“Ukraine’s Ministry of Digital Transformation has announced a roadmap for AI regulatory progress, aiming to prepare businesses for future requirements and ensure ethical AI usage. Meanwhile, major crypto players are adjusting to new financial promotion regulations from the UK’s Financial Conduct Authority, aiming to foster clean and transparent crypto promotions, despite potential challenges for smaller players.”

Search Results for: fca

Navigating the UK’s Financial Promotions Regime: Crypto Exchanges Adapt while Others Stumble

“Major crypto exchanges, Binance and OKX, are complying with the UK’s new Financial Promotions Regime, aiming for fairness and transparency in cryptocurrency promotions. Implementing changes offers compliance challenges but is seen as a necessary progression for the industry’s evolution.”

Komainu’s Milestone Regulatory Approval: A Victory for Progress or Threat to Cryptocurrency Essence?

Komainu, a venture co-founded by CoinShares, Ledger, and Japanese Nomura, has gained substantial regulatory approval in the U.K. as a custodian wallet provider. While this development brings crypto custody services to the U.K. and contributes to the country’s fintech landscape, it also raises concerns about individual privacy rights and the balance between industry regulation and the decentralized nature of cryptocurrencies.

Pivotal Move: How the UK’s Regulatory Changes Could Shape the Global Crypto Landscape

“The United Kingdom could potentially leapfrog the US in Web3 crypto environments, contingent on an unconventional regulatory trajectory. Changes like curbing liabilities for DAO token holders and amending FCA’s KYC guidelines could catalyze growth in emerging technologies. Nonetheless, the crypto evolution is challenged by potential misuse and regulatory hurdles.”

UK’s Digital Securities Sandbox: A Leap Forward or a Conflicting Balance?

The UK plans to launch a Digital Securities Sandbox by end of Q1 2024. Differing from earlier sandboxes, this will solely focus on digital securities, allowing companies to experiment with digital asset technology within a controlled, risk-free environment. Despite this progressive step, the UK still maintains stringent regulations pertaining to digital assets.

Tottenham Hotspur Embraces Blockchain with Exclusive Fan Token on Chiliz Platform

Tottenham Hotspur introduces its fan-exclusive token, $SPURS, on the Chiliz Blockchain to improve fan engagement. The token promises to offer fans participation in team-related decisions and other exclusive club activities. Despite potential regulatory concerns, this innovation promises rewarding experiences and marks a new chapter in fan engagement.

Tottenham Hotspur Embraces Blockchain: Balancing Fan Monetization and Complex Regulations

Tottenham Hotspur embraces blockchain technology, partnering with the Chiliz blockchain to launch a Web3 fan token unlocking unique privileges. However, the absence of comprehensive blockchain token regulation presents potential challenges for fans and sport entities navigating this technology.

Chase UK Targets Crypto Transactions: Banking Hurdles & Community Reaction

Starting October 16, Chase, a digital bank owned by JPMorgan, will decline transactions related to crypto assets, citing rising instances of fraud. This decision aligns with several other UK banks that have recently narrowed the scope of operations with cryptocurrencies.

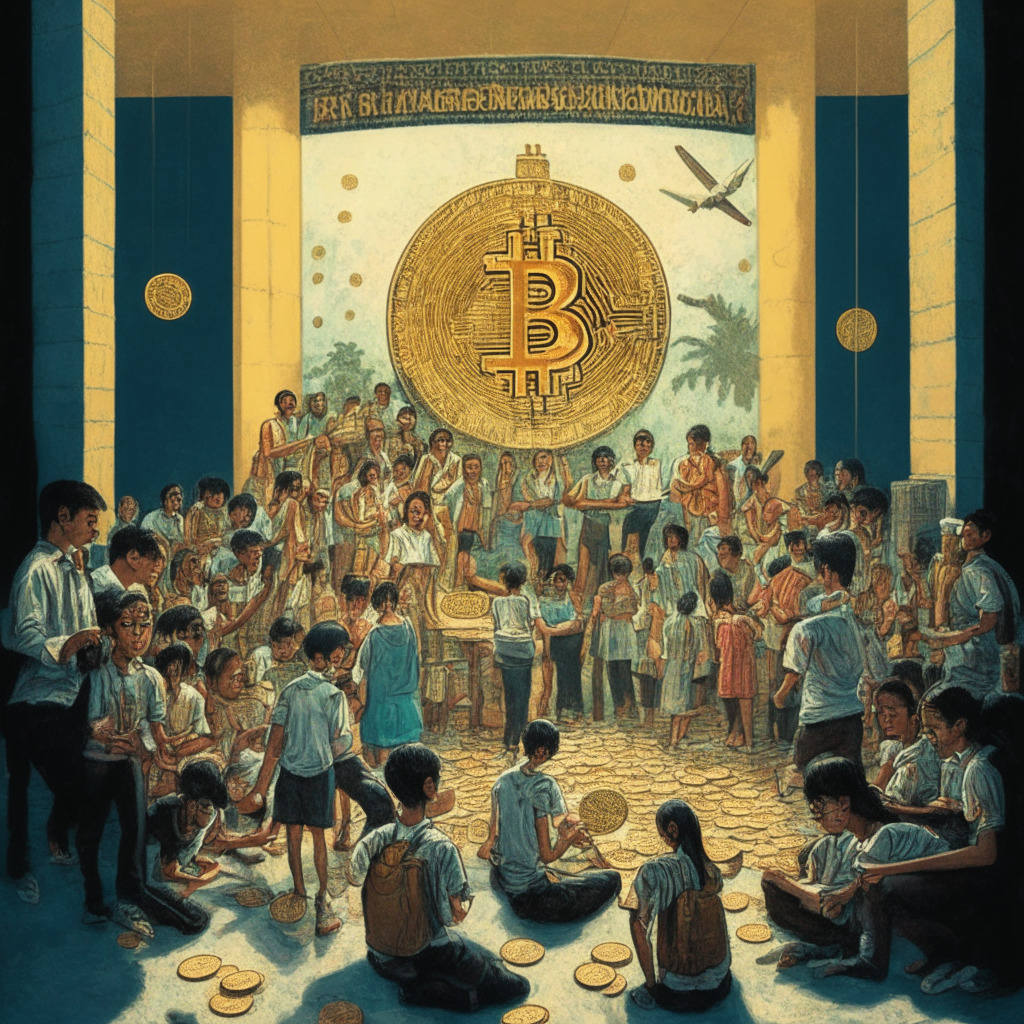

Emergence of Taiwan’s Crypto Association: A New Era for Global Currency Adoption

Taiwan’s crypto community is set to establish an operational group this October, designed to facilitate digital currency adoption and self-compliance. Spearheaded by nine local cryptocurrency exchanges, this initiative aims to foster a healthy industrial environment and ensure the industry’s robust wellbeing, ultimately propelling Taiwan onto the global cryptocurrency stage.

Navigating Rough Seas: Bybit’s Suspension in Response to UK Regulation Clampdown

Bybit, a popular cryptocurrency exchange, is suspending its UK operations following stringent regulations by the Financial Conduct Authority. This move, along with warnings about non-compliance penalties and possibly stricter regulations, signifies a complex stand-off between blockchain innovation and governance.

Political Pressure Meets Blockchain: The Shifting Sands of UK’s Crypto Regulatory Landscape

“Former FCA chairman Charles Randell discusses alleged political influence on UK regulatory bodies to adopt cryptocurrency companies. While some see these pressures as compromising, they may catalyze the safe adoption of emerging technologies like cryptocurrency within custom-built frameworks for the digital asset sector.”

UK Regulatory Authority’s Ultimatum to Crypto Firms: Comply or Face the Consequences

The UK’s Financial Conduct Authority (FCA) has demanded crypto firms to adhere to upcoming marketing regulations. Very few firms responded to their attempts at communication. The FCA warns non-compliance could be considered a criminal offense and lead to serious consequences including removal from digital platforms in violation of Anti-Money Laundering and Counter-Terrorist Financing regulations.

Crypto Galore: El Salvador’s Bitcoin Education to Binance’s Legal Tussle – the Week in Review

“The week in the crypto world was replete with notable developments from El Salvador’s Bitcoin literacy initiative to security issues identified with Telegram Bots by Certik. Meanwhile, high-profile legal battles and regulatory changes kept the industry on its toes. Despite challenges, tech giants like Sony and PayPal advanced their blockchain and crypto endeavors, emphasizing the market’s enduring dynamism.”

AI in Military and Beyond: Helsing’s Expansion and the Pervasive Role of Artificial Intelligence

AI startup Helisng, focused on developing AI-powered solutions for military use, has raised $223 million in Series B funding, led by General Catalyst and Saab. This funding is set to boost their goal of furthering AI technology for protecting democratic nations. Meanwhile, the proliferation of AI technology sparks discussions on job displacement and ethical issues surrounding its application, particularly in warfare.

Crypto Under Scrutiny: UK’s New Financial Regulations Stirring Controversy Among Crypto Businesses

The soon-to-be applied financial promotions rules in the U.K. are impacting crypto businesses. Despite new regulations requiring firms to be registered or authorized by the Financial Conduct Authority, Bybit – a top-tier crypto exchange – intends to maintain its UK operations. The company is actively assessing how to best adhere to these new regulations while persistently exploring all potential avenues for compliance. These changes show both advantages and drawbacks of regulations in crypto markets, highlighting the need for a balanced approach that encourages innovation without stifling the growing crypto market.

Impending UK Crypto Regulations: Trading Halts and Advertising Changes in the Crypto Sphere

“Luno, a crypto-platform under the Digital Currency Group, halts crypto-trading two days before the UK’s Financial Conduct Authority’s new rules take effect. Despite trading halt, the selling and withdrawal of funds will persist. New rules focus on clear, not misleading promotion of crypto trading. The adjustment aims to give potential investors better comprehension of the associated risks.”

Riding the Crypto Rollercoaster: Navigating the Bitcoin Crash Amid Regulatory Changes

In the constantly fluctuating cryptocurrency landscape, Bitcoin’s trading value has decreased significantly, influenced by big players or ‘whales’ offloading their stocks. With looming regulation tightening, exchanges like Luno are making adjustments to comply. It’s critical to stay informed and back your investments with thorough research and professional insight in this volatile market.

Navigating the Tightrope: UK’s Crypto-Regulation Paradox and its Impact on the Future of Blockchain Innovation

“The UK’s Financial Conduct Authority (FCA) is set to enforce restrictive measures on crypto promotions from October, potentially extending to January 2024 for technical compliance adjustments. This could impact crypto firms’ ability to advertise with clarity and fairness, redefining the crypto advertising ecosystem. However, these changes raise concerns about stifling innovation within the crypto industry.”

Exploring Crypto Facilities Potential in Reviving the Crypto Derivative Market after FTX’s Collapse

Crypto Facilities, associated with the crypto exchange Kraken, is planning to expand its diversity of client asset custody services but it requires expansion of its multilateral trading license. CEO Mark Jennings projects it may take six to twelve months for such implementation.

UK’s New Crypto Rules: Balancing Financial Security and Innovation

The UK’s Financial Conduct Authority now requires Virtual Asset Service Providers to gather and validate information on crypto transactions, even beyond local jurisdiction. This regulation, known as the Travel Rule, aims to counter money laundering and terrorist financing, yet raises concerns regarding privacy and curbing innovation within the growing crypto industry.

UK’s Cold Calling Ban Debate: A Front Against Crypto Scams or Threat to Lawful Operations?

The UK is considering a clampdown on cold calling in financial services, a move hailed as protection against digital asset scams, but may hinder companies relying on this practice. Furthermore, the government, while combating fraud, pledges support for blockchain, seeking to balance consumer protection and fostering industry growth.

Navigating The Crypto High Seas: The Impact of the UK’s Travel Rule Implementation

The U.K. is implementing “the travel rule”, a law aiming to curb money laundering in crypto, from September 1. This brings challenges for crypto firms, as they navigate variations in regulation across borders and gather data on customer’s overseas interactions.

UK Crypto Regulations Pinch But Promise Market Integrity: The FATF Travel Rule Unpacked

Starting September 1, UK crypto businesses will follow the Financial Action Task Force’s Anti-Money Laundering and Counter-Terrorist Financing regulations, including the ‘Travel Rule’. This may increase operations and marketing costs, but aims to prevent fraud and enhance customer protection in the crypto market.

Navigating the Shifting Regulatory Landscape: Crypto Advancement vs Anti-Money Laundering Measures

The Financial Conduct Authority (FCA) of the U.K. has detailed new rules to combat crypto money laundering, including the controversial ‘travel rule’, which requires crypto operators to identify both sender and recipient in fund transfers. Despite industry concerns, the FCA emphasizes these regulations’ role in preventing crypto from becoming a veil for criminal funds.

Bitcoin Slips Amidst Wall Street Woes: PayPal Halts UK Crypto Trades & Jada AI Secures Funding

“The Bitcoin value recently slipped to its lowest since June 21, trading just above $28,346, related to Wall Street’s drop caused by banking apprehensions and interest rate fears. Meanwhile, PayPal suspended crypto purchases in the UK until early 2024 due to new FCA regulations, but continues its crypto push in the US.”

PayPal Halts UK Crypto Purchases amidst BTC Price Instability: Panic or Opportunity?

“PayPal has paused crypto purchases in the UK because of new regulations, creating uncertainty for Bitcoin investors. The temporary halt until early 2024 emphasizes the complexity of the emerging digital asset world, its volatility, and the need for investor caution.”

PayPal’s Crypto Halt in the UK: Stricter Regulations vs Freedom of Decentralization

“PayPal has halted cryptocurrency purchases in the UK until early 2024 in response to stricter rules by the Financial Conduct Authority. Stricter regulations might increase security but contradict the decentralization principle of cryptocurrencies. Meanwhile, PayPal launched a stablecoin, PYUSD, evidencing the balance between regulation and innovation in the crypto world.”

Europe Pioneers Bitcoin ETF as US and UK Crypto Norms Fluctuate: A Regulatory Round Up

Europe recently approved the launch of the first spot Bitcoin ETF, fueling discussions about U.S. regulatory ambiguity. This move is significant given the SEC’s continued hesitance in endorsing a spot crypto ETF, raising concerns about regulatory transparency in U.S. cryptocurrency markets. Meanwhile, predictions suggest Bitcoin’s price breaching the $100,000 mark, even as debates about market outcomes continue.

Binance Connect’s Shutdown: Reflection on Regulatory Challenges in Crypto’s Growth Journey

“Binance Connect, a regulated crypto trading platform, is shutting down due to their provider discontinuing card payment service. Despite significant adaptation strategies and growth to a broad blockchain ecosystem, Binance faces ongoing regulatory complexities and issues, indicating an intricate, evolving landscape for crypto businesses.”

Striking a Balance: UK’s Rigorous Crypto Regulation Process and its Potential Backlash

The Financial Conduct Authority’s (FCA) rigorous registration process has led to only 13% of crypto companies receiving approval, as the requirements are deemed too challenging by some firms. The FCA’s stern warning that any information deficiency will lead to application rejection, along with a proposed ban on crypto incentives, further complicates the crypto industry’s operation in the UK.

Bitcoin Depot Dominating Crypto ATMs: A Setback for Smaller Players or An Industry Evolution?

“Despite once being a profitable industry, the crypto ATM landscape’s rapid evolution has led to reduced profit margins for smaller operators due to intense competition. The sector has potential to grow from $117 million to $5.5 billion by 2030; However, there is increasing speculation that smaller players will gradually be eliminated as the industry matures, aligning with the ‘survival of the fittest’ adage.”

UK Crypto Regulations: Ensuring Consumer Protection or Stifling Innovation?

CryptoUK has expressed concerns over potential cryptocurrency incentives prohibition that might lead businesses to move their operations away from the UK. The FCA’s new guidelines on crypto promotions, expected to be effective from October 8, have stirred apprehensions amidst concerns of limiting innovation and business growth.