“Regulatory frameworks globally are revising their stance on ASIC chip exports, pivotal in cryptographic technologies. The U.S. Department of Commerce denies prohibiting AI chips sale to the Middle East. However, new regulations require tech giants to get licenses for selling flagship chips to some Middle Eastern countries.”

Search Results for: Biden Administration

Grayscale’s Victory Stirs Up Controversy: Doubts Over SEC’s Gensler Heighten

“Cryptocurrency circles discuss Grayscale’s lawsuit and SEC chair Gary Gensler’s role. Congressman Warren Davidson suggests Gensler’s SEC decisions lack stead, as demonstrated by Grayscale’s legal victory. This opens up possibilities for a Bitcoin spot ETF emergence in the US, but the situation remains uncertain.”

Miami’s Blockchain Mayor Bows Out: What Suarez’s Presidential Campaign Suspension Means for Cryptocurrency Future

“Suarez, Miami’s Mayor, known for his bitcoin-friendly stance, accepted bitcoin as campaign donation and has explored the use of blockchain technology. Despite facing challenges, his pursuit of these technologies prompts discussion on the role of digital currencies in future political campaigns and public administration.”

Navigating the Regulatory Labyrinth: New Rules and Fluctuating Tides in Crypto Sphere

“The United States Internal Revenue Service (IRS) is proposing new tax policies for the sale/exchange of digital assets by brokers, attracting criticism from crypto figures. Meanwhile, Gemini, a cryptocurrency exchange, faces a SEC lawsuit on potential regulatory violations. These developments reflect the ongoing struggle to balance regulation with innovation in the emerging field of cryptocurrency.”

Laos Electric Company Curbs Crypto Mining Amidst Energy and Environmental Concerns

“Electricite du Laos (EDL) announces a significant cut to crypto mining firms’ operations, due to rising concerns on electricity production & environmental impact. This comes after Laos’ attempt to become a digital assets mining hub following China’s stringent regulation.”

Navigating the Tides: US Treasury’s Proposed Crypto Regulations Stir Debate

The US Treasury and IRS propose new regulations making digital asset brokers accountable for reporting certain sales and exchanges. This move aims to simplify tax calculations, bring digital asset tax reporting on par with securities, and prevent tax evasion. Critics, however, see this as an attempt at excessive government control, potentially stifling the growth of decentralization and web3 adoption.

Unraveling the IRS Draft on Digital Asset Reporting: A Regulatory Leap or Misguided Move?

The US IRS has issued draft guidelines on reporting rules for digital asset brokers. Aimed at regulating the digital asset industry, this regulation intends to streamline tax reporting and prevent fraud, proposing to raise $28 billion in fresh tax over a decade. Critics label it as “misguided” and “an attack on the digital asset ecosystem.”

Digital Energy Council: Sustaining Crypto Mining and Shaping Policymaking in Digital Assets

The Digital Energy Council, a group dedicated to cryptocurrency miners, has been introduced as a crucial intermediary for discussions about crypto mining sustainability, and policy advancement with Washington-based policymakers. This initiative prioritizes miners’ interests while ensuring compliance with U.S. energy laws, aiming to promote responsible energy development and national security.

Anthropic Secures $100M Investment from SK Telecom: Assessing the Future of AI in Telecom Industry

“AI developer Anthropic secured a $100 million investment from South Korean corporation, SK Telecom, to create a multilingual large language model for the Telco AI platform. This move represents SK Telecom’s aspirations to revolutionize the telecom industry leveraging AI technology.”

Navigating India’s Updated Data Protection Bill: BigTech’s Freedom vs Public Trust

India’s parliament has approved an update to the Digital Personal Data Protection Bill 2023, easing data compliance for tech giants. The Bill regulates data exports, with provisions for less stringent regulations on data storage, processing, and transfer. However, it’s still a topic of debate, as it potentially prioritizes tech advancement over robust data security.

Prospective President DeSantis: Halting the War on Crypto and Spurning CBDCs

Presidential hopeful Ron DeSantis pledges to halt the “war on Bitcoin and cryptocurrency” if elected President, criticizing the current administration’s approach to digital assets. DeSantis equates potential US plans for a central bank digital currency (CBDC) to those in China, expressing mistrust over government control of finances and stifling economic freedom.

Presidential Candidate’s Pro-Crypto Stance: Game Changer or Empty Promise?

Presidential candidate Ron DeSantis’ stance on cryptocurrencies aims to dispel the purported “war on bitcoin and cryptocurrencies” by the current administration. DeSantis’ intent is to allow American citizens the freedom to invest in cryptocurrencies, offering a potential paradigm shift in this sphere.

Could Bitcoin Decide the Next President? Exploring Cryptocurrency’s Growing Political Influence

“Bitcoin and the crypto community could be deciding factors in a U.S. presidential election. Candidates now need to proclaim their stance on cryptocurrencies. The U.S. Federal Reserve estimates that 8%-11% of the American population, owning cryptocurrencies, can considerably influence the election. Anti-Bitcoin policies may thus, alienate a rapidly growing cohort of voters.”

Bipartisan Agreement on Stablecoin Regulations: A Hopeful Step or Potential Roadblock?

The Republicans and Democrats have found consensus on proposed stablecoin regulations, with the Financial Services Committee targeting state-wise legislations. The bill tasks the US Federal Reserve with enforcing regulations and could give the Commodity Futures Trading Commission more oversight over cryptocurrencies. The state vs federal regulation issue may present future challenges.

Crypto Tax Regulations: Legitimizing the Industry vs Hindering Growth and Privacy

US Congressmen Brad Sherman and Stephen Lynch urge for crypto tax regulations, highlighting tax evasion concerns in the industry. Regulations could legitimize crypto and encourage adoption, but critics argue it may hinder growth and limit decentralization benefits.

Crypto in Politics: Jack Dorsey Backs Pro-Bitcoin Presidential Candidate RFK Jr.

Twitter CEO Jack Dorsey supports pro-crypto Democrat candidate Robert F. Kennedy Jr., who accepts Bitcoin donations for his presidential campaign. Kennedy criticizes CBDCs as tools to suffocate dissent and condemns a proposed 30% tax on crypto mining.

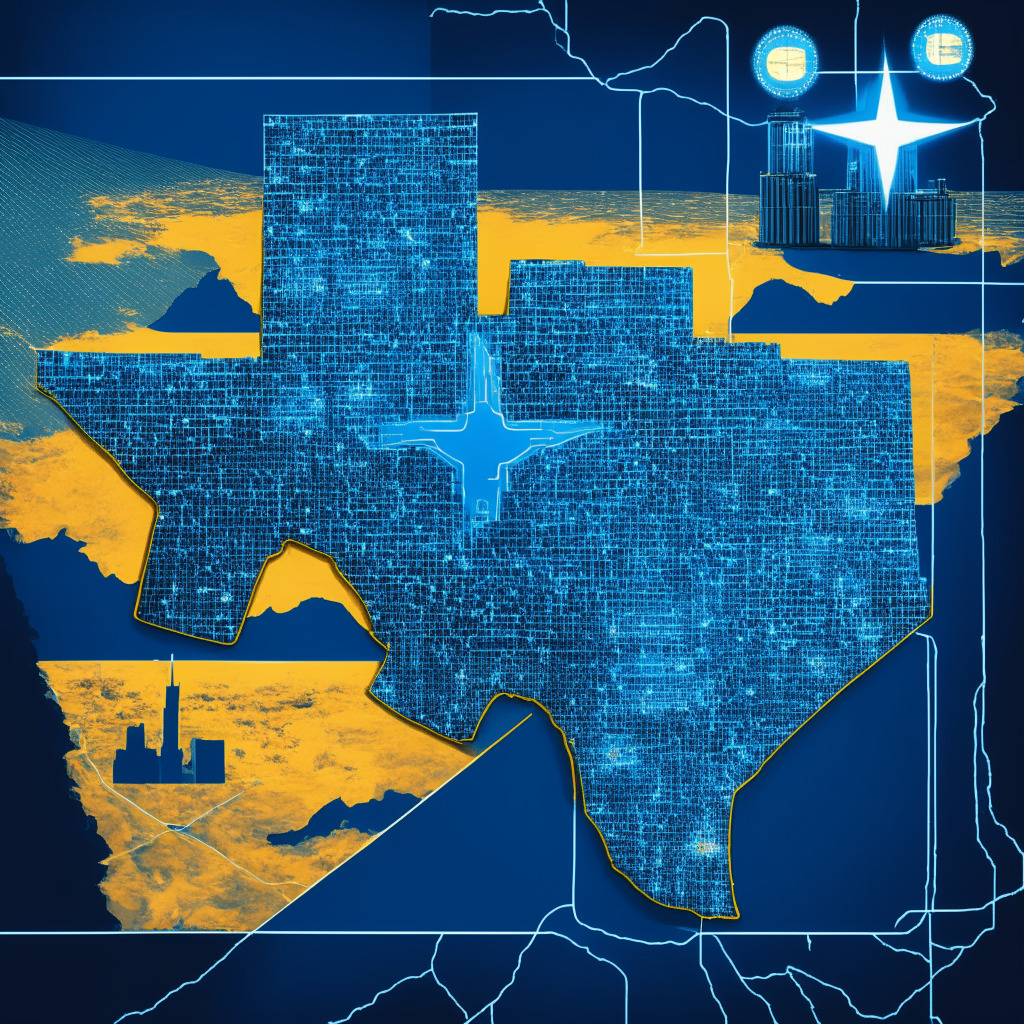

Texas Bitcoin Mining Boom: Supportive Legislation and State-Level Tug of War

Texas embraces bitcoin mining as legislators pass supportive bills, SB 1929 and HB 591, solidifying the state’s position as a premier destination for the industry. However, future federal-level regulation remains uncertain, with individual states currently leading policy development.

2024 Presidential Election: Crypto Regulation Takes Center Stage in Debates

The 2024 US presidential election could witness discussions on crypto market regulation taking center stage, impacting the US’s position as a global crypto hub. Prospective candidates like Ron DeSantis and Robert F. Kennedy Jr. openly support digital asset trading freedom, while JP Morgan CEO Jamie Dimon’s potential candidacy raises questions about cryptocurrency’s role in the American financial landscape.

2024 US Election and Crypto: Regulation vs Innovation Showdown

The US cryptocurrency regulatory stance becomes a significant topic as the 2024 presidential election approaches, with figures like Florida Governor Ron DeSantis discussing the possibility of banning CBDC use in Florida. The current administration’s enforcement actions, ongoing lawsuits, and heavy regulation could hinder innovation and force businesses to seek more open environments outside the US.

Debt Ceiling Negotiations and Cryptocurrency: Seeking the Perfect Balance

The House of Representatives votes on postponing the debt ceiling until 2025 through the Fiscal Responsibility Act of 2023. This bipartisan agreement will impose limits on discretionary spending, but its impact on growth, innovation and the cryptocurrency sector requires a delicate balance between fiscal responsibility and flexibility.

Bitcoin’s Growing Pains: Balancing Net-Zero Emissions Commitments and Crypto’s Future

Bitcoin mining’s energy consumption risks conflicts with global net-zero emission commitments, potentially leading to price decline and regulatory challenges. Governments should focus on greening their grids while the crypto industry embraces renewable energy and sustainable practices to stay on a secure footing amidst growing environmental concerns.

Crypto Mining Tax Shelved: Balancing Innovation, Regulation, and Sustainability Debate

The proposed Digital Asset Mining Energy excise tax (DAME) on cryptocurrency mining is absent from the recent US debt ceiling deal, stirring debates. While proponents argue DAME could generate revenue and promote eco-friendly practices, critics warn against stifling the growing industry with taxes.

Debt Ceiling Agreement Blocks Crypto Mining Tax: A Win for the Industry or Environmental Setback?

The recent U.S. debt ceiling agreement has notably blocked the proposed Digital Asset Mining Energy (DAME) excise tax, preventing a 30% tax imposition on cryptocurrency mining firms. This outcome, seen as a victory for the crypto industry, has sparked debates around the environmental impact of crypto mining operations and the importance of addressing energy consumption concerns for a sustainable future.

Debt Ceiling Deal Blocks Crypto Mining Tax: Boon or Bane for the Industry and Environment?

President Joe Biden and House Representative Kevin McCarthy reached a tentative debt ceiling deal that, if passed, would block the proposed 30% tax on crypto miner’s electricity bills. Critics argue the blocked tax denies encouragement for sustainable energy practices in the crypto mining industry, while proponents view it as a victory for maintaining competitiveness.

Stablecoins, Politics, and Regulations: Navigating the Crypto Market’s Calm Before the Storm

The cryptocurrency market experienced a flat week, with Bitcoin and Ethereum remaining stable. Meanwhile, ICP and LDO faced losses, while TRON rallied. The growing crypto market attracts political involvement, and regulatory bodies emphasize the need for clear guidelines and vigilance.

Debt Ceiling Crisis Looms: Potential Impacts on Crypto and Financial Markets

As the US faces a potential debt crisis, ongoing high-stakes discussions about raising the $31.4 trillion debt ceiling could impact financial markets, including the cryptocurrency sphere. Swift resolution of lingering issues is critical to avoid a widespread crisis and market uncertainty.

IMF’s US Rate Hike Advice: The Impact on Crypto Markets and Inflation Control

The IMF advises the US Federal Reserve to maintain interest rate hikes and adopt stringent fiscal policy to minimize federal debt. The tightening of fiscal policies and potential rate hikes might impact stock and crypto markets, causing a temporary decrease in Bitcoin value.

Digital Asset Mining Tax: Hindering Innovation or Addressing Energy Concerns?

The proposed Digital Asset Mining Energy excise tax (DAME) has divided opinions between those who view it as a hindrance to cryptocurrency industry innovation and those believing it addresses energy consumption concerns. Meanwhile, cryptocurrency regulation legislation, such as the Responsible Innovation Act and stablecoin bills, continue to evolve, shaping the future landscape of digital assets.

Bitcoin’s Resilience Amid Debt Ceiling Talks and Evolving Crypto Regulations

Bitcoin experiences a significant rebound, reaching the 38.2% Fibonacci retracement level, as it recovers from a recent pullback. Market dynamics such as US debt ceiling talks and ongoing cryptocurrency regulations impact the BTC/USD value, with caution advised amid mixed technical signals.

Debt Ceiling Negotiations: Predicting Bitcoin’s Fate Amid U.S. Economic Climate Shifts

As U.S. debt ceiling negotiations progress, Bitcoin and Ether maintain stability amidst uncertainty. Dave Weisberger, CEO of CoinRoutes, outlines three potential scenarios impacting crypto markets tied to debt ceiling outcomes. Meanwhile, Blend acquires 82% of NFT lending market share, and Nvidia’s stock soars by 25% due to its GPUs’ value in crypto mining and AI applications.

US Debt Ceiling Crisis: Impact on Crypto Markets and Blockchain Technology

The US faces a potential catastrophic default as President Joe Biden and Republican Kevin McCarthy urgently negotiate the debt ceiling. House Speaker McCarthy expresses optimism, with significant progress made during Wednesday’s talks. However, unresolved issues persist, causing tension in financial markets, including the crypto market. A deal failure by June 1st could result in severe consequences.

Florida’s CBDC Ban Sparks Debate: Privacy Concerns vs Financial Inclusion Prospects

Florida recently banned Central Bank Digital Currencies (CBDCs), igniting debates on the potential drawbacks of CBDCs, including surveillance and financial habit control. Governor Ron DeSantis voices concerns over central authority imposing environmental, social, and governance criteria, while proponents cite increased financial inclusion and monetary policy control benefits. The future of CBDCs in the U.S. remains uncertain.