“Ripple’s CEO, Brad Garlinghouse, argues that the U.S. is the worst country for crypto start-ups due to its hesitance towards digital asset innovation. He highlights the UK, Singapore, UAE, and Switzerland as nations nurturing such innovation. Aggressive lawsuits by SEC and CFTC complicate the implementation of crypto regulations in the U.S., possibly inducing a mass exodus of blockchain startups to friendlier jurisdictions.”

Search Results for: Exodus

The CoinEx Debacle: A $27 Million Wake-Up Call on Blockchain Security and Transparency

In a major security breach, cryptocurrency exchange CoinEx lost over $27 million from four separate hot wallets. The funds migrated into an unclaimed wallet, causing suspicions of a planned virtual break-in. CoinEx has acknowledged the incident, promising compensation measures and assuring the safety of remaining funds.

From Spook Shock to Fresh Start: Tracing the Crypto Market’s Recovery and Future Prospects

Justin Sun, founder of Tron, predicts a bullish future for the crypto market at the recent Korea Blockchain Week 2023. Noting past market shocks, he expresses certainty about a new industry cycle in the next two years. Despite concerns over tightening regulations, Sun believes cryptographic technology remains a global priority with god momentum behind dollar-pegged stablecoins in Asia and the resurgence of Hong Kong’s role in the crypto landscape.

Japan’s FSA Suggests Crypto Tax Reforms: An Effort to Revitalize the Digital Asset Landscape

Japan’s top financial regulator, the Financial Services Agency (FSA), has proposed changes to the country’s tax laws regarding digital asset profits. This move aims to better align Japan’s stance on cryptocurrencies with global standards, reduce financial burdens on local businesses, and foster innovation within the blockchain industry.

Qredo’s Crypto Winter Survival: Staff Cuts, Refocusing Efforts and Ramped-up Security

“Crypto infrastructure provider Qredo is reportedly laying off around 50 staff members, including key executives, reducing the firm’s headcount to around 130. The layoffs are part of a resizing strategy, an attempt to endure the difficult crypto market while refocusing efforts to save approximately 50% of its expenses.”

Solana’s Irresistible Appeal: Bucking the Crypto Outflow Trend Despite Stagnant Prices

“Despite broader crypto market outflows, Solana has sustained consistent inflows for the past nine weeks. While promising developments provide a bullish sentiment, a disconnection between investment inflows and price performance presents a sobering counter-narrative. Risks exist within the crypto spaces, such as hacking episodes.”

SNX and LPT Upswing Amid Crypto Stagnation: Opportunity or Risk?

“The decentralized liquidity platform, Synthetix’s token, SNX, recorded a 12.5% rise as the market observed a significant exodus of the token from Binance. This often hints at an increased buying pattern, as traders seek full ownership to avoid third-party misgivings. Altcoin’s volatility-prone environment can be capitalized for maximum profit, albeit with associated risks.”

Japan’s Crypto Tax Reform: Boosting Blockchain Growth or Reducing Government Revenue?

Japan’s Financial Services Agency is overhauling cryptocurrency regulations, focusing on tax systems for companies holding crypto assets. The proposals aim to amend the rule of taxing unrealized gains, a model criticized for hindering innovation in the blockchain and digital asset sector.

Declining Bitcoin Presence on Exchanges: Indication of Changing Trade Dynamics or Signal of Caution?

“Bitcoin (BTC) holdings on centralized exchanges have decreased by 4%, reflecting a growing trend of traders using private wallets. This shift may mitigate massive sell-offs, but also raises concerns for new users dependent on exchanges. Recent security breaches have foregrounded the need for self-custody measures, as the crypto market undergoes a key metamorphosis.”

The Quick Rise and Dip of Friend.tech: A Discerning Dissection of Crypto Fads and Futures

“The social app Friend.tech, constructed on Base layer-2 network of crypto exchange Coinbase, accumulated over $4.2 million in Ether fees in short periods. However, recently the transaction activity plunged by 95%, with volumes dropping from $16 million to barely over $700,000. Despite this, user activity remains dynamic with total users nearly doubling over the previous week.”

China’s Crypto Crackdown: A Tale of State Control vs Private Blockchain Ventures

China’s escalating efforts to eliminate private cryptocurrency activities are causing deep concern among blockchain firms. Measures taken by authorities include offering bounties for information leading to arrests and asset seizures of private crypto ventures – sparking fear amongst operators and sparking a mass exodus among Chinese Web3 founders. At the same time, state-sanctioned blockchain initiatives are flourishing, underscoring a dualistic approach by the Chinese authorities.

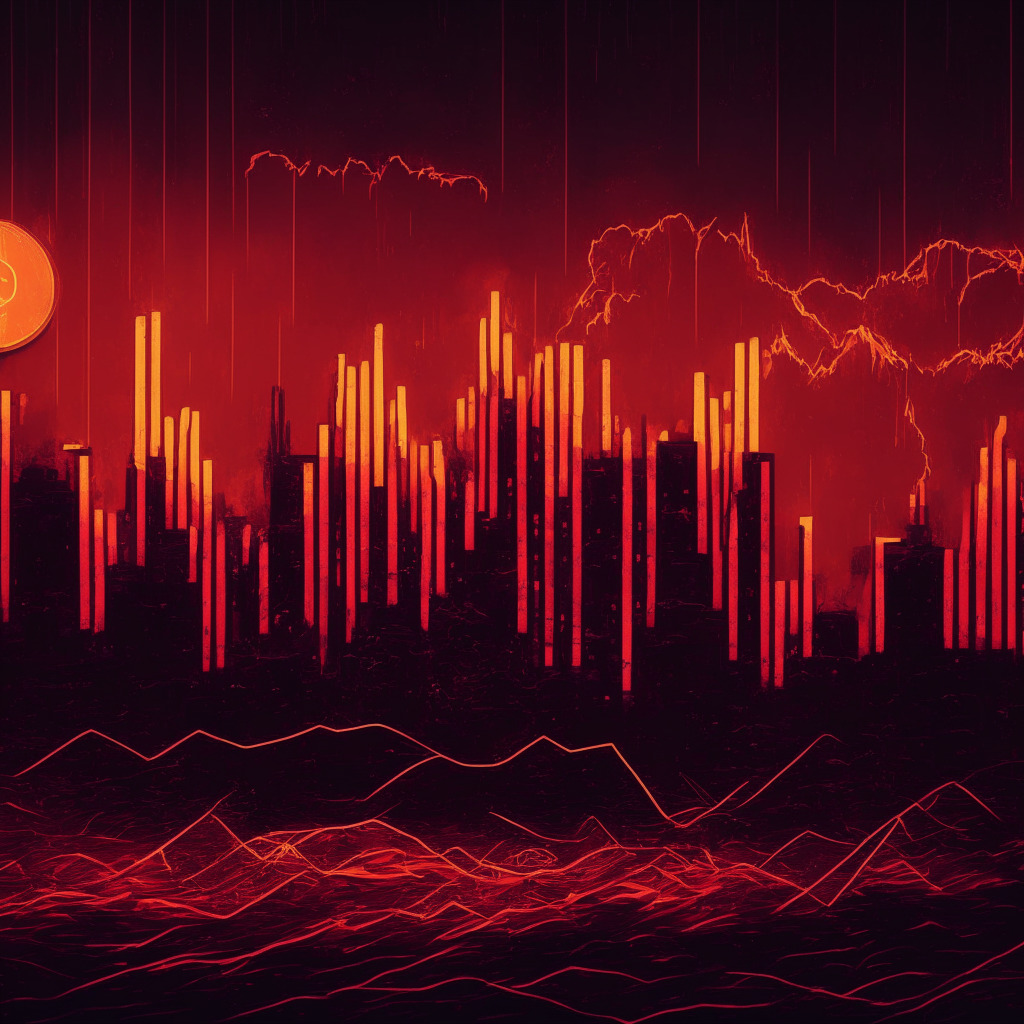

Crypto Market Meltdown: A Deeper Look at the Billion-Dollar Liquidation Frenzy

The cryptocurrency market experienced a staggering $1 billion in losses within 24 hours, marking the highest loss in 14 months. Bitcoin and Ether traders bore the brunt with a combined loss nearing $800 million, triggering a liquidation chain reaction. This plunge underscores the volatile nature of cryptocurrency and risky leveraged trading.

Navigating France’s Revamped Crypto Regulation: Balancing Investor Safety & Market Growth

France’s Autorité des Marchés Financiers (AMF) is updating its digital asset regulatory structure in preparation for the new Market in Crypto Asset (MiCA) regulation. The changes target the General Regulation and the registration process for Digital Asset Service Providers (DASPs), requiring timely disclosure of novel developments to regulatory bodies.

Stablecoins: The Potential Lifeline for US Dollar’s Global Dominance and The Challenge of Regulation

Stablecoins could potentially retain the global dominance of the U.S. dollar, countering “de-dollarization”. The authors express that with proper regulatory frameworks, stablecoins could reestablish the U.S. dollar’s role in international trade and provide relief for hyperinflation-affected economies.

Impending U.S. DoJ Action against Binance: The Possible Catalyst for a Crypto Market Meltdown

The US Department of Justice (DoJ) reportedly deliberates on fraud charges against Binance, one of the world’s largest crypto exchanges. A potential indictment could cause an exodus from Binance, triggering losses and a broader market panic. Authorities are considering fines and deferred prosecution agreements to minimize consumer harm. Binance prepares for potential fallouts by securing assets and maintaining a healthy ratio for mass withdrawals. The incident highlights complexities in the world of cryptocurrencies, with watchful scrutiny on the looming regulatory battle.

Tether’s Surge amid Wagner Uprising: Cryptocurrencies as Safe Havens or Volatility Traps?

“In June, Wagner Group’s actions triggered a 277% surge in Tether trades amidst political turbulence in Russia, symbolizing crypto’s role as a safe haven. Yet, the volatility presents a paradox concerning cryptocurrencies’ reliability as a secure alternative during unrest.”

Redrawing the Landscape: Sequoia Capital’s Dramatic Cutbacks in Crypto Investments

“Venture capital titan, Sequoia Capital, has notably reduced its cryptocurrency fund by over 65%, from $585 million to $200 million, amidst a fluctuating crypto market. The company’s strategic shift involves focusing on nascent start-ups rather than investing in larger firms. This comes as the firm, and other venture capitalists, retract their crypto investments amid turbulent market conditions.”

Twitter to X.com: The Great Migration of Crypto Enthusiasts and the Rise of Decentralized Platforms

“The rebranding of Twitter to X.com signals a shift in the cryptocurrency and social media worlds, spurred by Elon Musk. However, its decline and restrictive actions are leading crypto enthusiasts to consider alternate platforms, indicating a complex transition underscored by the importance of personal networks accrued over time.”

Shifting Social Media Power: The Failure of Twitter and Threads, and the Missed Blockchain Opportunity

“Entities operating blockchain-based social media missed a chance to collaborate during the mass transition from Twitter to Threads. The data portability and management issues could be alleviated using Decentralized ID, giving users control. Sadly, major platforms thrive on data sales, making this currently infeasible.”

Bitcoin’s Ascend to $250,000: Adjusted Timelines and Regulatory Challenges

Billionaire venture capitalist Tim Draper remains firm in his conviction of Bitcoin reaching $250,000 per coin by 2025. Despite setbacks and regulatory challenges, luminaries like Draper back Bitcoin’s potential for an impressive comeback, and continue viewing it as the future of everyday transactions.

Shrinking Bitcoin Supply on Exchanges: Is True Price Discovery on the Horizon?

“Less than 12% of Bitcoin’s total supply currently resides in exchange wallets, a shift in supply dynamics that could favor bulls and may signal an economic trend. The concept of “true price discovery” comes into focus – a market condition reflecting fair asset value based on available information.”

Crypto Licensing Rush in Hong Kong: Talent Shortage or Hiring Boom on the Horizon?

Around 150 companies have applied for Hong Kong’s crypto license, interestingly, this hasn’t resulted in a hiring spike. Recruitment remains low as demand for technical talents declines. However, experts predict a potential ‘talent war’ as companies wait on their license approvals.

Unraveling the Threads: Meta’s Crypto-Oriented Pursuits and the Tussle over Decentralization

“Mark Zuckerberg has introduced Threads, Meta’s new app, with protocols drawn from the open-source Mastodon system. Despite its decentralized backend, Meta could still gather full spectrum user data, reviving concerns about privacy. Its use of decentralization might urge acceptance of such protocols, but user interest stays uncertain.”

Bakkt Aims for International Expansion Amidst Unclear US Regulatory Landscape

Bakkt, a crypto-economy firm, expresses interest in expanding its operations to Hong Kong, the United Kingdom, and some European Union regions due to favorable regulatory environments. This follows Bakkt’s acquisition of Apex Crypto, leveraging partners like Webull, Public.com, and Stash to facilitate global growth. However, pesky regulatory uncertainties in the U.S. complicate alliances and force delisting of certain cryptocurrencies.

Dissecting the Fantom Heist & Thug Life Token Surge: A Paradoxical Crypto Landscape Explained

The recent hack on Fantom’s Multichain bridge resulted in a $126 million loss, causing software confidence to plummet. In contrast, Thug Life Token’s high level of decentralization provides investor assurance. Yet, despite promising advancements, blockchain technology remains vulnerable to exploitation, highlighting the need for secure, foolproof frameworks.

U.S. Spot Bitcoin ETF: Regulatory Milestone or Investor Attraction Dampener?

“The U.S. SEC’s potential approval of a spot bitcoin ETF may not significantly influence crypto markets, according to investment banking giant JPMorgan. Their report suggests the lack of interest in similar ETFs in Europe and Canada implies that even though a spot bitcoin ETF offers a streamlined, secure cryptocurrency investment method, it fails to attract widespread investor attention.”

UAE Emerges as New Powerhouse in Bitcoin Mining: Opportunities and Challenges

“Bitcoin mining companies are gravitating towards the UAE, now becoming a Middle Eastern hub for crypto mining. Its digital adoption, affordable energy, and crypto-friendly stance have attracted these companies. Currently, it’s home to nearly 4% of the Bitcoin global hashrate.”

Japan’s Crypto Tax Exemptions: A Boost for Industry or Only a Partial Solution?

The Japanese government announced tax exemptions for crypto issuers, exempting them from paying capital gains taxes on unrealized gains. Aimed at promoting growth in the cryptocurrency sector, this decision supports innovation and encourages crypto startups to remain in Japan, reversing a trend of significant tax burdens that led to an exodus of such startups.

Ukraine’s 18% Crypto Tax Proposal: Balancing Regulation and Market Appeal

Ukrainian regulators propose an 18% tax on cryptocurrency gains starting 2024, with plans to introduce a draft law and grant regulatory powers to the National Commission for Securities and Stock Market and the central bank. The proposed tax has sparked mixed reactions in Ukraine’s crypto community, with concerns about discouraging investors and potential user exodus.

Crypto Outflows Reach $88M in 8 Weeks: Analyzing Causes and Market Impact

Digital asset investment products witnessed $88 million in outflows last week, with a total of $417 million withdrawn over eight consecutive weeks, affecting primarily Bitcoin and Ethereum. Factors contributing to these outflows include monetary policy and regulatory actions, creating an environment of caution. Upcoming macroeconomic data releases may potentially overshadow regulatory concerns and influence the cryptocurrency market’s future trajectory.

Terra Luna Classic Struggles: Analyzing LUNC’s Rocky Future and Exploring Alternatives

Terra Luna Classic (LUNC) experienced recent volatility and struggles to break resistance. LUNC’s long-term rebound potential is weak due to a massive exodus of capital, users, and developers. Investors may want to consider diversifying with better-performing projects like AI-powered platform yPredict.

Crypto Market Slump Amid Inflation Fears and Growing Regulatory Scrutiny: Kraken Flourishes

Bitcoin and the broader cryptocurrency market experienced a second consecutive day of sell-offs amid worries around inflation and potential interest rate hikes. These concerns stemmed from the U.S. House of Representatives passing a debt ceiling deal, causing Bitcoin to decline to $26,800. Meanwhile, Kraken sees growth in Canada despite the ongoing downturn and increased regulatory scrutiny.