Investment firms Invesco and WisdomTree are seeking approval for spot Bitcoin ETFs following initial rejections, arguing that a lack of such funds puts US investors at risk by resorting to unreliable digital asset accounts. The proposed spot ETFs would directly hold and track the price of physical Bitcoin, distinguishing them from futures-based ETFs reliant on futures contracts.

Search Results for: CEL

Terra Luna Classic’s Q3 Ambitions: Opportunities and Challenges in Network Growth

The Joint L1 Task Force (L1TF) has submitted a revised proposal for Terra Luna Classic’s Q3 development, focusing on LUNC and USTC supply reduction, upgrading the Cosmos SDK, integrating Block Entropy AI app chain, and collaborating with external teams. These ambitious plans aim to increase stability and growth but also present challenges for the network.

Invesco’s Spot BTC ETF Push: Growth Catalyst or Regulatory Hurdle? Pros, Cons & Conflicts

Invesco submits a new application for a spot Bitcoin ETF, following major players like BlackRock and WisdomTree. The mainstream adoption of Bitcoin ETFs could potentially drive growth in the digital asset space. However, investors should remain cautious and conduct thorough market research before investing, as the market is volatile.

Bitcoin Halving & June 2024 Futures: Preparing for Market Volatility in Crypto World

In anticipation of Bitcoin’s fourth mining reward halving in April next year, Deribit is listing June 2024 expiry futures and options, allowing investors to hedge against market volatility. This decision, driven by investor demand, highlights the importance of effective hedging strategies and showcases the high stakes in the crypto market.

Polygon PoS Upgrade to zkEVM Validium: Security vs Scalability vs Decentralization Debate

Polygon co-founder Mihailo Bjelic proposes an upgrade to the Polygon PoS network, suggesting a shift to a “zkEVM validium” version for increased security through zero-knowledge proofs. This upgrade would enable Polygon zkEVM for high-value transactions, offering lower fees and enhanced security from Ethereum’s features, targeting applications like Web3 gaming and social media.

Bullish Outlook for Crypto Post-Winter: Pantera Capital’s Take on Market Recovery and Bitcoin ETFs

Pantera Capital’s founder, Dan Morehead, has a bullish outlook for the digital currency ecosystem following last year’s crypto winter. Encouraging indicators, like BlackRock’s Bitcoin ETF application, could contribute to a re-emerging optimism among crypto enthusiasts and investors.

Energy Web’s Shift to Polkadot: Boosting Decarbonization and Attracting Energy Giants

Energy Web is transitioning from its Ethereum-based blockchain to the Polkadot ecosystem to scale its decarbonization product line and attract traditional energy giants. This move aims to enhance cybersecurity, increase decentralization, and accelerate the adoption of cleaner energy sources by major energy producers. The integration with Polkadot will provide a “Web2-like experience” for companies, addressing the evolving needs of the energy sector.

Ethereum Explorer Etherscan Integrates AI: A Boost to Blockchain R&D or Risky Move?

Ethereum blockchain explorer Etherscan has integrated AI technology in its newly launched Code Reader beta version, aiming to simplify blockchain research and development. Etherscan’s AI-powered Code Reader allows users to understand smart contract integration with decentralized applications, though potential inaccuracies warrant cautious use and verification.

Generative AI: Democratizing Creativity or Displacing Artists? Pros, Cons & Copyright Dilemma

Generative AI, like ChatGPT, democratizes the creative process, aligning with Web3 decentralization ideals. Tools such as DALL-E and StarryAI enable users without artistic background to create AI-generated NFTs. However, concerns about job displacement, copyright issues, and ownership of AI-generated works persist, leaving the legal status uncertain.

Revolutionizing Parametric Insurance with AI and Blockchain: The dRe Platform Debate

Arbol’s dRe platform offers AI and blockchain-driven parametric insurance for reinsurance, targeting severe storm catastrophes. Leveraging dClimate’s weather data and Chainlink’s oracle network, the platform automates claim initiation, notifications, and loss calculations for faster payouts and improved transparency, aiming to revolutionize the reinsurance market.

Binance Lightning Network Integration: Fast Transactions vs Blockchain Security Risks

Binance, a leading crypto exchange, is working towards integrating Bitcoin’s Lightning Network for faster and cheaper transactions. Despite no set timeline for completion, this move highlights the network’s growing popularity among users and exchanges, while also raising concerns regarding potential risks to blockchain security and decentralization.

IMF’s Role in the Future of CBDCs: Pros, Cons, and Global Regulatory Debate

The IMF is working on a global infrastructure for interoperability between central bank digital currencies (CBDCs) to prevent underutilization. Meanwhile, France’s AMF advocates globally coordinated rules for DeFi, and Ethereum developers consider raising the maximum validator balance for network efficiency.

Tokenization: Unlocking a $5 Trillion Market or Stumbling on Regulatory Uncertainty?

Tokenization, the process of converting real-world assets into blockchain-based tokens, offers opportunities such as operational efficiencies, improved liquidity, and market accessibility. However, regulatory uncertainty remains a significant challenge as the approach of policymakers will influence the future success of this growing market.

Canadian Bitcoin Conference: Innovation, Self-Custody, and Future of Crypto Adoption

The first-ever Canadian Bitcoin conference showcased Canada’s resilient Bitcoin ecosystem, featuring presentations from Stephan Livera, a hands-on workshop by D-Central, and a preview of Bull Bitcoin’s mobile wallet. The event highlighted the growing importance of self-custody wallets amidst market downturns, regulatory challenges, and opposition from political figures.

IMF’s XC Platform: Revolutionizing Cross-Border Payments or Sparking Privacy Concerns?

The International Monetary Fund (IMF) introduced a new cross-border payment platform, offering a single ledger for central bank digital currency (CBDC) transactions, enhanced programmability, and improved information management. The XC platform aims to lower transaction fees and shorten processing times, potentially saving $45 billion in annual remittance fees. However, concerns over privacy and the need for CBDCs may impact its widespread adoption.

Crypto Exodus from the US: Regulatory Hostility Pushing Innovation Overseas

Crypto is leaving the US due to a hostile regulatory landscape, with investors seeking clear frameworks for digital assets. Asia, Middle East, and Europe are emerging as crypto hubs, offering progressive regulations and support for the industry. Without a balanced approach, the US risks losing its innovation capital status.

Etherscan’s AI-Powered Code Reader: Boon or Bane for Smart Contract Decoding?

Etherscan introduces an AI-powered Code Reader tool, developed by OpenAI, to assist users in decoding Ethereum smart contract source code. It enables better understanding but should be used cautiously, as overconfidence in AI-generated information may lead to decision-making errors.

5 AI Video Editing Tools: Transforming Workflow & Debating Data Privacy Concerns

Explore five remarkable AI video editing tools – Adobe Premiere Pro, Final Cut Pro X, DaVinci Resolve, HitFilm Express, and iMovie. These tools enhance editing workflows, elevate final products, and are user-friendly for professionals and amateurs.

Binance Struggles with Global Regulatory Scrutiny: Challenges and Crypto Market Stability

Binance, the world’s largest crypto exchange, faces increasing regulatory scrutiny in several countries, resulting in withdrawal from UK, Dutch, and Cypriot markets. This highlights the challenges exchanges face while navigating the complex global regulatory landscape and balancing innovation with investor protection.

Expanding Crypto Trading on Tel Aviv Stock Exchange: Pros, Cons, and Global Regulation Debate

The Tel Aviv Stock Exchange plans to allow nonbanking member customers to trade cryptoassets, expanding authorized activities. Meanwhile, the IMF and FSB aim to develop a coordinated global crypto regulation approach. In other news, private investment firm ABO Digital launched, supporting the digital asset space, and Push Protocol revealed a group chat feature for its Web3 messaging app.

Binance UK Subsidiary Deregisters: Navigating Complex Crypto Regulations & Global Challenges

Binance Markets Limited (BML), the UK subsidiary of crypto exchange Binance, has withdrawn its registration with the UK’s Financial Conduct Authority (FCA), indicating it can no longer offer regulated activities and products in the UK. This decision follows the FCA’s consumer warning in June 2021 and Binance’s ongoing regulatory challenges in the U.S., France, Cyprus, and the Netherlands.

Binance’s Regulatory Dilemma: Compliance Cooperation or Struggles to Maintain Operations?

The UK’s FCA has cancelled permissions granted to Binance Markets Limited, following the company’s request. Binance is adapting to changing regulations by focusing on fewer European jurisdictions. As regulatory scrutiny increases, crypto exchanges must balance innovation and compliance to stay competitive and protect customers.

Terraform Labs Scandal: Examining Crypto’s Plunge and the Fake Passport Controversy

Terraform Labs co-founder Do Kwon denies allegations of utilizing forged passports and insists on his innocence. Kwon and former CFO Han were arrested in Montenegro with potentially forged documents following the 2022 Terra ecosystem collapse that led to an extended crypto winter.

Hong Kong’s Crypto Surge: Analyzing Benefits, Risks, and the Role of Government Support

Hong Kong’s government has invested $7 million in accelerating Web3 development, attracting 150 Web3 firms to Cyberport, its digital innovation hub. As the government aims to build a strong crypto and fintech ecosystem by 2023, addressing potential risks and challenges posed by such innovative technologies is crucial for ensuring security and stability.

Exploring Web3 and Blockchain: Challenges, Opportunities, and the GAMI-Cointelegraph Partnership

The blockchain and cryptocurrency sector evolves with Web3 driving a decentralized, user-centric environment featuring DeFi, NFTs, loyalty programs, and gaming. Web3-focused venture builder GAMI partners with Cointelegraph Accelerator to empower promising projects, creating a global decentralized product suite. Challenges around security, scalability and regulation persist, but Web3’s potential outweighs the risks.

AI Crypto Showdown: InQubeta vs Fetch.ai & Bittensor – Battle for Blockchain Future

InQubeta (QUBE) is gaining attention for its unique approach to blending crypto and AI, accelerating AI technology development through crowdfunding and fractional investment. Its NFT marketplace enables AI startups to mint equity-based NFT assets, making QUBE an enticing investment in the crypto community.

CryptoPunk Burned and Linked to Bitcoin: NFTs, Ordinals, and Ownership Debates

CryptoPunk #8611, a highly-priced Ethereum NFT, was burned and symbolically linked to a Bitcoin Ordinals inscription. This community-led effort from Bitcoin enthusiasts showcases the growing popularity and dynamic potential of NFTs and Bitcoin, raising questions about asset ownership and legitimacy.

AiDoge Listing: Innovation or Gimmick? Analyzing AI Meme-Based Cryptocurrency

AiDoge, a cryptocurrency using artificial intelligence for meme generation, is set to be listed on MEXC and Uniswap DEX exchanges on June 19th. With $AI2 as its ticker symbol, the innovative AI-driven platform appeals to meme enthusiasts and forward-thinking investors amidst ongoing debate on its long-term viability.

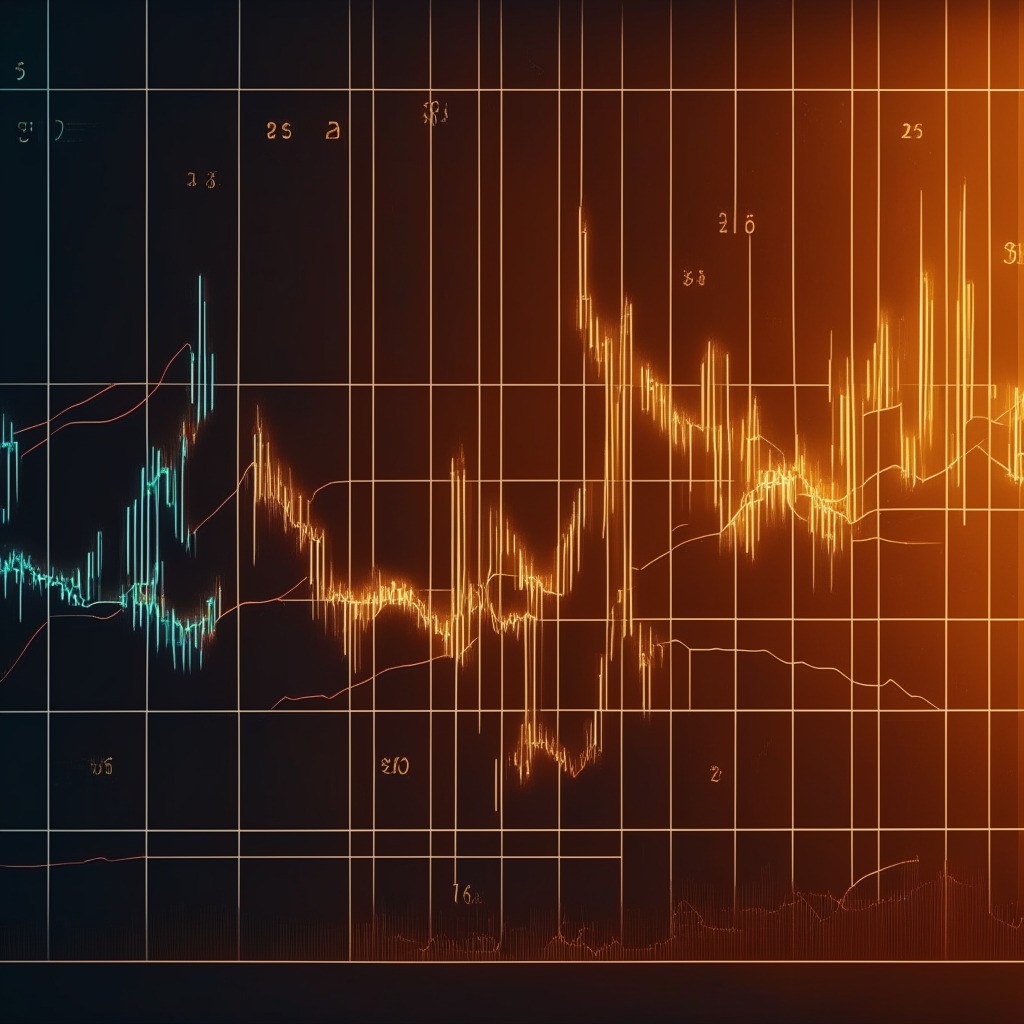

Double Bottom Pattern: Will Coinbase Share Price Rebound or Face Strong Resistance?

Coinbase’s COIN price quickly rebounded by 17.4% after a massive gap and seems to be forming a double bottom pattern, signaling a potential recovery and trend reversal. However, strong resistances may challenge this bullish thesis, and investors should closely monitor price action around key levels.

XRP Price Rejection at Support Trendline: Recovery Cycle or Trendline Breakdown Risk?

On June 14th, the XRP price experienced a significant decrease, finding support at the long-coming support trendline. Lower price rejection candles demonstrate increased demand, potentially initiating a recovery. However, uncertainty remains due to a narrow trading range, and traders should closely monitor market signals before making investment decisions.

Voicebox AI: Revolutionizing Speech Synthesis or Fueling Deepfake Dangers?

Meta’s new generative AI tool, Voicebox, creates realistic spoken dialogues but raises concerns about “deepfake” misuse. A cautious approach to sharing the technology is taken, emphasizing responsible innovation and addressing generative AI’s potential dangers, while minimizing negative consequences.

Binance.US and SEC Reach Temporary Agreement: Protecting Customer Funds While Addressing Concerns

Binance.US and the SEC have reached a temporary agreement restricting access to customer funds to Binance.US employees and preventing Binance Holdings officials from accessing private keys. This follows the SEC’s motion to freeze Binance.US assets during ongoing securities-related legal proceedings.