Reddit’s native token, Moons and Bricks, have seen a dramatic increase in price due to Reddit’s Terms of Service update, with Moons having a 170% price inflation. Reddit’s Ethereum-based wallet, Vault, now allows trading of verified virtual goods. The speculation around these changes is driving the value acceleration, creating feverish excitement among traders.

Search Results for: CEL

Digital Yuan’s Expedited Rise: Innovative Financial Revolution or Privacy Catastrophe?

The Chinese city of Shenzhen has reported the creation of nearly 36 million digital yuan wallets, accelerating the integration of blockchain-based central bank digital currencies (CBDCs) into everyday commerce. This expansion raises questions about regulation, privacy, and data protection in this growing currency system. Despite potential concerns, the adoption of CBDCs, supported by initiatives like the People’s Bank of China’s SIM-card based CBDC wallet, continues to progress.

Asia’s Multichain Saga and Binance’s Unsettling Developments: A Closer Look at Crypto’s Uncertainties

Recent events involving China’s Multichain protocol and Binance highlight uncertainties in the crypto world. Multichain’s authority misuse led to unauthorized withdrawals, and Binance’s large-scale layoffs signal operational difficulties. These instances emphasize the need for oversight, security, and transparency in blockchain technology.

Evolving Crypto-Banking Symbiosis: Spotlight on Customers Bank’s Emergent Leadership

“The rise of Customers Bank as the new favored banking partner in the US crypto industry highlights the complexities of financial relationships in this sector. However, as crypto firms rapidly switch to Customers Bank, concerns around market monopolization arise. This transition also exposes a tentativeness – navigating the line between leveraging opportunities and exercising caution in an uncertain regulatory climate.”

Bolstering Blockchain: The Integration of ZK Proofs in Cryptographic Technologies

This article discusses the partnership between Paris-based =nil; Foundation and Fabric Cryptography as they work together to enhance cryptographic technologies and accelerate the deployment of zero-knowledge (ZK) proofs – a cryptographic procedure with substantial privacy-preserving attributes. They aim to overcome barriers in computation, making ZK proofs more functional for digital transactions, cloud services and privacy applications.

Navigating Crypto Terrain: From BNB Shorting to 1inch Rally and Bitcoin Halving Implications

“BNB perpetual futures signal a price drop with increased shorting, as 1INCH value surges by over 58%. Bitcoin’s upcoming halving event in 2024 is predicted to challenge miner revenues. Meanwhile, CELO’s growth aligns with cLabs’ transition proposal, showcasing the crypto sphere’s dynamism and unpredictability.”

LUNC’s Slow Progress vs. Chimpzee’s Promising Future: Navigating the Crypto Maze

“The price of LUNC has noticed a 5% surge in the past 24 hours, hinting at a potential short-term gain in the cryptocurrency. However, disagreements over upgrade proposals within the community raise uncertain recovery times. Meanwhile, Ethereum-based platform Chimpzee, with innovative sustainable consumption features, has raised over $850,000 in its ongoing presale, indicating potential gains for investors.”

Meme Coin Mania: The Rapid Rise and Fall of SAFU and the Emergence of $WSM

The meme coin SAFU experienced a 30,000% value surge within a six-hour trading period, followed by a major retracement pattern. Despite this volatility, interest in meme coins like DOGE, SHIB, and $WSM continues, with investors drawn to the high-stakes trading and humor of these speculative assets.

XRP’s Bull Run: The Impact of SEC’s Decision and the Pending Threat of an Appeal

Following Ripple’s victory over the SEC, XRP has seen a 60% surge in value in just seven days. Despite the specter of a possible SEC appeal, the consensus remains positive for XRP’s continued growth. A potential rise to $1 or even $2 by the end of the year is deemed plausible.

Innovative Adoption Tactics: Changzhou’s Digital Yuan Push Via a Unique Shopping Festival

To accelerate the adoption of its central bank digital currency (CBDC), Changzhou, China will distribute about $700,000 worth of digital yuan tokens and coupons as part of a shopping festival, replacing cash-filled envelopes with digital tokens. This strategic initiative intends to foster digital currency use among locals and scale CBDC acceptance.

Harnessing the Metaverse: The Future of Banking, Blockchain & Crypto – A Deeper Look

“Bank of America has implemented the world’s first VR and AI training for banking employees in the metaverse. Cryptocurrencies like Ethereum are preferred by some businesses for their fluidity and decentralisation against traditional banking. However, market volatility and security threats remain a concern. Tech giant Siemens plans to build an ‘industrial metaverse’, but the ecological impact of such advancements is under scrutiny.”

Shifting Tides: ARK Invest Diversifies Portfolio Favoring Meta and Robinhood Over Coinbase

“ARK Invest, a leading investment management firm, is significantly reducing its Coinbase shares while increasing its shareholding in Meta and Robinhood. This shows a strategic shift acknowledging the potential growth in Meta and Robinhood as the crypto industry evolves.”

Ripple Labs’ Victory Versus SEC and the Juggling Act of Crypto Reality

“In a significant verdict, a New York court ruled in favor of Ripple Labs declaring XRP as not a security, leading to a surge in its value. However, the judgement is partial, maintaining Ripple Labs’ regulatory uncertainty. Meanwhile, major developments include the arrest of Celsius Network’s former CEO, Europe’s first Bitcoin ETF debut, and Binance’s workforce reduction amidst US regulatory crackdown.”

Riding the $THUG Wave: The Emerging Power of Meme Coins in Crypto Sphere

Thug Life Token has risen in the crypto market, amassing $1.8 million from $THUG token sales within two weeks of its presale launch. The project plans a massive airdrop campaign, focusing on community engagement, fair tokenomics, and liquidity lock. Unique from other meme coins, $THUG stands for a timeless theme, aiming to embody humor, camaraderie, and shared hustle experiences in the web3 world.

Blockchains Future: A Tale of Innovation, Regulatory Challenges and Intensified Crypto Adoption

“The future of blockchain technology is promising yet complex, as seen with events like Litecoin’s robust performance, Polygon’s proposed token nomenclature revision, and regulatory challenges worldwide. Developments like Coinbase’s secure messaging system and Google Play’s digital asset integration highlight the merging of conventional institutions with blockchain, while caution remains due to persistent crypto scams.”

Unveiling the Fir Tree’s Digital Asset Opportunities Fund: Turning Crypto Turmoil into Dividends

New York hedge fund, Fir Tree Partners, is launching the Fir Tree Digital Asset Opportunities Fund to capitalize on opportunities within the complex digital asset markets. The move, set for August 1, comes despite the firm’s history of risky crypto engagements and the notable risks associated with investing in distressed assets.

The Emergence of OPNX: A Symbiosis of Traditional Finance and Crypto Trading

“OPNX, an exchange dedicated to trading bankruptcy claims against collapsed crypto firms, merges traditional financial structures with new-age cryptocurrencies. It allows claims to be converted into collateral to trade crypto futures, adding a unique dimension to crypto trading.”

DeeLance – A Blockchain-Infused Game-Changer for the Freelance Industry?

DeeLance, a buzzing cryptocurrency asset, utilises Web3 tech to revolutionize the recruitment industry. By integrating Ethereum blockchain, NFT technology, and the metaverse, it provides a secure, transparent digital workspace that streamlines employment and payment processes in both fiat and crypto. Interest among crypto enthusiasts is growing, yet caution is advised due to the inherent volatility of crypto assets.

Navigating Cryptocurrency Seas: Lessons from Binance’s Six-Year Journey and Future Trends

In a reflective note marking Binance’s sixth year, CEO Changpeng Zhao shares lessons from the crypto exchange’s journey and visions for the future of cryptocurrencies. He highlighted the importance of financial management during market downturns, emphasizing Binance’s commitment to user priorities. Zhao anticipates traditional finance giants facilitating institutional crypto adoption, the acceleration of decentralized finance (DeFi), and growth of regulation-prone exchanges, despite uncertainties. He argues that strategic crypto adaptation will give countries an advantage in our increasingly digital world.

Bitget’s Staggering $1.44 Billion Reserve Ratio: Financial Fortitude or Overcautious Strategy?

Crypto exchange Bitget declares a debt-free status and remarkable reserves totalling $1.44 billion, exceeding the industry-standard backing with a reserve ratio of 223%. Built through transaction fee profits and returns from investments, Bitget seeks to maintain transparency and reinforce trust by issuing monthly proof-of-reserve statements. The exchange also initiates a crypto lending program, enabling users to maximize investment possibilities.

Ripple’s Partial Victory vs SEC: Impact on XRP and Future of Crypto Regulations

Crypto firm Ripple Labs had a partial victory against the U.S. Securities and Exchange Commission (SEC) shaping the crypto regulatory environment. The court ruled Ripple’s XRP token exchange isn’t an investment contract, but the sales to institutions violated federal securities laws.

Crypto Regulation Spotlight: Mashinsky’s Detainment Fuels Debate on SEC Oversight and CFTC Role

Alex Mashinsky’s detainment on allegations of wire fraud, securities fraud, and price manipulation intensifies discussions on crypto regulation. Mashinsky’s case, alongside a ruling favoring Ripple, could have significant implications for platforms like Binance, Coinbase, and Bittrex that have faced SEC accusations. The situation underscores the need for a comprehensive regulatory regime to counter potential frauds in the crypto market.

Navigating Crypto Bankruptcy with OPNX: A Glimmer of Hope or Risky Venture?

Open Exchange (OPNX) is offering beleaguered investors, from the collapse of crypto exchange FTX and lender Celsius Network, a chance to trade their claims on their platform. With claim tokenization, this offers an opportunity for immediate liquidity and control over their funds.

Techteryx Takes Over TUSD: A Significant Shift in Stablecoin Landscape or A Risky Gamble?

British Virgin Islands-based firm, Techteryx, announces readiness to take over full-operations of all offshore aspects of TUSD, the fifth largest stablecoin, including minting and redemptions, customer onboarding, and compliance from the previous manager, ArchBlock. Amidst high market capitalization of over $2.8 billion, this move casts significant implications.

XRP Surpasses Bitcoin in South Korean Trading Volume: Court Verdict Consequences and Uncertainties

Trading volume of XRP on South Korea’s Upbit recently surpassed that of Bitcoin, due to a favorable court verdict in Ripple’s battle with the U.S. SEC. The decision caused XRP’s trading volume to account for 46% of total trading on Upbit, sparking a market-wide bullish trend for altcoins.

Cross-Border Potency of Digital Rubles and Yuan: Boon or Bane for International Trade?

The dialogue between Russia and China’s central banks is accelerating speculation around Central Bank Digital Currencies (CBDCs). While Russia aims for early initiation with domestic commercial banks, China is progressing with offline and CBDC wallet tests. Meanwhile, Russia’s new legislation permits “non-residents” to own digital ruble wallets, establishing the digital ruble as an international trading tool. These developments challenge traditional banking norms and raise questions concerning international trade norms, regulations, and digital security.

Eyeball Scanning for Cryptocurrency: An Insight into Worldcoin’s Innovative Yet Controversial Venture

Worldcoin’s project World ID, a “global digital passport,” is gaining popularity, with 2 million sign-ups achieved in record time. This system rewards users with cryptocurrency for uploading their iris data. Despite potential privacy concerns, other protocols like Okta’s Auth0 and Talent Protocol have integrated World ID into their processes, endorsing the project’s credibility.

Bitcoin’s Waning Dominance: The Ripple Effect and the Resurgence of Altcoins

“The cryptocurrency market recently saw Bitcoin’s dominance fall to under 50% due to XRP, Ripple’s native cryptocurrency, winning its lawsuit against the US Securities and Exchange Commission. This triggered gains for other altcoins in the market, marking the return of the ‘Altcoin season.'”

Coinbase vs SEC: How a Supreme Court Ruling Could Impact Future Cryptocurrency Regulations

In facing litigation with the U.S. Securities and Exchange Commission (SEC), Coinbase draws parallels with a recent Supreme Court judgment on student debt cancellation. The cryptocurrency platform is challenging the SEC’s regulatory authority over digital assets, highlighting the lack of ‘clear congressional authorization.’ This lawsuit could significantly impact cryptocurrency regulations and the digital asset industry.

UAE’s Proactive Stance on Crypto Regulation: An Ideal Model or an Unattainable Standard?

“Dubai’s Virtual Assets Regulatory Authority has demonstrated a novel regulatory approach to digital assets, offering a clearer and more proactive regulation environment than the U.S, emphasizing the benefits of a flexible regulatory framework for digital assets that supports innovation and preserves regulatory power.”

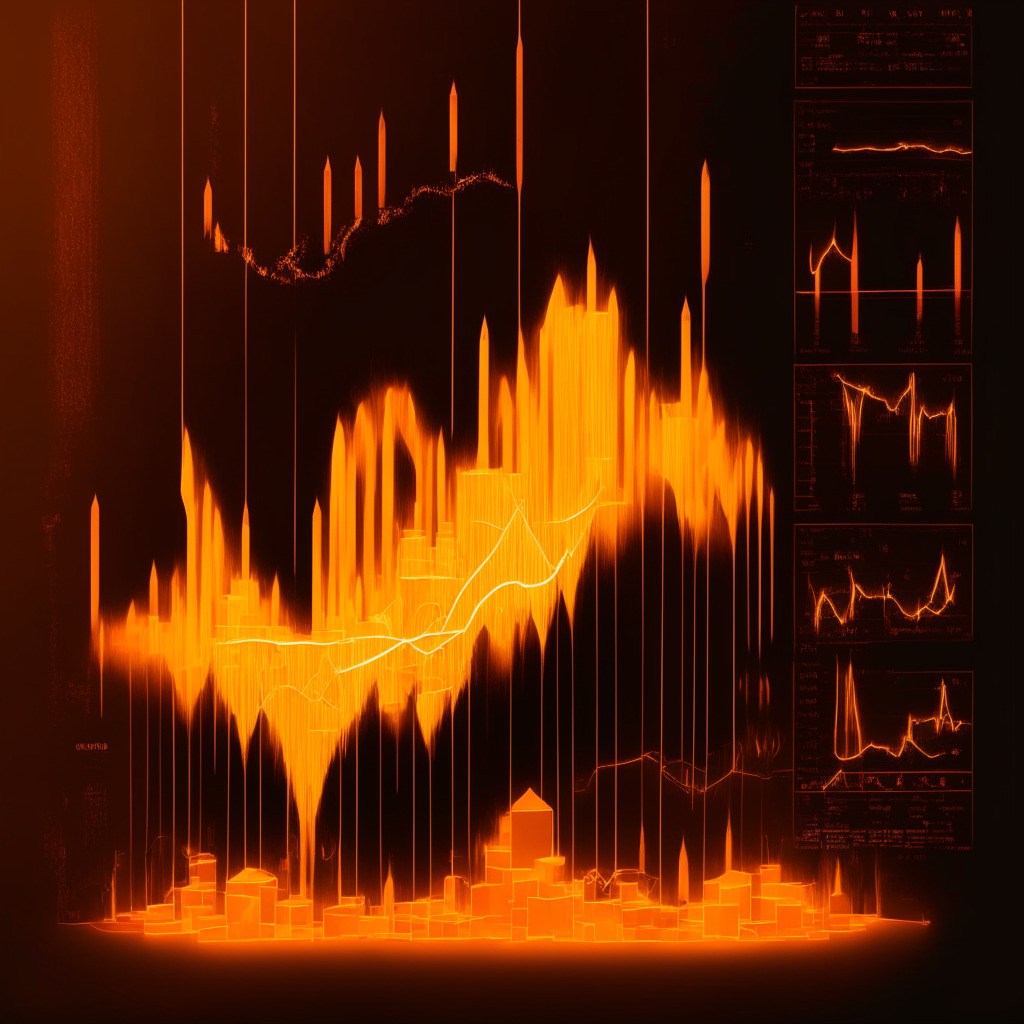

Bitcoin Hovering: Signs of a Bullish Phase or Merely a Brief Respite?

Bitcoin remains steady around $30,500, igniting speculation of a potential bullish phase. It found support at $30,400, accelerating robust debate amongst analysts. Relative Strength Index indicates strong buying pressure, yet a slowdown in bullish momentum is hinted at by the Moving Average Convergence Divergence.

Breaking Down BTC’s Disinflation driven Surge amidst Market Contrasts and Regulatory Hurdles

“Forecast for BTC price to reach $31K is driven by ‘disinflation’, with falling U.S. Producer Price Index (PPI) numbers creating a conducive environment. Some analysts associate declining inflation with BTC price rebound, contributing to an asset price spike. Contrasting views suggest a return to normalcy based on market patterns and expected moves from the Federal Reserve.”