Tether co-founder, William Quigley, in a recent interview expressed skepticism towards the acceptance of PayPal’s impending stablecoin. Highlighting that cryptocurrencies earn credibility over time, he outlined that new entrant, PayPal, would face challenges in gaining trust and performance reputation among crypto users. He flagged significant regulatory challenges and the high cost of compliance as potential hurdles for PayPal’s stablecoin.

Search Results for: coin

Bitcoin’s Market Momentum: Bold Forecasts, El Salvador’s Mining Move and the Potential of ETFs

“Former BitMEX CEO foresees Bitcoin’s price surging to approximately $70,000 in 2024, propelled by potential financial disruptions and an anticipated Bitcoin halving event. Meanwhile, El Salvador launches its maiden sustainable Bitcoin mining pool, and BlackRock nears approval of a Bitcoin ETF – potentially triggering a $650 billion surge in crypto asset management.”

Unearthing the Tug-of-War: Canada’s Blockchain Regulatory Evolution & Its Impact on Stablecoins

The Canadian Securities Administrators’ recent clarification on stablecoin trading rules indicates that exchanges may be allowed to trade these value-referenced crypto assets if sufficient asset reserves are maintained and necessary information is disclosed. This regulatory intervention could significantly affect the crypto landscape in Canada.

Forecasting Bitcoin’s Future: Market Movements, ETF implications, and Cyber-security Enhancements

The Bitcoin community anticipates the outcome of the US job data with hopes of a surge in Bitcoin’s value. A potential gamechanger is the SEC’s expected approval of a Bitcoin Exchange-Traded Fund (ETF), which could attract significant investments and raise Bitcoin’s prices. However, maintaining vigilance is essential as Bitcoin’s value may fluctuate in the coming days.

Nervous Wait: Bitcoin Stalls Ahead of US Jobs Data, Meme Coins Grab Spotlight

“Bitcoin (BTC) deflected from the $28,000 mark once again, as the US jobs data release this Friday looms. Higher yields on risk-free assets could impart pressure on crypto prices. Amidst this, traders are exploring less liquid meme coin markets for better trading opportunities.”

Harnessing Volcanoes for Bitcoin: El Salvador’s Pioneering Lava Pool Project and its Global Implications

“El Salvador introduced the Lava Pool project, merging renewable geothermal energy with cryptocurrency mining, in a strategic blend of Volcano Energy’s infrastructure and Luxor Technology’s expertise to counter environmental concerns of digital currencies. It signifies El Salvador’s determination to integrate Bitcoin into its power infrastructure, becoming the first geothermally driven Bitcoin mining pool in the country.”

Unveiling Kabosu: How Dogecoin Transformed Into Cultural Icon Amid Market Volatility

“Doge enthusiasts are raising funds for a bronze statue of Kabosu, the Shiba Inu dog behind the Dogecoin meme, with plans to unveil it on the dog’s 18th birthday on November 2nd. PleasrDAO, a collective of high-value NFT enthusiasts, is leading the effort. The event will offer unique opportunities for NFT owners, alongside a documentary tracking Kabosu’s life and the meme’s rise in popularity.”

Navigating Bitcoin’s Tough Road to $30,000: Exploring the Underlying Challenges

Bitcoin’s struggle to surpass $28.5K is attributed to factors such as failed launch of Ether futures ETFs, US Federal Reserve’s economic concern, a dip in Bitcoin’s core trading metrics, and dwindling faith in the prospect of a spot Bitcoin ETF. The path towards $30,000 appears uncertain.

Disrupting the Bitcoin Mining Industry: Unpacking the Bitcoin Minetrix Project

“Bitcoin Minetrix has emerged as a potential game-changer in the field of tokenized Bitcoin cloud mining. Their Stake-to-Mine paradigm offers users the opportunity to mine Bitcoin by staking tokens, resulting in a redistribution of mining profits from corporates to retail investors. This approach provides a high yield return, offering both access and inclusivity to the Bitcoin mining process.”

Navigating the Tumultuous Seas of Bitcoin: The Untold Tale of Dips, Spikes, and Hope

“Bitcoin’s recent dip to $27,431 has sparked alert among enthusiasts for potential new local lows. Expert analysis remains mixed, with bullish optimism pinned on a claim above 200-Week MA and bearish views sustained by ongoing uncertainty beneath 21-Week MA. Traders anticipate the challenging $30,000 resistance, while recommending diligent research to navigate the innate investment and trading risks.”

CoinDCX’s Integration of Transak: Fostering User-Centric Globalization or Inviting Regulatory Complexity?

CoinDCX has expanded its self-custody wallet, Okto, through its integration with the on-ramp platform, Transak. This move enhances transactions, boosts supported tokens and expands its reach globally. However, potential regulatory issues and complexities from involving a multitude of tokens cannot be overlooked.

XRP’s Steady Rise versus Pre-Sale Coins Potential: Deciphering the Cryptocurrency Conundrum

“After a recent drop, XRP shows an overall uptrend with a 4.5% increase in the past week. Positive legal developments involving Ripple have strengthened XRP’s standing, yet the coin’s future holds uncertainty. Meanwhile, newer tokens like Meme Kombat offer promising pre-sale opportunities, presenting potential rewards for investors despite being a high-risk avenue.”

Shifting Sightlines in Crypto: A Case Study of Newly Released Ether ETFs Vs. Bitcoin Futures ETFs

“After Ether futures-based ETFs debut, crypto analysis firm K33 Research suggests investors might need to shift focus from ETH to BTC due to underwhelming results. Despite excitement, the ETFs didn’t intervene with Ether’s ongoing value decline compared to Bitcoin.”

Cracking the Bitcoin Eggflation Paradox: Exploring the Unusual Buying Power of Cryptocurrency

A recent study shows Bitcoin balances the rising cost of eggs, or ‘eggflation’, more efficiently than the US dollar. Since January 2021, Bitcoin hodlers have had to spend 70% fewer satoshis for egg purchases compared to 58% fewer USD as of August 2023, indicating Bitcoin’s superior buying power.

Navigating Bitcoin’s Tides: Marathon’s Mining Surge, Kraken’s BTC Inflow, and Uzbekistan’s Crypto Regulations

Marathon Digital Holdings exhibited a 16% surge in Bitcoin production in September 2023. However, Uzbekistan introduced stringent regulations on crypto mining, potentially limiting industry growth. Meanwhile, U.S. based crypto exchange, Kraken, recorded its highest Bitcoin deposit activity, possibly indicating future price increases.

Ethereum Futures ETFs Stumbling: Are Investors Leaning towards Bitcoin?

The subdued performances of new Ethereum futures ETFs suggest shifting investor interest back to Bitcoin. Initial trading volume was significantly lower than anticipated, indicating lackluster interest in Ether ETFs. This hints that increased institutional access will only boost buying pressure if significant demand exists, which currently doesn’t seem the case for Ether.

Bitcoin’s Downward Spiral Despite Optimistic Events in Crypto World: A Market Analysis

“Despite positive developments like the introduction of Ether ETFs and a UAE Dirham-based stablecoin, Bitcoin continues to decline, now valued below $28,000. Influenced by declining US bond yields and overbought signals, the crypto market fell 0.90% over 24 hours. While Bitcoin sees substantial investments, Ether suffers consistent outflows, clouding the future of digital assets.”

Bullish October: Analyzing Bitcoin’s Historic Win in September and Predicting Future Trajectory

“Bitcoin’s surprising September performance has market analysts predicting a positive October trajectory for the cryptocurrency. Factors such as increased volatility, futuristic market metrics, and strong backing from long-term holders suggest potential for constructive price movements and stability.”

Shaky Ground: Navigating Crypto Markets amidst Bitcoin Stagnation and the Rise of Memecoins

“Cryptocurrencies like Bitcoin and Ether show mixed responses to external factors such as U.S. economic performance and labor market data. Attention is turning towards low-cap coins, offering volatile, short-term gain opportunities. Crypto presales might offer a less-risky, high-reward strategy for investors willing to navigate a delicate balance of risk and return.”

Coinbase vs SEC: A Case of Interpretation in Crypto Regulation Compliance

The SEC accuses Coinbase of non-compliance in the registration as a securities exchange, an accusation Coinbase counters by declaring cryptocurrency transactions don’t resemble traditional investment contracts. The lawsuit’s pivot point is the interpretation of the “Howey test” for classifying assets as securities. Coinbase maintains the assets on its platform are not securities and exist outside SEC’s jurisdiction.

The Remarkable Ascent of Bitcoin BSC: Stellar Debut or Crypto Roulette?

“Bitcoin BSC, a new crypto, has kicked off on PancakeSwap, surging 50% and securing a market cap of $30m. With 2,310 token holders just after debut and an audited smart contract, it shows promise for future performance, although risks remain high.”

Bitcoin’s Calm Amid Stormy Legacy Markets: A Tale of Contrasting Market Conditions

Bitcoin’s price stability recently contrasted with a volatile U.S. dollar, almost mirroring a stablecoin. Despite these calm conditions, the U.S. dollar’s strength can cause market turbulence. Amid potential economic fluctuations, Bitcoin manages to maintain steadiness, prompting questions about the benefits of investing in traditional markets over emerging ones like Bitcoin.

Bitcoin’s Resurgence and Emergence of TG.Casino: A Double Whammy in the Crypto World

“Polygon has seen a 17% increase in high-value transactions, in line with the unveiling of key governance proposals. However, its Relative Strength Index indicates potential need for consolidation. Additionally, TG.Casino emerges as an exciting entity, linking casino industry with decentralized blockchain capabilities, offering both opportunities and challenges in the cryptocurrency future.”

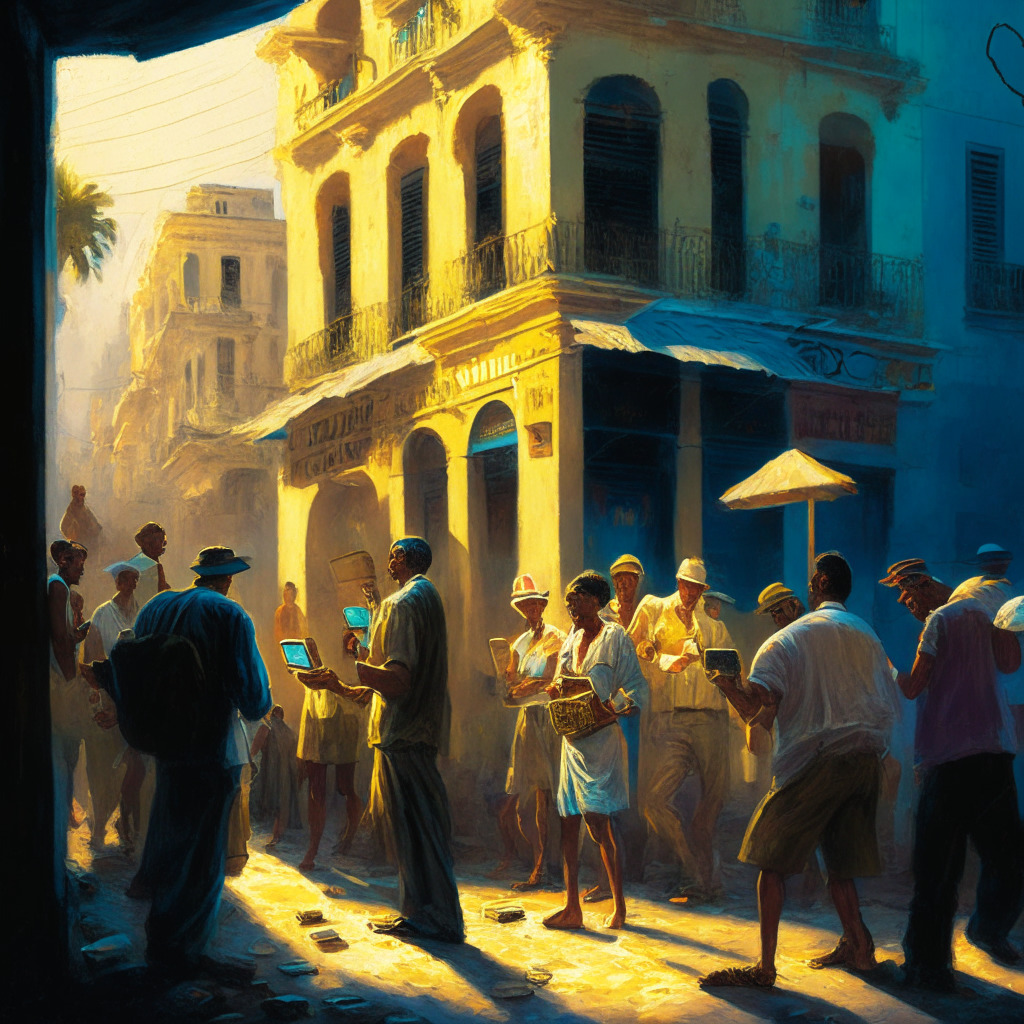

Bitcoin Awareness Rises in Cuba amid Fears of National Currency Decline

Amid devaluation of the Cuban peso and inflation, the crypto community in Havana, Cuba is turning to Bitcoin due to its relative financial stability. Despite governmental restrictions, Cubans have developed ways to buy and sell Bitcoin, hoping for a more economically secure future.

Falling Star or Rising Phoenix? Comparing Terra Luna Classic and Bitcoin Minetrix in Crypto Market

“The Terra Luna Classic has seen a 3% drop, marking a downward trend in its annual report. Despite the struggling market interest and poor ranking, a new proposal aims to revitalize the blockchain. Meanwhile, Bitcoin Minetrix’s popularity surges with a unique investing mechanism offering BTC as investor rewards.”

Navigating the Storm: Bitcoin Cash’s Market Struggles and the Rise of Bitcoin Minetrix

“Bitcoin Cash (BCH) tests the 20DMA support line as trading volume slips 48.19% to $246k. Meanwhile, Bitcoin Minetrix, an emerging Bitcoin cloud mining presale is drawing attention with its Stake-to-Mine model, which leverages token-staking to offer efficient, secure BTC mining.”

Unleashing the Bull: Bitcoin’s Prospects Amid Rising U.S Treasury yields and Looming Economic Unrest

Recent developments in the US economy, such as rising treasury yields and national debt, suggest a bullish future for Bitcoin. Former crypto exchange CEO, Arthur Hayes, speculates this could lead to mass liquidity injections, possibly triggering a Bitcoin bull run. However, the volatile interplay between these economic factors also warrants caution.

Shadows Over Crypto: Fentanyl Sanctions, Regulatory Barriers, and the Future of Bitcoin

Bitcoin saw a slight downturn recently amid challenges such as the US Treasury’s move to outlaw cryptocurrency wallets and a crackdown on illicit substances like fentanyl. Additional regulatory barriers in the US are hindering crypto innovation, leading to concerns over future Bitcoin prices and investor sentiment.

Ripple’s Rise in Singapore vs. Coinbase’s Legal Quagmire: Paving the Path for Crypto Regulation

The Monetary Authority of Singapore has awarded Ripple a digital payment tokens license, enhancing its position in the digital asset market. Concurrently, the SEC and Coinbase are engaged in a contentious lawsuit, calling attention to potential hurdles and the urgent need for clear cryptocurrency regulation.

Crypto Regulation Variance: SEC vs Coinbase and Argentina’s Proposed Digital Currency

“The SEC and Coinbase are in court, debating securities registration for crypto assets. Meanwhile, Argentina’s presidential candidates propose differing cryptocurrency solutions to economic issues: introducing a digital currency or supporting Bitcoin and abolishing the central bank.”

Rescuing Argentina’s Economy: Central Bank Digital Currency vs. Bitcoin Adoption

Argentina’s second-leading presidential candidate, Sergio Massa, plans to launch a national central bank digital currency (CBDC) if elected, aiming to combat the country’s escalating inflation. Massa believes that a strong digital economy, supported by a CBDC, offers a better solution than relying on the U.S. dollar, a strategy that is in direct contrast with competitor Javier Milei, who favours a pro-Bitcoin, anti-central bank approach.

Introducing DRAM: Dirham-Backed Stablecoin Aims for Global Impact Amidst Regional Restrictions

Swiss company DTR presents a Dirham-supported stablecoin, DRAM, aiming to facilitate global value transfer. Despite its non-availability in UAE and Hong Kong, the token, developed by Dram Trust is listed on decentralized exchanges like Uniswap, PancakeSwap trading with Binance Coin.