“Dinari, a blockchain-based stock trading platform, has gained preliminary regulatory approval to tokenize stocks. This is a significant step forward in asset tokenization. Dinari’s plans are to simulate the US stock market within securities laws criteria.”

Search Results for: Nvidia

US-China AI Tug-of-War: National Security or Economic Coercion?

“The US aims to control investments in semiconductors, quantum computing, and AI technologies, leading to global effects. The friction is impacting global trade, with criticism of potential divergence from market principles. In response, China controls export of AI chip-making materials, while other countries contemplate the implications.”

Unpacking the AI Market Boom: Navigating Investment Trends Amidst Tech Revolution

“Morgan Stanley recently highlighted the transformative potential of AI across various industries, predicting a profound digital alteration and considering it a primary secular investment trend for the decade. Despite fears of a tech bubble, the AI index’s continuous growth and its ‘stickiness’, or potential to retain user attention, strengthen AI’s prospects.”

Cerebras and G42’s AI Supercomputer Partnership: A Game Changer or Risky Gamble?

“Cerebras Systems partners with UAE-based G42 to create a $100M AI supercomputer, possibly generating up to 36 exaFLOPs of AI computing. This could revolutionize sectors like healthcare and energy. However, American manufacturing and competitive challenges could disrupt plans.”

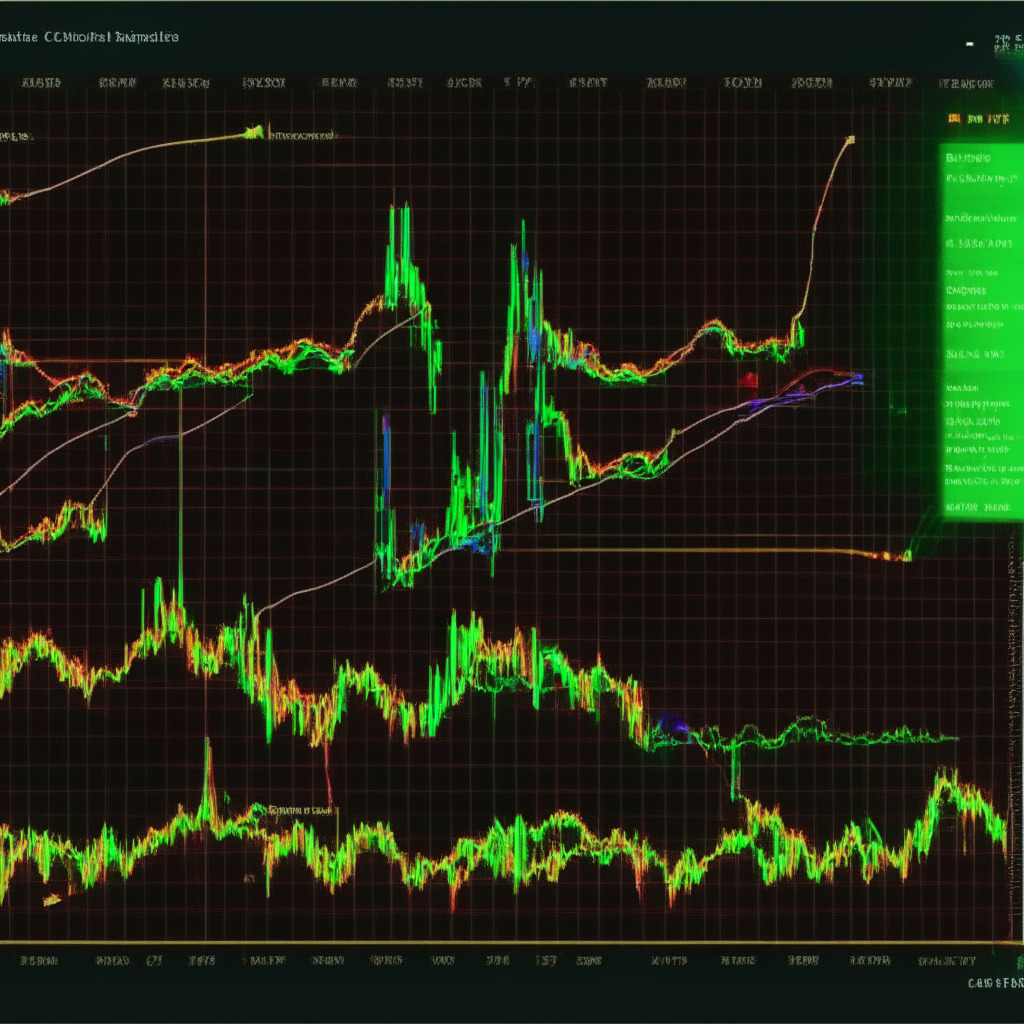

Predictions Versus Reality: The Unforeseen Surge of Crypto Amidst Adverse Predictions

Despite predictions of a fall in crypto prices in 2022 due to macroeconomic factors, the current landscape significantly diverges. Bitcoin’s value ascended impressively this year, buoyed by an influx of institutional capital. Liquidity easing in bond markets could potentially benefit crypto, and factors including attractive interest rates, a booming equity market, and regulatory advancements predict a bullish future for the crypto market.

Hive Digital Technologies: A Bold Move from Blockchain to AI and Cloud Computing

“Hive Blockchain, now known as Hive Digital Technologies, is refocusing towards AI, cloud computing revenues, and GPU mining. They plan to use Nvidia GPUs for cloud services, demonstrating a shift from traditional blockchain technology while not completely discarding it.”

AI-Boosted Crypto Tokens Soar Following Elon Musk’s New Venture Announcement: Promising Future or Eruption of Skepticism?

“AI-related crypto tokens such as SingularityNET (AGIX) and Fetch.ai (FET) soared after Elon Musk’s announcement of new AI company, xAI. The announcement triggered an interest in AI-related cryptocurrency, however, questions about xAI’s operational model and its effect on crypto tokens remain.”

Supercalculating the Future: AI, Blockchain, and the Surprising Resilience of Bitcoin Miners

Applied Digital Corporation (APLD) notably ventured into AI as its third business initiative, gaining attention for its strategic partnership with Hewlett Packard Enterprises (HEP) for the use of HPE Cray XD supercomputers. This partnership hopes to enhance APLD’s AI cloud service, potentially generating around $820 million over the next three years and compensating for the decrease in bitcoin prices.

GPU Shortage as a Catalyst for Web3: How Decentralized Infrastructure Networks Benefit AI Startups

The GPU shortage could accelerate the adoption of Web3 by mainstream thanks to decentralized physical infrastructure networks (DePIN). Protocols like Akash, enabling GPU leasing to AI start-ups, and Arweave, offering permanent data storage, could help alleviate resource issues. DePIN could provide inexpensive, reliable infrastructure for startups, shielding them from AI threats and offering advantages over Web2.

Massive Funding of Inflection AI: Bold Leap into Large-Scale AI or a Potential Setback

“Inflection AI, having secured $1.3B in funding from industry giants, plans to construct a 22,000-unit NVIDIA GPU cluster for large-scale AI models. However, some suggest that technological limitations could make these models inefficient, advocating for smaller, target-specific AI models instead.”

Amazon’s $100M Generative AI Fund: Economic Boon or Integration Challenge? Pros & Cons Explored

Amazon Web Services (AWS) has committed $100 million to support generative AI startups through its Generative AI Innovation Center. This technology, capable of producing innovative content, has the potential to add $4.4 trillion annually to the global economy and revolutionize diverse industries.

Iris Energy’s AI Expansion: Boon or Bane for Crypto Mining and Data Center Industries?

Iris Energy plans to increase its Bitcoin mining capacity by over 63% and transition to high-performance computing (HPC) data center strategy by early 2024. This move is fueled by growing AI data center demands, highlighting a trend among crypto miners who are expanding into AI cloud services.

Improbable’s MSquared: Fueling the Future of the Metaverse or Overpromising?

Improbable’s MSquared, a metaverse creation engine, is gaining interest through its early access and open-sourcing of Metaverse Markup Language. With support from tech giants like Google, Nvidia, and Dolby, MSquared aims to promote development of novel business models and enable unique experiences within a network of metaverses.

Gensyn Secures $43M: Decentralizing AI and Leveling the Playing Field for Developers

Gensyn, a UK-based provider of blockchain-powered computing resources for AI platforms, secures $43 million in Series A funding led by venture capital firm a16z. Gensyn aims to level the playing field by allowing developers to build AI systems on smaller data centers and personal gaming computers, fostering accessibility and connecting underutilized hardware globally.

AI-Based Coins Hit Hard by Regulatory Crackdown: Analyzing the Impact on Top Tokens

AI-based coins face a downturn amid ongoing regulatory turmoil in the crypto market. Top AI token, The Graph, experiences a 17% drop, while Render Token trades down 7%. Altcoins see severe impact, highlighting the need for comprehensive market research before investing in cryptocurrencies.

Exploring the Metaverse Gold Rush: Opportunities, Risks, and Investment Strategies

The metaverse industry is potentially worth trillions, with investments pouring into blockchain-based projects. However, market cap losses and speculative transactions warrant caution among investors. Despite challenges, tech giants like Microsoft, Apple, Nvidia, and Qualcomm continue developing metaverse strategies, indicating a promising future.

Rounding Bottom Pattern Predicts Render Token Uptrend: Analyzing AI Crypto Rally Potential

The Render token price recently displayed a rounding bottom pattern, suggesting a potential uptrend. A trendline governs the ongoing recovery rally, and after a resistance breakout at $2.45, a 24% rally is anticipated. The formation of the rounding bottom pattern indicates a steady recovery for RNDR, with no major resistance expected until the $3.3 mark.

AI Tokens: Riding the Wave of Apple VR Headset & Market Frenzy – Weighing the Risks

AI tokens like Render and SingularityNET are gaining prominence in the crypto market due to mainstream AI adoption. Render’s blockchain-based GPU rendering network may benefit from Apple’s anticipated 2023 VR headset launch, driving potential Render token price increases. Market conditions can change rapidly, so thorough research is advised.

AI Coins on the Rise: GRT, AGIX, and RNDR Show Potential for Long-Term Gains

The crypto community is eyeing AI coins like Graph (GRT), SingularityNet (AGIX), and Render Token (RNDR) for potential growth. As AI technology adoption increases, these discounted AI coins may offer investors attractive opportunities amid a generally bullish market trend.

Microsoft-CoreWeave Deal: The Growth of AI Tech and Its Impact on Blockchain and Crypto

Microsoft’s multi-billion-dollar deal with former Ethereum miner, CoreWeave, raises concerns in the crypto community while demonstrating the ability of blockchain-based firms to pivot towards new technology sectors, such as AI cloud computing and machine learning. This collaboration also highlights questions about AI tech’s impact and potential dangers of unchecked innovation.

Ripple Effects of FTX Collapse: Analyzing Industry and Regulatory Impacts

FTX’s collapse led to a ripple effect on crypto companies like Silvergate Bank, BlockFi, and Genesis Global Capital, debanked crypto firms, and a regulatory crackdown. Binance considers boosting compliance, while Tether plans sustainable BTC mining in Uruguay. Nvidia, Microsoft, and other tech companies advance AI technology and NFT marketplace, Tabi raises $10 million for gaming ecosystem development.

US Default Averted: Market Optimism Fuels Crypto Rally and Debate on Future Prospects

US futures surged on Thursday as the House of Representatives passed a crucial deal averting a dangerous US default. Combined with hints of a pause in interest-rate hikes, this sparked optimism in the market. Positive trends were observed in S&P 500, Dow Jones Industrial Average, and Nasdaq Composite futures, while tech-heavy Nasdaq experienced a slight setback. The broader cryptocurrency market may also be impacted by this development.

Bitcoin’s Decoupling from Tech Stocks: Pros, Cons and the Future of Crypto Investments

Bitcoin’s correlation with tech stocks has weakened, as it faces a 3% dip and trades under $27,000 amidst a Nasdaq 100 rally driven by AI interest. As dynamics within crypto and tech spaces continue to evolve, monitoring market movements and research are crucial for investment decisions.

Cryptocurrency Volatility: Navigating Price Drops, Regulatory Woes, and Future Potential

The cryptocurrency market sees significant shifts and volatility, with major digital assets like BTC, Ethereum, and Ripple experiencing declines. However, some cryptocurrencies defy the trend, like Stellar and OmiseGo, indicating a possible larger shift. Investors should monitor this landscape, considering both potential growth and decline, understanding risks in this fluctuating market.

AI Token Mania: The Real Deal or Just Hype? Pros, Cons, and Key Conflicts Explored

The AI mania has generated demand for AI crypto tokens like RNDR and AGIX, with values surging. However, industry experts question the compatibility between AI and crypto technologies, and whether this trend will result in lasting demand for AI tokens.

Cryptocurrency Rollercoaster: The Future Amid Fluctuations and Divergent Opinions

Cryptocurrencies face significant fluctuations, raising questions about their stability and long-term potential. Despite a promising future due to blockchain’s increasing acceptance, concerns persist regarding regulatory frameworks, price volatility, environmental impact, and the performance of smaller digital assets.

Balancing AI Innovation and National Security: China and US Strive for Tech Dominance

Chinese officials express concern about artificial intelligence (AI) posing national security risks. As AI development accelerates, China pushes for tighter controls and regulatory “guardrails” to manage potential negative consequences, while still fostering innovation.

AI Boom and Tech Stocks Fuel RNDR Rally: Durable Growth or Short-Lived Hype?

RNDR cryptocurrency rallies alongside tech stocks, driven by the AI narrative and its unique integration of Apple ecosystem, Metaverse, AI, and 3D rendering capabilities. Future growth may depend on collaborations with tech giants and staying at the forefront amid competitive AI technologies and GPUs.

Pandemic-Accelerated AI Boom: Impact on Tech Stocks and Balancing Market Optimism

Pandemic-fueled innovation in AI has catalyzed unprecedented growth in the tech industry, benefiting hardware manufacturers like NVIDIA, and software companies including Meta and Microsoft. Amid financial boons, a balance of optimism and caution is required to navigate AI’s evolving landscape and potential pitfalls.

Debt Ceiling Negotiations: Predicting Bitcoin’s Fate Amid U.S. Economic Climate Shifts

As U.S. debt ceiling negotiations progress, Bitcoin and Ether maintain stability amidst uncertainty. Dave Weisberger, CEO of CoinRoutes, outlines three potential scenarios impacting crypto markets tied to debt ceiling outcomes. Meanwhile, Blend acquires 82% of NFT lending market share, and Nvidia’s stock soars by 25% due to its GPUs’ value in crypto mining and AI applications.

AI-Powered Cryptocurrency: Booming Market Frontier or Security Risk?

AI’s rapid progress has led to a surge in AI-related cryptocurrencies, with projects like AiDoge and yPredict gaining attention. Despite facing challenges like market volatility and potential security risks, this intersection offers abundant potential for technological breakthroughs and investors in the long run.

Debt Ceiling Negotiations Impact on Bitcoin: Analyzing Market Trends and Future Predictions

The ongoing debt ceiling negotiations are a primary concern for crypto investors, impacting Bitcoin and the broader crypto market. Market analysts believe regulatory developments and next year’s Bitcoin halving event could significantly influence the crypto market, while recent U.S. labor market data has not affected asset prices, signifying a shift in market sentiment.