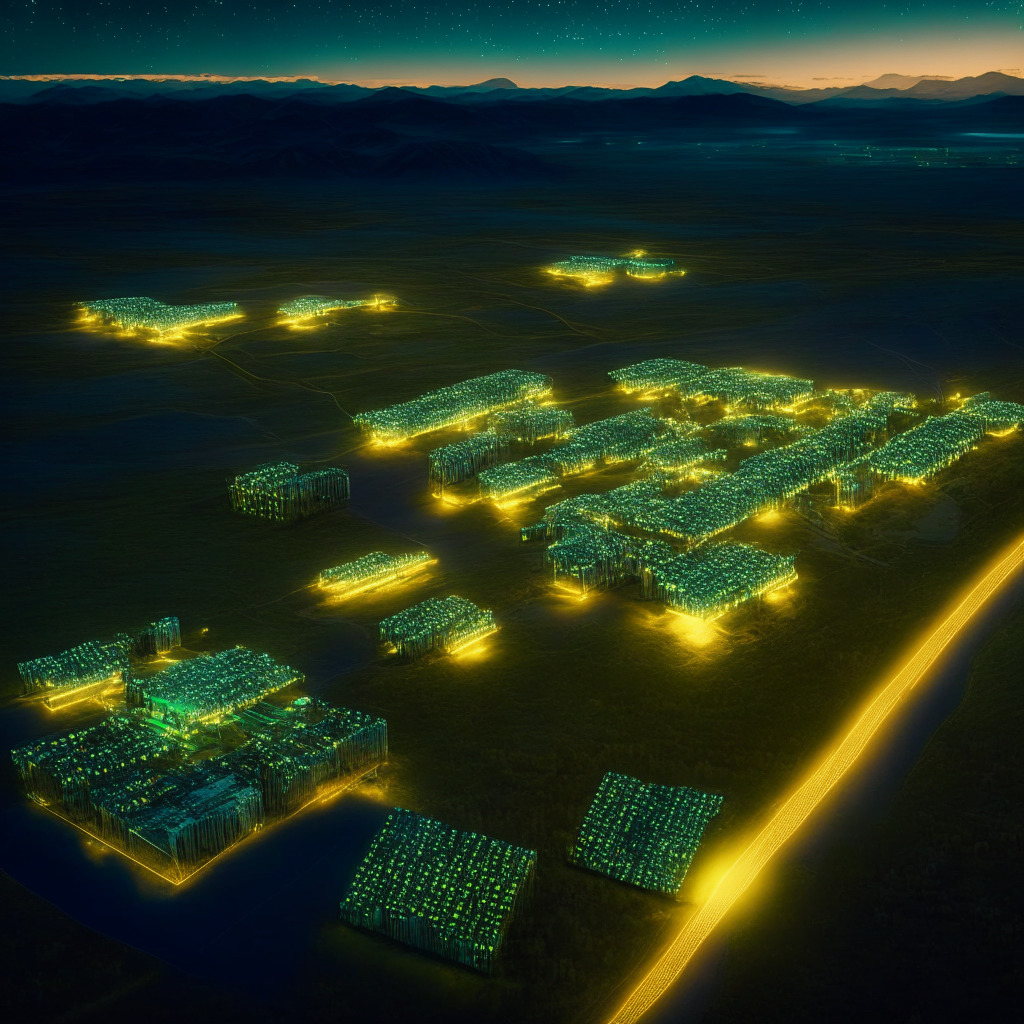

“Bitmain and Anastasia Digital potentially plan to acquire equity stakes in Core Scientific, the world’s second-largest publicly listed bitcoin miner, amid its imminent bankruptcy. Core’s funding for acquiring Bitmain Antiminer units comprises of $23 million cash and $54 million in equity, hinting Bitmain’s first interest in a publicly listed miner.”

Search Results for: Marathon

Bitcoin Mining: Futuristic Boom or Looming Risk? A Deep Dive into the State of BTC Production

“Bitcoin miners are increasing their mining power, with 16 key public companies controlling 16% of all BTC mined. However, the industry is unbalanced, favouring large miners with low production costs. The anticipated BTC halving in 2024 may further impair miner profitability. However, exchange-traded-fund approvals and institutional involvement could potentially improve conditions.”

Bitcoin’s Turbulent Ride: NFP Data, Cash App Influence and Binance’s New Trading Pairs

“The crypto market is in suspense due to Bitcoin’s performance above $29,000. US Non-Farm Payrolls data could affect Bitcoin’s trajectory. Block Inc’s consistent performance and Binance’s new trading pairs have contributed to Bitcoin’s surge. However, bearish undertones suggest a possible downward trend.”

Striking a Balance: Implications of New SEC Cybersecurity Disclosure Regulations on Crypto Firms

“The SEC has ruled that significant public firms, such as cryptocurrency companies Coinbase, Marathon Digital, and Riot Blockchain, must disclose major cybersecurity breaches within four days. This rule signifies an intensified blend of finance, tech, and cybersecurity in our digital age, though concerns have been raised about feasibility and potential operational burdens.”

Crypto’s Legal Labyrinth: Analyzing Recent Litigations, Regulations and Their Impact on the Industry

The cryptocurrency community has been hit by various legal and regulatory changes recently, surrounding issues like fraudulent activities, securities violations, and money laundering investigations. These developments demonstrate the dynamic challenges faced when crypto technology interacts with traditional financial structures. For a robust future, it’s crucial that the pace of regulations matches the innovation in this field.

Navigating the Bitcoin Mining Labyrinth: Texas’ Struggle between Economy and Ecology

“Texas, a significant bitcoin mining hub, is experimenting with integrating mining into power grids. However, this move has been criticized for potentially prioritizing an environmentally harmful industry over local communities. On the other hand, supporters highlight the potential grid benefits and job opportunities, but concerns about sustainability and water usage persist.”

Harnessing the Duck Curve: The Rise of Bitcoin Mining in Texas and its Implications

“In their strategy to attract Bitcoin miners, Texas utilizes a unique “duck curve” model illustrating energy supply and demand fluctuations. Texas’s adaptive system allows the price of energy to “float” throughout the day, creating a favourable environment for Bitcoin miners with an abundance of cheap renewable energy. However, regulatory and environmental concerns pose a challenge.”

Binance’s Benefit Cut Strategy amid SEC Clashes and Ripple’s Optimism for XRP Adoption in Banks

“Binance is adjusting staffing benefits amidst regulatory pressures and rumors of downsizing. Ripple expects U.S banks to adopt XRP for cross-border transactions following a court ruling. Legal issues plague Marathon Digital, while venture capitalists make a comeback in funding crypto startups despite market uncertainties.”

South Korea’s Stablecoin Feasibility Test, US Crypto Mining Firm Lawsuit, and the NEAR Foundation’s Green Pledge

Shinhan Bank in South Korea successfully carried out a feasibility test for stablecoin remittance payments using Hedera’s distributed ledger technology. Meanwhile, US crypto mining firm Marathon Digital faces legal action for alleged regulatory infringements. Cronos partners with gaming giant Ubisoft, while the NEAR Foundation pledges commitment to the Ethereum Climate Platform. Also, crypto exchange Bitget reports strong growth and Crucible offers a blockchain-based SDK for game developers.

Rise of Internet Computers: Eluding Centralization and AWS-like Services or Trading Security?

“Dfinity is developing a system called the Internet Computer, aiming to shift the foundation of the blockchain realm. They plan to remove centralized systems and replace them with ‘canister smart contracts’, providing a decentralized alternative to services like Amazon Web Services. However, these smart contracts can pose serious risks if flawed.”

UAE Emerges as New Powerhouse in Bitcoin Mining: Opportunities and Challenges

“Bitcoin mining companies are gravitating towards the UAE, now becoming a Middle Eastern hub for crypto mining. Its digital adoption, affordable energy, and crypto-friendly stance have attracted these companies. Currently, it’s home to nearly 4% of the Bitcoin global hashrate.”

Shaping the Future of Bitcoin ETFs: A Dance between Innovation and Regulation

“The US SEC has raised concerns over new proposals for spot bitcoin exchange-traded funds (ETFs) submitted by BlackRock and Fidelity through Nasdaq and CBOE Global Markets. The SEC identified gaps that could stem from a lack of clarity in their structuring.”

Hut 8’s $50M Credit Boost: Analyzing HODL Strategy & Merger Implications in Crypto Mining

Canadian Bitcoin mining company Hut 8 Mining recently secured a $50 million credit facility through Coinbase Credit. The funds will be used for general corporate purposes as Hut 8 continues to evolve its Bitcoin treasury management strategy, maintaining its commitment to the “HODL strategy.”

Dutch Bitcoin Equities ETF: Gaining Access to Crypto Stocks within a Regulated Framework

The new Bitcoin Equities ETF by Melanion Capital on Euronext Amsterdam offers Dutch investors a regulated way to gain exposure to the Bitcoin ecosystem through stocks of crypto-related companies. However, the ETF may have potential discrepancies in correlation to Bitcoin’s performance.

Navigating

Despite recent regulatory crackdowns on Binance and Coinbase, blockchain and digital assets offer transformative potential that shouldn’t be ignored by long-term investors. Amplify ETF’s Transformational Data Sharing ETF (BLOK) has strategically increased exposure to Bitcoin miners, resulting in a 31% year-to-date growth.

Roblox Bitcoin Mining Simulator Outshines Web3 Metaverse: A Curious Crypto Phenomenon

In the Roblox metaverse, Bitcoin Miner Beta allows users to simulate real-life bitcoin mining, gaining more popularity than actual cryptocurrency metaverse platforms. This raises questions about the popularity of Web3 metaverse projects and the future convergence between Web2 and Web3 gaming experiences.

Blockchain Revolution in Banking Meets AI-Generated Fraud: Unleashing Potential or Unraveling Trust?

JPMorgan collaborates with six Indian banks to enable real-time interbank dollar settlements on its blockchain-based platform, Onyx. However, concerns emerge over AI-generated fraud in the crypto and blockchain sectors. Meanwhile, the UK’s APPG proposes recommendations for crypto regulation, and the US Treasury Department’s sanctions on Tornado Cash face legal challenges.

Crypto Market Resilience Amid US Debt Dilemma and Regulatory Challenges

Crypto market displays resilience amid regulatory challenges and US debt concerns, with experts predicting pre-FOMC market correction. Experts expect correction and consolidation between $25K-$27K levels, while the decline in bitcoin options put/call ratio indicates reduced investor concerns. Ethereum’s post-merge performance captures market attention through increased staking demand and realized deflationary promise.

US Crypto Mining Tax Proposal: Impacts, Reactions, and the Future of Regulation

The proposed Digital Assets Mining Energy (DAME) tax, which aimed to impose a 10-30% tax on electricity used for crypto mining, failed to make its way into a U.S. debt ceiling bill. The tax’s potential impact on global emissions, renewable energy incentives, and the uncertain regulatory environment stirred debates within the crypto community, highlighting the need for governments to embrace and properly regulate the evolving blockchain future.

Sabre56’s Bold Shift: From Bitcoin Consulting to Hosting Services and Its Impact

Sabre56 plans to shift from consulting on Bitcoin mining projects to offering hosting services for industry firms over seven years. This strategic move addresses the need for reliable, large-scale hosting services in the Bitcoin mining industry, emphasizing Sabre56’s focus on providing scalable solutions in a dynamic market.

Bitcoin Mining Difficulty Nears 50T: The Impact on Miners and Blockchain Growth

Bitcoin mining difficulty is set to surpass a record 50T, driven by factors like the Bitcoin price rally and the surge in popularity of the Ordinals protocol. Increasing difficulty levels impact miner profitability but also stimulate growth within the network, with transaction fees tripling, benefiting miners’ revenue.

Bitcoin ETFs Surge 5%: Institutional Buying and Debt Ceiling Deal Fuel Crypto Rally

Multiple Bitcoin ETFs, including ProShares Bitcoin Strategy ETF (BITO) and Valkyrie Bitcoin Strategy ETF (BTF), witnessed a 5% jump in pre-market hours on Tuesday, indicating institutional buying and anticipation of a BTC price rally. The recent debt ceiling agreement between President Joe Biden and Republicans eliminated a 30% tax on Bitcoin mining, positively affecting markets.

Biden’s 30% Bitcoin Mining Tax: Balancing Environmental Concerns and Industry Growth

Senator Cynthia Lummis strongly opposes the Biden Administration’s proposal for a 30% tax on electricity for Bitcoin miners. Critics argue this could drive the industry offshore, while supporters claim it addresses environmental concerns. The debate highlights complexities in regulating the digital asset industry and balancing consumer protection, sustainability, and innovation.

Ethereum Shifts, TradeBlock Closure, and the Rise of US Mining Giants: Navigating the Crypto World

The closure of TradeBlock, a prime brokerage service owned by Digital Currency Group, highlights the dynamic nature of the digital asset landscape. Meanwhile, Ethereum’s ecosystem sees significant shifts as ether holdings on exchanges hit a low unseen since 2016, and the U.S. Bitcoin Corp. acquires major mining assets.

USBTC Joins Crypto Mining Giants: Rapid Expansion Strategy’s Pros, Cons, and Challenges

U.S. Bitcoin Corp. (USBTC) joins mining giants after acquiring assets from bankrupt lender Celsius, raising its computing power to 12.2 EH/s. This deal includes 121,800 mining machines, adding to USBTC’s existing 270,000 rigs. However, rapid expansion raises concerns of high energy consumption and environmental impact.

Bitcoin Mining: Savior or Strain on Texas Power Grid? Pros, Cons & the Ongoing Debate

A recent paper suggests that Bitcoin mining loads can help mitigate power shortages in Texas if managed correctly. The state faces concerns about the grid’s ability to handle mining activities. Financial incentives and location strategies can enhance grid-supporting capabilities and alleviate reliability concerns, while legislation and collaboration are needed for sustainable solutions.

USBTC’s Comeback: Analyzing the Shift in Mining Landscape & its Implications for the Industry

U.S. Bitcoin Corp (USBTC) recently signed multi-year agreements to host 150,000 bitcoin mining machines with major firms like Marathon Digital Holdings, signaling a potential resurgence in the mining industry. However, challenges remain as the industry faces transformations and companies navigate varying levels of success.

Analyzing Bitcoin’s Future: EU Regulations vs Institutional Adoption & Market Trends

This market overview assesses Bitcoin’s potential support level near $26,800 by analyzing key technical indicators and trends like the EU’s comprehensive crypto regulations, Peter Thiel’s investment in Bitcoin startup River, and a new wave of institutional adoption. Bitcoin’s price trajectory remains uncertain amidst mixed investor sentiment.

Auradine’s $81M Series A Funding: Impact on Blockchain Security, AI & Privacy Debate

Privacy-focused blockchain startup Auradine raised $81 million in Series A funding led by Celesta Capital and Mayfield, with participation from Stanford University and Marathon Digital Holdings. Auradine aims to develop scalable, sustainable, and secure solutions in the fast-evolving blockchain technology sector.

Auradine Secures $81M Series A Funding: AI, Blockchain and Privacy Technologies’ Potential Impact

Auradine, a Silicon Valley-based web infrastructure provider, has raised $81 million in a Series A funding round, aiming to develop hardware, software, energy-efficient silicon, and AI solutions for decentralized applications. Backers include Marathon Digital Holdings, Celesta Capital, and Mayfield.

Bitcoin’s Future at $25,000: Factors Influencing Market Sentiment and Key Price Levels

As Bitcoin nears the $25,000 support level, its future trajectory is uncertain due to factors like increased regulatory scrutiny, concerns around the Grayscale GBTC Trust Fund, and the strong US dollar. Technical indicators suggest a potential bullish rebound if Bitcoin stays above $26,000, but challenges remain.