Shanghai and Suzhou cities aim to accelerate the adoption of China’s Central Bank Digital Currency, Digital Yuan. The move follows the People’s Bank of China’s revelation that $250 billion worth of Digital Yuan transactions have been processed nationwide. Despite the significant figure, it represents a minor part of the Chinese economy, motivating these bustling cities to advance digital currency promotion.

Search Results for: China

Cryptocurrency in China: A Cat and Mouse Game of Capital Control and Legal Dilemmas

“Mr. Chen, a Chinese individual, was sentenced to nine months for aiding a $13,104 USDT transaction. Viewed as money laundering by authorities due to Chen’s personal bank information involvement, this reflects China’s stringent crypto stance linked to capital control regulations.”

China’s Blockchain Conquest: Game-Changing Revolution or Opportunistic Strategy?

Sichuan, China, once a major crypto mining region, is redirecting its focus towards the metaverse industry, aiming to build a 250 billion yuan market by 2025. The scheme involves nurturing metaverse-related ventures, enhancing blockchain infrastructure, strengthening privacy safeguards, and fostering cross-chain control mechanisms. The government also encourages public feedback to ensure collective acceptance of its plans.

Leveraging China’s Digital Yuan for Green Financing: Pros, Cons, and Future Potentials

Zhongshan Jewelly Optoelectronics Technology, a Guangdong-based firm, has secured over $276,000 from China’s first digital yuan-powered green finance loan. Using the digital yuan offers cost-effective, efficiency for enterprises, with real-time fund transfer and no incurring handling and service fees. Meanwhile, its traceability can prevent misappropriation of green funding loans.

Unmasking Task Force Lima: US Defense’s AI Double-Edged Sword & Tech Race with China

“Task Force Lima, initiated by the US Department of Defense, explores artificial intelligence’s potential for US defense operations enhancement. The initiative, reflecting growing concern over the AI rivalry with China, is set to streamline operations, increase efficiency and bolster warfighting capabilities, while investigating adversarial AI misuses.”

US-China AI Tug-of-War: National Security or Economic Coercion?

“The US aims to control investments in semiconductors, quantum computing, and AI technologies, leading to global effects. The friction is impacting global trade, with criticism of potential divergence from market principles. In response, China controls export of AI chip-making materials, while other countries contemplate the implications.”

Exploring China’s Crypto Leap: Minsheng Bank’s Digital Yuan Initiative with JD.com and the Risks Involved

China’s Minsheng Bank, in alliance with e-commerce giant JD.com, is launching a digital yuan-based payment service. This enables Minsheng customers in the CBDC pilot zone to use digital yuan tokens for platform purchases. Minsheng differentiates as the first Chinese firm predominantly owned by private sector interests to support the nation’s digital yuan pilot.

Hong Kong’s Ambition to Lead the Crypto Industry: Harmony or Collision with China’s Ban?

“Hong Kong is striving to become a leading crypto hub, aiming to integrate its virtual asset platforms with Shanghai’s. As part of this development, they’ve established a robust regulatory framework for cryptocurrency exchanges, fostering an environment of diverse investment opportunities. This shift poses a likely harmonization between China’s cautious approach and Hong Kong’s liberal views on blockchain technology.”

Crypto Conundrum: China’s Unofficial Crypto Boom Despite Ban and Its Impact on Binance

Despite China’s ban on cryptocurrencies in September 2021, Chinese traders reportedly facilitated $90 billion worth of crypto trades on Binance in one month this year, accounting for one-fifth of Binance’s global volume. These trades are enabled through virtual private networks, allowing users to bypass censorship. However, this situation could escalate Binance’s regulatory challenges in the U.S. despite its growing popularity in the Chinese market.

Cryptocurrency: The Supremacy Race Between U.S and China in the Blockchain Era

In the current era of technological renaissance, the U.S. struggles to keep up with blockchain technology, while China continues to make significant progress with its central bank digital currency. Binance, reportedly handling a majority of global crypto trading volume, faces legal challenges in the U.S. amidst a larger climate of legal obscurity in the crypto industry.

Exploring China’s Deepening Embrace of the Digital Yuan: Opportunities and Concerns

“Several Chinese banks are considering incorporating the digital yuan, or e-CNY, into their services. Industrial Bank has introduced a CBDC-powered service for bulk commodity spot clearing. More banks are joining People’s Bank of China’s pilot programme, signalling a significant shift in China’s financial landscape.”

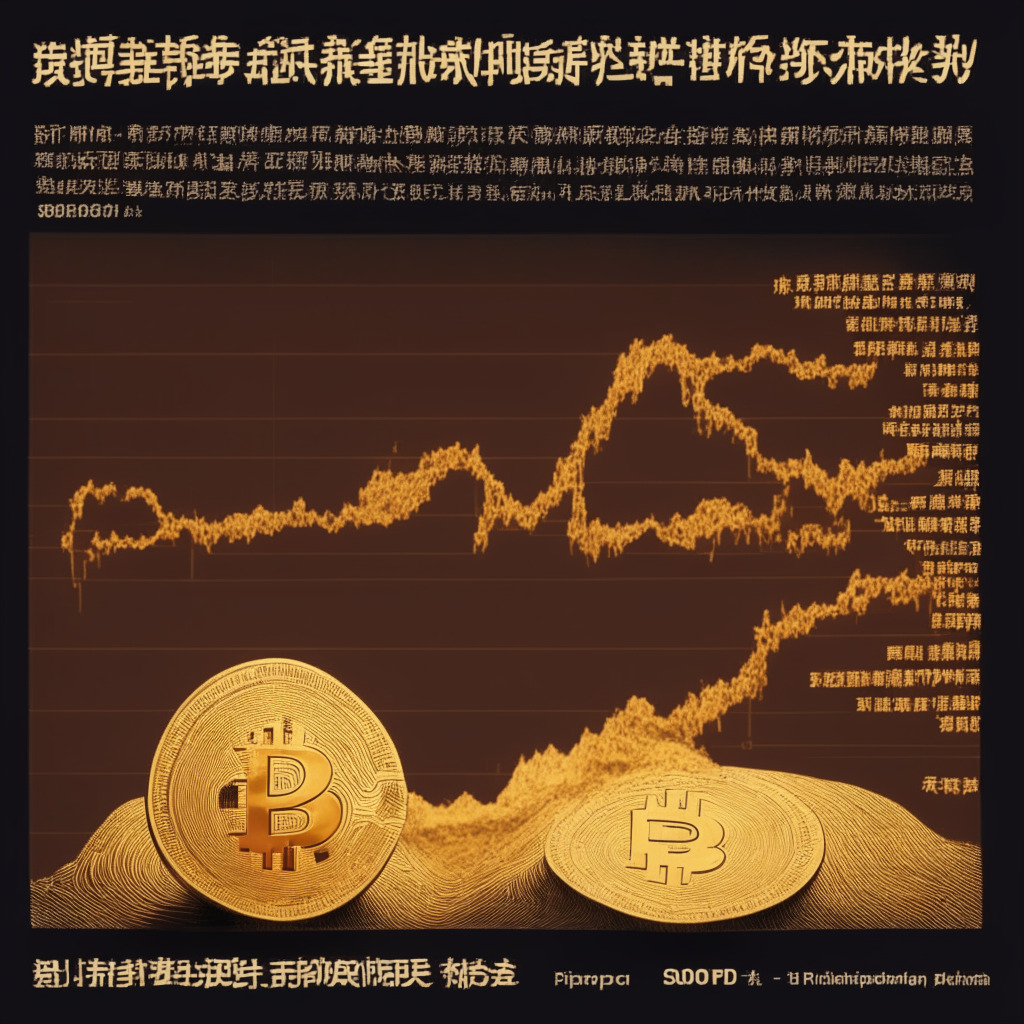

Binance’s Possible Wash Trading Conundrum Tangles with Bitcoin Amid China’s Economic Trouble

“The Bitcoin market experienced a jolt due to Binance’s possible involvement in wash trading, and China’s uncertain economic recovery. The Wall Street Journal reported an internal communication of Binance’s CEO suggesting that $70,000 worth of BTC trading could be wash trading. Additionally, China’s official intimation lacked assurance of economic stimuli, causing BTC prices to stumble.”

Prospects and Hurdles: An Analysis of China’s Digital Yuan Adoption and Its Global Impact

China’s central bank, the People’s Bank of China (PBoC), executed $250 billion in transactions using the Central Bank Digital Currency (CBDC), named digital yuan, over an 18-month period. Remarkably, a mere 0.16% of China’s currency supply is in digital yuan. Despite a substantial transaction milestone, the currency’s utilization rate within China’s vast economy remains relatively limited.

Sailing or Sinking: The Adoption of Digital Yuan in China’s Aviation and Beyond

Chinese businesses will soon experience a digital yuan era in aviation, following a cooperation between China Merchants Bank and the Civil Aviation Administration. This e-CNY platform aims to simplify transactions, hinting at the future of digital economy. Despite rapid growth, the crypto adoption is shadowed by risk of fraud and deception, underlining the complexity of digital currency implementation.

Unraveling the Digital Yuan: Promise, Limitations, and China’s Financial Future

China has processed approximately $250 billion in transactions using their central bank digital currency (CBDC), the e-CNY, predominantly used in domestic retail payments. Despite this growth, this only accounts for 0.16% of China’s total monetary supply, highlighting the untapped potential of this digital currency.

China’s Crypto Conundrum: A Tale of Blockchain Progress and Cryptocurrency Resistance

“Hong Kong’s burgeoning crypto scene is likely a reflection of mainland China’s strategic interest in Web3, despite official anti-crypto stance. This reveals a notable contradiction and raises questions about China’s potential flexibility towards cryptocurrencies, and its intent to challenge US tech dominance with blockchain technology.”

China’s Digital Yuan Tests: Ushering in a Cashless Future or the Death of Traditional Banking?

“The Bank of China tests an offline payment system linked to SIM cards for the digital yuan, marking China’s push towards a cashless society with their central bank digital currency (CBDC). This signals the potential future of centralized digital currencies.”

Navigating the Tense Waters: Renminbi-Based Stablecoin Vs. China’s Digital Yuan

Jeremy Allaire, CEO of Circle, proposed that a renminbi (RMB)-based stablecoin might be better for the Chinese government than a central bank digital currency (CBDC) to increase global RMB use. However, China’s digital yuan, which isn’t positioned as a stablecoin, could create conflicts for Circle’s USD Coin.

China’s Tightening Grip on AI: Controlling the Unpredictable or Stifling Innovation?

China’s Cyberspace Administration (CAC) plans to enforce licensing requirements for local firms before releasing AI systems. This tighter regulation aims to ensure AI-generated content aligns with central governance philosophy and embodies socialist values. Companies like Baidu and Alibaba are already working to stay compliant. Critics express concerns about AI’s potential to generate disinformation.

Navigating the Roaring Tides: The Confluence of Stablecoins, CBDCs and China’s Economic Strategy

Jeremy Allaire, CEO of Circle, suggests that a Yuan-backed stablecoin could aid Beijing’s goal of widespread acceptance of the Chinese Yuan. However, he notes that strict economic policies and capital controls could be potential obstacles. Allaire highlights that despite the challenges, stablecoins have proven beneficial for overseas monetary remittances, particularly for Chinese firms.

China’s PPI Influence and Its Effect on Bitcoin’s Stability Above $30,000

Bitcoin’s stability above $30,000 aligns with signs that the liquidity-tightening cycle that started last year, affecting cryptocurrencies among other risk assets, is about to end. This is suggested by China’s recent Producer Price Index (PPI) data indicating expanding deflationary pressures globally.

China’s Digital Metamorphosis: Unveiling the Future of Yuan and the Global Financial Landscape

“China’s capital, Beijing, has announced plans to pioneer the acceptance of the Digital Yuan and Central Bank Digital Currency (CBDC) through various applications. It’s part of a broader goal of fostering digital transformation in the financial industry, with emphasis on the digital yuan central to their strategy. However, implementing CBDC across China faces challenges but holds potential for global financial landscape redefinition.”

China’s Drive Towards Integrating Digital Yuan with Social Security Cards: Boon or Bane?

“Chinese state-run banks aim to integrate the digital yuan with government-issued social security cards in an initiative promoting digital payments. This assists the elderly and rural populations with low smartphone ownership, while addressing the issue of unbanked individuals within these demographics.”

Asia’s Blockchain Revolution: DBS Embraces China’s Digital Yuan and What It Means for Global Finance

“Singapore’s leading bank, DBS, has started accepting the digital yuan (e-CNY), bridging the gap between digitized and conventional money. This step validates digital currencies and encourages other global banks to follow suit. However, e-CNY’s current adoption remains nascent.”

China’s Crypto Future at Risk: The Impact of Pan Gongsheng’s Potential PBoC Governor Role

The appointment of well-known crypto-sceptic, Pan Gongsheng, within the People’s Bank of China, is triggering fresh concern for cryptocurrency prospects in the nation. His possible promotion hinders hopes of China softening towards digital currencies and may pose a significant barrier in global crypto integration.

Embracing New Era: Digital Yuan Use Expanded To Bus Services in Jinan, China

The city of Jinan in China has announced its adoption of the digital yuan across all bus services. Passengers can now use China’s CBDC for daily commuting, and those who opt for CBDC payments can avail of significant travel discounts. This incentivized move accelerates the wide-scale adoption of digital currencies in day-to-day life.

China’s Leap: Adopting Digital Yuan for Energy Payments – Transformation or Challenge?

China’s energy providers are accepting payments in digital yuan, the country’s central bank digital currency (CBDC). This initiative enables faster transactions, low-cost transfers, accessibility, and transparency. However, it also raises challenges of digital literacy, volatility, and privacy. Companies plan to offer educational workshops to help users understand the differences between conventional payment methods and digital yuan.

Bitcoin Soars 36% Since China’s Prediction of Collapse: Market Resilience Defies Doubts

Amid the bearish market of 2022, the Chinese government claimed Bitcoin was heading to zero. However, Bitcoin has since experienced a 36% increase in value, disproving their predictions. Despite market fluctuations and regulatory challenges, the cryptocurrency’s resilience demonstrates the uncertainty of predicting its future trajectory.

Alibaba’s New Chairman Sparks Crypto Dreams: Is China Ready to Embrace Web3?

Alibaba appoints crypto-friendly Joseph Tsai as new Chairman amidst restructuring, sparking interest in the crypto community. Tsai is an advocate of cryptocurrencies and digital assets, prompting speculation of Alibaba embracing Web3 and crypto in China. Hong Kong’s recent regulatory framework for crypto shows growing interest in digital assets.

China’s Rate Cut Impact on Bitcoin: Boost or Bust for the Crypto Market?

Bitcoin struggles to find an upward trajectory amid China’s first benchmark lending rate cut in 10 months, reflecting a slowing economy. Market participants question the rate cuts’ sufficiency to revive China’s economy, while crypto enthusiasts anticipate a larger stimulus package may bring benefits to bitcoin.

Alibaba Leadership Shuffle: A Step Towards Crypto Adoption in China?

Alibaba’s founder Joseph Tsai, a known cryptocurrency proponent, will become Chairman in September amid company reorganization. This move sparks interest among crypto enthusiasts, suggesting Alibaba might be preparing for potential cryptocurrency and Web3 developments in China.

Bank of China’s First Tokenized Securities: Hong Kong’s Growing Crypto Hub Status & Challenges

The Bank of China’s investment banking arm, BOCI, has issued tokenized securities on Ethereum in Hong Kong, a first for a Chinese financial institution. This move signifies increased crypto adoption, supports Hong Kong’s ambition to become a key crypto hub, and highlights the need for addressing regulatory and safety challenges.