The Federal Reserve’s intensified scrutiny of banks’ cryptocurrency activities has sparked criticism from Republican lawmakers who argue this deters institutions from participating in the digital asset landscape. The Fed’s new requirements may potentially suppress the progress of decentralized finance. Amidst this, U.S. regulations on digital assets remain unclear, pushing some crypto companies to explore alternative markets overseas. The discourse focuses on balancing effective supervision with fostering blockchain innovation.

Search Results for: U.S

Major dYdX Token Release: Astonishing Growth Opportunity or Risky Gamble?

Decentralized exchange dYdX is preparing to unlock 6.52 million DYDX tokens worth around $14 million for the community treasury and rewards. This major token unlock emphasizes the complex interplay of fast-growth potential and inherent risk in the nascent blockchain markets.

Matrixport’s Bold Crypto Strategy: Is Being Bullish on Bitcoin the Right Move?

“Matrixport’s Markus Thielen suggests a counter-intuitive strategy for crypto traders – taking long positions on bitcoin with a stop loss below $25,800. The strategy banks on a potential fall in Treasury yields, bolstering the appeal of risk assets, including cryptocurrencies.”

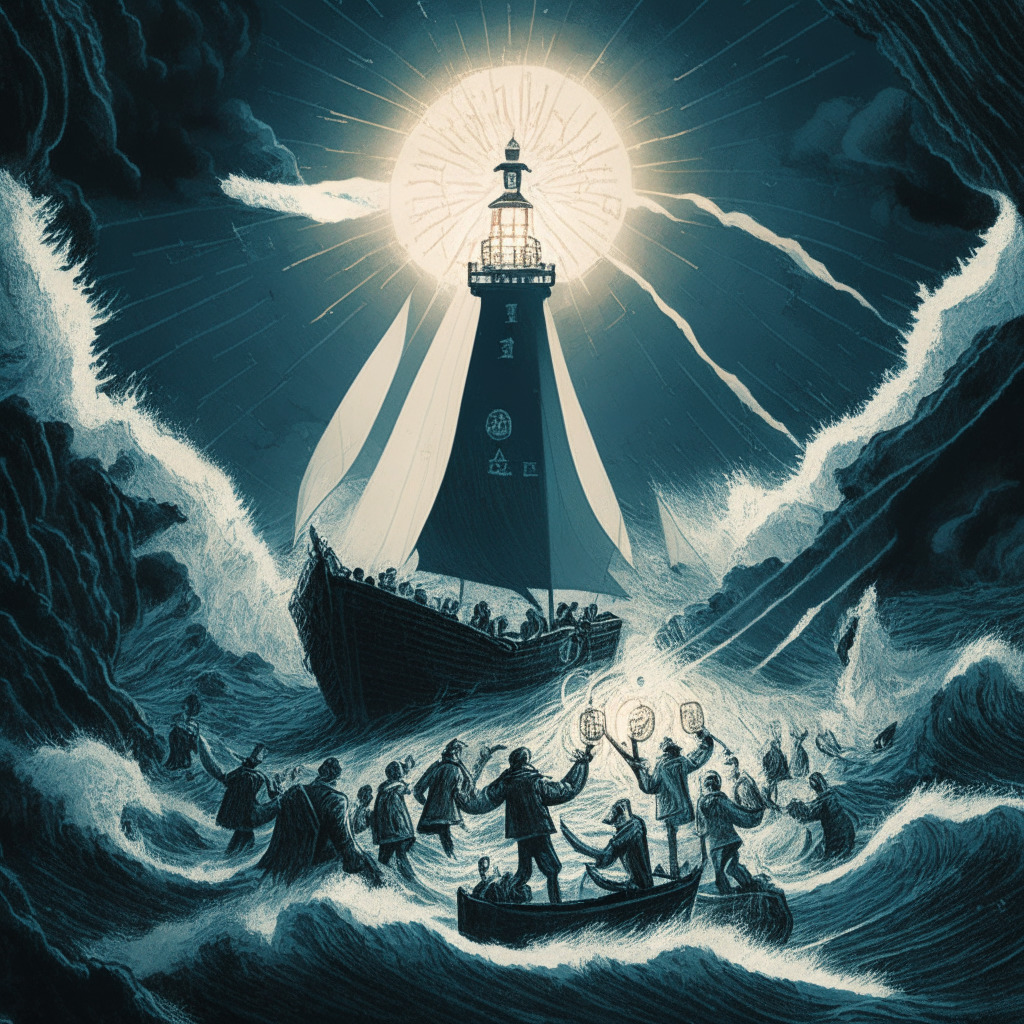

Navigating the Choppy Waters: Bitcoin’s Uncertain Future Amidst Increasing Mining Challenges and Slowing Trading Activity

“Bitcoin, currently trading around $26,111, is facing mining challenges and a slowdown in trading activity due to cost exceeding potential profit. Despite this, long-term investors remain hopeful with potential catalysts such as Bitcoin ETF decisions forthcoming.”

Navigating the Impacts of Token Unlocks: The Case of SUI and HBAR

“The cryptosphere is witnessing a drop in prices of major coins, especially SUI and HBAR due to an expected increase in circulating supply. This token unlock event – a strategy to alleviate selling pressure from early investors and project team members, could cause market fluctuations. However, these short-term shifts should not disconcert investors as smart strategizing can turn such events into opportunities.”

SEC’s Maiden NFT-Related Enforcement Action: A Curbing Move or Growing Pains?

U.S. regulators have asked Impact Theory, a Los Angeles firm, to repay investors for an illegal, unregistered securities offering related to non-fungible tokens (NFTs). This ruling, the SEC’s first NFT-related enforcement action, doesn’t imply all NFTs are securities. The company must create a fund to reimburse investors and pay a $6.1 million penalty.

Bitcoin’s Race to $100,000: An Optimistic Prophecy or Fantasy Among Fraught Skepticism?

“Hut 8 VP, Sue Ennis, predicts Bitcoin could reach $100,000 by snaring 2%-5% of gold’s market cap. Despite political turbulence and Bitcoin’s dismal performance, she maintains that diversifying mining revenue and approval of a Bitcoin ETF could drive Bitcoin’s surge.”

Urgent Anticipation: SEC Verdict on Major Bitcoin ETF Applications and the Crypto Industry’s Future

The U.S. SEC’s impending response to Bitcoin ETF applications from top financial firms like BlackRock, VanEck, Invesco, Bitwise, and WisdomTree represents a crucial phase in integrating cryptocurrencies with conventional financial markets. The SEC’s decision could indicate some significant implications for the crypto industry’s future.

The Battle of Blockchain: Ethical Boundaries vs. Legal Sanctions in the Crypto World

Cryptocurrency regulations are often filled with controversies, as shown in Sam Bankman-Fried’s recent legal predicament. His pre-trial detention ties to alleged witness tampering, resulting in heated court arguments. His predicament invites questions around the balance between defending oneself and crossing ethical boundaries in the crypto world.

Crypto Regulation: Candidates’ Stances and Upcoming Election Implications

“Crypto regulation has become a significant issue in U.S. presidential campaigning. Candidates’ positions vary widely, from skepticism to enthusiastic adoption, yet the subject of digital assets regulation was absent from the recent Republican debate. This highlights the increasing importance of cryptocurrencies in our socio-political landscape, and suggests a need for informed legislation.”

India’s Blockchain Future: Ambani’s Gamble on Blockchain and CBDCs – Opportunities and Pitfalls

Mukesh Ambani’s Jio Financial Services (JFS) is promoting blockchain adoption and exploring central bank digital currencies (CBDCs) to aid digital inclusivity and financial growth in India. JFS aims to deliver blockchain-based products while ensuring utmost security, regulatory compliance, and customer data protection.

Navigating Bitcoin Adoption in El Salvador: Promises, Pitfalls and Possibilities

Bitcoin holds promise in building an equitable financial system, but its understanding is a hurdle for many. In El Salvador, DitoBanx’s CEO aims to ease the transition, offering Bitcoin-based services to the unbanked. However challenges including volatility and apprehension towards crypto adoption persist.

Binance Regulations and Its Impact on Russian Cryptocurrency Traders: An Analytical Perspective

“Binance introduces new P2P trading restrictions specifically targeting its Russian clients, limiting them to only using the Russian ruble. While narrowing choices, this strengthens local control over RUB in the Russian crypto sphere. However, Russians abroad face difficulties as their usage of other currencies has been banned on the platform.”

Bitcoin’s Turbulent Journey: The Worst-Performing Month of 2023 Amidst Stellar Miner Performance

“With the Bitcoin price showing uncertainty and the upcoming close of August potentially leading to a downturn, concerns grow amongst traders and analysts. The bear market’s impact lingers, despite the growth of Bitcoin’s hash rate to an all-time high, suggesting a possible miner’s bull run. However, Bitcoin’s performance may remain volatile with September’s historically weak performance approaching.”

Surge in Blockchain Betting Forecasts a Potential Dark Horse in 2024 Presidential Race

“Bitcoin-friendly entrepreneur Vivek Ramaswamy emerges as a formidable contender in the 2024 U.S. Republican presidential nomination. Blockchain-based betting platforms indicate his growing popularity, signifying possible cryptocurrency and blockchain acceptance in political scenarios. Though legally limited, this technology may revolutionize gauging public sentiment.”

Biden’s Crypto Tax Regulations: A Threat to Innovation or a Step Towards Transparency?

“Recently, the crypto market experienced a significant ripple due to new proposed crypto tax reporting regulations by President Joe Biden. Critics argue these regulations could stifle innovation and make crypto firms reluctant to operate within the United States.”

Crypto Controversies: Tornado Cash’s Legal Troubles, FTX Founder Behind Bars, and Huge Bitcoin Concentration

“The crypto industry is grappling with legal and ethical challenges, whilst showing high-risk, high-reward nature. With recent controversies involving Tornado Cash co-founders, FTX founder, and the parent company of Prime Trust, it’s clear that proper evaluation and risk-assessment are crucial.”

Downtrend Departure: The Future of Crypto and Possibility of an Upturn Amid Fluctuating Regulatory Landscape

“Analysts from a leading American bank have observed the recent cryptocurrency market downturn and predict its end, citing a decline in open interest in Bitcoin futures contracts. However, this prediction does not account for unpredictable future disruptions such as regulatory or economic changes.”

Regulations In The Blockchain Age: A Closer Look Through the FTX Founder’s Trial

“Legal representatives for FTX founder Sam Bankman-Fried are unimpressed with US prosecutors’ handling of his upcoming trials. They argue their client needs more time to review millions of pages of case documents and constant internet access. Bankman-Fried faces serious charges for alleged fraudulent activities, affecting the ongoing narrative around regulations in the blockchain and cryptocurrency world.”

Bitcoin’s Future: Influenced by Federal Reserve Policies or Independent Market Stalwart?

“The co-founder of BitMEX, Arthur Hayes, shares an optimistic view of Bitcoin’s future, driven by critique of Federal Reserve’s contentious strategies. Bitcoin is seen as an antidote to banking anomalies, growing fiat liquidity, and may face potential surges or falls.”

Dancing on Shifting Sands: Crypto Companies Adapt Amid Regulatory Obstacles and Market Developments

“The crypto industry is witnessing significant developments like Coinbase and Circle’s consortium dissolution, Binance.US’s collaboration with MoonPay, and customer withdrawal issues on the main Binance platform. These changes highlight the dynamic adaptations adaptive to changing regulations, representing both intriguing possibilities and cautionary tales for the industry.”

Visa and Mastercard Sever Ties with Binance: A Shake-up or Just a Ripple in the Crypto Market?

“Payment giants Visa and Mastercard have distanced themselves from Binance amid ongoing regulatory challenges for the leading crypto exchange. Despite this, industry experts predict modest impact on Binance’s market share. The situation illustrates how institutional caution could affect the cryptocurrency market’s future.”

Breaking Down the Misconceptions: Pursuit of Privacy VS Illicit Activities

“This article examines the tension between the pursuit of individual privacy and law enforcement within the new dynamic of digital transactions and encrypted communications. The piece explores evolving attitudes towards privacy, concerns around governmental access to private information, and the complexities introduced by emerging technologies on privacy rights.”

Navigating the Current Crypto Sphere: A Look at the Push and Pull of Bull and Bear Forces

“The Federal Reserve’s interest rate hikes till 2024 prompted a dip in Bitcoin and altcoins, yet U.S. equities markets recovered impressively. Meanwhile, Pantera Capital predicts Bitcoin to reach $35,000 by April 2024. Ethereum and Binance Coin face resistance, while Bitcoin, tanking below $24,800, could trigger a sell-off.”

Unraveling the Enigmatic Ties: The Trifecta of Sun, Bankman-Fried, and Kwon & Their Cryptocurrency Reign

This article explores the influences of Justin Sun, Sam Bankman-Fried, and Do Kwon in the cryptocurrency industry. It examines their methods, impacts and the potential consequences of their actions. Comparing Sun’s Tron to Kwon’s Terra, the article questions whether Sun’s potential downfall could cause even greater harm.

PayPal’s PYUSD Stablecoin: A Turbo Boost or Damp Squib for Crypto Adoption?

PayPal’s recently launched stablecoin, PYUSD, appeared to have a slow start with 90% of it residing in Paxos Trust’s reserves and only 7% on crypto exchange wallets. However, despite the somewhat sluggish kick-off, it’s still early days; a shift in the crypto market could significantly change PYUSD’s future prospects.

Bitcoin’s Chilly Wave: Market Effects, Reactions and Future Predictions Amid Federal Reserve Statements

The cryptocurrency market plunged as Bitcoin fell below $26,000, triggered by U.S. Federal Reserve Chair’s statements on countering inflation and possible rate hikes. Leading altcoin Solana also dipped 3%, and MKR saw a 4% decrease due to fears of a loan default. However, despite the gloomy outlook, experts like Sacha Ghebali believe the market could see an upturn if a spot bitcoin ETF is approved, offering a possible crypto market recovery.

Binance’s Russian Rumble: Gearing Crypto Towards Regulatory Compliance or Decoupling From Traditional Bank Partners?

“Binance terminated its relations with five Russian banks amidst a system upgrade aimed at strengthening compliance with regulatory norms. This move brings into question the reliability of digital currencies as a stable transfer medium, highlighting the often complicated relationship between cryptocurrencies, regulatory compliance and traditional banking systems.”

Navigating the Crypto Storm: Powell’s Speech, ETF Dreams, and the Shifting Market Landscape

“Cryptocurrencies experienced mixed responses to the indication of further U.S. interest rate hikes from Jerome Powell, Federal Reserve Chairman. While some digital assets dipped, others held steady, revealing an evolution within the crypto market towards resilience in the face of monetary tightening and ever-growing interest in internal crypto narratives.”

Navigating the Storm: Treasury’s Proposed Crypto Tax Rules Stir Controversy and Promise

The U.S. Treasury Department’s proposed digital assets tax rules have sparked controversy within the crypto community. The debate revolves around the feasibility of regulating decentralized operations and potential implications for wallet vendors, decentralized exchanges, and smart contract systems. Nonetheless, a clear taxation path might facilitate easier engagement with digital assets.

Bitcoin’s Resilience amidst Monetary Shocks: A Debate on Investment Stability versus Volatility

Jerome Powell’s hawkish remarks prompted an initial dip, then rebound, for bitcoin, showcasing the cryptocurrency’s resilience to external monetary shocks. Despite volatile tendencies, cryptocurrencies may offer an alternative, potentially stable investment option, even amidst fluctuating traditional markets and restrictive monetary policies.

Forecasting the Uncertain Bitcoin Future: An Unsteady Road Ahead or a Stable Boom in Q4, 2023?

Noted analyst Filbfilb suggests a stabilization phase for Bitcoin until Q4, 2023, entering the “critical time” zone. The ‘smart money’ tend to drive prices higher during this period. However, U.S. economic policy, especially the September Federal Reserve meeting, could influence BTC’s trajectory significantly.