A U.S. federal judge delayed a sentencing hearing for radio host Ian Freeman, who allegedly created an illegal Bitcoin exchange used by scammers. Meanwhile, the DeFi Education Fund contests a patent claim by tech company True Return Systems. Also, DigiFT’s dETH0924 provides up to 4% APR, boosting Ethereum’s PoS mechanism, while crypto infrastructure provider Qredo integrated Circle’s USDC stablecoin into its wallet.

Search Results for: DAO Maker

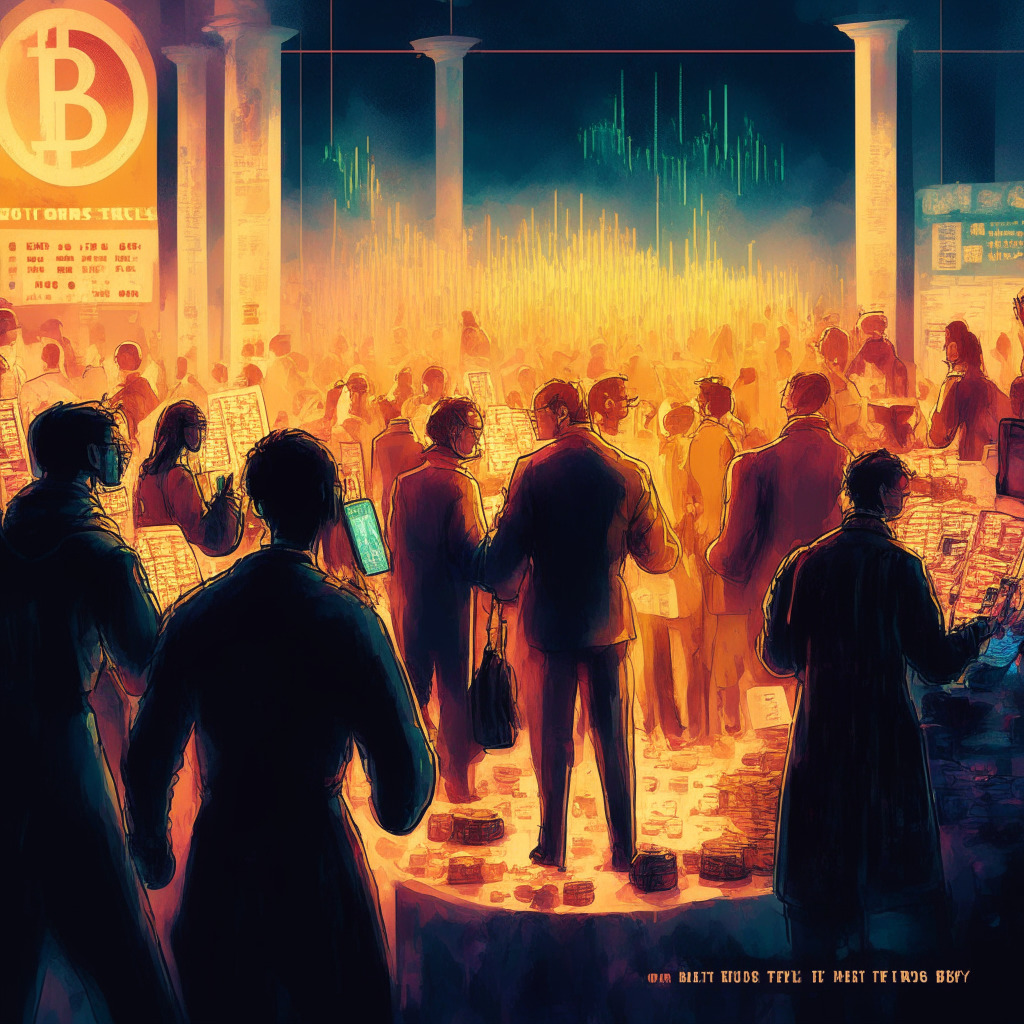

Crypto Freedom Alliance: Paving the Way for Blockchain Regulations in Texas

Leading digital assets and blockchain companies, including Coinbase and Ledger, formed the Crypto Freedom Alliance of Texas to pave the way for tangible cryptocurrency regulations. The Alliance seeks to educate stakeholders, inspire technological advancement, promote crypto-friendly laws, and make Texas a significant hub for cryptocurrency mining.

Stablecoin De-Pegging: A Deep-Dive into USDC and DAI Performance versus USDT and BUSD

“Analysts reveal ‘de-pegging’ is more common in stablecoins USDC and DAI compared to Tether and Binance USD. While stability ideally requires good governance, collateral and reserves, market confidence and adoption, USDT has shown steadiness despite mainstream scrutiny.”

Chronicle’s Leap Forward: Lower Gas Fees, More Networks and Integrity Questions Unanswered

“Chronicle, the second-largest oracle provider, is set to expand its services to other networks, thereby introducing more competition to the oracle landscape. The Chronicle Protocol aims to reduce gas fees by 60% envisioning higher platform utilization and maintaining uncompromised data integrity with data origin monitoring user dashboards.”

Solana’s Irresistible Appeal: Bucking the Crypto Outflow Trend Despite Stagnant Prices

“Despite broader crypto market outflows, Solana has sustained consistent inflows for the past nine weeks. While promising developments provide a bullish sentiment, a disconnection between investment inflows and price performance presents a sobering counter-narrative. Risks exist within the crypto spaces, such as hacking episodes.”

Web 3 Dilemma: $1.2 Billion Lost to Hacks and Fraud Amid the Blockchain Revolution

“The digital ecosystem of Web 3 platforms has reported a loss of over $1.2 billion this year due to hacks and rug pulls, states web3 bug bounty establishment, Immunefi. With heavy losses in August 2021, Ethereum witnessed the most manifold of attacks. Hacks clearly outweighed frauds as the root cause of these financial missteps. These financial drains highlight the need for thorough scrutiny of blockchain technology’s defense mechanisms.”

Bitcoin’s Chilly Wave: Market Effects, Reactions and Future Predictions Amid Federal Reserve Statements

The cryptocurrency market plunged as Bitcoin fell below $26,000, triggered by U.S. Federal Reserve Chair’s statements on countering inflation and possible rate hikes. Leading altcoin Solana also dipped 3%, and MKR saw a 4% decrease due to fears of a loan default. However, despite the gloomy outlook, experts like Sacha Ghebali believe the market could see an upturn if a spot bitcoin ETF is approved, offering a possible crypto market recovery.

Integration of Real-World Assets and DeFi: The Future or a Paradox?

“Pendle Finance aims to integrate real-world assets within the digital finance ecosystem, opening access to traditional financial instruments. While this could attract large, off-chain institutional investors, it raises questions of blurring boundaries between decentralized finance and traditional systems.”

Decentralized Finance: A Revolutionary Potential Sailing Rough Waters

“The capital held in decentralized finance (DeFi) protocols has dipped to $37.5 billion, its lowest since February 2021. This drop comes amidst concerns about governmental regulations, falling crypto prices, and recent scandals. Despite Ethereum’s rise, DeFi’s total value locked (TVL) has contracted, suggesting inherent challenges exist in the DeFi market.”

Blockchain Revolution: How Friend.tech Makes Huge Strides in Crypto Market in Less Than a Month

“Friend.tech, a Twitter-associated blockchain application recently outperformed several large-scale projects by marking a revenue of $840,889 over a 24-hour cycle. Within 30 days post-launch, its cumulative revenue ascended to $2.95 million. The app tokenizes crypto personalities on Twitter, enabling users to buy and sell ‘shares’ of these individuals.”

Untangling Asset Tokenization: Promising Innovation or a Risky Venture?

“Asset tokenization firm Securitize has acquired a digital asset wealth platform, Onramp Invest, intending to enable registered investment advisors to buy digital tokens. However, growing concerns around risk underscore the need for caution in the decentralised finance (DeFi) world.”

Binance Labs’ $5M Investment in Curve: A Hopeful Future Amidst Past Challenges

“Binance Labs has invested $5 million in Curve DAO Token (CRV) of the decentralized finance (DeFi) sector. While solidifying its lead as a stablecoin automated market maker, Curve had challenges, including a $70 million hack injuring its token price.”

Decentralized Finance: Far from Dead or a Doomed Experiment?

“Despite setbacks and criticisms, such as the recent Curve Finance controversy, the DeFi sector is far from ‘dead.’ It’s actually seeing significant interest from corporate stalwarts like Mastercard, Visa, and BlackRock, all harnessing its efficiency-enhancing capabilities. Decentralized finance technology promises transparency, efficiency, disintermediation, and self-custody, indicating the sector’s potential for long-term growth.”

Crypto Solidarity: Understanding Justin Sun’s Rescue of Curve Finance from Looming Crisis

In an effort to save the decentralized exchange protocol, Curve Finance, from a potential bad debt crisis, crypto investor Justin Sun purchased approximately 5 million Curve tokens. Sun’s actions helped preserve the value of CRV tokens and demonstrated the potential of collective action in protecting investments amid the volatile nature of the cryptocurrency market.

Decoding Systemic Risks in Blockchain Universe: The G-SIP Protocol and Beyond

“The Global Systematically Important Protocol (G-SIP), inspired by traditional banking, offers a benchmark for identifying and measuring potential systemic risk in DeFi institutions. This tool could prove crucial in preventing market crashes, demonstrating both the potential and inherent risks within decentralized finance and the blockchain universe.”

Cryptocurrency Variance: Analyzing July’s Market Performances and Looming Prospects of Diverse Crypto Markets

“MakerDAO’s MKR advanced by a remarkable 47% in July, outpacing other Coindesk Market Index constituents. Ripple Labs’ XRP followed closely with a growth of 46.6%, linked to a U.S. Judge’s ruling. Contrastingly, Bitcoin and Ether each lost 4% in July, shedding light on the unpredictable volatility of cryptocurrencies.”

Navigating the Era of DeFi Micro-Primitives: Innovation or Complexity Overload?

“DeFi micro-primitives, a growing trend, represents more nuanced, decentralized & trustless DeFi protocols that are concurrently becoming complex. With inherent advantages and challenges, these micro-primitives hold potential to sculpt a DeFi landscape that’s refined, adaptable, programmer-friendly, and multifaceted.”

Crypto Market Stability vs Lending Protocol Risk: A Tale of Two Worlds Unraveling in Summer Heat

“Major cryptocurrencies Bitcoin and Ether appear stable despite market turmoil. Contrarily, a significant blow threatens lending protocols, especially the CRV token linked to Curve Finance’s DAO. The founder’s position drifts towards liquidation, leading to possible cascades of liquidations and a flood of assets into the market.”

Dark Side of Crypto: Rising Casualties and Increasing Regulations, Unveiled

“The mysterious demise of Argentina-based BTC millionaire Fernando Pérez Algaba has caused speculation within the crypto community. U.S. regulations are tightening on cybersecurity for crypto businesses, with the SEC mandating listed firms to disclose major cybersecurity incidents within four days.”

Unmasking the Two Faces of DeFi: The Lure of Freedom and the Lingering Concerns of Safety

“Decentralized finance (DeFi) brings transparency and freedom from centralized authorities, yet lack of regulatory oversight leaves safety in question. Despite allowing for more financial services and privacy, DeFi carries potential risks, including loss of funds due to wrong transactions or lost keys.”

Paradigm Capital’s Massive MKR Transfers: Calculated Moves or Market Disruption?

“Paradigm Capital transfers 3000 MKR tokens into an OTC wallet, potentially signaling a strategy for greater liquidity amid anticipated price instability. This move, mirroring a similar one by Andreessen Horowitz, may disrupt market balance or incite reactionary cascades from other market players.”

Crypto Market Dynamics: A Tale of Resilience amid the Uncertainty

Bitcoin and Ether have maintained their market positions despite a subdued trading atmosphere, while other cryptocurrencies experienced fluctuation. Experts keep a close watch on Federal Reserve interest rate hikes and the bitcoin options expiration. Uncertainty about institutional capital potential leaves the crypto-market unpredictable. Future trends could be influenced by unexpected events.

Stablecoins’ Struggle for Dominance Amid Market Turbulence: A Chronicle of Ups and Downs

The recent downturn in crypto markets has led to a decreased dominance of stablecoins, with the Pax Dollar (USDP) facing a significant decrease. Despite an overall reduction in the stablecoin market, there has been a surprising increase in stablecoin trading volumes. This turbulence in the crypto space continues to influence the stablecoin market.

DeFi Dilemma: The Power of Community Decision Making Amidst Defaults in the Crypto Domain

In the rising decentralized finance (DeFi) sphere, MakerDAO, a project on the Ethereum blockchain, halted additional lending to a tokenized credit pool in the Centrifuge protocol owing to a concerning trend of $2.1 million in loan defaults. The move alleviated communal concern despite the unfortunate circumstances provoking the decision.

Stellar Lumens (XLM) Glows amidst Crypto Market Surge: Risks and Rewards of Investment

Stellar Lumens (XLM) has shown a 24-hour surge, marking it as a top performer within the largest cryptocurrencies. This performance is complemented by Stellar’s alliance with Fonbnk, a project aimed at converting prepaid SIM cards into virtual debit cards and aiding Africa’s 350 million unbanked population.

Bridging the Gap: Gnosis Fuses Decentralized Payments with Visa’s Traditional Channels

Gnosis is pioneering the integration of decentralized payment systems with conventional channels, launching products allowing users to spend their digital assets from wallets via Visa’s system. Gnosis Pay and Gnosis Card, a self-funded Visa debit card connected to an on-chain wallet, aim to simplify the movement of crypto-assets and reinforce the Gnosis blockchain ecosystem.

Decentralized Lending: The Top Five P2P Platforms Disrupting Traditional Banking

“Decentralized Peer-to-Peer lending platforms like Aave, Compound, MakerDAO, dYdX, and Fulcrum transform the traditional lending system. Leveraging blockchain technology for operations, they offer flexible terms and competitive returns, fostering transparency and independence from traditional banks.”

Grayscale DeFi Fund’s Bold Move Boosts Lido but Raises Controversy

Grayscale has added Lido’s governance token to their DeFi fund’s portfolio by selling portions of existing Fund Components. LDO now accounts for 19.04% of the Grayscale DeFi fund, following Uniswap which holds 45.46%. Lido’s increasing prominence in liquid staking solutions for cryptocurrencies is drawing substantial individual and institutional investments.

Navigating the Crypto Seas: Interpretations of Recent Market Fluctuations and Insight into ETF Filings

“Cryptocurrencies maintain gains with Bitcoin above $31,000 and Ethereum around $1960. DeFi tokens like Compound and MakerDAO show remarkable growth. Amidst regulatory uncertainties like the delayed Bitcoin ETF filing by BlackRock, the market showcases resilience but highlights the ecosystem’s volatility and need for transparency and prompt information update.”

Jet’s Fixed-Rate Loans: A Game Changer or Niche Market Solution for Crypto Lending?

Solana-based crypto lending platform Jet is relaunching with fixed-rate loans, diverging from competitors’ variable rate products. Jet’s order book design lets borrowers and lenders set terms, resulting in a market-based annualized percentage yield. Jet’s innovation aims to attract Decentralized Autonomous Organizations and on-chain corporations holding idle treasuries.

Bitcoin ETFs Reignite Interest: Institutional Boost or Crisis of Confidence in Crypto?

Bitcoin surpasses $30,000 as major firms like BlackRock, Invesco, and WisdomTree file for spot Bitcoin ETFs, boosting investor confidence despite regulatory uncertainty. Growing institutional interest suggests a new wave in crypto evolution, with the potential involvement of traditional financial institutions, pension funds, and university endowments.

Decentralized Animation: The Future of Film Industry with Atrium’s Nouns Movie Pilot

Atrium has released the pilot for “Nouns: A Movie,” the first-ever animated film funded by a decentralized autonomous organization (DAO), showcasing blockchain technology’s potential in the entertainment industry. By leveraging remote workforce and blockchain technologies, creators can potentially bypass traditional funding and production avenues, ushering in a new era of decentralized entertainment.