The UK’s Financial Conduct Authority (FCA) has demanded crypto firms to adhere to upcoming marketing regulations. Very few firms responded to their attempts at communication. The FCA warns non-compliance could be considered a criminal offense and lead to serious consequences including removal from digital platforms in violation of Anti-Money Laundering and Counter-Terrorist Financing regulations.

Search Results for: United Kingdom

UK’s Virtual Parliament on Metaverse: Blockchain Prowess Versus Regulatory Endeavors

In a virtual parliament session, politicians in the UK discussed their plans for the blockchain and Web3 industries, highlighting the potential of the U.K. becoming a profoundly blockchain-enabled “smart country.” Despite this, current regulations could possibly restrict blockchain and Web3 growth and innovation.

U.S. Regulatory Hurdles: Driving Crypto Startups Towards Friendlier Shores?

“Ripple’s CEO, Brad Garlinghouse, argues that the U.S. is the worst country for crypto start-ups due to its hesitance towards digital asset innovation. He highlights the UK, Singapore, UAE, and Switzerland as nations nurturing such innovation. Aggressive lawsuits by SEC and CFTC complicate the implementation of crypto regulations in the U.S., possibly inducing a mass exodus of blockchain startups to friendlier jurisdictions.”

Navigating the French Finfluencer Landscape: Decoding the ‘Responsible Influence Certificate’

France is introducing a ‘Responsible Influence Certificate’ for finance bloggers or “finfluencers” to bring more oversight and credibility into promotion of investment products, including cryptocurrency. Despite not being obligatory, it represents a potential regulation method for online financial advice.

Coinbase’s Global Game Plan: Tapping into Foreign Markets Despite US Regulatory Tensions

Coinbase, a global digital asset exchange, plans to expand its operations into Canada, the UK, Australia, Brazil, Singapore, and the European Union, prioritizing these markets due to more progressive digital asset regulations. This decision came after acknowledging restrictive regulations in the US market as a significant impediment. Key strategies for expansion include partnering with banks, payment service providers, and increasing local community engagement.

Coinbase’s New Expansion: A Strategic Move or Industry Pressure?

Coinbase, a top crypto exchange, aims to expand to non-U.S. markets, prioritizing countries with clearer crypto regulations. The company’s strategy includes acquiring licenses, setting operations, and registering in these markets. It points to a lack of crypto-forward regulation in the U.S., potentially impacting its influence in the crypto field.

FCA Extends Crypto Marketing Compliance Deadline: Breathing Space or Consumer Risk?

“The UK’s Financial Conduct Authority could extend the deadline for crypto companies to comply with its marketing rules until January 8, 2024. This move underlines the need for crypto firms to provide transparent and honest marketing. Firms violating regulations could face strict penalties, including suspensions or removal of social media accounts.”

Crypto Millionaires’ Paradise: Singapore Rises as Global Crypto-Friendly Haven

Singapore and the United Arab Emirates have emerged as top destinations for crypto millionaires due to their favorable tax policies on cryptocurrency-related ventures. The global cryptocurrency market is booming, with 425 million people owning some form of digital currencies, and certain individuals even possessing crypto fortunes surpassing the $100 million mark. This growth is prompting traders, investors, and entrepreneurs to seek secure locations to protect their digital assets.

Exploring the Potential of RLN in Harmonizing CBDC with Commercial Bank Money

The Regulated Liability Network (RLN), a U.K. based financial marketplace infrastructure, is working on a use case involving the consumer domestic payment case with the central bank digital currency (CBDC). Exploring how commercial bank money and CBDC could coexist, the RLN aims to maintain equilibrium between the two. The network further mitigates authorized push payment fraud and quickens settlement time. Despite the complexity of regulations and jurisdictions, systems like RLN are key to a seamless digital economy transition.

Grayscale’s Bitcoin ETF Approval: A Pivotal Moment or a Narrow Victory?

The U.S. Court of Appeals Circuit Judge has granted Grayscale Investments’ request to convert its Bitcoin Trust into a listed Bitcoin exchange-traded fund (ETF). But as the industry hails the decision as a victory, it’s worth questioning the real implications for the crypto industry and the broader acceptance of crypto ETFs in the future.

UK’s New Crypto Rules: Balancing Financial Security and Innovation

The UK’s Financial Conduct Authority now requires Virtual Asset Service Providers to gather and validate information on crypto transactions, even beyond local jurisdiction. This regulation, known as the Travel Rule, aims to counter money laundering and terrorist financing, yet raises concerns regarding privacy and curbing innovation within the growing crypto industry.

UK’s Vision for Global AI Safety: Tackling Risks and Encouraging Development

The UK government focuses on the risks and policy support for AI at the upcoming global AI safety summit. The discussions will address the risks posed by AI systems, fostering AI development for public good, and establishing international consensus on AI safety.

UK’s Implementation of the Crypto Travel Rule: A Double-Edged Sword?

The UK’s recent implementation of the ‘Travel Rule’ for crypto transactions aims to deter anti-money laundering and counter-terrorist financing on-chain. This rule requires UK-based virtual-asset service providers to collect, verify, and share information about crypto-asset transfers, even from overseas jurisdictions.

Worldcoin: Decentralizing Digital Identity or Invading Privacy?

“Worldcoin, despite controversies, showcases a potentially groundbreaking use of blockchain: creating an immutable, biometrically authenticated digital identity. While the project faces both ethical dilemmas and security concerns, its potential in revolutionizing finance, political systems, and social structures cannot be overlooked. A critical question remains: trusting a private entity with our digital identities.”

AI’s Copyright Conundrum: Balancing Creativity and Tech Advancement in the UK

“The UK government’s proposal to exempt AI from copyright protections for system training using existing literature, music, and art has ignited controversy. Critics assert this potentially undermines creators’ rights and treats arts and cultural production as mere inputs to AI development. The dispute mirrors a broader tension between AI advancement and preserving creative rights, urging for a balanced strategy.”

Navigating the Regulatory Labyrinth: New Rules and Fluctuating Tides in Crypto Sphere

“The United States Internal Revenue Service (IRS) is proposing new tax policies for the sale/exchange of digital assets by brokers, attracting criticism from crypto figures. Meanwhile, Gemini, a cryptocurrency exchange, faces a SEC lawsuit on potential regulatory violations. These developments reflect the ongoing struggle to balance regulation with innovation in the emerging field of cryptocurrency.”

World Mobile’s Decentralized Service Expansion: Democratizing Internet Access with Blockchain and AI

World Mobile, a decentralized mobile internet provider, has expanded its services via Google Play, allowing users in select countries to leverage blockchain for cost-effective internet access. This blockchain-based project promotes telecom sharing economy and integrates AI solutions for enhanced customer service, thereby democratizing technology and wealth access.

Navigating Bitcoin Transactions through Cash App: A Convenient Tool or a Security Nightmare?

“Cash App, developed by Block Inc, has won popularity for facilitating Bitcoin transactions, with its ‘Auto Invest’ tool easing price volatility. However, limitations exist in Bitcoin-only support and transactional data vulnerability. Also, funds lack FDIC or FSCS insurance, warranting caution.”

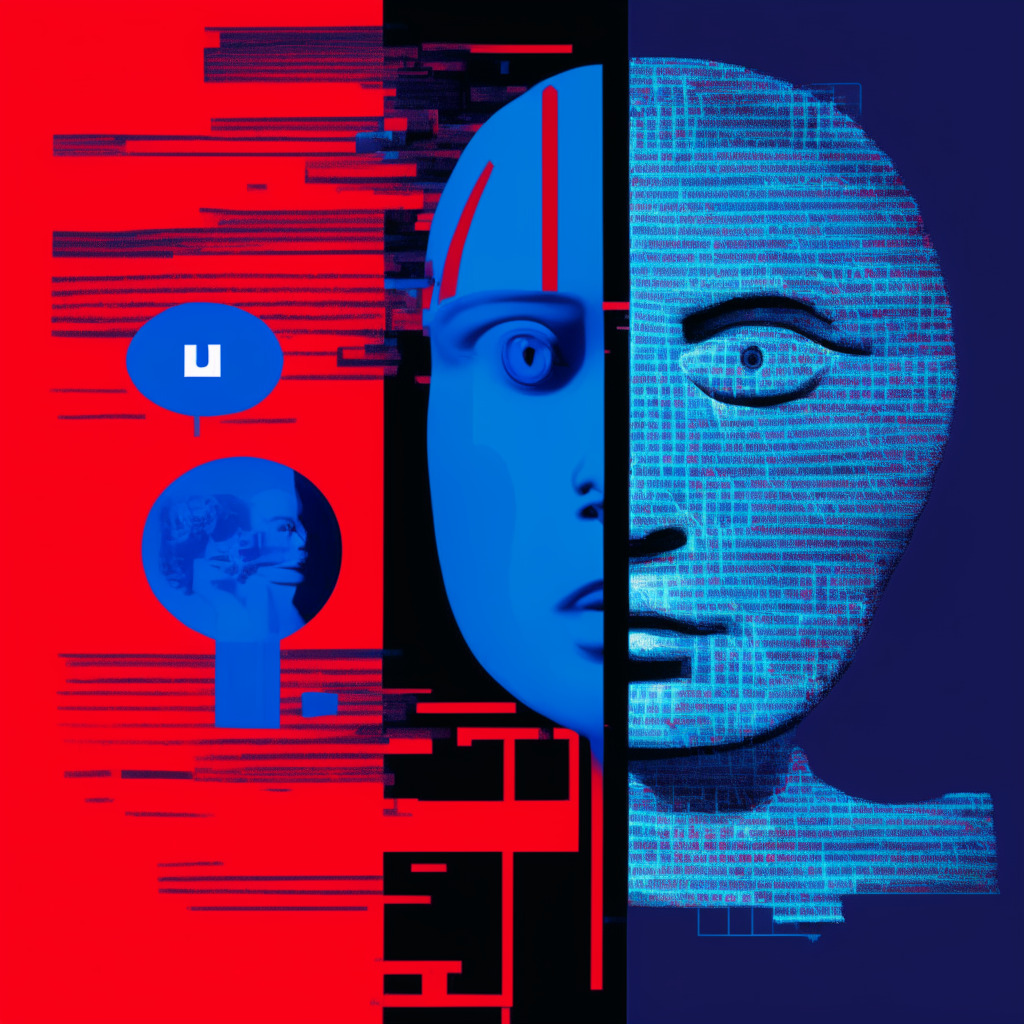

Uncovering the Political Bias in AI Chatbots: A Deep-Dive into OpenAI’s ChatGPT

“AI chatbot, ChatGPT, developed by OpenAI, has shown a tendency towards left-leaning responses in its discussions of political issues. The emission of bias might be a result of biased training data or the algorithm itself. Although AI brings advancements, biases and security concerns must be mitigated for safe adoption.”

Bitcoin Slips Amidst Wall Street Woes: PayPal Halts UK Crypto Trades & Jada AI Secures Funding

“The Bitcoin value recently slipped to its lowest since June 21, trading just above $28,346, related to Wall Street’s drop caused by banking apprehensions and interest rate fears. Meanwhile, PayPal suspended crypto purchases in the UK until early 2024 due to new FCA regulations, but continues its crypto push in the US.”

UK’s FCA and its Rigorous Screening of Crypto Firms: Innovation vs. Regulation

The Financial Conduct Authority’s rigorous scrutiny of crypto firms seeking registration has led to only 13% of 291 applicants receiving permission to operate. This strictness protects investors but could potentially stifle the crypto and blockchain sector’s growth.

Unveiling PayPal’s Stablecoin: Impact on Ethereum, Crypto Centralization & The Rise of Chatbot Trading

“PayPal has launched its stablecoin PayPal USD (PYUSD), stirring a debate on potential implications and risks. As PayPal explores the stablecoin space, Bitstamp seeks global expansion, and Coinbase launched its Base layer-2 network. Meanwhile, Telegram bot crypto trading popularity is on the rise.”

Iris-Scanning Tech Meets Crypto: The Worldcoin Experiment, Innovation or Just Overreach?

Worldcoin, a crypto initiative utilizing iris-scanning for human identification, recently introduced a reservation feature for unverified users to secure their Worldcoin (WLD) tokens. Despite regulatory hurdles and data privacy concerns, this marks a significant step in expanding its user base.

Regulatory Highwire: UK’s Crypto Future Amidst FCA’s Proposed Promotions Ban

CryptoUK voices concern over the UK’s Financial Conduct Authority’s proposal to ban crypto incentives like NFTs and airdrops. Fearing this might push firms to relocate, they urge consideration of potential ‘unintended consequences.’ CryptoUK also seeks further clarity in FCA’s existing guidance on crypto advertisement regulations.

US-China AI Tug-of-War: National Security or Economic Coercion?

“The US aims to control investments in semiconductors, quantum computing, and AI technologies, leading to global effects. The friction is impacting global trade, with criticism of potential divergence from market principles. In response, China controls export of AI chip-making materials, while other countries contemplate the implications.”

Crypto Exchange Bitstamp’s Global Expansion Plans: A Bold Move or Risky Venture?

Bitstamp, a pioneering crypto exchange, is planning a major expansion to enlarge its operational scope. The capital raised will be invested in derivatives trading, extending to Asian markets, and increasing services in the UK. Notably, Bitstamp’s global chief executive asserts they’re raising funds to broaden services, not for company sale. However, doubts rise due to their altered stance towards investment, and the challenge of navigating complex international crypto regulations.

UK National Crime Agency Strengthens Battle Against Crypto-Crime: Promising Development or Taxpayer Burden?

The UK’s National Crime Agency (NCA) plans to hire four senior investigators to combat crypto-related crimes, particularly the activities of organised criminal syndicates. This move comes in response to an alarming rise in crypto fraud, with $287 million reportedly stolen in 2022. The initiative signifies the government’s prioritisation of digital assets security, although concerns remain about potential intrusions of privacy associated with crypto asset regulation.

Worldcoin’s Iris-Scanning Identity Project: Breakthrough Innovation or Data Privacy Nightmare?

“Worldcoin, a digital ID crypto project, introduces a digital identity system based on iris scanning to differentiate humans from AI entities. Despite concerns about data privacy, it has secured $115 million funding and over 2 million sign-ups. However, industry experts question Worldcoin’s ability to manage personal information securely.”

WorldCoin’s Iris-Scanning Tech: An Innovative Solution or a Privacy Nightmare?

“WorldCoin, a tech venture by Sam Altman, aims to build the largest financial and identity community through its unique iris-scanning technology. Despite facing regulatory scrutiny and concerns over potential misuse of biometric data, WorldCoin claims to have signed up over 2.2 million users and recently secured $115 million in funding.”

Navigating the Controversy: Worldcoin’s Retinal Scans Stir up Crypto Scepticism and Safety Debates

Worldcoin, a project aiming to authenticate users via retinal scans for a global digital currency, faces scrutiny over its biometric data collection methods from various European authorities concerned about potential user risk. Amidst this flak, Worldcoin is still attracting significant interest, exemplifying the ongoing conflict between fostering innovative growth and ensuring security in the crypto space.

Worldcoin’s Proof of Security Amid Biometric Criticism: A Necessary Evil or Orwellian Nightmare?

“Worldcoin, known for its proof of humanity protocol, faced criticism over data collection practices. Post security audits by Nethermind and Least Authority, 24 out of 26 identified issues were resolved. Unaddressed issues remain a concern despite progress in addressing challenges for this biometric security and blockchain blend.”

UK’s Electronic Trade Documents Act 2023: A Blockchain Revolution in Trade Documentation

“The Electronic Trade Documents Act 2023, passed in the UK, enables the digital storage and distribution of trade documents, potentially leveraging blockchain technology. This could enhance security, compliance, and record traceability, and improve workflow efficiency, while considering reliability and security challenges.”