“Bitcoin trading volumes have dipped below the $5 billion mark due to an ongoing power crisis in Texas impacting cryptocurrency miners. However, increasing signals from influential parties indicate growing acceptance of digital currencies like blockchain-based tokens from JPMorgan aimed at revolutionizing fund transfers.”

Search Results for: Texas

Navigating Turbulence: Crypto Lending, Slumps, and Bold Moves in Blockchain Landscape

“Crypto giant Coinbase unveils its lending platform targeted to institutional investors amidst turbulent crypto market conditions. Meanwhile, Google’s new ad policy will allow promotion of blockchain-based NFT gaming, hinting at further acceptance of digital assets.”

Navigating the Global Ambitions of Coinbase: Expansion, Investments, and Hurdles Ahead

“Coinbase’s ‘Go Broad, Go Deep’ global expansion includes acquiring licenses and enhancing market presence in regulatory clear countries like Europe, Canada, Brazil, Singapore, and Australia. It added six new projects to its Base Ecosystem Fund while cryptocurrency startup LBRY battles a legal charge brought by the SEC.”

Unveiling the Dark Side of Crypto: The MTI Case, Regulatory Challenges and Forward Steps

“CFTC imposed a $1.7 billion fine on Mirror Trading International for fraud, revealing systemic issues plaguing the crypto space. The case emphasizes the necessity for change and serves as a reminder for investors to be wary of potential fraud, misconduct, and market manipulation.”

Ethereum Threatens Bitcoin’s Supremacy Amid Marathon’s Production Dip and Grayscale’s Exposed Wallets

Bitcoin’s market position becomes increasingly complex with dips in mining due to hot weather and revealed wallet addresses for the Grayscale Bitcoin Trust. Meanwhile, Ethereum’s surging trading volume challenges Bitcoin’s dominance, as the future of Bitcoin is shaped by evolving developments and market fluctuations.

Riot Platforms’ Energy Saver Strategy: A Game Changer in Bitcoin Mining Operations

Riot Platforms, a well-known Bitcoin mining company, saved roughly $31 million in August through a novel energy strategy. This strategy not only reduces Riot’s Bitcoin mining costs but also reinforces its position as a low-cost leader within the industry. Its efficient miner fleet and robust financial standing make it a major contender in Bitcoin’s anticipated ‘halving’ event next year.

The Fall of Celsius: A Cautionary Tale of Blockchain Revolution and Its Risks

“Alex Mashinsky, ex-CEO of the defunct crypto lender, Celsius, faces federal court restrictions due to fraud allegations, including overselling Celsius’ financial health and indulging in risky trading practices. Legal action includes civil lawsuits and a potential $4.7 billion fine. The Celsius saga exemplifies the potential risks and rewards of the blockchain revolution.”

Frozen Assets in Cryptospace: A Dance between Innovation and Regulation

The US court has frozen former Celsius CEO, Alex Mashinsky’s assets amidst ongoing charges against him. This highlights increasing regulatory scrutiny in the crypto industry, raising concerns of stifling technological advancement while stressing accountability and consumer protection. The growing tension between innovation and regulation could potentially impact blockchain’s future.

Mining Uncertainties: How Weather Influenced Marathon’s Bitcoin Production in August

“Marathon’s August Bitcoin mining rate slid 9% due to unfavorable weather conditions, yet showed a fivefold increase from August 2022. Despite environmental challenges, the US-based crypto mining operator is pursuing growth targets and new facilities, underlining both the potential rewards and inherent volatility of the cryptocurrency industry.”

Kentucky’s Cold Shoulder to Cryptominers: Climate vs Crypto Economy

“Kentucky’s Public Service Commission rejected a proposal from Ebon International for discounted energy rates for a cryptocurrency mining facility. The decision was welcomed by environmental advocacy groups warning of increased environmental and fiscal burdens from large-scale crypto mining operations.”

Bitcoin Mining: A Hidden Champion in Green Energy Revolution or Grid Nightmare?

Bitcoin miners, against popular belief, are actually evolving to become beneficial players in grid optimization and the ongoing green transition. They leverage underutilized renewable energy sources, partake in grid-flexibilization initiatives and provide a unique capability for swift power usage adjustments. They suggest new strategies for energy-intensive industries to navigate the renewable energy landscape.

Iris Energy’s $10M Nvidia GPU Investment: Advancing Bitcoin Mining & AI or Overburdening Power Resources?

Iris Energy acquires 248 state-of-the-art Nvidia GPUs worth $10 million, aiming to explore the domain of generative AI and Bitcoin mining. The company, already operational in renewable-rich locations, faces competition from Genesis Digital Assets Limited and sustainability concerns. Critics fear overburdening power resources and possible future bubble bursts.

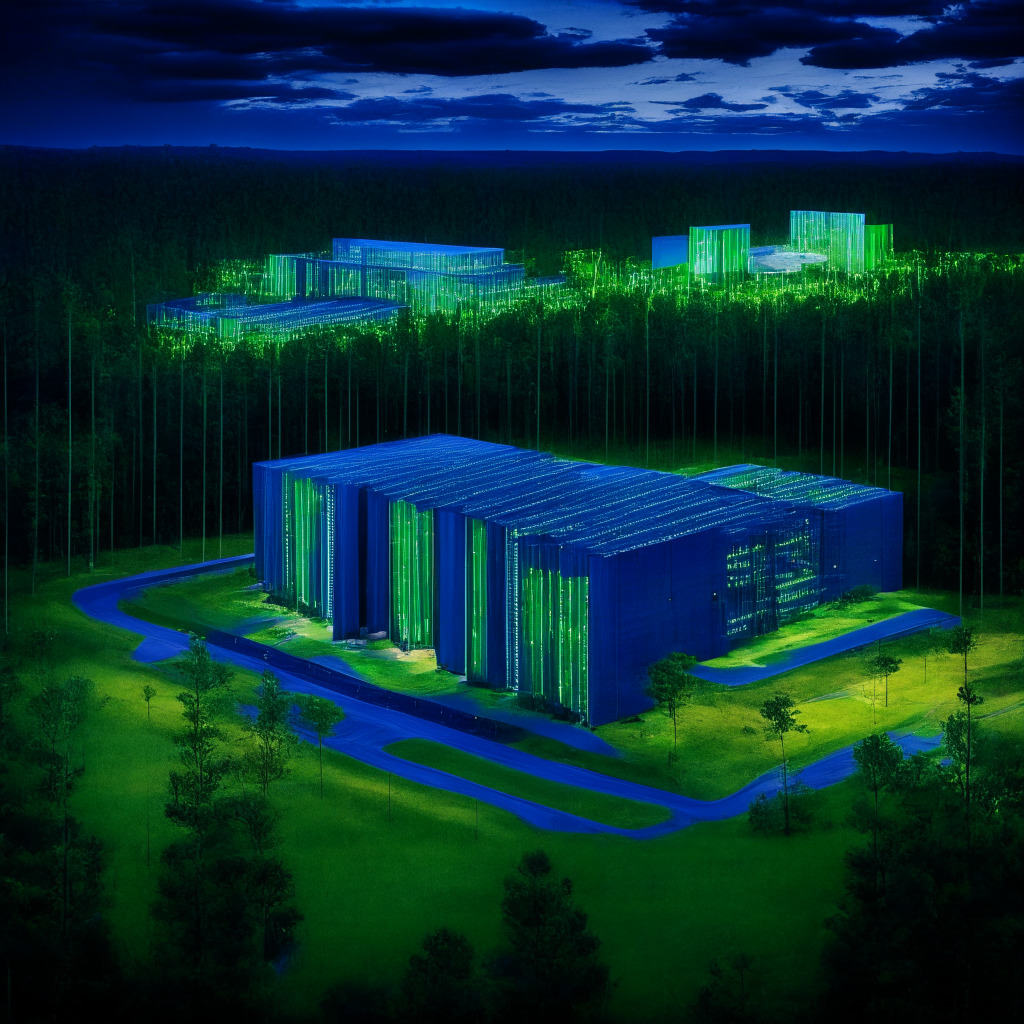

Hydro-Powered Bitcoin Mining: Pioneering the Green Crypto Future or Exacerbating Energy Woes?

Bitcoin mining is moving towards renewable energy, with Genesis Digital Assets Limited opening a hydroeletricity-powered data center in Sweden. This reflects a trend, proving that Bitcoin mining and clean, renewable energy can coexist, which potentially addresses the industry’s environmental concerns.

Farewell to the Airdrop: Web3’s Future and the Ever-Evolving Landscape of Blockchain

“The Airdrop’s final voyage highlights the undeterred interest in the technological, economic, and cultural shifts towards a decentralized internet and creator economy. While coverage of NFTs, Metaverse, and DAOs decreases, the focus remains on innovative real-world blockchain applications and the future of the internet.”

Upholding Sanctions on Crypto Mixer Tornado Cash: A Regulatory Triumph or Freedom Infringement?

“A federal judge in Texas validated sanctions on Tornado Cash, a crypto mixing service, dismissing concerns that the Treasury Department overstepped their jurisdiction. This significant precedent for regulatory authority over crypto services underscores the need to balance user anonymity with oversight for illicit activities.”

Blockchain regulation: A deep dive into the Tornado Cash vs Treasury case and its implications

“The case underscores a delicate dynamic in the blockchain world – the continuous tussle between freedom and control, between decentralized finance and government intervention, each with weighty implications on the other. This case symbolizes a battle of principles, signaling a profound shift in the future of blockchain technology.”

Clash of the Titans: Crypto Community vs U.S. Treasury in Tackling Anonymity and Regulation

“Regulation in the crypto world came under scrutiny after a lawsuit backed by Coinbase challenged the U.S. Treasury Department’s sanctions on Tornado Cash, a crypto transaction platform. Despite uproar from the crypto community, a judge ruled that the Treasury acted within its powers, escalating the ongoing tension between crypto advocates and regulatory bodies.”

The Downfall of Las Vegas Crypto Custodian Prime Trust: An Inside Look into the Bankruptcy Fallout

“Las Vegas cryptocurrency custodian, Prime Trust, filed for Chapter 11 bankruptcy amid liabilities ranging from $100 to $500 million. The future of this fintech enterprise now heavily depends on solving regulatory challenges and finding a willing buyer. Widespread financial turmoil has been revealed within the company, with debts surmounting to over $85 million in fiat and $69.5 million in cryptocurrency.”

Crypto Celebrity’s Lawsuit Withdrawal: Embezzlement Allegations, Community Support, and Lingering Doubts

“In a surprising turn, Taiwanese music celebrity Jeffrey Huang withdrew a defamation lawsuit against internet investigator ZachXBT, after revisions to an article sparked tensions. This incident underscores the crypto community’s volatility, the importance of reliable information, and raises questions about truthfulness.”

Galaxy Digital Turns Tide Amidst Bitcoin Surge: Balancing Skyrocketing Profits and Regulatory Hurdles

Galaxy Digital, led by CEO Michael Novogratz, managed to drastically reduce losses from $555 million in Q2 2022 to a significantly lower $46 million in this year’s second quarter, largely thanks to Bitcoin’s 80% surge. Despite a 54% dip in trading revenues, the company’s asset management division saw a 619% revenue increase and its mining revenue grew by 51%. However, the company is facing regulatory uncertainties in the US.

Harnessing Green Solutions: How Bitcoin Mining Could Drive Us Towards A Carbon-Neutral Future

“Bitcoin mining’s energy consumption has raised environmental concerns. However, recent innovations like flare gas solutions and nuclear energy are promising enhancements. Harnessing flare gas, an underused resource, for mining operations could drive a carbon-neutral era. Further potential lies in microgrids and nuclear power, despite safety and regulatory concerns. All these seek to incentivize blockchain use beyond Bitcoin mining, significantly reducing the industry’s carbon footprint.”

Bitcoin Mining Giants Take the Green Leap: Genesis Digital Assets Expands in South Carolina

Genesis Digital Assets (GDA) inaugurated three eco-friendly data centers in South Carolina, contributing to over 2% of the total Bitcoin network hash rate. These expansions notably utilize local energy resources, strengthen local energy grids, and align with GDA’s clean energy ethos, potentially leading crypto mining towards a more sustainable, eco-friendly future.

Crypto Giant’s Expansion: Genesis’ New Data Centers and the Push for Eco-Friendly Mining

Genesis Digital Assets has expanded their cryptocurrency mining operations with three new data centers in South Carolina, marking its strategic move into the North American market. CEO, Andrey Kim, emphasizes the company’s aspiration for industry leadership in environmentally-friendly Bitcoin mining.

The SEC Caution to Crypto Accounting Firms: Transparency vs. Honest Endeavors

The SEC’s chief accountant, Paul Munter, issued a statement warning accounting firms against working with crypto platforms beyond comprehensive financial audits. He believes crypto firms may selectively present their business to deceive accounting firms and clients. Meanwhile, Commissioner Hester Pierce countered this, saying such caution could inhibit crypto platforms’ honest efforts.

The Thrills and Spills of Home Crypto Mining: Endurance Amid Industry Giants

The world of crypto mining has evolved into a dominion of large-scale mining and finance behemoths, making individual mining increasingly doubtful due to high electricity and equipment costs. Despite these challenges, diehard enthusiasts continue to innovate solutions, believing in the potential of the crypto market.

Digital Dollar Race: Wyoming’s State Stablecoin and the National Push Towards Blockchain Adoption

“Wyoming seeks to establish a state stablecoin, with the state posting a job opening for a Stable Token Commission head to create legislative frameworks for the project. Meanwhile, Texas lawmakers aim to create a gold-backed digital currency, indicating an emerging inter-state rivalry in digital currency initiatives.”

Argo Blockchain’s Survival Strategies in the Volatile Crypto Market: Sacrament or Sacrifice?

Argo Blockchain recently raised 5.7 million pounds by selling new shares to alleviate the company’s debts. However, with these shares constituting approximately 12% of the pre-sale market cap and sold at about a 14% discount, this could have implications on investor sentiments. Despite strategic moves like selling its mining facility and securing a loan with its mining equipment as collateral, ARB’s shares have dropped by almost 20%. The company’s situation underlines the inherent volatility and uncertain nature of the crypto market.

Marathon Digital’s Mining Decline Vs the Foul Play in Crypto Markets: A Tale of Ups and Downs

“Marathon Digital’s Bitcoin mining yield declined due to adverse weather and lower transaction fees, despite a 599% increase from June 2022. However, Bitcoin miners reportedly earned $184 million in Q2 2023. Yet, hacking risks and operational challenges linked to climate change remind us of the industry’s instability, insisting on continued vigilance and resilience.”

Bittrex Exchange Under Florida’s Regulatory Scrutiny: An Omen or An Opportunity for Crypto?

“Bittrex, a cryptocurrency exchange, is under Florida’s financial regulator scrutiny for alleged law violations, including failure to separate customer assets from operational funds. Earlier, Bittrex had announced plans to withdraw its US operations following a $53 million fine.”

The AI Revolution in Crypto Trading: Pioneering Change or Mere Hype?

“The integration of AI in crypto markets could undermine traditional trading wisdom, argues blockchain consultant Sheraz Ahmed. AI trading bots are transforming profit realizations while drawing scepticism about their current capabilities. However, the potential of AI outperforming human traders and changing the mechanisms of trading seems indefeasible.”

Bittrex Inc. vs the Florida OFR: Navigating regulatory hurdles in Crypto’s Future

“Bittrex Inc., a crypto exchange, faced several allegations including mixing customer assets with the firm’s capital and neglect of maintaining a surety bond, leading to its bankruptcy filing. With regulatory scrutinies and legal battles, the crypto future is filled with complexities and regulatory challenges.”

Hut 8’s Shift from Bitcoin Mining to AI: The Future of Tech or a Temporary Lifeline?

“Hut 8, a previously struggling Bitcoin mining company, plans an ambitious revival by setting up in the United States and incorporating high-performance computing and AI. This move, spurred by industry rebound and Bitcoin mining profitability surge, illustrates a growing trend of integrating cryptocurrency with cutting-edge technology.”