Marathon Digital Holdings partners with Zero Two to establish a large-scale immersion Bitcoin mining facility in Abu Dhabi, overcoming previous challenges posed by the desert climate. Utilizing a custom-built immersion solution to cool mining rigs, the collaboration aims to increase the viability of crypto mining in challenging climates and contribute to global crypto market growth, whilst addressing energy consumption and ecological concerns.

Search Results for: Marathon Digital

Middle East’s First Immersion-Cooled Crypto Mining: Is It The Future Amid Potential US Taxation?

In partnership with Zero Two, Marathon Digital plans to establish the Middle East’s first large-scale immersion Bitcoin mining operation, utilizing excess energy in Abu Dhabi for a sustainable approach. This pioneering venture might prompt a global shift towards eco-friendly solutions and infrastructure development in digital asset mining.

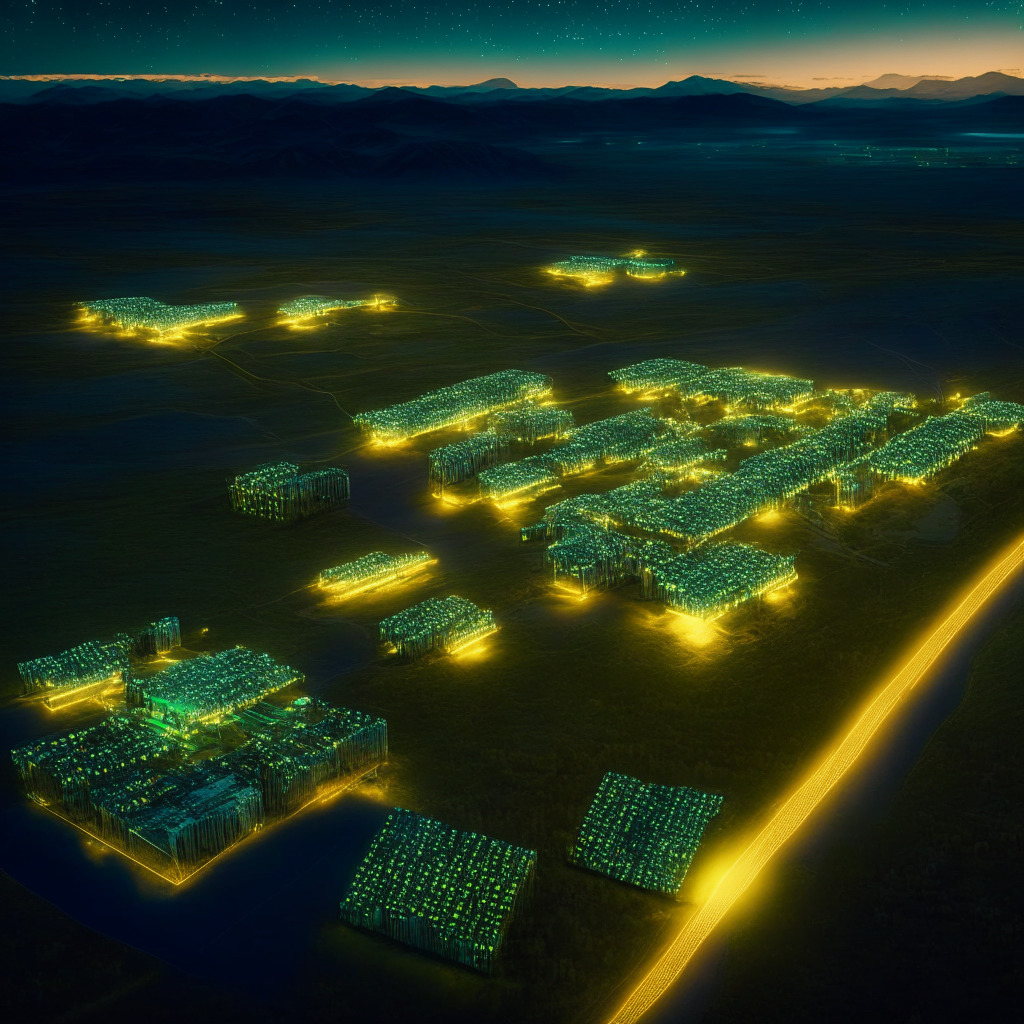

Texas Surges Ahead: Altering the Landscape of US Crypto-Mining

“The state of Texas is now claiming a staggering 28.50% of the U.S. crypto-mining hashrate, up from 8.43% at the end of 2021. This rise, attributed to favorable conditions including negative pricing, comes at the expense of states like Georgia, previously a blockchain leader. Meanwhile, Texas’ mining growth draws in leading crypto entities keen on expansion.”

Texas Mining Clampdown and Bitcoin’s Turbulence: Is $20K the New Norm?

“The escalating energy crisis in Texas has led to a suspension of Bitcoin mining, pushing Bitcoin’s price down to $25,900. This event, along with weakening prices, increased rivalry, and reduced returns post-halving, creates challenges for the mining sector. Despite the current scenrio, crypto enthusiasts anticipate a promising 2023, mixed with risk and volatility.”

Navigating Turbulence: Crypto Lending, Slumps, and Bold Moves in Blockchain Landscape

“Crypto giant Coinbase unveils its lending platform targeted to institutional investors amidst turbulent crypto market conditions. Meanwhile, Google’s new ad policy will allow promotion of blockchain-based NFT gaming, hinting at further acceptance of digital assets.”

Surge in Bitcoin Value Hints at Crypto Watershed: Grayscale, Bitwise and BlackRock Await ETF Decisions

“The Bitcoin market experienced significant changes, surging 7% following the court ruling favoring Grayscale’s lawsuit against the SEC. This sets the stage for potential approval of a spot BTC ETF, driving prices beyond $30,000. Simultaneously, the Bitcoin Network hash rate and mining activities have displayed steady growth, indicating a vibrant future for the cryptocurrency sector.”

Bitcoin ETF Dreams: Court Orders SEC to Reconsider Grayscale Appeal Impact on Crypto Market

“A federal appeals court directive for the SEC to reassess its dismissal of Grayscale Investments’ motion to modify Grayscale Bitcoin Trust into an ETF led to Bitcoin’s surge on the market. This legal success could introduce a spot Bitcoin ETF in the U.S., encouraging broader public participation in Bitcoin investment while avoiding complexity and custodial concerns. This could lead to a more inclusive crypto market while raising concerns about possible regulatory inconsistencies.”

Analyzing Bitcoin Market Fluctuations: Impacts, Future Prospects, and Resiliency Amid Recession

“In his analysis, Mike Colonnese discusses recent Bitcoin (BTC) market fluctuations, attributing the sharp drop to SpaceX’s decision to devalue its BTC holdings and concerns sparked by Evergrande’s bankruptcy. He also outlines potential future trends, including possible boost in BTC prices if the Federal Reserve cuts rates amidst a recession, and impact of upcoming halving event in 2024.”

Bitcoin Mining: Futuristic Boom or Looming Risk? A Deep Dive into the State of BTC Production

“Bitcoin miners are increasing their mining power, with 16 key public companies controlling 16% of all BTC mined. However, the industry is unbalanced, favouring large miners with low production costs. The anticipated BTC halving in 2024 may further impair miner profitability. However, exchange-traded-fund approvals and institutional involvement could potentially improve conditions.”

Crypto’s Legal Labyrinth: Analyzing Recent Litigations, Regulations and Their Impact on the Industry

The cryptocurrency community has been hit by various legal and regulatory changes recently, surrounding issues like fraudulent activities, securities violations, and money laundering investigations. These developments demonstrate the dynamic challenges faced when crypto technology interacts with traditional financial structures. For a robust future, it’s crucial that the pace of regulations matches the innovation in this field.

Harnessing the Duck Curve: The Rise of Bitcoin Mining in Texas and its Implications

“In their strategy to attract Bitcoin miners, Texas utilizes a unique “duck curve” model illustrating energy supply and demand fluctuations. Texas’s adaptive system allows the price of energy to “float” throughout the day, creating a favourable environment for Bitcoin miners with an abundance of cheap renewable energy. However, regulatory and environmental concerns pose a challenge.”

Rise of Internet Computers: Eluding Centralization and AWS-like Services or Trading Security?

“Dfinity is developing a system called the Internet Computer, aiming to shift the foundation of the blockchain realm. They plan to remove centralized systems and replace them with ‘canister smart contracts’, providing a decentralized alternative to services like Amazon Web Services. However, these smart contracts can pose serious risks if flawed.”

UAE Emerges as New Powerhouse in Bitcoin Mining: Opportunities and Challenges

“Bitcoin mining companies are gravitating towards the UAE, now becoming a Middle Eastern hub for crypto mining. Its digital adoption, affordable energy, and crypto-friendly stance have attracted these companies. Currently, it’s home to nearly 4% of the Bitcoin global hashrate.”

Shaping the Future of Bitcoin ETFs: A Dance between Innovation and Regulation

“The US SEC has raised concerns over new proposals for spot bitcoin exchange-traded funds (ETFs) submitted by BlackRock and Fidelity through Nasdaq and CBOE Global Markets. The SEC identified gaps that could stem from a lack of clarity in their structuring.”

Hut 8’s $50M Credit Boost: Analyzing HODL Strategy & Merger Implications in Crypto Mining

Canadian Bitcoin mining company Hut 8 Mining recently secured a $50 million credit facility through Coinbase Credit. The funds will be used for general corporate purposes as Hut 8 continues to evolve its Bitcoin treasury management strategy, maintaining its commitment to the “HODL strategy.”

Dutch Bitcoin Equities ETF: Gaining Access to Crypto Stocks within a Regulated Framework

The new Bitcoin Equities ETF by Melanion Capital on Euronext Amsterdam offers Dutch investors a regulated way to gain exposure to the Bitcoin ecosystem through stocks of crypto-related companies. However, the ETF may have potential discrepancies in correlation to Bitcoin’s performance.

Navigating

Despite recent regulatory crackdowns on Binance and Coinbase, blockchain and digital assets offer transformative potential that shouldn’t be ignored by long-term investors. Amplify ETF’s Transformational Data Sharing ETF (BLOK) has strategically increased exposure to Bitcoin miners, resulting in a 31% year-to-date growth.

Blockchain Revolution in Banking Meets AI-Generated Fraud: Unleashing Potential or Unraveling Trust?

JPMorgan collaborates with six Indian banks to enable real-time interbank dollar settlements on its blockchain-based platform, Onyx. However, concerns emerge over AI-generated fraud in the crypto and blockchain sectors. Meanwhile, the UK’s APPG proposes recommendations for crypto regulation, and the US Treasury Department’s sanctions on Tornado Cash face legal challenges.

Crypto Market Resilience Amid US Debt Dilemma and Regulatory Challenges

Crypto market displays resilience amid regulatory challenges and US debt concerns, with experts predicting pre-FOMC market correction. Experts expect correction and consolidation between $25K-$27K levels, while the decline in bitcoin options put/call ratio indicates reduced investor concerns. Ethereum’s post-merge performance captures market attention through increased staking demand and realized deflationary promise.

US Crypto Mining Tax Proposal: Impacts, Reactions, and the Future of Regulation

The proposed Digital Assets Mining Energy (DAME) tax, which aimed to impose a 10-30% tax on electricity used for crypto mining, failed to make its way into a U.S. debt ceiling bill. The tax’s potential impact on global emissions, renewable energy incentives, and the uncertain regulatory environment stirred debates within the crypto community, highlighting the need for governments to embrace and properly regulate the evolving blockchain future.

Sabre56’s Bold Shift: From Bitcoin Consulting to Hosting Services and Its Impact

Sabre56 plans to shift from consulting on Bitcoin mining projects to offering hosting services for industry firms over seven years. This strategic move addresses the need for reliable, large-scale hosting services in the Bitcoin mining industry, emphasizing Sabre56’s focus on providing scalable solutions in a dynamic market.

Bitcoin Mining Difficulty Nears 50T: The Impact on Miners and Blockchain Growth

Bitcoin mining difficulty is set to surpass a record 50T, driven by factors like the Bitcoin price rally and the surge in popularity of the Ordinals protocol. Increasing difficulty levels impact miner profitability but also stimulate growth within the network, with transaction fees tripling, benefiting miners’ revenue.

Bitcoin ETFs Surge 5%: Institutional Buying and Debt Ceiling Deal Fuel Crypto Rally

Multiple Bitcoin ETFs, including ProShares Bitcoin Strategy ETF (BITO) and Valkyrie Bitcoin Strategy ETF (BTF), witnessed a 5% jump in pre-market hours on Tuesday, indicating institutional buying and anticipation of a BTC price rally. The recent debt ceiling agreement between President Joe Biden and Republicans eliminated a 30% tax on Bitcoin mining, positively affecting markets.

Biden’s 30% Bitcoin Mining Tax: Balancing Environmental Concerns and Industry Growth

Senator Cynthia Lummis strongly opposes the Biden Administration’s proposal for a 30% tax on electricity for Bitcoin miners. Critics argue this could drive the industry offshore, while supporters claim it addresses environmental concerns. The debate highlights complexities in regulating the digital asset industry and balancing consumer protection, sustainability, and innovation.

Ethereum Shifts, TradeBlock Closure, and the Rise of US Mining Giants: Navigating the Crypto World

The closure of TradeBlock, a prime brokerage service owned by Digital Currency Group, highlights the dynamic nature of the digital asset landscape. Meanwhile, Ethereum’s ecosystem sees significant shifts as ether holdings on exchanges hit a low unseen since 2016, and the U.S. Bitcoin Corp. acquires major mining assets.

USBTC Joins Crypto Mining Giants: Rapid Expansion Strategy’s Pros, Cons, and Challenges

U.S. Bitcoin Corp. (USBTC) joins mining giants after acquiring assets from bankrupt lender Celsius, raising its computing power to 12.2 EH/s. This deal includes 121,800 mining machines, adding to USBTC’s existing 270,000 rigs. However, rapid expansion raises concerns of high energy consumption and environmental impact.

Analyzing Bitcoin’s Future: EU Regulations vs Institutional Adoption & Market Trends

This market overview assesses Bitcoin’s potential support level near $26,800 by analyzing key technical indicators and trends like the EU’s comprehensive crypto regulations, Peter Thiel’s investment in Bitcoin startup River, and a new wave of institutional adoption. Bitcoin’s price trajectory remains uncertain amidst mixed investor sentiment.

Bitcoin’s Future at $25,000: Factors Influencing Market Sentiment and Key Price Levels

As Bitcoin nears the $25,000 support level, its future trajectory is uncertain due to factors like increased regulatory scrutiny, concerns around the Grayscale GBTC Trust Fund, and the strong US dollar. Technical indicators suggest a potential bullish rebound if Bitcoin stays above $26,000, but challenges remain.

Bitcoin Price Drop: Regulatory Uncertainty and Resilient Traders Battle for $28,000

The Bitcoin price dropped 7% on May 12, breaking below the 55-day support and liquidating $100 million worth of long BTC futures contracts. Possible causes for the decline include increased regulatory uncertainty in the U.S., concerns over Grayscale GBTC Trust Fund holdings, and the Dollar Strength Index. Despite this drop, derivative market metrics and trader stances indicate hope for a recovery towards $28,000.

Crypto Crime Roundup: Extradition, Insider Trading, and Kidnapping Cases Unfold

Recent legal news includes the extradition of UK national Joseph O’Connor for the 2020 Twitter hack, Coinbase’s former product manager being sentenced for insider trading, and a Vietnamese kidnapping case involving stolen crypto. In developments, Binance launches Capital Connect, Xapo Bank integrates Tether payment rails, and Unstoppable Domains joins the OMA3 Board of Directors.

DAME Tax Debate: Balancing Crypto Mining, Environmental Impact, and Industry Growth

The proposed Digital Asset Mining Energy (DAME) excise tax in President Joe Biden’s budget aims to reduce greenhouse gas emissions and electricity costs by taxing 30% of electricity used by US cryptocurrency miners. Critics argue it could drive miners to countries with looser environmental regulations, potentially increasing emissions. The tax’s impact on renewable energy production and the crypto industry’s growth remains uncertain.