“XRP has seen a 3% gain, boosting its price to $0.529853 and an increase in trading volume to $1.5 billion overnight. Market indications suggest a promising future for XRP, with a 55% price increase since the year’s start. Supporting its optimistic outlook are Ripple’s recent partnerships and steady XRP sales, hinting at stronger performances ahead.”

Search Results for: Coinbase Prime

Navigating Blockchain: Innovations, Challenges, and the Intriguing Future of Cryptocurrency

“A telling report by Glassnode indicates that long-term crypto holders are showing tenacity, with Coinbase and Binance creating waves in the sector. Coinbase launched its Ethereum layer-2 blockchain, whereas Binance became the first fully licensed crypto exchange in El Salvador.”

Exploring the Impacts of PayPal’s Stablecoin PYUSD: Vehicle for Financial Inclusion or Corporate Gain?

“PayPal’s U.S. stablecoin, PYUSD, has sparked interest in the crypto world. Unlike smaller cryptofirms, traditional giants like PayPal can influence regulators to accommodate their aspirations. However, whether PYUSD will democratize access or predominantly serve business interests remains uncertain.”

Binance Marches Back Into Japan: Strategic Move or Risky Gamble for the Crypto Giant?

“Binance, a leading global cryptocurrency exchange, recently launched its Japan-based branch amid earlier regulatory issues. Their presence in Japan, acquired through Sakura Exchange Bitcoin, aims to boost the Japanese digital-asset markets and aligns with the Prime Minister’s plans for promoting Web3 innovations.”

Risky Profits and Rival Allegations: A Base Layer 2 Network Exploration

The Base network, a testnet built by Coinbase, is witnessing substantial profits through potentially risky trades, one example being the “bald” token (BALD). Market successes hint at high investor trust, but the crypto market’s volatility, coupled with practices like ‘calls,’ raises concerns about the sustainability of such investments. Market liquidity is increasing but there are obstacles, including the unidirectional flow of funds. The uncertain dynamic illustrates the definitive risks of the crypto landscape.

Dark Side of Crypto: Rising Casualties and Increasing Regulations, Unveiled

“The mysterious demise of Argentina-based BTC millionaire Fernando Pérez Algaba has caused speculation within the crypto community. U.S. regulations are tightening on cybersecurity for crypto businesses, with the SEC mandating listed firms to disclose major cybersecurity incidents within four days.”

Japan’s Web3 Vision and Crypto-Pioneering Ambitions amid Global Exchange Controversies

“Japan’s PM Fumio Kishida supports Web3 innovation and hints at Binance commencing its operations in Japan by August 2023, presenting numerous opportunities for investors. Despite legal issues faced in the U.S., certain cryptocurrencies like Maker, Evil Pepe Coin, GMX, Chimpzee, and Trust Wallet Token (TWT) are showing promising trends bolstered by strong fundamentals and technical findings.”

Bitcoin Bulls vs Bears: The Battle at the $30,000 Mark and Spot ETF Proposals

The upcoming Bitcoin options’ expiry on Friday could reinforce the $30,000 resistance level, indicating potential control by the bears. However, the bulls might leverage spot ETF proposals under SEC scrutiny. Amidst this, the transformative power of blockchain technology remains unperturbed, despite volatile market dynamics.

Ripple’s Partial Victory and the Complex Dance of Crypto Regulations: A Regulatory Tug-of-War

“The Ripple’s XRP token case indicates the evolving complexities in blockchain regulations, with the token classified as a non-security for digital asset exchanges but not for institutional investors. This dual classification signifies future regulatory challenges, but also presents opportunities for increased investor protection and transparency in the crypto sector.”

Stellar’s XLM Bulls, Ripple’s Victory and the Rise of Wall Street Memes: Crypto Market’s Week in Review

“Stellar’s XLM has seen a 55% price jump, resulting in a 3000% surge in trading volumes and similar upturn in market cap. Despite legal challenges, XLM remains bullish, and the favourable ruling for XRP paints a hopeful scenario for Stellar. Meanwhile, Wall Street Memes (WSM), with its community-focused approach, is posed to outperform many new meme tokens.”

Navigating Cryptocurrency Regulation: Upcoming Legislative Proposal by US Senators Lummis and Gillibrand

US Senators Cynthia Lummis and Kirsten Gillibrand are to propose a new legislation known as the ‘Responsible Financial Innovation Act’, aimed at regulating cryptocurrencies and digital assets. The bill plans to classify most cryptocurrencies as commodities and enforce crypto exchanges to store consumer assets in third-party trusts, enhancing security. Critics argue it may also create unintended consequences.

Bitcoin’s Rocky Route: Navigating ETF Concerns and Japan’s Crypto Crossroads

“Bitcoin maintains a steady valuation above $30,000 despite SEC’s skepticism towards Bitcoin ETFs. Concerns loom of Bitcoin testing a support zone triggering deeper altcoin declines. Meanwhile, Japan’s conservative approach to Web3 raises questions about its crypto future as large corporations face backlash for their audacious entries into Web3 and NFT spaces.”

Week in Review: FTX Splash, Binance Moves & Global Crypto Legal Twists

“This week in crypto was marked by major exchange operations, regulatory challenges, and shifts in nations’ attitudes towards digital assets. Developments included FTX’s plans to reopen, Binance’s regulatory issues, MicroStrategy’s portfolio growth, potential CBDC launches, and varied legal positions on crypto worldwide. These events highlight the rapidly evolving crypto landscape.”

Crypto World Update: Bull Run, Japan’s Tax Relief, and Regulatory Challenges

This week, Bitcoin stays above $30K and ether witnesses a 1.3% increase, driven by multiple applications for spot BTC ETFs. Japan excludes unrealized gains of self-issued cryptocurrencies from taxation, providing relief for crypto startups, while the U.S. still lacks specific rules for crypto regulation.

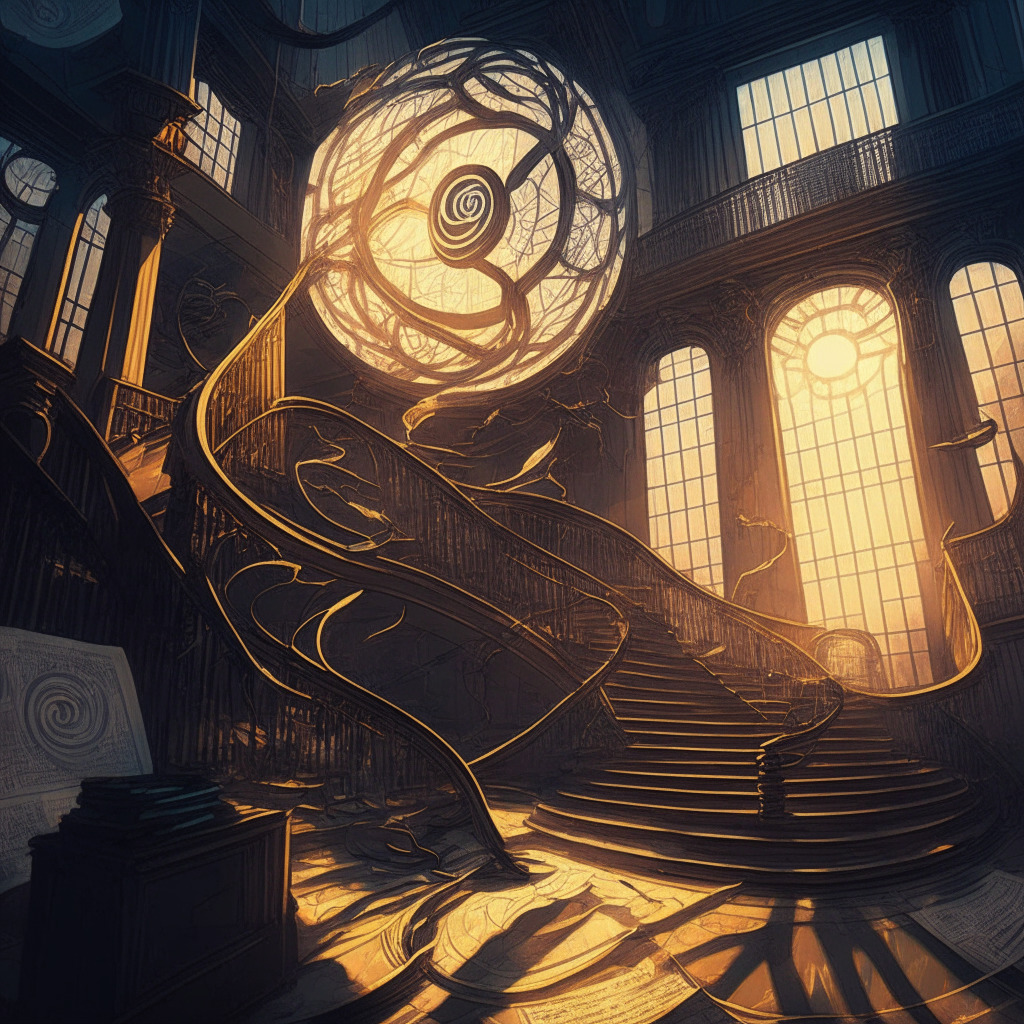

Blockchain Revolution: Disruptive Potential vs Regulatory and Safety Concerns

The blockchain revolution has garnered attention for its potential for disruption and advancement. This technology enables greater transparency and decentralization, transforming industries such as decentralized finance (DeFi). However, concerns about safety, criticisms, and regulatory hurdles call for adaptability, diligence, and collaboration within the community to unlock blockchain’s full potential.

Canadian Bitcoin Conference: Innovation, Self-Custody, and Future of Crypto Adoption

The first-ever Canadian Bitcoin conference showcased Canada’s resilient Bitcoin ecosystem, featuring presentations from Stephan Livera, a hands-on workshop by D-Central, and a preview of Bull Bitcoin’s mobile wallet. The event highlighted the growing importance of self-custody wallets amidst market downturns, regulatory challenges, and opposition from political figures.

SUI Token Rises Amid Market Turmoil: Exploring Factors Behind Surprising Surge

SUI, the token of the Sui Network, rose 7.9% after the SEC targeted large exchanges. Developed by former Facebook blockchain team members, SUI is used for gas payments and validation in the layer-1 blockchain platform. Recent tokenomics improvement proposal and a short squeeze in futures market contribute to its price surge.

Bitcoin’s Uncertain Week: Examining Market Volatility, Legal Battles, and Potential Growth

Bitcoin enters an uncertain week with support below $26,000, influenced by legal battles in the US. Key factors to watch include US macroeconomic data, SEC conflicts with exchanges, and legal proceedings involving Coinbase and Binance. Despite the precarious situation, Bitcoin’s strong network fundamentals and potential macro shifts present opportunities for recovery and growth.

Andreessen Horowitz’s London Expansion: Pros, Cons, and the Future of Crypto Regulation

Andreessen Horowitz (a16z) is opening its first office outside the U.S. in London, aiming to capitalize on a predictable business environment and welcoming stance toward blockchain technology. The firm will also launch a Crypto Startup School program in Spring 2024 and collaborate with U.K. universities to promote blockchain education.

Binance’s Mounting Troubles: SEC Charges, TUSD Minting Pause, and Massive Liquidations

Binance faces mounting troubles as TrueUSD (TUSD) minting via Prime Trust is paused, adding to the exchange’s woes after the SEC brought 13 charges against them. Despite this, TUSD ensures users that minting and redemption services will continue without disruption. Meanwhile, the crypto market experiences a massive liquidation amid unfavorable conditions.

Binance.US Shifts to All-Crypto Exchange: Balancing Compliance and Innovation in Blockchain

Binance.US temporarily transitions to an all-crypto exchange amid SEC pressures, suspending USD deposits and de-listing USD-based trading pairs. Meanwhile, BitGo acquires crypto custody specialist Prime Trust, and Coinbase faces potential devaluation due to regulatory challenges and weak trading volumes. The future of blockchain and cryptocurrency sectors remains uncertain amid regulatory hurdles and the need for investor protection.

Ripple Navigates SEC Challenges: XRP’s Potential Breakthrough and yPredict’s AI Trading Edge

Amid turbulent crypto markets and SEC enforcement actions, Ripple (XRP) is positioning itself for a potential positive outcome in its ongoing legal battle. With strong technical structure and developments in the SEC vs. Ripple case, XRP could experience an upside move soon, making it an attractive entry point for investors. Utilizing innovative AI-powered trading platforms like yPredict($YPRED) can offer traders a competitive edge in the increasingly complex crypto trading landscape.

SEC Lawsuits, FTX Bankruptcy, and BitGo Acquisition: Market Impact on Bitcoin and Ethereum

Bitcoin and Ethereum face significant developments impacting price predictions due to the US SEC lawsuit, bankruptcy of FTX exchange, and BitGo’s acquisition deal. As clear regulation and reliable custody services are crucial, cryptocurrency prices remain sensitive to market changes.

Swan Bitcoin’s Custodian Switch: Struggles, Outages, and Rival Exchange Criticism

Swan Bitcoin experienced struggles during a transfer of assets to custodians Fortress Trust and BitGo Trust Company, causing significant outages affecting user transactions. Despite internal issues, CEO Cory Klippsten criticized rival exchanges facing SEC lawsuits and assured clients of constant communication and transparency.

Strike’s El Salvador Move: Growth or US Regulatory Uncertainty Escape?

Strike establishes its international headquarters in El Salvador, highlighting the country’s friendly crypto atmosphere compared to the uncertain regulatory climate in the United States. The move showcases the importance of a favorable regulatory environment for the growth of the global crypto ecosystem.

PEPE vs SPONGE: Battle of Meme Tokens and the Quest for Exchange Listings

PEPE, a meme token with a 2,500% growth since April, experiences a 63% drop since its all-time high. Despite the decline, high trading volumes and potential major exchange listings indicate a possible rebound. Traders may shift focus to newer tokens like SpongeBob (SPONGE) with promising gains and listings on prominent exchanges.

Lack of Audits and Independent Boards: Crypto Firms Risking Collapse?

A recent Bloomberg report reveals that numerous influential crypto firms do not work with external auditors and independent boards, raising questions about transparency and professionalism in the cryptocurrency space. This lack of regulation persists despite the high-profile collapse of the FTX exchange and Alameda Research due to poor management and misappropriation of funds.

DOJ Crypto Unit Targeting Exchanges: Navigating Regulation and Avoiding Illicit Activities

The Department of Justice’s crypto enforcement unit, led by Eun Young Choi, is intensifying efforts against illegal activities in the digital assets sector, particularly targeting crypto exchanges that facilitate crimes and fail to follow compliance regulations. In addition, the unit will address investment scams and security issues within the decentralized finance ecosystem.

Prestigious NYC Office Signals Blockchain Growth: Balancing Innovation and Regulation Challenges

The inauguration of new offices at 133 W 19th St., New York, signifies the industry’s commitment to promoting the adoption of digital assets. The offices embody a forward-thinking mindset, featuring state-of-the-art security and infrastructure for blockchain research and development. This office opening highlights the ongoing journey towards mainstream adoption of blockchain technology and cryptocurrencies, with a focus on achieving a balance between innovation and regulation.

Coinjar’s Bold US Expansion: Navigating Regulatory Challenges and Stiff Competition

Australian cryptocurrency exchange Coinjar plans to expand into the US market despite regulatory challenges. Coinjar CEO Asher Tan believes their strong compliance record will help them navigate the contentious environment, while gradually adding states for near-complete coverage.