. Stimulated by disruptions during the COVID-19 pandemic, blockchain’s potential for lowering operational costs is driving industry growth.”

Decoding CryptoNight: Champion of Mining Democracy or Falling Giant?

The CryptoNight mining algorithm, a feature of the CryptoNote protocol, aims to prevent the centralization of mining power by allowing CPUs and GPUs to mine blocks. Despite criticisms and ASICs adapting, it remains a successful tool advocating privacy and fairness in mining.

UK’s Digital Securities Sandbox: A Leap Forward or a Conflicting Balance?

The UK plans to launch a Digital Securities Sandbox by end of Q1 2024. Differing from earlier sandboxes, this will solely focus on digital securities, allowing companies to experiment with digital asset technology within a controlled, risk-free environment. Despite this progressive step, the UK still maintains stringent regulations pertaining to digital assets.

Shadows Over Crypto: Fentanyl Sanctions, Regulatory Barriers, and the Future of Bitcoin

Bitcoin saw a slight downturn recently amid challenges such as the US Treasury’s move to outlaw cryptocurrency wallets and a crackdown on illicit substances like fentanyl. Additional regulatory barriers in the US are hindering crypto innovation, leading to concerns over future Bitcoin prices and investor sentiment.

Russian Firms Take Leap into Future with Adoption of Digital Ruble

Russian firms are adopting the central bank digital currency (CBDC), the digital ruble. Sirius Innovation Science and Technology Center and Rostelecom are pioneering this journey with their digital wallets, highlighting the practical application of this currency. However, this new model poses challenges for traditional financial institutions, and concerns remain about security and potential economic disruption.

Former FTX CEO’s Trial: Uncertainty, Trust Issues and Prospects for Crypto Exchanges

“The trial of former FTX CEO, Sam Bankman-Fried, sparks international debate on cryptocurrency future and regulation. With trust in innovation shaken, the crypto community is balancing between transparency and trust, contemplating the future of crypto exchanges post-FTX’s collapse.”

Ripple’s Major Milestone: Singapore MPI License Amid Regulatory Scrutiny in the US

Ripple Markets APAC Pte Ltd, the Singapore branch of crypto-payment giant Ripple, has received its Major Payments Institution license from the Monetary Authority of Singapore. This permits Ripple to provide digital payment token services, marking a substantial stride towards wider crypto acceptance. In contrast to its regulatory challenges in the US, Ripple’s journey in Singapore has shown regulatory clarity and fostered a secure environment encouraging crypto investigation.

Crypto Regulation Variance: SEC vs Coinbase and Argentina’s Proposed Digital Currency

“The SEC and Coinbase are in court, debating securities registration for crypto assets. Meanwhile, Argentina’s presidential candidates propose differing cryptocurrency solutions to economic issues: introducing a digital currency or supporting Bitcoin and abolishing the central bank.”

Crypto Race in the East: Japan’s Deregulatory Push vs. South Korea’s Cautious Approach

“Japan is pushing to deregulate the crypto market to create a more conducive environment for crypto businesses possibly making it a ‘crypto and Web3 El Dorado’, while South Korea leans towards stricter regulation. International crypto companies are reportedly eyeing the Japanese market, signalling a burgeoning ‘crypto race’ in East Asia.”