“Blockchain is steering a ‘digital sovereignty’ revolution through the principle of decentralization and Web3. It aims to disrupt conventional infrastructure and restore trust in traditional institutions by combating grave cybersecurity threats and enabling control over personal data. Moreover, blockchain products like cryptocurrency and tokenization could potentially transform our digital interactions and transaction methods.”

Search Results for: Wall

Surge in Crypto Space: Binance’s Expansion, HashKey Partnership, Patricia Token, and Favorable EOS White listing

“Binance Japan aims to triple its token offerings by listing 100 more. HashKey partners with imToken for digital asset self-management. Patricia, an Nigerian cryptocurrency exchange, launches ‘Patricia Token’, a debt management tool. SEBA Bank’s Hong Kong branch obtains approval-in-principle for securities and virtual asset dealings. EOS is whitelisted by the JVCEA for trading against Japanese yen. Cathedra Bitcoin improves its cryptocurrency mining production.”

Rising Momentum for Bitcoin SV and New Opportunities in Web 3.0 with Launchpad XYZ

“Crypto enthusiasts closely watched as Bitcoin SV (BSV) surged by 10% overnight, likely due to the possibility of the SEC abandoning their current legal stance that has been preventing a Bitcoin spot ETF. Despite some retracement, Bitcoin SV has still maintained a strong technical form, even amid localized resistance. In parallel, the new AI analytics tool, Launchpad XYZ (LPX), is catching attention, promising to pave innovative paths within the crypto sphere.”

Navigating Cryptos: Dissecting Asset Handling Strategies from Hodling to Active Trading

“In the uncertain cryptocurrency landscape, experts suggest understanding basics before making bold decisions about investing or trading. Some suggest self-custody for asset control, while others trust institutions like Coinbase. Diversification, focusing on long-term over short-term fluctuations, and safety tools like stop losses are also recommended. Holding on to large-cap cryptocurrencies and using hardware wallets for secure long-term storage are considered safest.”

BlockFi’s Redemption Saga: From ‘Trade Only’ Assets to Gemini Dollars and Patricia’s PTK Crisis

BlockFi’s saga continues as the company seeks court authorization to convert ‘trade only’ assets into stablecoins for user withdrawal. This move, supported by the Committee of BlockFi creditors, is part of efforts to return user funds. However, uncertainty remains due to debt and questionable plans. Similarly, Patricia crypto exchange faces skepticism over its debt token, Patricia Token (PTK). These situations highlight tension between trust, regulation, and innovation in the crypto world.

Rising Phoenix: XRP’s Resurgence and the Emergence of New Altcoins like WSM

“XRP has seen a 3% gain, boosting its price to $0.529853 and an increase in trading volume to $1.5 billion overnight. Market indications suggest a promising future for XRP, with a 55% price increase since the year’s start. Supporting its optimistic outlook are Ripple’s recent partnerships and steady XRP sales, hinting at stronger performances ahead.”

Stacks (STX) Surge: The Ripple Effect of Grayscale’s Triumph and Promising Altcoin Prospects

“Despite a previous decrease, Stacks (STX) leads today’s cryptocurrency market with a recent surge of 16.5%. This is believed to follow Grayscale’s win with the SEC. The future implications of BTC ETF approvals promise further STX gains, while new opportunities for investors like the Launchpad.xyz (LPX) platform continue to emerge, suggesting the ever-evolving nature of the crypto landscape.”

Robinhood’s Tenuous Ties with Crypto: Navigating Uncertainty and Shifting Alliances

Robinhood has severed ties with market-making partner Jump Trading, a significant player in its crypto ventures. This decision stems from the unstable regulatory landscape and changing internal alliances. Moreover, Robinhood’s recent financial records reveal a drop in interest in crypto trading, with trading figures decreasing by 68% relative to the previous year. Despite this data, Robinhood remains one of the largest bitcoin holders.

Jamaican Cab Drivers Embrace Jam-Dex: Relevance, Challenges and Potential Outcomes

Jamaican cab drivers are optimistic about the nation’s Central Bank Digital Currency, “Jam-Dex”, aiming to revolutionize public transportation by eliminating cash and its associated security concerns. Despite a lukewarm public response, proponents believe Jam-Dex could significantly improve daily transactions if successfully adopted by customers.

China’s Giant Leap: JD.com’s Digital Yuan Revolution for Supply Chain Financing

“JD.com and ICBC are developing a digital yuan using smart contract technology for supply chain financing, enhancing verification, risk identification, and credit guarantees for SMEs. The solution, fostering trust among financial institutions, aims for wider digital yuan acceptance and marks a significant moment in streamlining financial processes.”

Bitcoin’s Market Rollercoaster: Billionaire Influence, Technical Indicators and Future Prospects

“Bitcoin’s recent tumultuous journey has raised eyebrows with an 11% decrease this month, and a speculated association with billionaire Prigozhin stirring market sentiment. Despite this, bullish indicators suggest a resilient momentum that could see Bitcoin reach $28,600, provided there’s a bullish breakout above $26,800.”

Binance Shakes Up Latin American Crypto Market: Suspends Debit Cards but Launches ‘Send Cash’

Binance’s new product in Latin America, “Send Cash”, combines crypto payment tech with licensed services for enhanced efficiency and lower transaction costs. Less than 1% of users will be impacted by the suspension of Binance’s debit card services. ‘Send Cash’ is a compensatory move targeting all Latin American nations with favorable rates, marking a strategic move towards feasible financial solutions to the region.

Grayscale’s Legal Victory Spurs Bitcoin Surge and Highlights Crypto’s Regulatory Challenges

“Yesterday’s Bitcoin surge was a reaction to the ruling in favor of Grayscale against the SEC, seen as a win for the broader crypto industry. Cryptocurrencies like XDC Network, Wall Street Memes, Avalanche, yPredict, and Algorand emerged as strong candidates in light of this regulatory development. However, approval for the first U.S. Bitcoin ETF is still needed, indicating ongoing regulatory challenges.”

Binance Quietly Removes Banco de Venezuela: Blockchain Freedom Versus Economic Sanctions

Cryptocurrency exchange Binance has silently removed Banco de Venezuela from its P2P service list, mirroring U.S Treasury-imposed financial sanctions. The move raises concerns among Venezuelan crypto enthusiasts, notably because the bank plays a crucial role in Venezuela’s digital currency ecosystem. Despite the silent removal, users can reportedly circumnavigate the ban due to the P2P nature of the services.

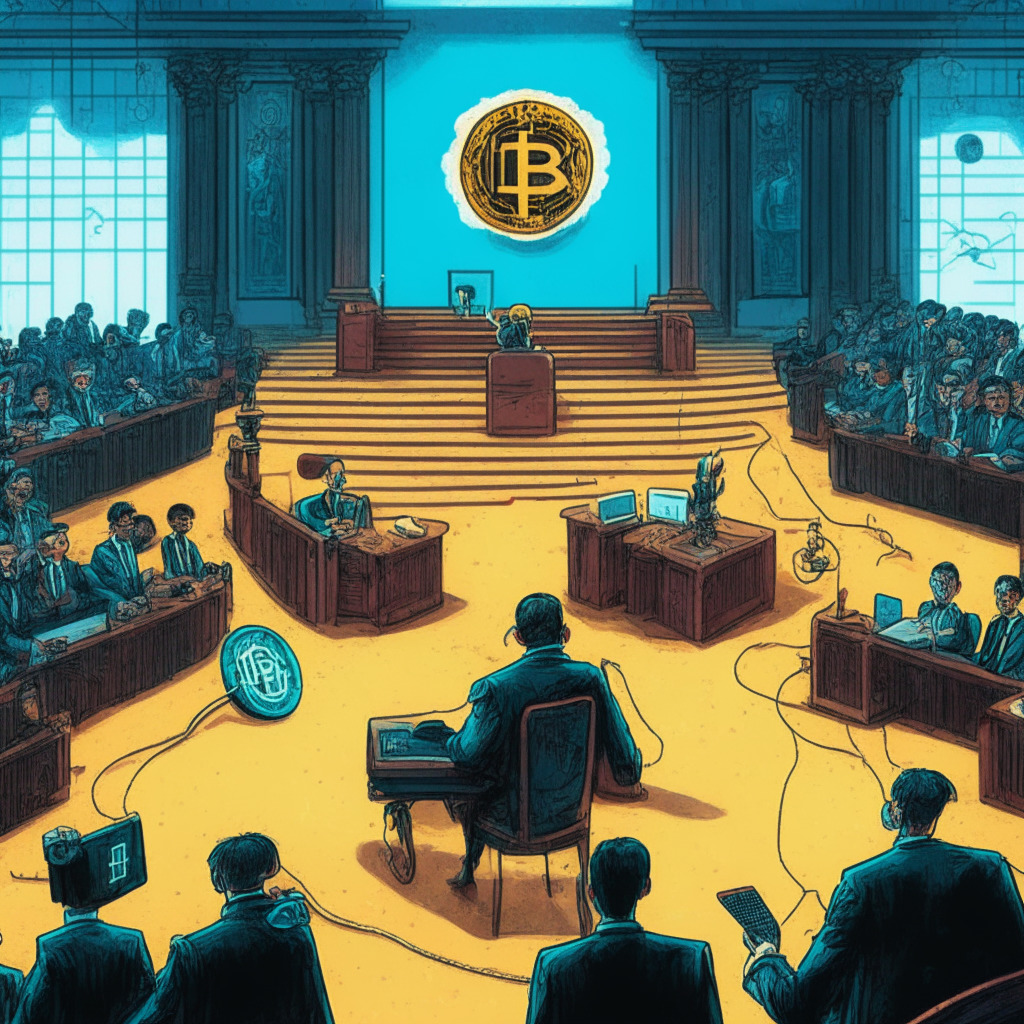

Redefining the Crypto Landscape: The Impact of US Court’s Ruling on Bitcoin ETFs

The U.S. Court of Appeals’ recent ruling criticizes SEC’s denial of a bitcoin spot-market ETF as “arbitrary” and “capricious”, fuelling hope for future acceptance. Grayscale Investments’ push for the Grayscale Bitcoin Trust’s transition into an ETF could force SEC to reconsider past rejections.

Decentralizing E-commerce: Analyzing the Revolutionary Potential of Bison Relay v0.1.8

The introduction of Bison Relay v0.1.8, a decentralized e-commerce system by Decred, is poised to transform digital retail dynamics. With features for enhanced user experience, this platform promotes increased control, improved privacy, and strengthened security in the online retail realm, potentially redefining the e-commerce landscape.

Coinbase: A Journey through Tech Glitches, User Experience Innovations, and Regulatory Challenges

Recently, Coinbase users encountered a bug resulting in the display of empty wallet balances, impacting the ability to add or import wallets. Despite setbacks including a 70% transaction slump and regulatory pressures, Coinbase continues seeing success, including a 156% stock gain this year.

Mainstreaming Crypto: The Future of Digital Transactions Unfolds on Social Media Platforms

“Social media giant, X, has established cryptocurrency payments for its global audience, following recent approval from regulatory authorities. This brings good tidings for X’s network of 400 million users who can potentially interactively share via cryptocurrencies, transforming the social media platform into an ‘everything app’.”

Crypto Chaos: The Rising Tension and Uncertainty Surrounding PEPE’s Future

Memecoin PEPE has seen an 80% decline in value because of rumors of a potential “rug-pull” by its developers. After changing token transfer rules, they moved $16 million worth of PEPE to exchanges, leading some to predict a crash. However, increased buying and oversold indicators point towards a possible market rebound.

XRP’s Market Rollercoaster: Drastic Dips, Promising Peaks, and the Quest for Stability

XRP has dipped 28% recently due to market sentiment and macroeconomic uncertainties. Despite its oversold status, the crypto asset has shown resilience, potentially offering a good opportunity for investors. However, XRP’s future still holds uncertainties, with conflicting market indicators and the possibility of dropping below $0.50.

GambleFi’s Rollbit Surges Amid Bearish Warning Signs & the Rise of Launchpad XYZ

“Rollbit (RLB), a leading token in the emerging online gambling sector, has surged by 44.5% in a week, amid anticipation about potential of this $63Bn marketplace. However, indicators suggest a potential need for consolidation, and the risk of a significant decline. Meanwhile, Launchpad XYZ (LPX), an innovative platform for Web 3.0 entry, may offer lucrative crypto investments, but also demands due diligence.”

Bitcoin Cash’s Struggles Amid Downturn: A Chance For Emerging Crypto To Shine?

“BCH, following a 60-day downturn resulting in a 42% loss, trades around $189.30. Amid descending hopes, signs of potential recovery surface as BCH firmly consolidates above $180, charting a possible return to $210. However, risks remain, with a potential drop to $160.”

Sanction Enforced: Binance Removes Banco de Venezuela from P2P Services

“In a move to enforce international financial sanctions, Binance, the world’s largest crypto exchange, has eliminated a payment method attached to Banco de Venezuela from its P2P trading service. This action reflects the limited room for maneuver that global crypto exchanges have amidst international sanctions and raises questions about the extent to which the promises of cryptocurrencies hold true in a regulated market.”

The Controversial Loan Request by Wintermute Trading: A Threat to Yearn’s Decentralization?

“Wintermute Trading faces criticism as they negotiate a loan of 350 YFI tokens from Yearn Finance. Yearn’s supporters challenge the benefit to Yearn from this deal, questioning its alignment with Yearn’s philosophy of decentralized finance. The main issue lies in Wintermute’s intention to borrow Yearn’s governance token, potentially undermining Yearn’s foundation of decentralization.”

Shiba Inu’s Slow Progress and Shibarium’s Relaunch: A Silver Lining amidst Underperformance?

Shiba Inu (SHIB) has seen a modest rise of 2% amidst overall market upshift. Despite experiencing a botched launch of Shibarium, an updated, more secure version could potentially drive SHIB’s price growth. Despite underperforming, indicators suggest potential for significant price rises in the near future.

Crypto Safety Compromised: Debating the Fallout of FTX Exchange Shutdown and Rising Phishing Attacks

After a major exchange shutdown, customers of FTX are still facing issues including a fresh phishing attack that targets their emails. In a SIM swapping attack, customer information from FTX, Genesis, and Blockfi were compromised. A dubious proposal claiming to recuperate lost capital asked customers to link a crypto wallet to their account, potentially risking a complete drain of token holdings.

Navigating the Choppy Waters: Binance’s Launch of T+3 Daily BNB Options & Its Market Implications

Binance Options is set to introduce “T+3” daily call and put contracts related to BNB, a cryptocurrency intrinsically linked with the exchange itself. Essentially, these options can be traded two days prior to expiry, initially offering a lifetime of three trading days from their introduction, promoting increased flexibility in cryptocurrency markets. This move also reflects Binance’s positive outlook towards the future of cryptocurrency markets.

Blockchain Evolution: Shibarium’s Triumph and Trials Post-Relaunch

“Shibarium, a new layer-2 blockchain for Shiba Inu, has surpassed 100,000 wallets with an impressive 35,000 coming within 24 hours of its relaunch on Aug. 28. Over 420,897 transactions have been facilitated by these wallets across 344,614 blocks.”

Navigating the Bear Market: A Spotlight on Promising Cryptocurrencies Amid Volatility

“In today’s tumultuous crypto market, investors explore suitable cryptos to invest in during the enduring bear market. Bitcoin’s challenges illustrate sector volatility; however, interest from global governments and institutions like BlackRock provide optimism. Cryptos like THORChain, Wall Street Memes, dYdX, Sonik Coin, and Bitcoin SV show promising fundamentals and bullish outlooks.”

Crypto Regulation: Candidates’ Stances and Upcoming Election Implications

“Crypto regulation has become a significant issue in U.S. presidential campaigning. Candidates’ positions vary widely, from skepticism to enthusiastic adoption, yet the subject of digital assets regulation was absent from the recent Republican debate. This highlights the increasing importance of cryptocurrencies in our socio-political landscape, and suggests a need for informed legislation.”

Unravelling the Blockchain Future: Justice, Global Sanctions, Charity Initiatives, Twitter Vulnerability, and Investment Trends

“In the face of persistent complications, the future of blockchain teeters precariously between pathbreaking transformation and a potential bubble. Blockchain’s breathtaking scope and opportunities invariably throw up a set of challenges for us to navigate. Our choices shape the blockchain of tomorrow.”

Navigating the Future of Blockchain: Innovation Progress Spurred by Cryptography, Regulation and Social Integration

“Binance Labs has invested in Delphinus Lab, a project exploring zero-knowledge cryptography in WASM environments. Meanwhile, Num Finance has launched a Colombian peso-pegged token on the Polygon network, with the potential regulatory scrutiny. Elsewhere, Unstoppable Domains has released a messaging feature for secure blockchain-based social interaction.”