The unanticipated inspection of Paris-based Worldcoin’s office by France’s data watchdog, the CNIL, has intensified debates over its privacy protocols. This event underscores the strict scrutiny crypto projects are subjected to and the growing worries surrounding user privacy and data storage.

Search Results for: Safe

Shackles or Safeguards? Federal Reserve’s Crypto Oversight Fuels Global Expansion

The Federal Reserve’s intensified scrutiny of banks’ cryptocurrency activities has sparked criticism from Republican lawmakers who argue this deters institutions from participating in the digital asset landscape. The Fed’s new requirements may potentially suppress the progress of decentralized finance. Amidst this, U.S. regulations on digital assets remain unclear, pushing some crypto companies to explore alternative markets overseas. The discourse focuses on balancing effective supervision with fostering blockchain innovation.

Crypto Safety Compromised: Debating the Fallout of FTX Exchange Shutdown and Rising Phishing Attacks

After a major exchange shutdown, customers of FTX are still facing issues including a fresh phishing attack that targets their emails. In a SIM swapping attack, customer information from FTX, Genesis, and Blockfi were compromised. A dubious proposal claiming to recuperate lost capital asked customers to link a crypto wallet to their account, potentially risking a complete drain of token holdings.

Binance Strategy for Low-Liquidity Projects: A Safety Measure or a Possible Dilemma?

“Binance, a leading crypto exchange, is considering partnering with low-liquidity crypto projects to enhance market liquidity and curb potential price manipulation. However, its proposal to take a stake from these projects’ circulating tokens could introduce unforeseen issues, including potential conflicts of interest and market distortion.”

Ethereum’s Balancer Protocol Security Concern: The Persistent Challenge of Blockchain Safety

“The blockchain space faces security concerns following a vulnerability warning by Ethereum and DeFi protocol, Balancer. Balancer disclosed $2.8 million hangs in balance, urging users to withdraw their assets. Despite the risk, the incident underscores the importance of maintaining solid security within the blockchain technology.”

Decentralized Science and Blockchain: Revolutionizing Longevity Research or Undermining Safeguards?

The recent Longevity+DeSci Summit in New York introduced the concept of Decentralized Science (DeSci), conducted outside traditional academic frameworks. This innovation, particularly when blended with blockchain technology, could revolutionize longevity sciences and provide alternate funding to traditional NIH grants for biotech firms. However, this shift also raises ethical questions.

Facebook’s Crypto Ad Conundrum: Promoting Blockchain Innovation and Ensuring User Safety

Under growing global regulatory scrutiny, Meta (Facebook) faces ultimatums from Thailand’s DES against fraudulent cryptocurrency scams advertised on its platform. Via lax ad regulations, Facebook’s increasing embrace of blockchain and crypto simultaneously invites potential misuse by malicious actors, emphasizing the need for responsible blockchain adoption.

FTX Legal Ordeal: Unfolding Drama, $176 Million at Stake, and Future of Crypto Safety

FTX cryptocurrency exchange faces a legal filing involving a proposed settlement with Genesis entities worth $176 million. If successful, FTX and its affiliates could bypass various complications and gain significant economic advantages. Wider discussions highlight the crucial role of such legal decisions in shaping future cryptocurrency regulation and safety.

The FBI’s Rising Stance Against Cryptocurrency Scams: A Step Towards Safer Crypto Future

The FBI has seized $1.7 million worth of cryptocurrencies amid a crackdown on unlawful activities. The law enforcement agency has voiced its stance against those aiming to exploit the crypto landscape for malicious purposes, urging caution against get-rich-quick schemes. The last year’s scams, reaching over $2 billion, necessitate the FBI’s increased regulatory involvement.

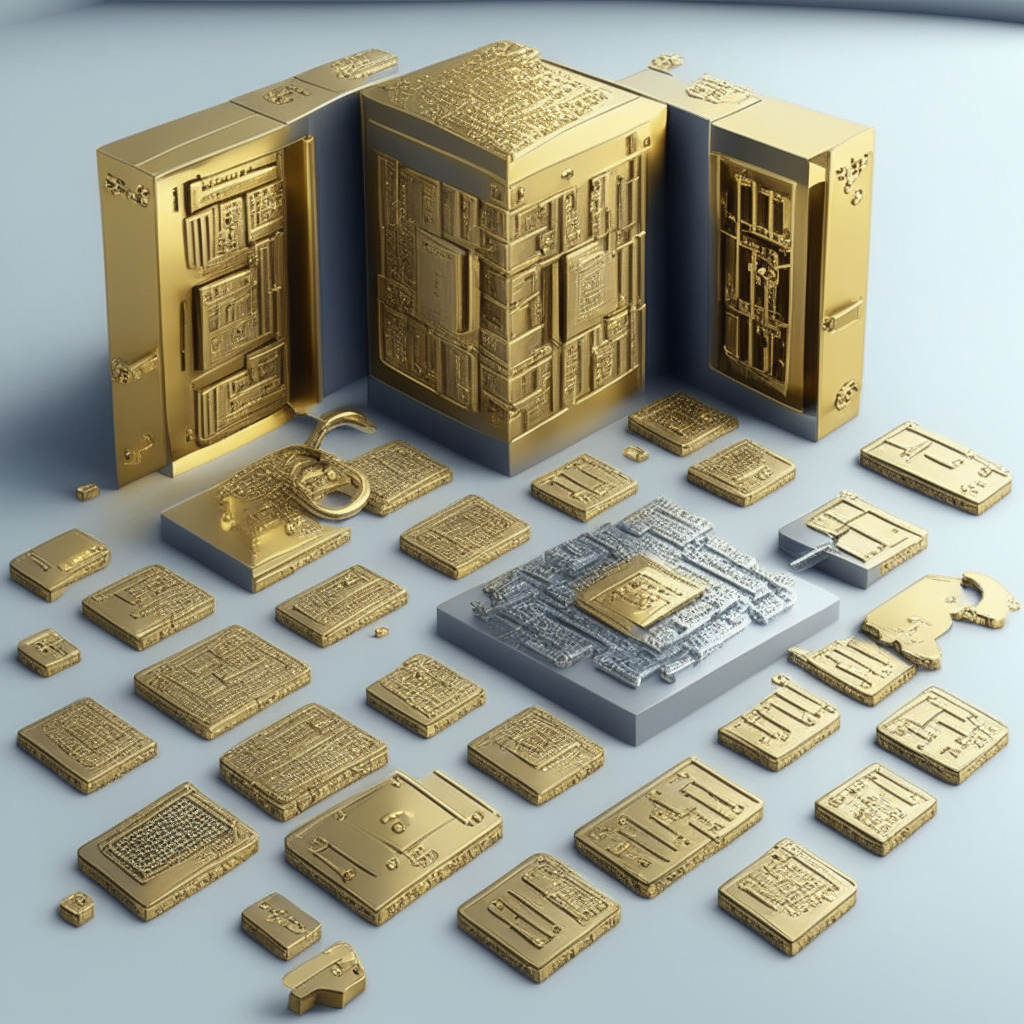

Securing the Gatekeepers: Safeguarding Your Cryptocurrency Private Keys

“Private keys in the digital asset universe are secure gatekeepers, providing access to your prized cryptocurrencies and data. Secure storage methods include hardware wallets, paper wallets, encrypted USB drives, cold storage, cryptocurrency vault services, password managers, and key-splitting. Your choice should consider your specific needs, tech expertise, and risk tolerance.”

Sei Labs Mainnet Live: Revolutionizing Asset Exchange or Risking Safety Protocols?

“Sei Labs recently announced its layer 1 blockchain “Sei” is live after a successful testnet phase with SEI, Sei’s native token, listed on prominent exchanges. Sei intends to simplify asset exchange including Non-Fungible Tokens (NFTs). However, they are also focusing on gaming, social platforms, and carbon credits, not just DeFi assets.”

Dissecting DeFi Security: An Unnerving Ride with Hacks, Investments, and Future Safety Measures

“In the face of security breaches in the DeFi sector, such as the infamous Curve Finance hack, the industry remains resilient. Major developments include Binance’s $5 million investment in Curve, and collaborations between Aptos and Microsoft for Web3 solutions. Despite the security challenges, the sector continues striving for its ambitious goals, while addressing the critical necessity of transactional security.”

Bitget Wallet: A Beacon of Safety or A Potential Threat in a Volatile Cryptocurrency Landscape?

Bitget Wallet, previously BitKeep, recently created a $360 million User Protection Fund to enhance security following a malware incident that led millions into loss. The wallet now includes stable payment channels and a P2P marketplace for smoother transactions, while underlining the importance of user education, stringent security measures, and swift responses to breaches.

Navigating France’s Revamped Crypto Regulation: Balancing Investor Safety & Market Growth

France’s Autorité des Marchés Financiers (AMF) is updating its digital asset regulatory structure in preparation for the new Market in Crypto Asset (MiCA) regulation. The changes target the General Regulation and the registration process for Digital Asset Service Providers (DASPs), requiring timely disclosure of novel developments to regulatory bodies.

Crypto Resurgence and the Threat of Sham Tokens: A Guide to Navigating the Blockchain Market Safely

“Today’s crypto sphere sees Bitcoin nearing $30,000, attributed to the unexpected fall in global long-end government bond yields, reacting to China’s disappointing trade record. Concurrently, PYUSD tokens scams alert investors to verify token legitimacy due to unscrupulous market exploits triggered by PayPal’s recent stablecoin launch.”

PayPal’s Stablecoin Revolution: Evolving Crypto Landscape with Regulatory Safeguards

PayPal launches its own stablecoin, PYUSD, representing a pioneering move in bringing regulatory oversight and customer asset protection to the crypto world. The coin, developed with Paxos, is closely monitored by the New York Department of Financial Services to secure it against bankruptcy risks.

Balancing Blockchain Regulation: Safeguarding Security or Stifling Innovation?

“The blockchain technology space is experiencing scrutiny regarding digital assets regulations due to North Korea’s alleged illicit cryptocurrency activities. Reducing such practices necessitates governmental involvement, but regulations should also foster innovation. The balance between regulation for protection and space for innovation will significantly determine the industry’s future.”

Regulating the Crypto Frontier: Stifling Innovation or Safeguarding Investors in Ukraine?

The National Bank of Ukraine’s increased control over local crypto firms has been met with concern. The bank’s demand for full financial transparency raises questions about the potential stifling of this burgeoning industry. Yet, despite the harsh regulatory landscape, the Ukrainian market holds untapped potential, suggesting that this regulatory turbulence could drive Ukrainian crypto stakeholders towards international success.

New Phishing Technique: The $20 Million ‘Zero Transfer’ Crypto Hack & How to Stay Safe

The cryptocurrency sphere has recently witnessed an innovative ‘Zero Transfer’ phishing attack that has cost us over $40 million in losses so far. The scam preys on our habit of overlooking the middle parts of a wallet address, tricking us into sending a transaction for zero tokens to a scammer’s address. This incident reminds us that technological advancements need robust safety systems to protect against risks.

Nigeria’s Cautious Stance on Crypto: Balancing Investor Safety and Industry Growth

“The SEC of Nigeria has warned investors against interacting with crypto exchange, Binance, citing its lack of necessary local operating license. This highlights the regulatory challenges confronting the evolving blockchain sector, which could potentially hinder innovation and growth.”

Navigating the Controversy: Worldcoin’s Retinal Scans Stir up Crypto Scepticism and Safety Debates

Worldcoin, a project aiming to authenticate users via retinal scans for a global digital currency, faces scrutiny over its biometric data collection methods from various European authorities concerned about potential user risk. Amidst this flak, Worldcoin is still attracting significant interest, exemplifying the ongoing conflict between fostering innovative growth and ensuring security in the crypto space.

Tether’s Surge amid Wagner Uprising: Cryptocurrencies as Safe Havens or Volatility Traps?

“In June, Wagner Group’s actions triggered a 277% surge in Tether trades amidst political turbulence in Russia, symbolizing crypto’s role as a safe haven. Yet, the volatility presents a paradox concerning cryptocurrencies’ reliability as a secure alternative during unrest.”

Banking Crisis Ripple: Heartland Tri-State Bank’s Collapse & Its Implications on Industry Safety

“The disruption in the U.S. banking sector, illustrated by the recent collapse of Heartland Tri-State Bank, is attributed to rising U.S. interest rates and inadequate risk management. This crisis highlights a need for improved banking system safety measures and increased bank executive accountability.”

Stablecoins: A Safer Alternative to Banking or a Risky Proposition?

“Brendan Malone, a former Federal Reserve Board analyst, posits stablecoins might pose less risk than traditional bank deposits. Stablecoins, such as Tether’s USDT and Circle’s USD Coin, offer an efficiency-laden alternative to traditional banking, given its insulation from the typical crypto volatility.”

India’s Crypto Dilemma: Balancing Innovation, Safety, Sovereignty in Turbulent Cryptocurrency Waters

India’s Supreme Court has voiced concern over the’ ongoing delay in setting clear crypto regulations by the union government, amid increasing crypto-related criminal activities. Despite intense trading volumes and central interest in the crypto market, the government’s unclear guidelines and imposed taxation laws risk pushing established firms overseas.

Unmasking the Two Faces of DeFi: The Lure of Freedom and the Lingering Concerns of Safety

“Decentralized finance (DeFi) brings transparency and freedom from centralized authorities, yet lack of regulatory oversight leaves safety in question. Despite allowing for more financial services and privacy, DeFi carries potential risks, including loss of funds due to wrong transactions or lost keys.”

Cracking the Crypto Conundrum: Balancing Decentralization and Regulation Safeguards

The CFTC has charged a Tennessee couple for defrauding investors through a crypto investment scheme, collecting $6 million in six months. The case underlines the importance of stricter regulations in the crypto sector to protect investors and maintain system integrity.

Cryptosphere Weekly Roundup: Market Fluctuations, Sec Regulations, and Wallet Safety

“In a tumultuous week for the cryptosphere, signs of a five-quarter drop in crypto investment emerged, yet developments like Neon EVM’s unique offering to build Ethereum applications on Solana, showed promise. Amidst market fluctuations, regulatory pressures and unique crypto innovations, this sector’s dynamics continue to surprise, underscoring the importance of wallet safety in navigating the digital ocean.”

AI Safety: Industry Giants Pledge, Challenges Lie Ahead, Future Perspectives Unfold

“Major artificial intelligence firms, including Google, Microsoft, and OpenAI have pledged towards creating a future where AI is secure, transparent, and safe for users. This commitment encompasses pre-release security testing, investing in cybersecurity, establishing threat safeguards, enabling third-party vulnerability reporting, and navigating global regulatory frameworks.”

Navigating Cryptocurrency Scams: Uniswap, Binance and the Real Cost of Online Safety

“In the face of rising phishing and social engineering scams in the cryptocurrency industry, Binance CEO suggests the use of hardware devices for two-factor authentication (2FA). Among proactive measures, experts recommend robust security applications such as Google Authenticator over traditional methods like SMS to counter threats.”

Kuwait’s Cryptocurrency Prohibition: A Setback or Necessary Safety Measure?

Kuwait’s primary financial regulator, the Capital Markets Authority (CMA), has issued an “absolute prohibition” on most cryptocurrency activities, including payments, investments, and mining. They warned about the risks of virtual assets, highlighting cryptocurrencies’ lack of legal status. This major decision sparks debate about its efficacy in combatting money laundering and terrorist financing.

SEC’s Cry for More Crypto Oversight: A Safety Net or A Threat to Innovation?

“SEC Chairman, Gary Gensler, seeks a significant budget increase to strengthen crypto market regulations, arguing it’s currently a ‘Wild West’ of noncompliance. This move could enhance investor safety but potentially stifle tech innovation in this emerging industry.”