“Roman Storm and Roman Semenov, coders of the Tornado Cash protocol, face U.S. legal proceedings, accused of aiding North Korea’s Lazarus Group with money laundering. This indictment raises questions on developer accountability, regulation standards, and the balance between potential national security risks and the right to financial independence and privacy in blockchain technology.”

Search Results for: Coindesk Korea

Dramatic Plunge in Ether Futures on Binance: Unsettling Calm or the Start of a Storm?

The U.S. dollar value in active ether perpetual futures contracts on Binance has dropped to $1.41 billion, the lowest in over a year. Binance has seen its ether futures notional value dip 35% within a week, reflecting a system-wide leverage washout. This suggests a lower probability of future volatility instigated by liquidations.

Tornado Cash Founders Charged: A Blow for Privacy or Triumph for Law Enforcement?

“Roman Storm and Roman Semenov, key figures of Tornado Cash, are facing charges for helping North Korea’s Lazarus Group launder over $1 billion via a privacy mixer. This incident sparks debate on blockchain privacy protections being exploited by criminals versus the potential shortfalls of legal jurisdiction in regulating such abuses.”

Decoding the Legal Matrix: Tornado Cash, DAOs, and the Future of Blockchain Oversight

A recent legal case saw a federal judge approving U.S. Treasury’s sanctions on Tornado Cash, a crypto tool allegedly used by North Korea for money laundering. The ruling, which validated an enforcement action against a Decentralized Autonomous Organization (DAO), sets a compelling precedent for DAOs’ future role in crypto projects.

Maple Finance’s $5 Million Expansion into the Asian Crypto Market: Innovation or Risk?

“Maple Finance, a blockchain-based credit marketplace, has revealed plans to expand into the Asian market, supported by a $5 million investment from firms including BlockTower Capital and Tioga Capital. This move forms part of a growth strategy to extend its technology and create global alliances, primarily within Singapore, Japan, Hong Kong, and Korea.”

Clash of the Titans: Crypto Community vs U.S. Treasury in Tackling Anonymity and Regulation

“Regulation in the crypto world came under scrutiny after a lawsuit backed by Coinbase challenged the U.S. Treasury Department’s sanctions on Tornado Cash, a crypto transaction platform. Despite uproar from the crypto community, a judge ruled that the Treasury acted within its powers, escalating the ongoing tension between crypto advocates and regulatory bodies.”

Hedera Hashgraph HBAR: A Micropayment Powerhouse Attracting Market Attention or a Fleeting Trend?

“Hedera Hashgraph’s HBAR token sees over 15% surge following the inclusion of Dropp, a Hedera-based micropayments platform, on the FedNow. HBAR’s unique use of hashgraph consensus permits over 10k transactions every second. Its growth also aligns with a 288% jump in daily active accounts and a notable spike driven by non-fungible tokens (NFTs).”

Bitcoin’s Bullish Surge: Analyzing the Taker Buy-Sell Ratio and Its Role in Crypto Market Rebounds

“Bitcoin’s ‘taker buy-sell ratio’ on crypto exchanges peaked at 1.36 recently, indicating strong bullish sentiment. This suggests that buy volume is exceeding sell volume, a classic sign of bullish trading. Some attribute this to large Bitcoin investors, often termed ‘whales’, increasing their buying volume.”

The Unsettling Reality of Crypto Hacks: Unraveling the CoinsPaid Heist

“The Ukrainian firm CoinsPaid fell victim to a cyber heist that resulted in an estimated loss of $37.3 million in crypto assets. The attack was reportedly orchestrated via social engineering attempts using LinkedIn and involved malicious usage of software called JumpCloud. It’s believed that this crime mirrors the tactics of the North Korean Lazarus Group, highlighting the evolving complexity of cybercrime in the digital marketplace.”

Crypto Power Shift: Upbit Surpasses Coinbase and OKX in Spot Trading Volume

“A recent shift saw South Korea’s Upbit surpass Coinbase and OKX in spot trading volume, ranking as the second largest global crypto exchange. Meanwhile, Coinbase has opened Base, a layer-2 blockchain built with OP Stack’s Optimism, offering ether transfer capabilities to users.”

Upbit Trumps Coinbase and OKX in Trading Volume Supremacy: A Shift in Crypto Powerhouses?

In July, South Korean cryptocurrency exchange, Upbit, saw a trading volume escalation of 42.3% to $29.8 billion, outperforming both Coinbase and OKX for the first time. In contrast, Coinbase and OKX saw reductions in their trading volumes. Upbit now commands 5.8% of the trading volumes on centralized exchanges.

Bypassing the Barrier: How Chinese Traders Navigate Through Crypto Restrictions

China, despite heavy restrictions, is Binance’s largest market with around 900,000 active users. Traders are using inventive ways, including VPNs and digital residencies, to bypass geographic constraints. Binance fosters an active crypto market in China, even facilitating fiat onramps via Alipay and WeChat pay.

Unlocking the Mystery: Curve Finance’s Crisis and Crypto Market Responses

“A discrepancy in Curve Finance’s CRV token stablecoin pools sparked volatility, leading to a loss of over $100 million. The issue arises from a vulnerability in Vyper programming language, which is used by Curve. Reactions varied among crypto exchanges, raising questions about risk management strategies in crypto markets.”

Dogecoin’s Unexpected Surge: Twitter Rebranding Effects and Market Instability Ahead

“Dogecoin (DOGE) recently experienced a 10% hike, seemingly due to trading activity on South Korean exchange UpBit. Speculation surrounding Twitter’s rebranding to the app X accepting DOGE payments seems to fuel the surge. However, these developments pose questions about stability in the volatile crypto market.”

BlackRock’s Bitcoin ETF: Market Enthusiasm vs Trader Caution – A Shifting Dynamic

BlackRock’s application for a bitcoin spot exchange-traded fund (ETF) has reinvigorated the cryptocurrency market and positively influenced Bitcoin’s value. However, Bitcoin futures traders show reluctance towards high-risk dealings. Observations indicate that spot prices may increase in the near future, as long-term holders acquire more Bitcoins, even as regulatory uncertainties underlie.

Surging Bitcoin Rally and BCH’s Triumph: Boon or Bane in the Crypto Sphere?

Bitcoin recently hit a new 13-month high, indicating a promising July ahead. Despite previous skepticism, BlackRock’s CEO, Larry Fink, suggested Bitcoin could potentially redefine finance, offering an attractive hedge alternative. However, a drop in Bitcoin Cash’s trading volume implies Korean interest may be dwindling.

Navigating the Stormy Seas of Digital Asset Investment: Can CryptoQuant Steer the Ship?

Data analytics platform, CryptoQuant, recently secured $6.5 million in Series A funding, led by Atinum Investment. The platform plans to redefine investment methodologies for digital assets using precise, genuine data, aiming to provide a competitive edge in the volatile world of cryptocurrencies.

Crypto Market Post-Holiday: Stability, Asymmetry, and an Undulating Future

Despite a slight downward trend, Bitcoin’s market stability suggests that the crypto winter is transitioning towards warmer days, according to Tim Frost, the CEO of Yield App. However, market situations like the implosion of the exchange giant FTX remind us of the risks in crypto markets.

Unpredictable Ascent of Storj (STORJ): A Dynamic Change in the Cryptocurrency Landscape

“In under 48 hours, storage token Storj managed to inflate its market value twofold, soaring by 43% and reaching a peak of $0.58. It’s noted that Storj’s rally potentially correlates with increased trading volumes on South Korea’s largest crypto exchange, Upbit. The story of Storj demonstrates the unpredictable, high-stakes nature of crypto markets.”

Emerging Opportunities and Hidden Pitfalls: Navigating the Crypto World Amidst Current Market Trends

“In the first six months of the year, Ether experienced a robust 61% rise. A trader made a significant move recently, acquiring around 63,250 “bull call spreads” linked to Ether. The SEC’s position on spot bitcoin exchange traded funds (ETF) is reportedly moving from steep to promising with futures-based bitcoin ETFs already permitted.”

BitCoin Cash Traders Face High Losses: A Deep Dive into BCH Futures Market Dynamics

Recent trading activity linked to bitcoin cash (BCH) resulted in the highest losses in over two years, wherein both longs and shorts lost over $25 million on BCH futures. Factors influencing such losses may include shorting interest in BCH, high negative funding rates, and heightened trading activities on South Korean exchanges and new platform EDX Markets.

Fidelity’s Relentless Push for Bitcoin ETF and Shifting Institutional Sentiment in Crypto Sphere

“Fidelity refiles paperwork for its Wise Origin Bitcoin Trust, indicating institutional interest in the crypto market. Other movements include Bitcoin Cash’s rapid rally and increased trading on South Korea’s Upbit. Yet, with potential regulatory changes, the journey remains fluctuating.”

BCH Cash Reaps High Returns: A Bubble or Sustainable Growth?

“BTC Cash has appreciated by over 30% in 24 hours, reaching a 14-month high of $320, following the inclusion of this cryptocurrency in the trading portfolios of Fidelity, Charles Schwab, and Citadel-backed EDX Markets. The trading volume of BCH on Upbit, a significant South Korean exchange, rose tremendously, signalling high anticipated rewards tied to BCH.”

Exploring DeFi and NFT-Driven Altcoin Surges: Profitable Opportunities or Hidden Dangers?

DeFi and NFT-related altcoins like BLUR and ARB experienced double-digit gains recently, as capital shifts from larger assets to these speculative tokens. However, traders must exercise caution and research due to potential risks and market volatility.

Singapore’s MAS Proposes Digital Money Standards: Exploring Pros, Cons, and Conflicts

The Monetary Authority of Singapore (MAS), in collaboration with the IMF and others, has proposed standards for using digital money on distributed ledgers, including central bank digital currencies (CBDCs) and tokenized bank deposits. The protocol addresses programmability, balancing innovation, and regulation to ensure digital money serves as a medium of exchange without compromising financial stability and user experience.

Massive Crypto Heist Sparks Debate: Transparency vs Security in Blockchain Technology

Hackers targeted Atomic Wallet, stealing $35 million and using THORChain to launder their gains. Blockchain analysis firm MistTrack tracked the stolen funds, exposing the transparency of blockchain technology. Yet, concerns about digital asset security and decentralization misuse persist.

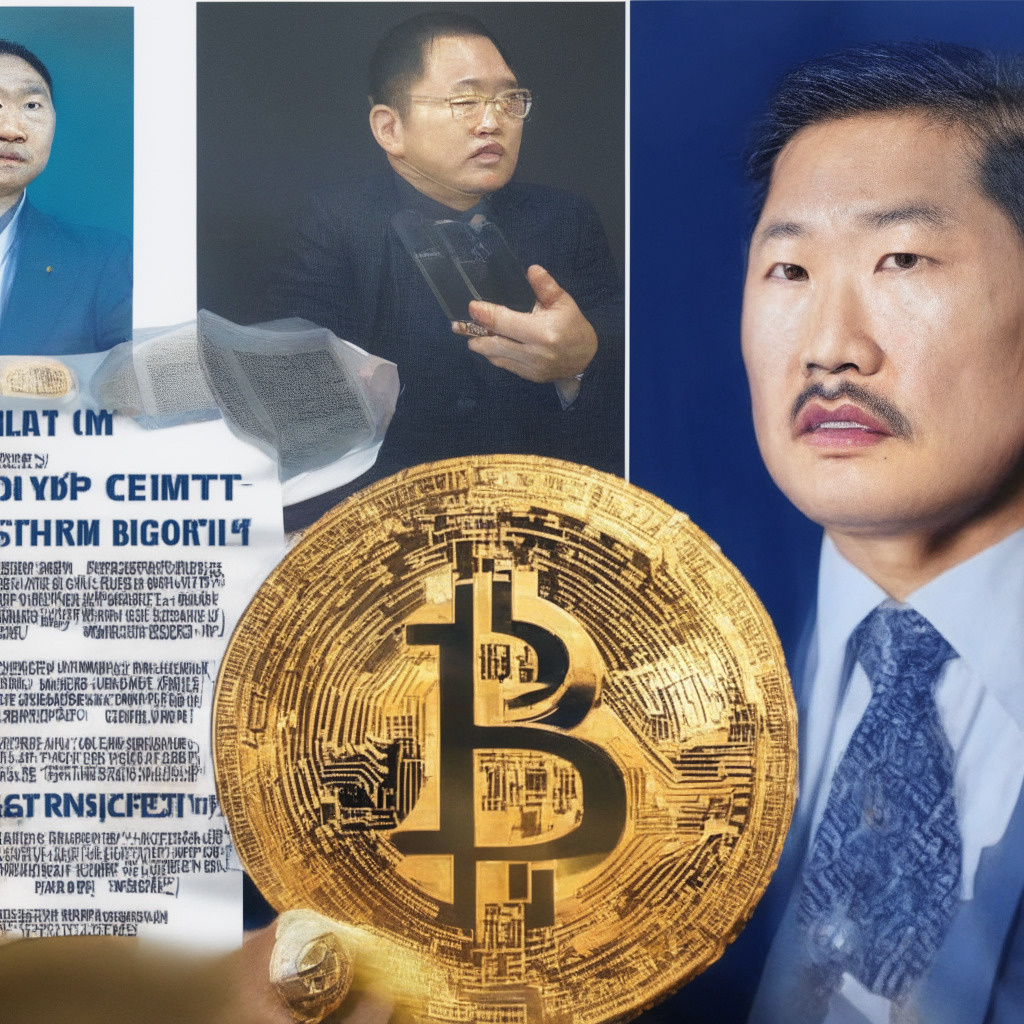

Crypto Industry’s Integrity Debated after Terraform Labs Founder Conviction

Terraform Labs founder Do Kwon’s conviction for document forgery highlights the importance of decentralization and regulatory oversight in the crypto industry. This incident raises concerns but also underscores the potential benefits of blockchain technology, emphasizing the need for addressing challenges and instilling greater trust.

Terraform Labs Co-Founder’s Legal Woes: A Turning Point for Crypto Industry Trust and Regulations

Terraform Labs co-founder Do Kwon faces legal troubles in Montenegro over document forgery allegations. His prolonged detainment and potential extradition to South Korea has the global crypto community concerned about its impact on the legitimacy and stability of the emerging crypto industry.

Banq Bankruptcy Saga: Domino Effects, Legal Battles, and Crypto Industry Lessons

Banq’s bankruptcy filing amidst Prime Trust’s acquisition deal with BitGo has raised concerns over accountability and transparency in the crypto space. With TrueUSD and Haru Invest also affected, the industry must address safety and integrity challenges in the midst of a demanding regulatory climate.

Atomic Wallet Hack: Unveiling Security Flaws and $100M Lost to Cybercrime

The Atomic Wallet, with over 5,500 wallets affected, experienced a $100 million hack compromising various cryptocurrencies. Blockchain experts suspect North Korean group Lazarus may be responsible. This marks the increasing vulnerability in the crypto world, highlighting the importance of security features and vigilance when choosing wallets and services.

Atomic Wallet Hack: $35M Laundered, Regulatory Woes, and Emerging Cyber Threats

The crypto world experienced a major security breach as attackers exploited Atomic Wallet and stole $35 million in tokens. As funds move via the OFAC-sanctioned exchange Garantex, the involvement of North Korean hacking group Lazarus is suspected. This incident highlights the challenges cryptocurrencies face for security and regulatory compliance.

Crypto Rollercoaster: SEC Crackdown, Security, and the Future of Crypto Investment

The rollercoaster ride of cryptocurrencies, major exchange security lawsuits, and regulatory crackdowns has impacted the crypto community. However, the focus is now on compliance and addressing regulatory issues for a secure and flourishing digital assets environment.