“The OneCoin fraud case highlights significant challenges for cryptocurrency regulations. As the line between privacy and security blurs, there’s a growing need for nuanced regulatory strategies and discernment in this evolving techno-finance landscape to prevent potential violations of user privacy.”

Search Results for: 2018

Unraveling the Regulatory and Ethical Quagmires: Navigating through the Crypto Landscape

A U.S. federal judge delayed a sentencing hearing for radio host Ian Freeman, who allegedly created an illegal Bitcoin exchange used by scammers. Meanwhile, the DeFi Education Fund contests a patent claim by tech company True Return Systems. Also, DigiFT’s dETH0924 provides up to 4% APR, boosting Ethereum’s PoS mechanism, while crypto infrastructure provider Qredo integrated Circle’s USDC stablecoin into its wallet.

Navigating the Seas of Global Crypto Regulation: G20’s Role and India’s Stance Unveiled

“The G20 summit in India recently started a comprehensive global regulation on crypto assets, revealing global recognition of cryptocurrencies’ potential. Despite some disapproval, even India’s Reserve Bank permitted banks to service crypto companies, marking a significant shift towards global acceptance of cryptocurrency.”

Unraveling Taiwan’s Regulatory Moves: Balancing Crypto Boom and Security Concerns

Taiwan’s Financial Supervisory Commission plans to release guidelines for crypto companies to ensure safety and compliance with anti-money laundering laws. This move, affecting local and overseas firms, reflects Taiwan’s intent to regulate and embrace the crypto sector while balancing innovation and security.

Hong Kong’s Digital Yuan Testing Phase II: A Leap to Future or a Threat to Privacy?

“Hong Kong is advancing on the second phase of technical testing for China’s digital yuan, focusing on the digital wallet’s top-up functionality via the Faster Payment System. Concomitantly, the city grapples with challenges balancing financial innovation and consumer protection in the fast-paced digital currency landscape.”

Dismissal of Lawsuit Against Curve Finance’s CEO: An Unfolding Legal Drama in Decentralized Finance

A lawsuit against Curve Finance’s CEO, Michael Egorov, alleging fraud and misappropriation of trade secrets was dismissed by a California judge due to procedural technicality. Egorov’s lawyers argued the case belongs in Switzerland, where both Egorov and his company, Swiss Stake resides.

Breaking Boundaries: AI Generated Art and Royalty Rights in the Crypto World

“AI art pioneer, Pindar Van Arman, has generated recognition in the cryptosphere with his AI-created NFTs. Van Arman promotes the notion that, much like the recording or writing world, crypto artists should hold royalty rights, sparking controversy among collectors. His AI art, challenging traditional definitions of creativity, incites both scepticism and appreciation, whilst highlighting the potential applications of AI beyond the creative arts.”

Google’s Blockchain Turnaround: The Dawn of NFT Gaming Advertisements and the Hidden Implications

Google has revised its advertising policy to permit promotion of blockchain-powered non-fungible token (NFT) games, affecting NFT games that abstain from promoting gambling content. However, it maintains its prohibition against game advertisements where players risk NFTs for earning additional digital assets.

Navigating the Crypto Turbulence: Exploring Bitcoin’s Potential for Patient Investors

“Despite the current bleak outlook for the cryptocurrency market, indications suggest potential generational buying opportunities, especially with recent Bitcoin price drops. Considering a long-term perspective, this could be an opportunity to buy Bitcoin at a lower price, a strategy that has resulted in great returns in previous cycles.”

Google’s Softened Stance on Crypto-Ads: A Boon for Blockchain World or a Safety Rigor?

“Google has updated its cryptocurrency ad policy to permit ads from cryptocurrency gaming companies promoting blockchain-based non-fungible token (NFT) games. The change, effective September 15th, excludes games promoting gambling or gambling services. While this shows a more inclusive approach, Google still maintains stringent rules to protect consumers from potential scams and maintain control over crypto-related advertisements.”

Decentralized Exchange dydx’s Token Migration to Layer 1: A Unanimous Move or Market Hype?

“Decentralized exchange dydx gains almost universal user approval to migrate to its latest version, adopting DYDX as its Layer 1 token for its imminent blockchain. The community’s vote facilitates the token’s transition from Ethereum to a Layer 1 appchain within the Cosmos ecosystem.”

Qredo’s Crypto Winter Survival: Staff Cuts, Refocusing Efforts and Ramped-up Security

“Crypto infrastructure provider Qredo is reportedly laying off around 50 staff members, including key executives, reducing the firm’s headcount to around 130. The layoffs are part of a resizing strategy, an attempt to endure the difficult crypto market while refocusing efforts to save approximately 50% of its expenses.”

Blockchain Future: Balancing the Pitfalls and Potentials of a Digital Revolution

“Blockchain technology offers potential benefits like improved transaction speed, efficiency, and security. However, the future of these systems faces challenges like regulatory interventions, cyber threats, and market volatility. Despite these issues, blockchain and cryptocurrencies hold significant revolutionary potential in our financial systems.”

Newly Elected Singapore President and His Challenging Influence on Crypto Regulations

Singapore’s new president, Tharman Shanmugaratnam, with past finance roles may reshape fintech policies. His views on cryptocurrency, from ‘slightly crazy’ to its potential significant role in finance, could impact Singapore’s crypto regulatory balance amidst the aftermath of local crypto establishments’ failures.

Dismantling North Korea’s Crypto Power: A Bold South Korean Stance Against Cybercrime

“South Korea has reportedly drafted a bill to neutralize North Korea’s crypto assets, aiming to cripple Pyongyang’s illicit weapons program. The bill proposes tracking and neutralizing stolen digital assets, offering potential benefits despite raising concerns about decentralization and anonymity in the cryptocurrency world.”

Landmark Court Ruling: The HelbizCoin Class Action Suit and an Awaited Legal Framework for Crypto

The United States District Court has allowed a class action suit against the creators of HelbizCoin, marking a significant step towards effective regulation in the crypto world. Accused of a deceptive pump-and-dump scheme by around 20,000 investors, Helbiz has wound up in court where accusations of fraud, price manipulation, and violations of securities and commodities laws have been upheld.

Ethereum’s Co-founder Sells Remaining Stake in MakerDAO: A Signal for Blockchain’s Future?

Ethereum co-founder, Vitalik Buterin, recently traded his remaining stake in MakerDAO tokens after MakerDAO’s co-founder announced plans to reimplement the project on a new blockchain, NewChain. The move shows shifting alliances and notable developments in blockchain dynamics.

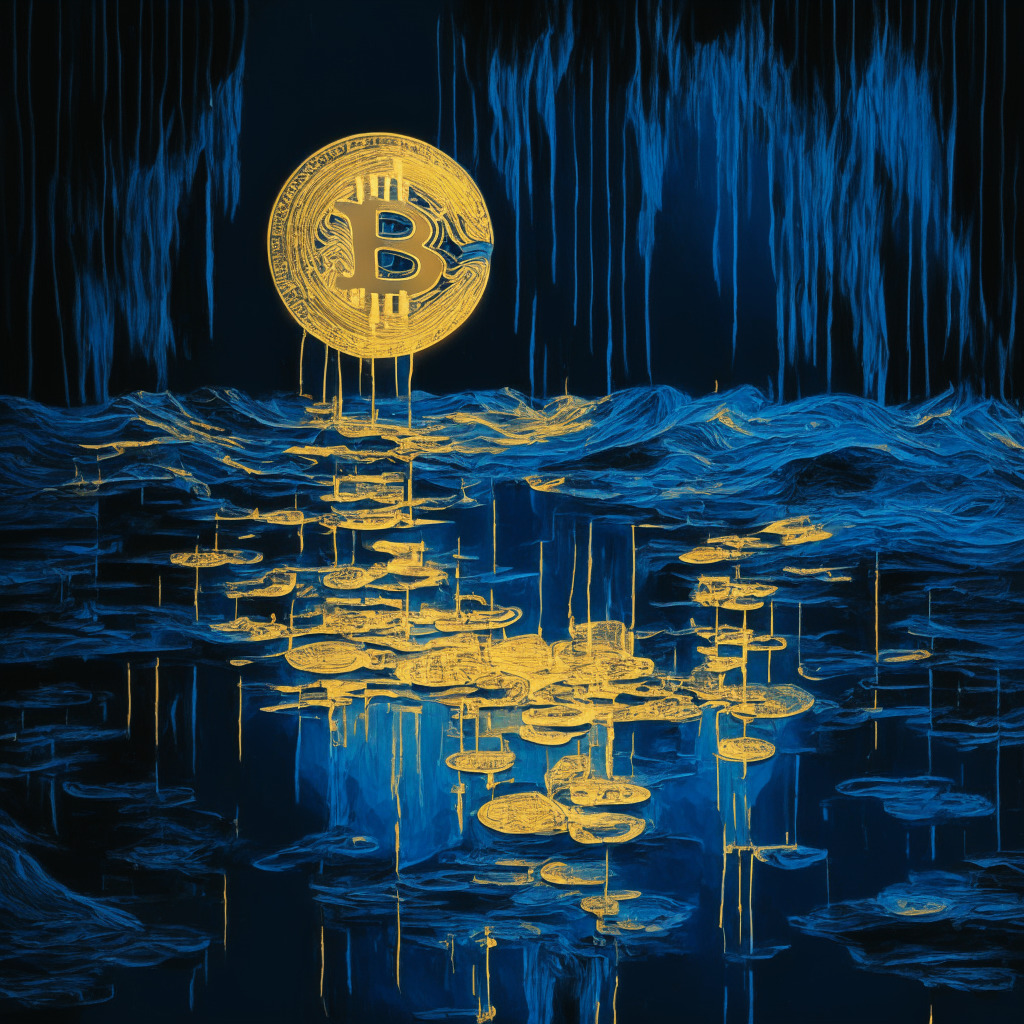

Declining Bitcoin Presence on Exchanges: Indication of Changing Trade Dynamics or Signal of Caution?

“Bitcoin (BTC) holdings on centralized exchanges have decreased by 4%, reflecting a growing trend of traders using private wallets. This shift may mitigate massive sell-offs, but also raises concerns for new users dependent on exchanges. Recent security breaches have foregrounded the need for self-custody measures, as the crypto market undergoes a key metamorphosis.”

Ether’s Death Cross Paradox: A Bearish Omen or an Opportunity for Bullish Rally?

“Ether has registered a boost of 3.5%, however, it might be forming a ‘death cross’, a long-term bearish omen. Ether’s market movements remain unpredictable and mesmerizing, with unique death cross scenarios and unexpected bullish rallies challenging market expectations and perceived reliability of this standalone indicator.”

Dwindling Exchange Balances Foreshadow a Maturing Cryptocurrency Market

“The shrinking balance of Bitcoin on centralized exchanges, now at its lowest in half a decade, could signal a new phase in the crypto market. This decreasing reserve signifies growing investor confidence in long-term prospects of cryptocurrencies and a trend towards self-custody. The changing paradigm necessitates exchanges to reevaluate their business models for maintaining profitability.”

Unmasking the Truth: Decreased Bitcoin Deposits on Exchanges & Future Market Predictions

Bitcoin’s recent departures from centralized exchanges could suggest a bullish outlook or indicate trust in custody solutions. However, SEC regulatory actions, declining buyer interest, and lower daily volumes suggest traders may be reluctant to actively trade the asset.

Robinhood’s Tenuous Ties with Crypto: Navigating Uncertainty and Shifting Alliances

Robinhood has severed ties with market-making partner Jump Trading, a significant player in its crypto ventures. This decision stems from the unstable regulatory landscape and changing internal alliances. Moreover, Robinhood’s recent financial records reveal a drop in interest in crypto trading, with trading figures decreasing by 68% relative to the previous year. Despite this data, Robinhood remains one of the largest bitcoin holders.

Navigating Regulatory Waters: How Seba’s Expansion Reflects the State of Crypto Banking

Switzerland-based crypto bank, Seba, has received approval-in-principle from Hong Kong’s Securities and Futures Commission. This is an initial step towards gaining a full license for operations with cryptocurrency-related products and traditional securities. Seba’s move correlates with Hong Kong’s new regulatory measures aiming to attract companies into the region.

Sanction Enforced: Binance Removes Banco de Venezuela from P2P Services

“In a move to enforce international financial sanctions, Binance, the world’s largest crypto exchange, has eliminated a payment method attached to Banco de Venezuela from its P2P trading service. This action reflects the limited room for maneuver that global crypto exchanges have amidst international sanctions and raises questions about the extent to which the promises of cryptocurrencies hold true in a regulated market.”

Cryptosphere Tremors: BitBoy Crypto Decouples from YouTuber Ben Armstrong – Impact & Implications

“The ‘BitBoy Crypto’ brand is parting ways with popular YouTuber Ben Armstrong, citing issues of substance abuse and accusations of damage to network employees. This decision raises questions about the brand’s future and the influence of its key figure.”

Bankruptcy Judge’s Hesitation on Crypto Tokens as Securities: A Case Study of Celsius

The bankruptcy judge recently declined to classify CEL, Celsius’s native token, as a security amid Ripple Labs and SEC’s ongoing legal issues. CEL’s business model significantly deviated, being referred to as “insolvent since inception” by a court-appointed examiner, who suggested CEL was part of a problematic scheme. The rising token value benefits the company but raises concerns about ethical considerations and customer implications.

Decoding the ZTX Genesis Home Mint: A Leap towards Next-Gen Metaverse Governance

ZTX, the South Korean metaverse platform, is set to launch its ZTX Genesis Home Mint, strengthening ties with OpenSea. ZTX, facilitated by the ZEPETO mobile platform, enables users to engage in an open-world 3D platform, including socializing, gaming, and even virtual governance. The upcoming Genesis Home Mint offers incentives for early supporters and offers digital assets known as District Homes.

Overconfidence in Bitcoin Bulls Amid Market Skepticism: The Impact on Future Trade

“Despite overconfidence among Bitcoin bulls, there’s a need for Bitcoin to reclaim the $27.8K moving average for positive momentum. Skepticism around Bitcoin’s multi-year low RSI readings adds to the market uncertainty. Meanwhile, Binance’s modification of its zero-fee Bitcoin trading could incite market selloffs, shifting focus from TUSD to FDUSD stablecoin.”

Innovative Partnerships: How Crypto is Paving the Way to Luxury Real Estate

Cryptocurrency lender, Ledn, partnered with Cayman’s top crypto real estate broker, Parallel, unlocking opportunities for crypto investors to purchase Cayman real estate. The partnership opens doors to “Golden Visa” eligibility without requiring traditional currency conversion or selling of digital assets. This initiative is an exciting opportunity to blend digital asset ownership with real estate investment.

Inside the Intricate Web of Alleged $290m Crypto Swindle: The Trail of Moshe Hogeg

Former Beitar Jerusalem FC owner, Moshe Hogeg is accused of a $290 million crypto swindle, with funds from four cryptocurrency projects allegedly misused for personal interests rather than pledged development. This case demonstrates that the crypto world is not immune to deceit and underlines the need for stricter safety checks and transparency in blockchain technology and cryptocurrencies.

North Korean Hacks vs. Blockchain Transparency: The Duel That Shapes Crypto Security

The FBI has put six Bitcoin wallets, affiliated with North Korea’s Lazarus Group, on its radar, highlighting their potential possession of around $40 million. The Group’s success in crypto exploits is counterbalanced by blockchain’s public-ledger technology which makes laundering assets increasingly difficult due to traceable and freezeable transactions.

Coinbase Acquires Stake in Circle: Betting Big on Stablecoins and Shaping Cryptocurrency Markets

Coinbase has acquired a minority stake in Circle Internet Financial and both companies dissolved their Centre Consortium associated with issuing USD Coin (USDC). Amid greater regulatory clarity, Circle will become the sole issuer of USDC and control reserve governance, facilitating its integration on various blockchains. This shifting control indicates wider stablecoin adoption in the crypto economy.