Binance appoints Richard Teng, a traditional finance veteran with significant regulatory expertise, as head of all regional markets excluding the US. This move reflects the company’s intent to strengthen regulatory compliance, acquire licenses, and pursue international expansion.

Search Results for: SWIFT

Asian Nations Lead the Charge in Crypto Regulation: Innovations, Trust, and Challenges

Asian nations are increasingly regulating cryptocurrencies, with Japan enforcing stricter Anti-Money Laundering measures, South Korea mandating officials to report crypto holdings, and Hong Kong allowing licensed platforms to serve retail investors. Elsewhere, Beijing fosters Web3 technology innovation, and the International Organization of Securities Commissions pushes for global crypto regulatory frameworks.

Temasek Penalizes Team for FTX Investment Debacle: A Tale of Reputational Damage and Crypto Risks

Temasek faces punitive measures over its $275 million investment in controversial exchange FTX, reducing salaries of involved team members despite no misconduct found. FTX’s “fraudulent” activity allegedly “intentionally hidden” has negatively impacted Temasek’s reputation, emphasizing the need for vigilance in the cryptocurrency world.

Temasek Holdings’ FTX Debacle: Balancing Crypto Investment Risks and Rewards

Singapore investment firm Temasek Holdings reduced compensation for executives after a $275 million investment loss in the now-defunct crypto exchange FTX. Despite extensive due diligence, Temasek’s loss exposes potential pitfalls for even experienced investors in the rapidly growing crypto market.

Ripple’s 2023 New Value Report: Confidence in Crypto and Unleashing Blockchain Potential

Over 70% of global finance leaders express increased confidence in the crypto industry, driven by factors such as traditional financial companies investing in crypto assets, mainstream adoption of digital assets, and tokenization of real-world assets. The future of cryptocurrencies looks bright as they revolutionize finance, disrupt ownership models, and transform cross-border transactions.

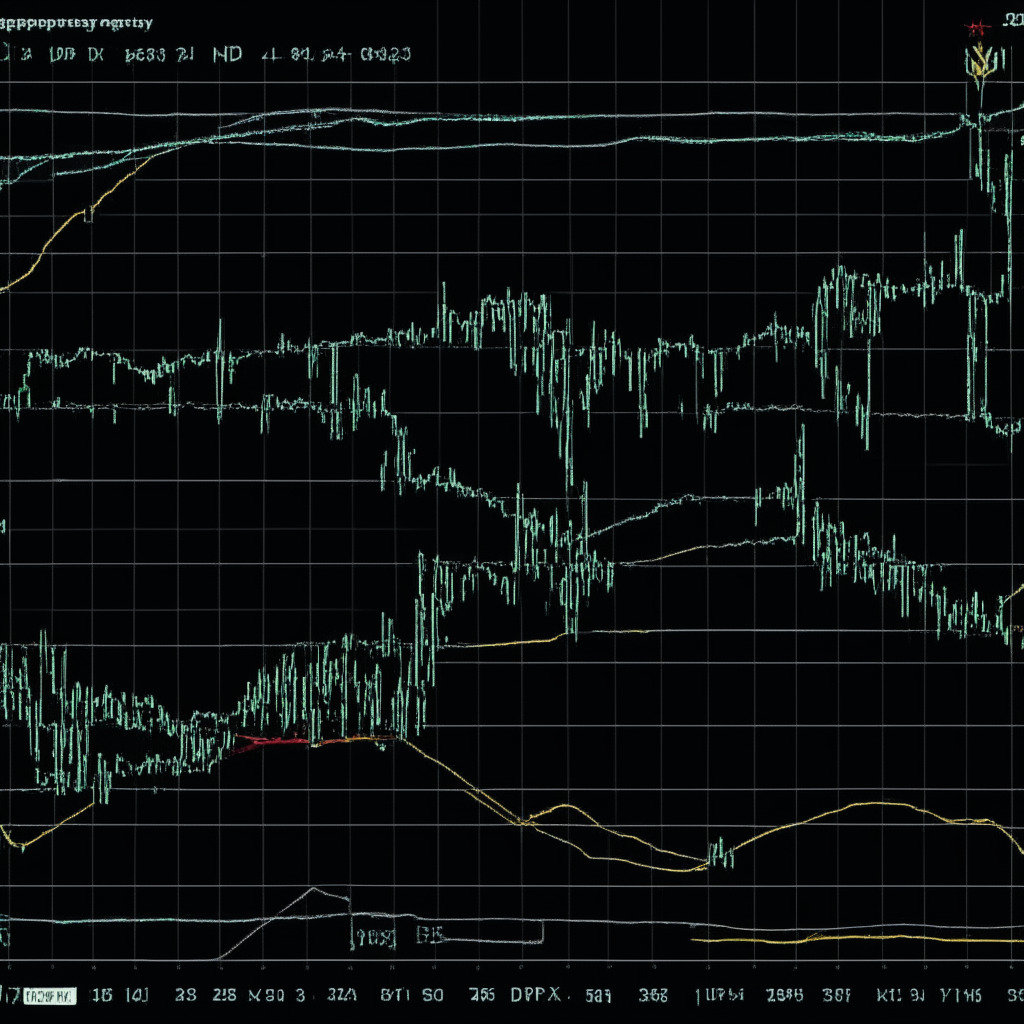

Bitcoin’s $27,500 Test: Double Bottom Pattern vs. Resistance Trendline Battle

Bitcoin’s recent significant upwards momentum, marked by four consecutive green candles and a double bottom pattern, could soon test the $27,500 level. As it bounces off the $26,000 psychological support level, the cryptocurrency’s price could potentially break the immediate resistance to continue the bullish upswing, with technical indicators pointing to possible bullish price action.

Debt Ceiling Crisis Looms: Potential Impacts on Crypto and Financial Markets

As the US faces a potential debt crisis, ongoing high-stakes discussions about raising the $31.4 trillion debt ceiling could impact financial markets, including the cryptocurrency sphere. Swift resolution of lingering issues is critical to avoid a widespread crisis and market uncertainty.

AI Arms Race: JPMorgan Chase’s Finance Chatbot and the Ethical Debate on Unregulated AI

JPMorgan Chase filed a trademark application for finance-focused chatbot IndexGPT, aiming to use it for advertising, marketing, tracking securities values, and providing financial information. With AI playing a significant role in future trading, the company has allocated over 2,000 experts to enhance its AI capabilities. Incorporating AI-driven solutions while mitigating risks and ethical concerns will be crucial in shaping the future of finance and technology.

Balancing AI Innovation and Regulation: Microsoft’s 5-Point Blueprint Explored

Microsoft President Brad Smith introduces a “5-point blueprint for governing AI,” emphasizing collaboration between public and private sectors. He proposes government-required licensing for advanced AI models, acknowledging that both sectors must work together to ensure AI serves society while addressing potential risks and maintaining ethical standards.

XRP Price Breakout Signaling Trend Reversal: Analyzing Potential Gains and Ripple Lawsuit Impact

XRP price witnesses a 2.1% jump, potentially breaking the bear’s grip and signaling a trend reversal. A breakout from the channel pattern’s resistance trendline could lead to a swift 5% jump towards the $0.5 mark, provided buyers maintain their position and trading volume provides sufficient confirmation.

USBTC Joins Crypto Mining Giants: Rapid Expansion Strategy’s Pros, Cons, and Challenges

U.S. Bitcoin Corp. (USBTC) joins mining giants after acquiring assets from bankrupt lender Celsius, raising its computing power to 12.2 EH/s. This deal includes 121,800 mining machines, adding to USBTC’s existing 270,000 rigs. However, rapid expansion raises concerns of high energy consumption and environmental impact.

Apple Takes a Bite of OpenAI’s ChatGPT Profits: A Dance between Pioneers and Big Tech

OpenAI’s ChatGPT iPhone app has quickly climbed App Store charts, with Apple endorsing it as a “must-have” app. Apple’s infamous 30% cut, or “Apple Tax,” on new iOS subscriptions means the tech giant profits from every ChatGPT Plus subscription, highlighting the complex interactions among AI pioneers, big tech, and regulators in this emerging revolution.

Central African Republic’s Bitcoin Adoption: Economic Boost or Risky Endeavor?

The IMF displays optimism for the Central African Republic’s economic prospects following its adoption of Bitcoin as a legal tender. Key factors contributing to this positive projection include policy adjustments, fuel supply enhancements, and an anticipated real GDP growth rebound of 2.2% by 2023. However, challenges surrounding liquidity risks and market conditions remain.

Crypto Wallet Security: Ledger’s Open Source Dilemma and the Future of User Protection

Ledger, a renowned crypto wallet hardware maker, faces security vulnerability concerns with its latest feature possibly exposing users’ seed phrases, prompting users to reevaluate their choice of wallet. Ledger’s team opens source code for its operating system to address the issue, focusing on security and transparency. This controversy highlights the importance of vigilance in the crypto industry’s ongoing efforts to secure assets while maintaining transparency and open-source development.

Expedited Crypto Disclosure Bill in South Korea: Balancing Transparency and Innovation

The South Korean government aims to enforce a new bill requiring lawmakers and high-level officials to declare their digital assets for greater transparency. Intended to address public interest in crypto regulation, the bill’s implementation has been expedited due to allegations against an opposition party politician for suspicious crypto transactions.

South Korea’s Crypto Regulation Debate: Balancing Transparency and Market Growth

South Korea’s People Power Party calls for swift crypto regulations following the approval of a bill targeting transparency in lawmakers’ digital asset holdings. The proposed bill would require lawmakers to report their cryptocurrency holdings in annual asset disclosures, promoting greater transparency and addressing concerns of potential money laundering.

Aave V2 Polygon Bug: How It Happened and the Road to Recovery

Aave V2 users on the Polygon blockchain have faced difficulties accessing funds due to a faulty upgrade in the ReserveInterestRateStrategy contract, affecting various token holders. Despite challenges, Aave governance proposed a solution and continues to address the issue while maintaining platform stability.

Navigating US Regulatory Maze: Impact on Digital Assets and Need for Comprehensive Reform

The US regulatory landscape for digital assets is fragmented and slow-moving, hindering industry growth. Legislators must act swiftly, extending investor protections from traditional markets to digital assets and carefully crafting new rules to accommodate their unique characteristics. Collaboration is essential for fostering innovation in a rapidly evolving sector.

AI-Generated Image Chaos: Impact on Stocks, Crypto, and the Need for Regulation

An AI-generated image depicting a false Pentagon explosion caused chaos on social media and a brief sell-off in the U.S. stock market. The incident raises concerns about unchecked AI development and highlights the importance of rigorous source verification.

Stalled Dash Transactions: Examining the Impact and Resolving the Blockchain Halt

Dash, a privacy-focused blockchain, faced a stall in processing transactions and producing blocks due to a problematic v19 activation. The Dash Core team is actively investigating and working to resolve the issue, while Binance suspends mining rewards distribution for DASH until block production resumes.

High-Profile Phishing Attack: Stolen NFTs, 100 ETH Loss, and Lessons Learned

In a recent high-profile phishing attack, valuable tokens from Bored Ape Yacht Club (BAYC) and Mutant Ape Yacht Club (MAYC) were stolen and sold on the Blur marketplace, resulting in losses surpassing 100 ETH. This alarming event underscores the importance of staying vigilant in the crypto and NFT space, as phishing scams continue to threaten the security and livelihood of cryptocurrency owners.

Tornado Cash Attack: Hacker’s Change of Heart Raises Questions on Trust and Blockchain Security

A new proposal surfaces to potentially restore Tornado Cash’s governance after a malicious attacker hijacked it. Quick action by community member Tornadosaurus Hex aimed to limit damage while the attacker surprisingly signaled intent to return governance control. This incident highlights the need for constant vigilance in blockchain cybersecurity.

MetaMask Tax Controversy: Debunking Misconceptions and Clarifying Terms of Service

Accusations of MetaMask and its parent company, ConsenSys, collecting taxes on cryptocurrency transactions created controversy. However, the company clarified the claims resulted from a misreading of their terms of service, and they do not collect taxes on on-chain crypto transactions.

Crypto Market Watch: Top Gainers, Losers, and DAO Attack Impact Unveiled

In this article, we explore the recent updates in the crypto market, including top gainers and losers. We discuss the security breach facing Tornado Cash and its impact on the TORN price. We also highlight Pepe’s swift market capitalization growth, the rise of DREP coin, and innovative Web3 projects like IDEX and DeeLance. Stay tuned for further developments in the fast-paced world of cryptocurrencies.

XRP Price Prediction: Bearish Momentum or Bullish Breakout? Examining Key Factors

The XRP price experienced a 2.5% intraday loss amid market uncertainty, showing a bearish evening star candle pattern. A possible 18% drop to the $0.38 support trendline might occur if bearish momentum persists. However, a breakout from the channel pattern’s upper trendline could signal an uptrend continuation. It’s essential for investors to conduct thorough research and be aware of potential risks in the volatile cryptocurrency market.

Chainlink VRF and Arbitrum One Unite: Unlocking New Smart Contracts and DApps

Chainlink and Ethereum Layer 2 scaling solution Arbitrum have launched Chainlink Verifiable Random Function (VRF) on Arbitrum One, uniting both platforms for new smart contracts and decentralized application (DApp) development, featuring secure, scalable, and fair applications such as NFTs and gaming.

DeFi Turbulence: DOJ Pursues Hackers, Lawsuits, and Ethereum Un-Staking

The DOJ’s crypto czar, Eun Young Choi, highlights the prominence of chain bridges thefts and hacks involving DeFi, emphasizing North Korean state-sponsored hackers’ significant role in exploits. Meanwhile, Ethereum un-staking commenced on the Beacon Chain and Coinbase Cloud joined forces with Chainlink Oracle network to improve smart contract reliability.

Swaprum Scandal: Balancing Trust, Transparency, and Decentralization in Crypto

The recent Swaprum exit scam on Ethereum Layer 2 network Arbitrum reveals the ongoing security challenges in the crypto world. This incident highlights the importance of credible security audits, regulatory framework, and user education in addressing growing concerns about hacks, scams, and the future of cryptocurrencies.

Litecoin’s Future Prospects: Halving Event, Adoption, and Diversification Strategies

Litecoin experiences a dip along with the broader cryptocurrency market, but analysts remain optimistic about its future prospects. Factors such as the upcoming halving event, progress in adoption, and rising transaction count drive Litecoin’s recent success. Investors are accumulating Litecoin ahead of the halving event, and a near-term return to $100+ levels may be possible.

Crypto Surge Amid US Debt-Ceiling Optimism and CBDC Developments: Analyzing the Impact

Bitcoin experiences a 3% increase amid optimism surrounding a potential US debt-ceiling deal and rallying equity markets. Ripple develops a CBDC platform enabling institutions to issue digital currencies. Meanwhile, the Bitcoin Frogs NFT collection gains traction as the most traded within 24 hours.

Bitcoin’s Potential Explosive Rebound: Analyzing Pros, Cons, and Market Conflicts

The recent bullish signals on Bitcoin spark optimism as it shows potential to bounce back from its current corrective phase, with gains topping out at 3.5%. On-chain monitoring suggests Bitcoin’s newfound strength could endure, while trader Credible Crypto believes an explosive upside move could materialize within the next month.

Voyager Digital’s Bankruptcy Saga: A Cautionary Tale for Crypto Companies

Crypto lender Voyager Digital’s liquidation plan received approval, enabling the return of approximately $1.33 billion in crypto assets to its customers. The firm’s bankruptcy highlights the importance of understanding the complex economic and regulatory landscape in the turbulent and unpredictable cryptocurrency market.