“The recent alleged hacking of a cryptocurrency project highlights both the effectiveness of global blockchain security and the rising threat of internal cyber breaches in the sector. It underscores the need for advanced countermeasures and practices, early detection, and security awareness training.”

Search Results for: cryptocurrency

Implications of Effective Altruism on Cryptocurrency Regulations and Security

The recent collapse of crypto exchange, FTX, has sparked discussions about the role of effective altruism in decision-making within major cryptocurrency stakeholders. Amid debates on the genuineness of altruistic actions, there’s also increasing awareness of advanced deceptive practices by hacker groups. These highlights the necessity for stringent crypto regulations to prevent misuse.

Cryptocurrency’s ‘Uptober’: A Bullish Mirage or a Substantial Surge?

This October recorded an unexpected upsurge in crypto heavyweights like Bitcoin and Ethereum, rooting positive forecasts. The sudden increase liquidated $70 million in short positions and substantiated ‘Uptober’ as a bullish month for cryptocurrencies. However, this optimism should be paired with calculated vigilance due to market unpredictability.

Government Shutdown Dodged: Possible Fallout for Cryptocurrency Regulation

“The future of cryptocurrency regulation was at risk with the potential for a government shutdown. This stalemate could have hindered several key crypto-focused bills, including the Financial Innovation and Technology for the 21st Century Act, the Blockchain Regulatory Certainty Act, among others, shaping crypto’s future.”

Cryptocurrency Analysis: Chainlink’s Bullish Trend and Meme Kombat’s Pre-Sale Success vs Market Risks

“Chainlink (LINK) experiences a bullish wedge pattern with support at $6.549 and potential downside risks, while also hinting at a price correction. Meanwhile, Meme Kombat, a blockchain platform, enables users to stake $MK tokens, raising $165k in its pre-sale, highlighting the dynamic and nuanced nature of the crypto space. “

Climbing the Ranks: The Rise and Uncertainty of Wall Street Memes Cryptocurrency

“Wall Street Memes (WSM), a new cryptocurrency, has seen a 30% valuation increase since its launch and has a promising estimated value of $0.045620 as of September 29. Despite its success, new crypto entrant, Meme Kombat casts uncertainty on WSM’s future, underlining the high-risk nature of crypto investments.”

US vs Europe: CoinShares Stakes its Claim on American Cryptocurrency Regulation Prospects

European cryptocurrency investment firm CoinShares disputes the notion that the U.S. lags in cryptocurrency adoption and regulation. CoinShares argues that due to U.S regulators evaluating digital assets similarly to traditional asset classes, the U.S. is a leader in digital asset development. The company also references the integration of emerging and traditional financial players as evidence of this.

Unleashing AI on Cryptocurrency Markets: The Potential Blessings and Curses of ChatGPT

OpenAI’s AI-powered chatbot, ChatGPT is now able to extract current information from the web, expanding its role in providing insights about the mutable crypto world. Not only predicting crypto prices, the ChatGPT’s integration in crypto risk management enables the identification of emerging threats, making the system more robust.

European Commission’s Effort to Mitigate Cryptocurrency’s Environmental Impact: A Balanced Digital Future?

The European Commission has secured an 800,000 euro contract to develop methodology and sustainability standards that alleviate environmental hazards associated with cryptos. This move stems from concerns over how crypto transactions and mining may negatively affect the environment, economy, and society.

Fireblocks and Tezos Integration: A New Era of Security and Scalability in Cryptocurrency

Fireblocks, a provider of cryptographic custody and settlement solutions, has integrated full support for the Tezos network. This partnership enhances security for Tezos-based asset storage and streamlines access to decentralized applications. The collaboration also anticipates a surge in the protocol’s Decentralized Finance activities, contributing to its rising position among all protocols by total value locked.

Europe’s Rising Role in Driving Institutional Cryptocurrency Adoption: A Regulatory Perspective

The recent Blockchain Expo in Amsterdam highlighted Europe as the key driver for institutional cryptocurrency adoption due to its favorable regulatory climate. The European Union’s Markets in Crypto-Assets (MiCA) regulation is implicated as a safety net, offering a regulatory framework for the emerging sector and ensuring user protection, which are lacking in countries like the United States.

Unraveling PayPal’s Plan: Crypto.com, Stablecoin and the Future of Cryptocurrency Markets

“PayPal has plans to make Crypto.com the preferred platform for their USD-backed stablecoin, PYUSD. Despite skepticism around adoption and seamless trade, this move could mark a significant stride towards widespread crypto adoption in traditional finance.”

Cross-Border CBDCs: A Look at Recent Trials and Cryptocurrency Platform Bankruptcies

“France, Singapore, and Switzerland recently experimented with cross-border Central Bank Digital Currencies (CBDCs) using public blockchain and DeFi technology in a venture named Project Mariana. Despite successful trials, further investigation and iterations are required to fully understand the complexities of implementing such systems.”

Gary Gensler’s Regulatory Tightrope: Balancing Innovation and Regulation in Cryptocurrency

The SEC under Gary Gensler’s leadership has been accused of regulatory overreach, hampering the U.S. capital markets. While many criticize the lack of clear regulations around cryptocurrencies and other novel financial instruments, Gensler refrains from concrete classification, highlighting the complexity of these emerging issues.

Cryptocurrency Market: A Tug of War Between Bulls and Bears in Flux

“In the ebb and flow of the cryptocurrency market, BTC held its ground despite the fluctuating market and signs of trader stagnation. Investment in the market continues, potentially signaling a market reversal. However, competitive tension and high unpredictability dominate, urging traders to tread cautiously amidst volatility.”

Cryptocurrency: Between the Tides of Progress and Doubt – An In-depth Look at Trials, Tribulations, and Transformations

“Bankman-Fried, former CEO of FTX, faces fraud charges relating to his tenures at FTX and Alameda Research. Meanwhile, in Hong Kong, Hashkey becomes the first to receive a retail crypto license, with trading restricted to professional investors. Blockchain’s future balances advancement and skepticism.”

Unveiling AirBit Club: Tale of a Cryptocurrency Ponzi Scheme with a $100M Penalty

“Pablo Renato Rodriguez, co-founder of the crypto-based pyramid scheme AirBit Club, received a 12-year prison sentence for masterminding a multilevel marketing club falsely promising revenue through crypto mining and trading, essentially exploiting investors.”

Navigating Cybersecurity Challenges in the Cryptocurrency Sector: A Balancing Act Between Threats and Innovations

“The vibrant and rapidly evolving cryptocurrency sector experiences various cybersecurity issues, including phishing attacks, malware, and flaws in smart contracts. Despite blockchain and decentralized technologies bolstering security, these technologies present unique risks. To counter these, security experts advocate for cold storage solutions, strong passwords, two-factor authentication, and caution against phishing attempts.”

Cryptocurrency Conflict: SEC’s Resistance to Celsius Network’s Partnership with Coinbase

“The SEC has expressed concern over Celsius Network’s plan to engage Coinbase for its revival. Sec regulators insist on rigorous scrutiny of the agreement, citing undisclosed terms and potential legal complications. Celsius, recovering from previous SEC charges, remains hopeful for court approval.”

Gemini’s Cryptocurrency Expansion into India: Boon or Bane Amid Regulatory Ambiguity?

“The cryptocurrency exchange, Gemini, is planning a $24 million expansion into India’s tech market over the next two years. This move aligns with the opening of their new office in Gurgaon, India, which contributes to worldwide operations. Despite the current ambiguous regulatory environment for cryptocurrencies in India, Gemini sees potential in the country’s supportive framework for startups and its global reputation as a hub for tech advancement.”

Cryptocurrency Critic Senator Menendez Embroiled in Bribery Scandal: Irony or Reality?

“U.S. Senator Robert Menendez, known for his disapproval of cryptocurrencies like Bitcoin, ironically finds himself in a scandal involving traditional bribery means. He’s accused of accepting bribes, pointing out the contrast to his criticisms of crypto enabling criminal activities.”

Three Drivers of Cryptocurrency Market Growth: BTC ETFs, Regulatory Progress, and Scaling Solutions

The article identifies three potential growth catalysts for the cryptocurrency market: approval of Bitcoin ETFs, positive regulatory changes, and advancements in blockchain scaling. It spotlights BlackRock’s Bitcoin ETF application, Ripple and Grayscale’s victories against the SEC, and progress in Ethereum layer-2 scaling solutions. Crucial investment details about various cryptocurrencies are also discussed in light of market volatility and shifting trends.

Cryptocurrency Outflows Extend for Six Weeks Straight: The Spotlight on Global Differences

In a volatile week for digital assets, an unbroken six-week outflow trend was experienced, with Bitcoin and Ethereum contributing significantly. CoinShares market report revealed $9 million total outflows, with Bitcoin and Ethereum accounting for $6 million and $2.2 million, respectively. Interestingly, altcoins like Ripple(XRP) and Solana (SOL) saw inflows.

Navigating Cryptocurrency Volatility Amid Dollar Strength and Market Security Concerns

“The cryptocurrency market currently indicates US dollar index dominance with Bitcoin (BTC) and Ethereum (ETH) experiencing a downward trend. Contributing risk factors seem to arise from the enduring US dollar strength and uncertain global economic health. However, signs of a bullish divergence suggest possible reduction in selling pressure. Meanwhile, controversy surrounds the Mixin Network due to a significant security breach, highlighting concerns about fund security in cryptocurrencies.”

Latency in Cryptocurrency Trading: A Barrier or a Competitive Edge?

“Latency in cryptocurrency trading significantly impacts the speed and flexibility of trades. Though achieving low latency can be challenging and costly due to investments in high-performance tech and regulatory compliance, its benefits in trade efficiency and competitiveness in the volatile crypto market are noteworthy.”

Hong Kong’s SFC to Publicly List Licensed Cryptocurrency Exchanges: A Step Towards Transparency

Hong Kong’s Securities and Futures Commission (SFC) plans to publish a list of cryptocurrency trading companies that have applied for operational licenses, bringing transparency to the industry. Nevertheless, this doesn’t guarantee rule conformity. This follows a major financial scam involving unlicensed cryptocurrency exchange JPEX which reportedly caused significant losses for investors. The SFC emphasizes strict governance measures including asset safety and market manipulation prevention to ensure investor protection.

Unraveling the Lazarus Group: A Deep Dive into their $47m Cryptocurrency Loot

“The North Korean Lazarus Group, a notorious hacking collective, reportedly has $47 million in cryptocurrencies, the majority in Bitcoin. Despite a surprising lack of privacy coins, their wallets are active, suggesting underreported holdings. Previously implicated in major crypto hacks, their activities question security in blockchain.”

Community Power in Cryptocurrency: A Close Look at Terra Classic’s Decision to Halt USTC Minting

“In the crypto world, community decisions often drive major changes. Recently, 59% of Terra Classic community voted to cease USTC minting due to its sharp value drop. This decision aims to restore USTC’s stability against the US dollar, with potential broader impacts on the global crypto market.”

XRP’s Resurgence and the Rising Star of Wall Street Memes (WSM) in Cryptocurrency Landscape

XRP has secured its position as the fifth-largest cryptocurrency in terms of market cap, surpassing USDC. Despite slight volatility, XRP appears poised for future growth, with recent developments suggesting a potential surge. Ripple’s alliances with other entities further enhance this positive outlook.

Bankrupt Cryptocurrency Exchange: A High-Stakes Poker Game for Credit Investors

Amidst market volatility, major credit investors are reportedly buying the debt of collapsed crypto exchange FTX, signifying a bullish sentiment in the bankruptcy claims market. Yet, FTX’s bankruptcy presents unique challenges due to the fluid and often unpredictable value of crypto. Resolving such corporate collapse may take years, underlining the importance of due diligence and savvy risk management in the high-risk crypto markets.

Sky-High Interest Rates: An Unavoidable Future in Cryptocurrency Markets

“Sky-high interest rates are becoming a necessity in the cryptocurrency market as reliance on central banks erodes. The rising forecast for the Federal Funds Rate signifies a lasting high interest rate scenario, significantly impacting crypto markets. Therefore, focus must shift towards thorough assessment of the crypto ecosystem and its offerings.”

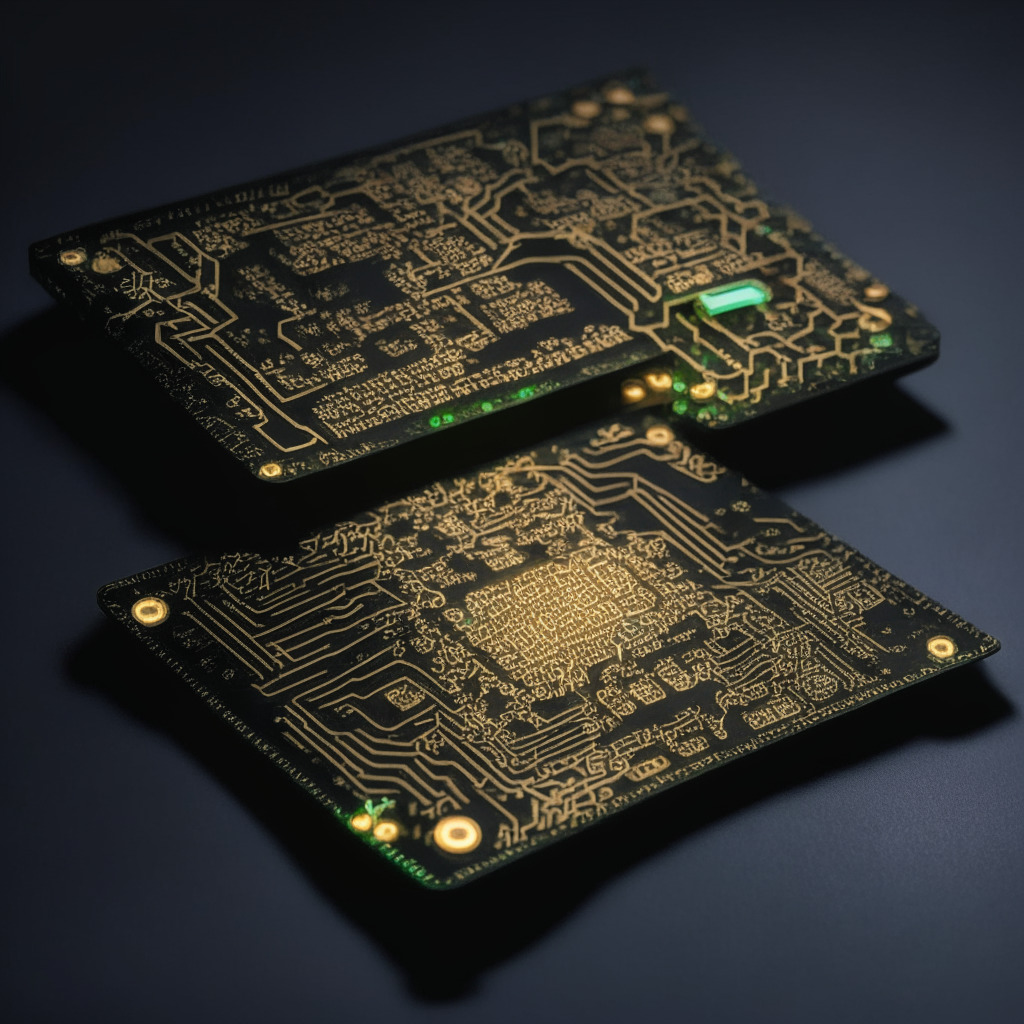

Building Your Own Cryptocurrency Wallet: Alluring Innovation or Security Nightmare?

Using Trezor’s open-source code, electronics design manager Florin Cocos constructed his own DIY Trezor cryptocurrency wallet. However, creating a functioning hardware wallet requires expertise in electronics and significant time investment. Aspects including potential security vulnerabilities and the required level of technical know-how should also be considered before undertaking such a project.