“Meta’s metaverse-centric arm, Reality Labs, has reported a loss of $7.7 billion this year, raising questions about the viability of metaverse projects. Despite this, the company also boasts an 11% year-over-year revenue growth and a robust growth in stock prices. This showcases the high risk-high reward nature of venturing into new technologies like metaverse and cryptocurrencies.”

Search Results for: Ftx

Blockchain Universe: SBF’s Legal Trouble and Taxation Turmoil Over Staked Tokens

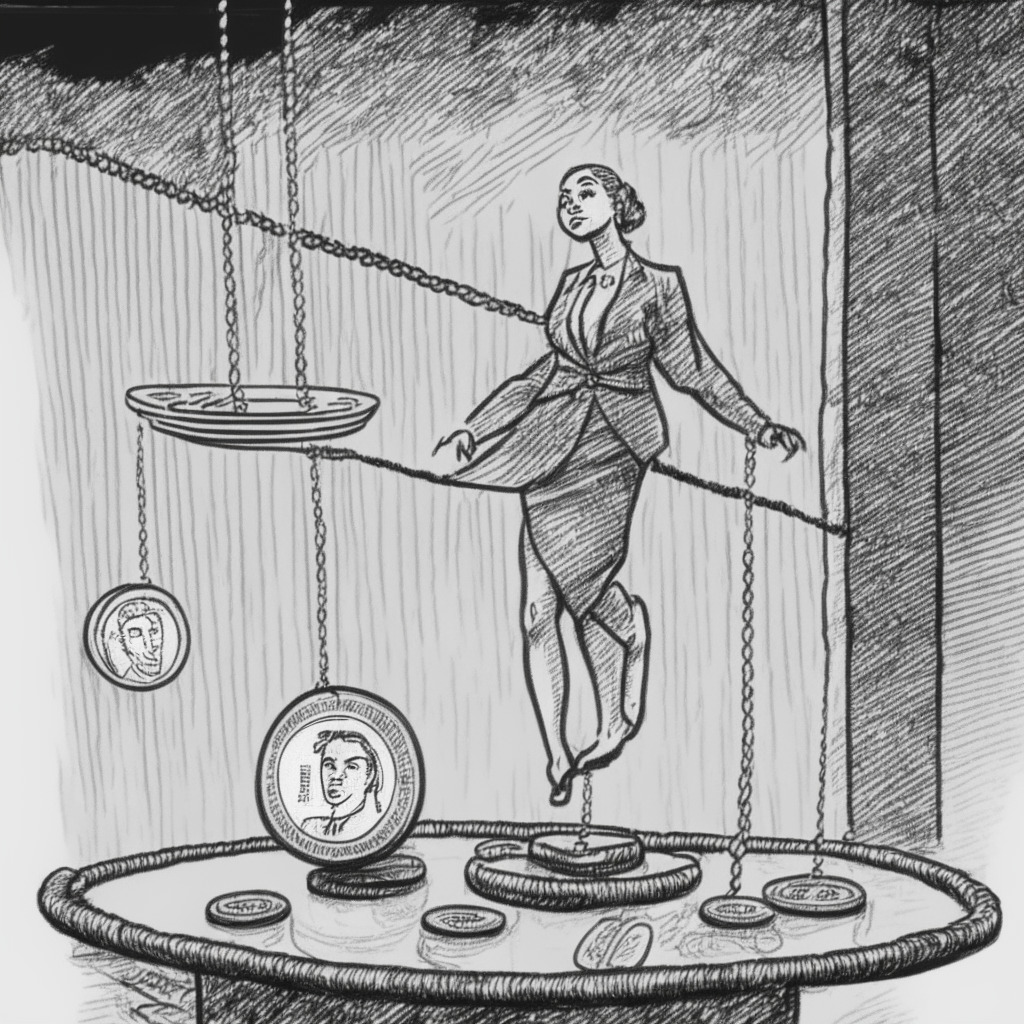

The article discusses a legal case involving former FTX CEO, Sam Bankman-Fried, which might impact the crypto industry, and another case dealing with tax regulation on staked tokens. It points towards the need for balanced regulations, addressing individual issues without hindering industry growth.

Crypto Regulation in the US: Balancing Innovation and Consumer Protection

“The US House Financial Services Committee is examining legislation for regulatory clarity in the crypto and blockchain space, including the Financial Innovation and Technology for the 21st Century Act. Critics are concerned about potential favoritism towards cryptocurrency firms over consumers and the possibility of mishandling customer funds. Regardless of outcome, there’s widespread acknowledgment of the urgent need for comprehensive cryptocurrency regulation.”

Navigating DeFi: Atlendis Flow Bridging Crypto and Fiat, a Template for Future Blockchain Adoption

“French DeFi project Atlendis, recently secured a €1M loan and a crypto services provider license, setting a precedent for future regulatory guidelines. Atlendis now targets real-world assets and fintech companies, facilitating crypto-to-fiat transactions, and opening blockchain opportunities to non-crypto businesses.”

Navigating the Legal Labyrinth: A Close Look at Former Celsius CEO, Alex Mashinsky’s Legal Battle

The article discusses recent legal developments in the crypto industry, particularly the extended discovery timeline granted to former Celsius CEO, Alex Mashinsky, facing several fraud charges. The article emphasizes the importance of regulatory adherence and transparency in the growing cryptocurrency sector.

Solana Developer Automata: A Victim of Precarious Crypto Climate or Overambitious Game Plan?

Solana game developer Automata makes mass layoffs due to substantial financial losses and slower development of its Star Atlas game. The downturn is linked to the in-game token Atlas’ 80% value decline impacting 33% of the project’s revenue. Meanwhile, trading platform Robinhood accelerates UK expansion. The volatile crypto landscape necessitates strategic, informed decisions.

Worldcoin’s Future: Privacy Concerns, Dubious Investors and Potentially Revolutionary Tech

The Worldcoin project, co-founded by OpenAI’s Sam Altman, uses a hardware unit called the Orb for identity verification by iris scanning. Despite initial success, criticism has piled up around privacy, centralization, security concerns, and questionable marketing strategies. Ethereum co-founder, Vitalik Buterin and crypto influencer ZachXBT have voiced concerns about potential misuse and exploitation.

Gag Order in Crypto Case: Balancing Fair Trial and Blockchain Transparency

“Concerns arise as a U.S. federal judge suggests a gag order in the case of a former cryptocurrency CEO, Sam Bankman-Fried (SBF), potentially impacting transparency within the blockchain industry. This order might set a precedent of censorship, affecting public perception and understanding of the blockchain and crypto ecosystem.”

Unveiling Crypto’s Legal Conundrum: Individual Privacy vs Public Discourse

“Former CEO of FTX, Sam Bankman-Fried, faces a gag order in an ongoing trial, raising questions about legal transparency and public discourse in the world of cryptocurrency. Meanwhile, a case involving South Korean platform, Delio, highlights concerns about enforceability of regulatory decisions within the industry’s decentralised and anonymous framework.”

Exploring Cryptocurrency Regulations: A Story of Survival Bunkers, Genetic Labs and Misused Funds

“Regulations are pivotal as cryptocurrencies surge in popularity. For instance, Gabriel Bankman-Fried’s plan to purchase Nauru using cryptocurrency funds raises questions about potential misuse. These unusual circumstances underline the need for greater scrutiny, transparency, and comprehensive regulations in the blockchain domain to ensure safety and trust.”

Arkham Intel Exchange: A Peek into the Blossoming Bounty Marketplace and Emerging Controversies

“Arkham Intel Exchange, a crypto intelligence bounty marketplace, sees active interaction with the majority bounties from Tron DAO and Arkham Admin. Bounties emphasis on identifying public addresses and associating with larger assets. However, its practice of incentivizing identification of individuals behind anonymous blockchain addresses faces criticism.”

Unveiling Paradex: Paradigm’s Hybrid Leap Merging DeFi and CeFi in Crypto Landscape

“Paradigm extends its services to decentralized finance (DeFi) through Paradex, a decentralized perpetuals platform. This hybrid derivatives exchange integrates liquidity and efficiency of centralized finance with transparency, self-custody, and trustlessness inherent to DeFi. Paradigm’s DeFi-CeFi fusion presents a new investment avenue.”

The DOJ’s Vigilance in the Crypto Environment: Unveiling the Prospects of the National Crypto Enforcement Team

The U.S Department of Justice intends to enhance vigilance in the crypto space with the National Crypto Enforcement Team (NCET). Coupled with other computer crime divisions, the NCET plans to combat digital asset-related transgressions more efficiently through larger structures and enhanced resources. The team has displayed remarkable tenacity handling cases such as FTX incidents and other crypto infringements. The focus now lies in fostering understanding of this new “digital battlefield.”

Blockchain World Upheaval: The Sam Bankman-Fried Scandal under a Legal and Ethical Lens

“U.S DOJ accuses Sam Bankman-Fried of leaking private documents, raising privacy concerns in the digital domain. Amidst lawsuits and FTX’s collapse, this signifies the need for regulatory vigilance, ethical practices, and privacy safeguards in blockchain technology and cryptomarkets.”

Navigating the Murkiness of Crypto Regulations: The Verdict on XRP and the Unfolding Impact on Bitcoin and Ether

“A U.S. judge ruled that XRP is not a security, and BlackRock’s Bitcoin ETF reached the next approval stage, boosting XRP’s price. This and the acceptance of crypto in retirement portfolios pose more regulatory uncertainties, possibly affecting Bitcoin, Ether, and altcoin prices and trade volumes. Despite 2022’s crypto turbulence, H1 2023 saw a reversal led by Bitcoin, with notable shifts in option market activity and increased focus on crypto-specific news. Ethereum’s classification remains uncertain, potentially impacting the market’s move towards higher beta altcoins.”

Binance Coin Burn: A Bold Move Amid Regulatory Challenges and Bearish Market Predictions

Binance, a leading crypto exchange, has completed its quarterly burn of 1.99 million BNB coins (around $477 million), as part of a commitment to reduce the token’s supply. Despite regulatory challenges and market skepticism, Binance persists in its Auto-Burn and Pioneer Burn initiatives to maintain its supply path.

US Congress Critics Challenge SEC’s Approach to Crypto Regulation

“US representatives French Hill and Dusty Johnson question SEC chairman Gary Gensler’s approach to digital asset regulation. They suggest that shaping legislation is a more potent tool for resolving regulatory issues in the digital asset space, offering firms guidance and bolstering customer protection.”

Manta Network’s $25M Series A: A Strategic Step or a Tangle in Regulatory Challenges?

“Manta Network’s developer, p0x labs, recently accrued $25 million in the latest Series A round. This investment supports infrastructure projects like Manta Network which focuses on zero-knowledge applications, safeguarding transaction privacy. With a valuation of $500 million, the funds intend to scale the network, reaching more users and enhancing Manta Pacific—boosting growth in pivotal Asian markets.”

Evertas Acquires Bitsure: A Game Changer for Crypto Mining Insurance Landscape

Evertas, a digital asset insurance entity, has acquired Bitsure, a leading provider of crypto mining insurance. Aiming to broaden coverage across multiple jurisdictions, this move may reshape the crypto mining landscape. The acquisition is speculated to support mining operations and other related exchanges amid market instability.

Cryptocurrency Bounties Reinvents the Fight Against Crypto Theft: Privacy vs Justice

“Arkham’s new platform, “Intel Exchange”, designed for exchanging crypto bounties for information, raises concerns about privacy and security. Criticism suggests the exchange could potentially compromise anonymity principles inherent to cryptocurrency and invite exploitation by bad actors, despite CEO reassurances of high verification standards.”

Exploring the Intricate Network of Relationships in Crypto: Constance Wang’s Move to Sino Global Capital

Constance Wang, known as the “right hand” to Sam Bankman-Fried, has now become the head of gaming at Sino Global Capital. Leveraging her extensive professional background, her entrance into Sino Global Capital signifies a promising turn for the company, indicating an increased need for gaming expertise in the crypto industry. This highlights the fluid nature of this industry and the potential for new alliances.

G20’s Financial Stability Board’s Recommendations for Regulating Crypto Firms: An Overview and Analysis

The Financial Stability Board (FSB) of G20 Nations has published final recommendations for regulating crypto trading firms, in response to recent cryptocurrency market volatility. These recommendations propose regulatory standards for crypto assets, focusing on customer asset protection, conflict of interest prevention, and cross-border regulatory cooperation. The measures aim to ensure financial stability and avoid future disruptions.

BlockFi Bankruptcy: An Eye-Opening Case for Crypto Regulation and Risk Management

BlockFi’s bankruptcy saga has spurred conversations about the need for stringent regulations in the crypto industry. Accusations from creditors about deception, poor risk management, and hasty business decisions highlight challenges for future trust in crypto lending. The case underlines the need for caution within the crypto economy.

Navigating the Uprising: How FSB’s Proposed Crypto Regulation Promises Market Stability

The Financial Stability Board (FSB) is advocating for a global digital asset regulation to ensure safety for user assets. The proposed regulations separate user assets from platform assets for transparency. They also aim to solidify stablecoin regulations, prevent commingling of user funds, and expect stablecoin issuers to establish an identifiable legal body to ensure accountability.

BlockFi’s Downfall: Analyzing the High Stakes of Crypto Lending and Risk Management

This excerpt discusses the controversy surrounding BlockFi’s CEO who allegedly ignored risk warnings, leading to massive lending to Alameda Research. Despite facing potential liquidation risks, he loaned assets totaling $217 million. The issue underlines the preceding balance in the high-risk crypto industry and the critical importance of precise risk management.

Unveiling the Fir Tree’s Digital Asset Opportunities Fund: Turning Crypto Turmoil into Dividends

New York hedge fund, Fir Tree Partners, is launching the Fir Tree Digital Asset Opportunities Fund to capitalize on opportunities within the complex digital asset markets. The move, set for August 1, comes despite the firm’s history of risky crypto engagements and the notable risks associated with investing in distressed assets.

Solana’s Surging Prices: Rooted in Solidity or Simply Speculative?

Despite Solana’s recent price surge, concerns persist over the health of its ecosystem. With limited growth, low liquidity, and lower user engagement, skepticism over its sustainability is increasing. Success relies on forthcoming blockchain upgrades and overcoming network downtimes. Until then, investor caution is advised.

The Emergence of OPNX: A Symbiosis of Traditional Finance and Crypto Trading

“OPNX, an exchange dedicated to trading bankruptcy claims against collapsed crypto firms, merges traditional financial structures with new-age cryptocurrencies. It allows claims to be converted into collateral to trade crypto futures, adding a unique dimension to crypto trading.”

Navigating Cryptocurrency Seas: Lessons from Binance’s Six-Year Journey and Future Trends

In a reflective note marking Binance’s sixth year, CEO Changpeng Zhao shares lessons from the crypto exchange’s journey and visions for the future of cryptocurrencies. He highlighted the importance of financial management during market downturns, emphasizing Binance’s commitment to user priorities. Zhao anticipates traditional finance giants facilitating institutional crypto adoption, the acceleration of decentralized finance (DeFi), and growth of regulation-prone exchanges, despite uncertainties. He argues that strategic crypto adaptation will give countries an advantage in our increasingly digital world.

Bitget’s Staggering $1.44 Billion Reserve Ratio: Financial Fortitude or Overcautious Strategy?

Crypto exchange Bitget declares a debt-free status and remarkable reserves totalling $1.44 billion, exceeding the industry-standard backing with a reserve ratio of 223%. Built through transaction fee profits and returns from investments, Bitget seeks to maintain transparency and reinforce trust by issuing monthly proof-of-reserve statements. The exchange also initiates a crypto lending program, enabling users to maximize investment possibilities.

Navigating Crypto Bankruptcy with OPNX: A Glimmer of Hope or Risky Venture?

Open Exchange (OPNX) is offering beleaguered investors, from the collapse of crypto exchange FTX and lender Celsius Network, a chance to trade their claims on their platform. With claim tokenization, this offers an opportunity for immediate liquidity and control over their funds.

Unraveling Stringent Bail Conditions: Scrutinizing Crypto CEO’s Legal Tangle & Future Blockchain Regulations

“Former FTX CEO, Sam Bankman-Fried, facing strict bail conditions including restricted internet and phone use, has requested for relaxed security checks for specific visitors. This legal controversy puts into question current blockchain regulations, and could shape the future of crypto industry regulations.”