“The ‘X’ themed tokens trend catalyzed by Elon Musk is bringing significant attention to tokens like the XXX token which saw a gain of +2665% and the Wall Street Memes token, raising nearly $20m in presale. Despite rosy prospects, investors are warned about potential risks due to lack of centralized control.”

Search Results for: Nima Capital

DeFi Protocol EraLend Robbed of $3.4M: A Wake-up Call for Blockchain Security

“EraLend, a Decentralized Finance (DeFi) Protocol, has lost $3.4 million in a ‘re-entrancy attack’. This incident underscores the need for advanced security protocols within blockchain transactions, highlighting how dependencies and vulnerabilities can be exploited.”

A Look into the Future: AI and Blockchain Synergies at EthCC Paris Conference

The Ethereum-focused conference EthCC witnessed buzz due to potential shift in the crypto market and the confluence of AI with blockchain technology. Future prospects of AI in crypto financial markets and valuating non-fungible tokens were discussed. Skepticism around use-cases and computational demands of AI and blockchain intersection remain.

Worldcoin’s Future: Privacy Concerns, Dubious Investors and Potentially Revolutionary Tech

The Worldcoin project, co-founded by OpenAI’s Sam Altman, uses a hardware unit called the Orb for identity verification by iris scanning. Despite initial success, criticism has piled up around privacy, centralization, security concerns, and questionable marketing strategies. Ethereum co-founder, Vitalik Buterin and crypto influencer ZachXBT have voiced concerns about potential misuse and exploitation.

Taming the Beast: Bitcoin’s Volatility Index Hits Record Low and its Market Implications

Deribit’s Bitcoin volatility index, a crypto “fear gauge”, has hit its low since its launch, suggesting minimal near-term price fluctuation. This trend may imply diminishing crypto volatility, but could also signal opportunities as market predictions often swing unpredictably.

Nasdaq’s Withdrawal Shakes the Crypto World: Premising Contenders Emerging Stronger

“Nasdaq’s proposed cryptocurrency custody service has been put on hold due to regulatory ambiguity. The absence of a credible custodian like Nasdaq may impact smaller entities aiming to offer their own services. Meanwhile, cryptocurrencies like Flex Coin, Evil Pepe Coin, Stellar, Burn Kenny, and Cardano show promising signs despite potential risks inherent in a volatile market.”

Bitcoin’s Waning Dominance: The Ripple Effect and the Resurgence of Altcoins

“The cryptocurrency market recently saw Bitcoin’s dominance fall to under 50% due to XRP, Ripple’s native cryptocurrency, winning its lawsuit against the US Securities and Exchange Commission. This triggered gains for other altcoins in the market, marking the return of the ‘Altcoin season.'”

Navigating Uncertainties in Crypto: An In-depth Look at XRP and the Emerging THUG Token

“The blockchain market reveals a stagnation, with XRP price remaining relatively flat. Much of XRP’s fortune is tied to Ripple’s SEC case; a positive verdict could spur the price beyond $1. Meanwhile, the ERC-20 meme coin, Thug Life Token (THUG), draws substantial attention with rapid accumulation indicating a strong investor community.”

Pondering the Impact: Will Bitcoin ETF Approval Alter the Crypto Game?

A JPMorgan report suggests that the approval of a spot Bitcoin ETF may not drastically change the game as expected. Evidence from Europe and Canada, where such ETFs exist but failed to attract substantial investor interest, supports this claim. Nonetheless, some believe an approved Bitcoin ETF could increase Bitcoin’s liquidity and catalyze investor migration.

XRP’s Current Stability Amidst Ripple’s Legal Battle: A Prelude to a Rally? Pros and Cons

“XRP’s price has seen a 3% increase this week, despite falling by 8% over the last 30 days. As Ripple’s legal battle with the SEC nears its end, speculations anticipate a potential upside. Ripple’s CEO predicts a favourable judgment might boost XRP’s market standing. Diversified portfolios like Wall Street Memes provide investment opportunities to counterbalance risk. Do remember, crypto investment is always a gamble.”

Exploring the Impact and Risks of Microcap Tokens in Today’s Cryptomarket

“The cryptomarket consistently sees new microcap tokens promising huge returns. Tokens like ‘pepe 2.0’ ‘floki 2.0’ & ‘bobo 2.0’, have significantly multiplied original investments quickly but their longevity is often short-lived. Despite their appeal, the risks involved suggest they’re more high-risk lottery than stable, long-term investment.”

Untangling the Crypto Regulatory Web: A Tale of Overzealous Oversight vs Healthy Balance

“Anthony Scaramucci criticizes former FTX head, Sam Bankman-Fried, whose actions allegedly led to a regulatory crackdown on cryptocurrency. He suggests current regulations gravitate towards ‘prosecutorial oversight’, hindering innovation. He praises Canada’s approach, involving industry players in forming guidelines, and calls for increased transparency.”

Swiss Bank Julius Baer Group Expands Crypto Services to Dubai: A Strategic Move for Global Dominance

“Swiss private banking group, Julius Baer, aims to broaden its crypto services in Dubai, after a successful Bitcoin launch in May 2020. The bank’s expansion stands as a testimony to digital asset adoption at a global scale. Julius Baer seeks a license modification to offer custodial services for digital assets, strengthening its commitment to innovative crypto solutions.”

Ark vs BlackRock: Battle for the First Spot-Bitcoin ETF Approval Heating Up

ARK Investment Management believes it has secured frontrunner status for spot-Bitcoin ETF approval, despite BlackRock leading the race. USDC CEO Jeremy Allaire mentioned well-regulated custody infrastructures, mature spot markets, and effective market surveillance as factors supporting potential approval.

Crypto Inflows Skyrocket: Bitcoin Dominates while Altcoins Lag Behind

The cryptocurrency investment sector recently experienced its largest weekly inflows since July 2022, totaling $199 million, mainly due to Bitcoin ETF applications. Bitcoin attracted 94% of the total inflows, while Ethereum and altcoins saw minimal impact on investments. The involvement of traditional financial giants and increasing interest in multi-asset investment ETPs influence the market sentiment.

Bitcoin ETF Surge: Analyzing Institutional Interest, Market Impact, and SEC Challenges

The ProShares’ Bitcoin Strategy ETF (BITO) recorded the highest weekly inflow in over a year as Bitcoin prices crossed $30,000, with investors pumping $65 million into the fund. This surge suggests a growing desire for Bitcoin exposure among institutional investors amidst the ongoing U.S. Bitcoin ETF frenzy.

PepeCoin vs Dogecoin: Ultimate Memecoin Battle or Passing Trend in Crypto World?

PepeCoin recently gained prominence in the memecoin sector, challenging Dogecoin’s dominance. With native Ethereum integration and a fixed supply, it shows potential for growth, but it must overcome Dogecoin’s first-mover advantage and network dominance to become a mainstream memecoin contender.

Merging Giants: Hut 8 Mining & US Bitcoin Corp to Form $990M North American Crypto Powerhouse

Bitcoin miners Hut 8 Mining and U.S. Bitcoin Corp plan to merge, creating a $990 million North American crypto mining giant, Hut 8 Corp. The merger aims to expand revenue, adopt a diversified business model, and capitalize on their financial position.

HODLing on the Rise: Bitcoin Dominance Grows as Market Takes Volatile Turn

The cryptocurrency market is experiencing increased HODLing and a shift of capital from altcoins to major cryptocurrencies like Bitcoin. Recent data indicates a growing preference for Bitcoin, with its dominance rising to 47.6%. Despite this, investors should remain cautious and vigilant, as market conditions can change rapidly.

Crypto Market Volatility: Impact of Fed Policy, CBDCs, and Exchange Crackdowns

Cryptocurrencies experienced significant declines, with Bitcoin dropping below $25,000 and altcoins like MATIC and ADA falling up to 9%. This comes after the Federal Reserve’s policy decision to suspend rate hikes, yet signaled further monetary tightening. Meanwhile, the European Commission plans to propose a draft law affecting digital euro operations, and Binance Smart Chain faces challenges as total value locked drops to its lowest since March 2021. These events reflect the crypto space’s volatility and uncertainty, with ongoing debates on CBDCs, regulatory actions, and global economic influences impacting its future.

Inflation Data and CPI Impact on Crypto Market: Analyzing Bitcoin’s Bullish Outlook

Bitcoin price and crypto market experienced a positive reaction to the US CPI data reveal, as the annual inflation rate softened. Investors turned to riskier assets like crypto, and significant Bitcoin holders increased their positions, signaling a potential bullish turn in the near future.

Decentralizing AI: Gensyn Secures $43M Funding for Machine Learning Frontier

Gensyn AI recently secured $43 million in Series A funding led by a16z crypto to harness the power of decentralized technology for AI applications. Their decentralized machine learning compute protocol connects global machine learning-capable hardware, enabling a scalable, blockchain-based solution with minimal verification overhead.

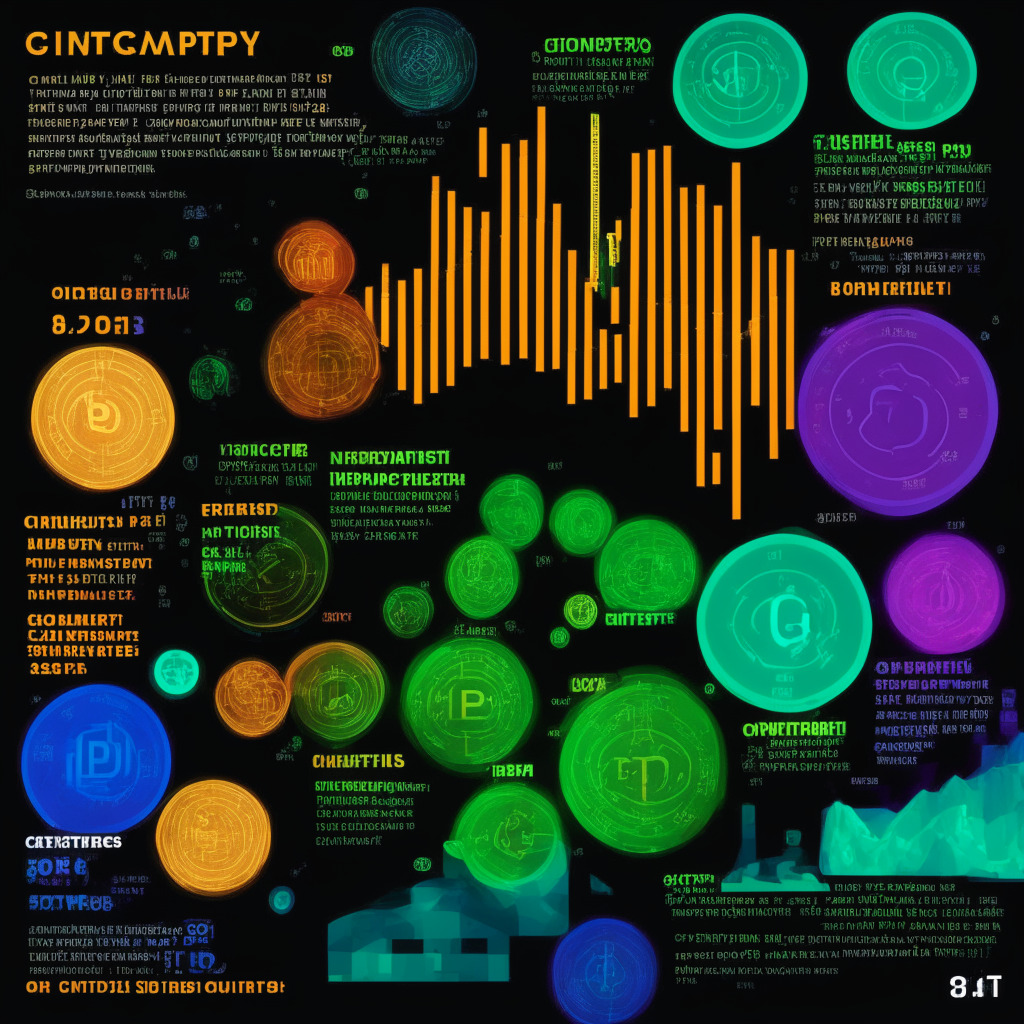

Cryptocurrency Performance Divergence: Growth Opportunities and Unpredictable Markets

The recent market overview reveals diverse cryptocurrency performances, with smaller coins experiencing remarkable growth compared to established coins. Despite fluctuations, market capitalization remains strong, indicating investor faith in long-term potential of digital assets. However, investors should remain cautious due to volatility and uncertainty in the market.

Nvidia Surpasses Meta and Tesla: AI Boom Ushers in Golden Age or Pitfalls Ahead?

The rapid rise of Nvidia’s market capitalization and AI investment signals a turning point for the tech industry, transforming gaming through AI-powered tech like Nvidia Avatar Cloud Engine. However, potential consequences, ethical questions, and societal implications must be addressed alongside embracing AI-driven innovation.

AI Boom and Tech Stocks Fuel RNDR Rally: Durable Growth or Short-Lived Hype?

RNDR cryptocurrency rallies alongside tech stocks, driven by the AI narrative and its unique integration of Apple ecosystem, Metaverse, AI, and 3D rendering capabilities. Future growth may depend on collaborations with tech giants and staying at the forefront amid competitive AI technologies and GPUs.

Stablecoins, Politics, and Regulations: Navigating the Crypto Market’s Calm Before the Storm

The cryptocurrency market experienced a flat week, with Bitcoin and Ethereum remaining stable. Meanwhile, ICP and LDO faced losses, while TRON rallied. The growing crypto market attracts political involvement, and regulatory bodies emphasize the need for clear guidelines and vigilance.

Terra Classic’s LUNC Price Plunge: Accurate Predictions and Alternative Investments

Terra Classic (LUNC) experienced a peak followed by a 50% decrease in value, which crypto traders Light Crypto and GCR attributed to a pump and dump staged by opportunistic developers and exchange operators. Investors are encouraged to diversify portfolios and explore promising alternatives like $COPIUM.

Crypto’s Role in Longevity: NewLimit’s Quest for Curing Aging and Blockchain Implications

NewLimit, a longevity pharma startup co-founded by Coinbase CEO Brian Armstrong, aims to extend human lifespan through epigenetic reprogramming. With $40 million raised in Series A funding, the startup explores the intersection of cryptocurrency, blockchain technology, and life sciences research, highlighting the potential convergence of these fields.

Meme Coins Resurgence: High-Risk, High-Reward Opportunities in the Crypto Market

Meme coins are back in trend, presenting high-risk, high-reward opportunities in the cryptocurrency market. Recently launched top meme projects include Pepe, Pooh, and GensoKishi Metaverse. Caution is necessary, as meme coins can prove highly unpredictable, and a thorough research is essential before investing.

Estonia’s Crypto Crackdown: Balancing Tech Adoption and Regulatory Compliance

Estonia enhanced its AML laws, impacting 400 Virtual Asset Service Providers (VASPs) that voluntarily shut down or lost authorizations. Despite stricter regulations, Estonia hosts 100 active crypto firms, showcasing the challenge of balancing safety and innovation in the crypto ecosystem.

Navigating Crypto’s Reputation: Overcoming Scandals and Embracing Blockchain Evolution

Recent incidents like hacks, ransomware attacks, and high-profile failures have contributed to a negative perception of cryptocurrency. It’s crucial to separate disruptive blockchain technology from shady acts and embrace regulation and rebranding to overcome setbacks and achieve widespread adoption.

Texas Crackdown on AI Crypto Scams: How to Protect Yourself and Recognize Red Flags

The Texas State Securities Board’s cease and desist order against promoters of TruthGPT Coin and Elon Musk AI Token highlights potential pitfalls in the crypto market. Investors are urged to remain vigilant against scams capitalizing on public interest in AI and crypto, particularly those made by unidentified individuals online.