“SOMA Finance plans to introduce the first legally issued and structured digital security, potentially providing a solution to criticisms in the crypto industry. This will be achieved through a blend of decentralized finance features, regulatory-compliant mechanisms, and investor-friendly options, suggesting a shift in digital asset valuation.”

Search Results for: First Digital

Future of Transactions: A Russian Salon Charts New Course with Digital Ruble Payment

A beauty salon in Yekaterinburg, Russia, recently accepted its first digital ruble payment, pioneering the use of Russia’s Central Bank Digital Currency (CBDC) in the commercial sector. This case has sparked optimism that digital currency could offer unique payment solutions, even in areas with limited or no internet access.

Financial Incentives for Eco-Friendly Behavior: Chinese Bank Rewards Recycling with Digital Yuan

In a pioneering move, the Qingdao Branch of the Bank of Communications in China has launched a rewards program that offers digital yuan for recycling. Partnering with Jiaoyun Beijie, the city’s household waste disposal provider, residents can earn digital currency deposited directly into their digital yuan wallets in return for recycling. This novel approach promotes environment-friendly behavior and integration into the digital economy.

Digital Rupee and Yes Bank Integration: A Gateway to Mass Adoption or a Breeding Ground for Risks?

“The digital rupee’s integration with Yes Bank’s app UPI extends its reach to millions of merchants in India, potentially driving its mass adoption. However, concerns regarding security, volatility and regulation of cryptocurrencies remain, alongside increasing competition. Despite these challenges, digital currencies showcase resiliency with digital rupee transactions worth $134 million reported within two months.”

Disney Goes Digital: The Advent of Mickey Mouse Blockchain Toys and the Future of Collectibles

Disney characters Mickey Mouse, Minnie Mouse and Pluto are set to be released as Cryptoys, digital toys on the Flow blockchain. This follows the success of Star Wars characters as crypto collectibles. The initiative includes rarity levels and rewards for complete sets, suggesting a promising future for the digital toy industry.

Institutional Crypto Exchange EDX Partners with Anchorage Digital: A New Trend or Threat to Coinbase?

“Institutional crypto exchange, EDX Markets, announces its partnership with Anchorage Digital, a renowned regulated crypto platform. EDX will leverage Anchorage’s financial services and infrastructure solutions for its upcoming venture EDX Clearing, aiming to integrate traditional finance structures into the digital asset landscape.”

Bridging Crypto and Traditional Finance: EDX Markets Teams Up with Anchorage Digital

EDX Markets, a major institutional crypto exchange, is partnering with regulated platform Anchorage Digital. The goal of this collaboration is to bridge traditional finance and the digital asset landscape with the launch of EDX Clearinghouse. This initiative aims to enhance security, governance, risk, and compliance solutions in cryptocurrency.

Oman’s Digital Leap: Unveiling Huge Digital Mining Facility in Pursuit of Blockchain Dominance

Oman has launched a $150 million digital asset mining facility, marking a major step in its drive to reduce economic dependence on oil. With 2000 cutting-edge machines, the facility bolsters Oman’s position in digital asset mining and contributes to an overall sector investment of $740 million. As part of this digital transformation, educational programs and business registration directives are also being rolled out.

Securing Your Digital Gold: Robust Password Management in the Crypto Sphere

This article emphasizes the importance of vigorous password management in the world of blockchain and digital currencies. It focuses on hard-to-crack password creation, use of reputable password managers and multifactor authentication, and secure recovery seed methods to fortify digital assets against online attacks.

Navigating the Digital Ruble: A Breakthrough or a Step Towards Financial Surveillance?

“The Central Bank of Russia is testing the digital ruble, a central bank digital currency (CBDC), with potential benefits like offline payment capability discussed. However, journalist Anastasia Tselykh raises concerns over benefits for ordinary citizens, and the implications of easier tracking of citizens’ money.”

Mastercard’s Venture into Central Bank Digital Currencies: Paradigm Shift or Adventurous Detour?

“Mastercard has initiated a unique forum for stakeholders in the crypto domain to deliberate on the issue of central bank digital currencies (CBDCs). CBDCs are not the same as cryptocurrencies as they are digitized versions of existing fiat currencies backed by issuing governments. Mastercard’s CBDC alliance aims to foster groundbreaking innovations and efficiencies in the digital asset space.”

Secret Cryptography: Trump’s Hidden Digital Assets Stir Presidential Crypto Debates

Former US President Donald Trump reportedly holds $2.8 million in a digital wallet, a larger sum than previously disclosed. Trump’s venture into the crypto domain began with his NFT endeavor, Trump Digital Collectible Cards. The discovery shows his deepened involvement in cryptocurrency. Meanwhile, other presidential candidates voice their crypto policies, underlining the rising influence of cryptocurrencies on the political stage.

Europe’s First Bitcoin ETF: Opportunity Amidst Turmoil in Crypto Realm

“Jacobi Asset Management has launched Europe’s first spot bitcoin exchange-traded fund (ETF), now trading under the ticker “BCOIN” on Euronext Amsterdam. The fund’s custody responsibilities are undertaken by Fidelity Digital Assets. Meanwhile, recent research by Coinbase suggests a strong investment case for bitcoin, considering current global macro uncertainties.”

Bitcoin’s Historic Journey: Europe’s First Spot ETF and its Global Implications

The Guernsey Financial Services Commission has approved the Jacobi FT Wilshere Bitcoin ETF, the first spot bitcoin exchange-traded fund in Europe. This highlights Europe’s progressive stance on integrating digital assets despite varying global regulations and the unstable nature of the crypto market. This development could serve as a model for similar funds globally.

Leveraging China’s Digital Yuan for Green Financing: Pros, Cons, and Future Potentials

Zhongshan Jewelly Optoelectronics Technology, a Guangdong-based firm, has secured over $276,000 from China’s first digital yuan-powered green finance loan. Using the digital yuan offers cost-effective, efficiency for enterprises, with real-time fund transfer and no incurring handling and service fees. Meanwhile, its traceability can prevent misappropriation of green funding loans.

Riding the Digital Wave: Russia’s Imminent Launch of the Digital Ruble and Its Implications

“Russia prepares to pilot the digital ruble, with the coin possibly acting as a payment method for state benefits. Initial trials will test micropayments, wallet top-up features, and direct debiting. Doubts persist, however, as some banks have inexplicably withdrawn from early pilot stages, casting uncertainty over the future of Russia’s digital ruble.”

Digital Rubles in Russia: Exploring the Future of Transit Payments with Blockchain

Russia’s Central Bank is launching a digital ruble pilot project, starting from August 15, involving smaller retailers across 11 cities. This digital finance experiment aims at integrating the digital ruble into the Moscow Metro system, offering passengers the ability to pay through digital wallets or purchase smartcards using the digital ruble. Despite challenges, the Russian Central Bank remains confident about this futuristic transaction method.

Digital Yuan Adoption: Genuine Demand or Orchestrated Push? Unraveling the Intricacies

China’s digital yuan adoption is surging, with tax payments through the currency totaling $51.3 million from January to June 2023. However, most transactions occur through a CBDC tax payment platform operated by Postal Savings Bank’s Hunan Branch, raising questions about true adoption rates.

Gearing up for the Digital Ruble Era: Russia’s CBDC Revolution Amid Economic Sanctions

Russia’s central bank digital currency (CBDC), the digital ruble, is entering a testing phase with real-world trials through 13 banks. This advancement could potentially sidestep Russia’s current financial challenges and reshape the nation’s digital currency future, despite risks such as cyber threats and potential declines in physical currency demand.

Power Play in Crypto: Bitmain and Anastasia Digital’s Equity Stakes in Core Scientific

“Bitmain and Anastasia Digital potentially plan to acquire equity stakes in Core Scientific, the world’s second-largest publicly listed bitcoin miner, amid its imminent bankruptcy. Core’s funding for acquiring Bitmain Antiminer units comprises of $23 million cash and $54 million in equity, hinting Bitmain’s first interest in a publicly listed miner.”

Regulatory Hurdles and Cryptographic Breakthroughs: A Dive Into the World of Digital Currency

The global payment powerhouse, PayPal, has introduced its Ethereum-based stablecoin, PYUSD, stirring up the digital currency landscape. Simultaneously, cryptographic activities like Sam Altman’s Worldcoin faces regulatory challenges in Kenya. Meanwhile, Curve Finance showcases resilience by recovering 73% of funds stolen in a recent hack. Despite occasional regulatory complexities, these developments affirm the dynamic growth in the cryptographic domain.

Exploring China’s Crypto Leap: Minsheng Bank’s Digital Yuan Initiative with JD.com and the Risks Involved

China’s Minsheng Bank, in alliance with e-commerce giant JD.com, is launching a digital yuan-based payment service. This enables Minsheng customers in the CBDC pilot zone to use digital yuan tokens for platform purchases. Minsheng differentiates as the first Chinese firm predominantly owned by private sector interests to support the nation’s digital yuan pilot.

Navigating the Stormy Seas of Digital Assets: Promising Advances and Regulatory Pitfalls

“The digital assets landscape is dynamic, but not insulated from regulatory scrutiny. Despite substantial backing, some ventures like Nifty’s struggle, while partnerships like Tel Aviv Stock Exchange and Fireblocks demonstrate promising blockchain confidence. However, the translation of tech potential to market reality presents challenges.”

Beeple’s First CryptoPunk Purchase: Underlying Dynamics of NFT Ownership and Identity

“Beeple, famed for creating an NFT that fetched $69 million, made his first profile-picture (PFP) NFT purchase—CryptoPunk #4593—for about $208,463. Highlighting the intricate dance of digital asset ownership, art, identity, and, increasingly, history, this acquisition holds a compelling narrative for the future of digital asset ownership and blockchain technology’s evolution.”

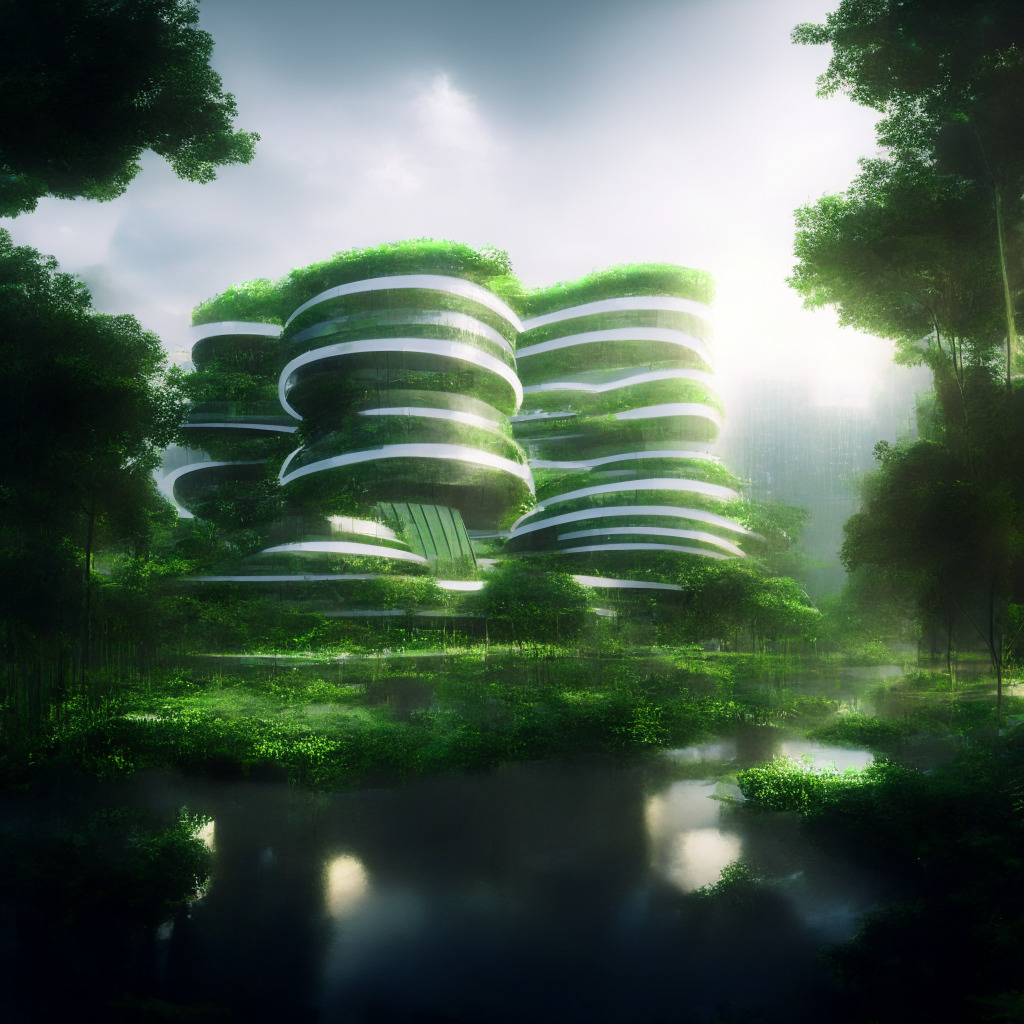

Bitcoin Mining Giants Take the Green Leap: Genesis Digital Assets Expands in South Carolina

Genesis Digital Assets (GDA) inaugurated three eco-friendly data centers in South Carolina, contributing to over 2% of the total Bitcoin network hash rate. These expansions notably utilize local energy resources, strengthen local energy grids, and align with GDA’s clean energy ethos, potentially leading crypto mining towards a more sustainable, eco-friendly future.

Binance Japan’s Grand Re-Entry: Analysis and Impact on Future Digital Markets

“Binance Japan, offspring of global giant Binance, is set to enroll users in Japan through its freshly introduced platform – featuring spot trading, earn products, and an NFT marketplace – after a two-year hiatus due to regulatory concerns”.

Spain’s A&G Bank Breaks Ground with First Local Crypto Hedge Fund: Promises and Pitfalls

A&G, a Spanish private bank, has launched the country’s first local crypto hedge fund —Criptomonedas, F.I.L. This fund, overseen by Spain’s financial markets regulator, is intended for professional investors and provides a safer, more efficient alternative to spot trading in cryptocurrency.

Unveiling EU’s First Tokenized Equities: A Game-changer or a New Challenge?

Securitize has issued the first tokenized equities under the EU’s digital assets framework via the Avalanche smart contract network. These tokens represent equity in Mancipi Partners, a Spanish real estate investment trust. This move signifies a blending between traditional capital markets and crypto, potentially signaling a shift in the financial landscape that could see the tokenized assets market reach $16 trillion by 2030. However, this emerging sector requires careful navigation with thorough regulatory oversight.

Unlocking Digital Investments in India: BlackRock, Jio, and the Curious Case of Missing BTC

“Global investment firm BlackRock and Jio Financial Services collaborate to form ‘Jio BlackRock’, investing $150 million each towards providing digital-first investment solutions for Indian investors. Yet, despite prior crypto involvement, BlackRock remains undecided about incorporating cryptocurrencies like Bitcoin into this venture.”

UAE’s First Licensed Crypto Exchange: A Leap Toward Regulatory Acceptance or a Step into Decentralization Dilemma?

In a significant boost for the crypto landscape, Middle-Eastern crypto exchange Rain has secured a license to operate in the United Arab Emirates (UAE). This marks Rain as the first regulated crypto exchange in the UAE, enhancing smoother transactions between the local UAE dirham and cryptocurrencies.

The Inevitable Clash: Central Bank Digital Currencies Versus Private Banks

“Central bank digital currencies (CBDCs) aim to regain monetary control by utilizing the blockchain, posing a threat to private financial institutions. Amid this, 93% of central banks are conducting CBDC research, predicting 24 CBDCs in circulation by 2030.”

Asian Games Shaping Digital Yuan Expansion: Opportunities, Challenges and City Rivalries

The city of Shaoxing is set to roll out an Asian Games-themed digital yuan giveaway to demonstrate China’s progress in central bank digital currency (CBDC). Supermarkets, hospitals, and transport providers in the city are embracing digital yuan payment functions, highlighting the adaptability and acceptance of this payment method. Additionally, the central People’s Bank of China is trying to make the digital yuan integral to metro payments.