“Texas, a significant bitcoin mining hub, is experimenting with integrating mining into power grids. However, this move has been criticized for potentially prioritizing an environmentally harmful industry over local communities. On the other hand, supporters highlight the potential grid benefits and job opportunities, but concerns about sustainability and water usage persist.”

Search Results for: U.S

A Look into the Future: AI and Blockchain Synergies at EthCC Paris Conference

The Ethereum-focused conference EthCC witnessed buzz due to potential shift in the crypto market and the confluence of AI with blockchain technology. Future prospects of AI in crypto financial markets and valuating non-fungible tokens were discussed. Skepticism around use-cases and computational demands of AI and blockchain intersection remain.

Could Bitcoin Decide the Next President? Exploring Cryptocurrency’s Growing Political Influence

“Bitcoin and the crypto community could be deciding factors in a U.S. presidential election. Candidates now need to proclaim their stance on cryptocurrencies. The U.S. Federal Reserve estimates that 8%-11% of the American population, owning cryptocurrencies, can considerably influence the election. Anti-Bitcoin policies may thus, alienate a rapidly growing cohort of voters.”

Digital Dollar Race: Wyoming’s State Stablecoin and the National Push Towards Blockchain Adoption

“Wyoming seeks to establish a state stablecoin, with the state posting a job opening for a Stable Token Commission head to create legislative frameworks for the project. Meanwhile, Texas lawmakers aim to create a gold-backed digital currency, indicating an emerging inter-state rivalry in digital currency initiatives.”

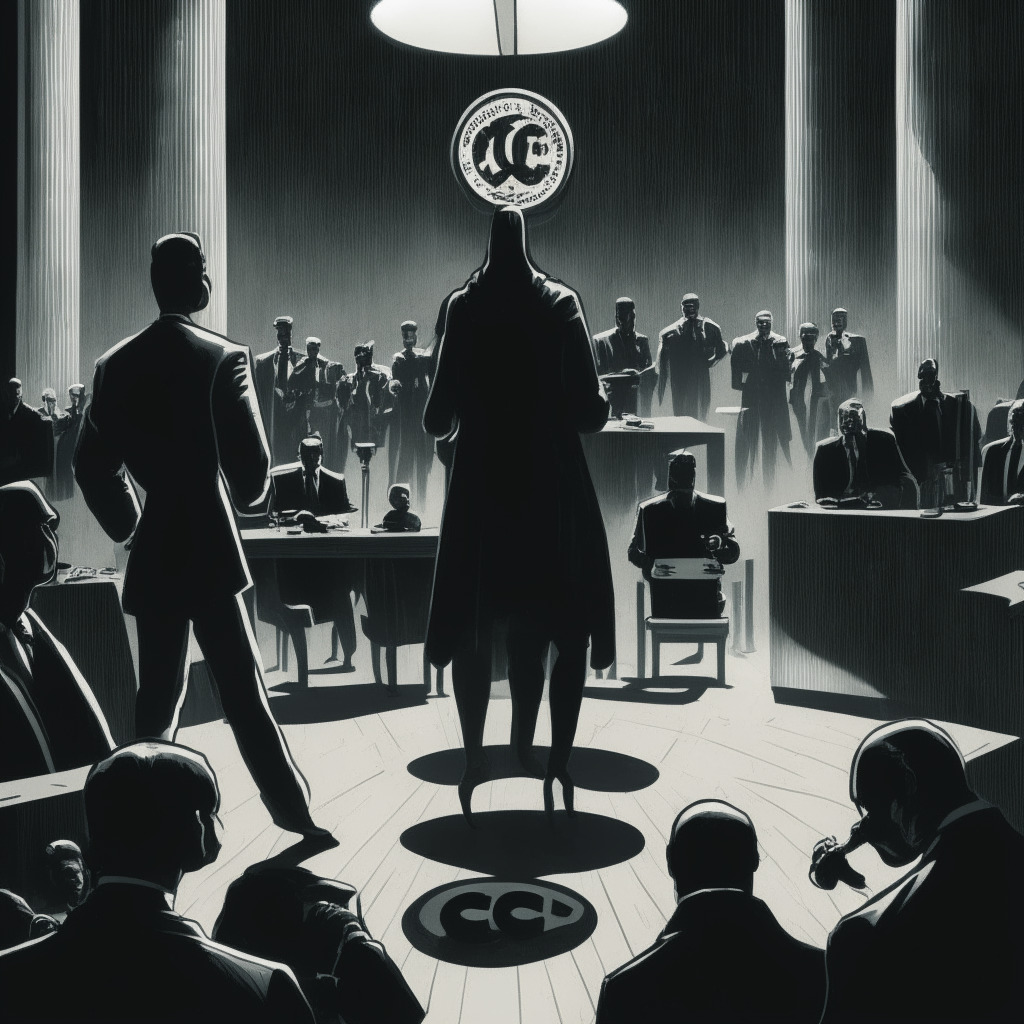

Legal Battle Heats Up: Unraveling the Binance, CZ, and SEC Conflict

The CFTC filed a complaint against Binance, accusing it of violating laws by offering unregistered crypto derivatives in the US. The SEC has also brought charges against Binance and its founder for flagrant disregard of federal securities laws.

US Crypto Regulation: A Patchy Landscape and the Urgent Need for Unified Oversight

“A recent report by the United States Government Accountability Office (GAO) shows significant regulatory gaps in the crypto assets market. It highlights the need for unified coordination to counter blockchain risks and establish a timely response system. Particularly, the report emphasizes rising concerns around stablecoins and decentralized finance’s escalating risks to the crypto and macro economy.”

Binance Battles US Regulatory Allegations: Analysis of the Crypto Regulatory Tug-of-war

“The CFTC alleges that Binance engaged in illicit trading for U.S. customers since 2019, without proper registration. Yet, Binance is striving to dismiss the complaint, reflecting a sentiment that regulatory bodies may be overly stringent with crypto markets.”

Federal Reserve, Inflation and Crypto: A Delicate Dance Amid Economic Flux

“The FOMC meeting is expected to continue the trend of increasing interest rates due to persistent inflation concerns. Meanwhile, despite macroeconomic shifts, Bitcoin and crypto markets remain stable. The Fed’s attempts to align a thriving job market with price reduction strategies pose considerable challenges.”

Gag Order in Crypto Case: Balancing Fair Trial and Blockchain Transparency

“Concerns arise as a U.S. federal judge suggests a gag order in the case of a former cryptocurrency CEO, Sam Bankman-Fried (SBF), potentially impacting transparency within the blockchain industry. This order might set a precedent of censorship, affecting public perception and understanding of the blockchain and crypto ecosystem.”

Gavel on Crypto: FTX Founder’s Alleged Meddling Could Silence Key Voices in Court Case

A federal judge might place restrictions on “parties and witnesses” in the FTX case, potentially preventing them from speaking to the media. This involves FTX founder, Sam Bankman-Fried, who allegedly disclosed confidential documents and thus might compromise trial fairness. The upcoming judge’s order could drastically impact Bankman-Fried’s bail conditions.

The Digital Ruble Takes Center Stage: Potential Lifeline or Invasion of Financial Privacy?

“Vladimir Putin has signed the Digital Ruble Bill into law, enabling Russia’s Central Bank to launch its own digital currency. The digital Ruble, a Central Bank Digital Currency (CBDC), can serve as both a tool against international sanctions and a means of monitoring governmental expenditure on social projects. However, there are concerns it could be used to control citizens’ spending.”

Emerging Trends: How ISIS Uses Cryptocurrency and Blockchain Technology for Funding Activities

“Affiliate groups of ISIS are increasingly utilizing cryptocurrency, specifically Tether stablecoins on the Tron network, suggests a report by TRM Labs. Regions such as Tajikistan, Indonesia, Pakistan, and Afghanistan are particularly active. This misuse of digital currencies underscores the importance of tracing blockchain donations and identifying donors to thwart pro-ISIS networks.”

Growing Regulatory Pressure on Crypto: Ripple’s Impact and a Call for Clear Legislative Pathways

The SEC’s ruling against Ripple and the increasing interest in crypto ETFs have propelled U.S. lawmakers to consider clear regulatory pathways for digital assets. Notable legislation under discussion includes the Financial Innovation and Technology for the 21st Century Act, Responsible Financial Innovation Act, Digital Asset Anti-Money Laundering Act, and Digital Asset Market Structure bill. These will shape the future crypto industry.

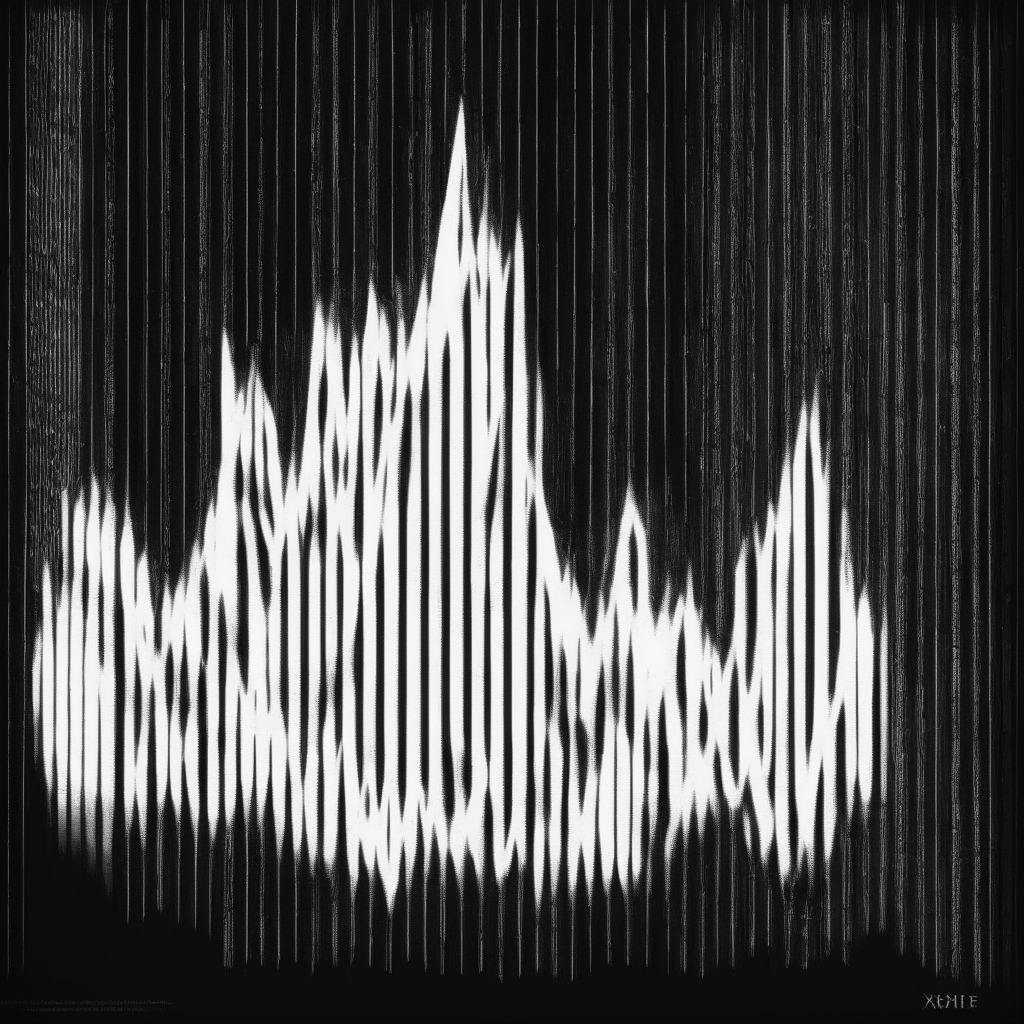

Dynamics of XRP and Dollar Strength: A Graph of Peaks and Valleys in the Crypto World

XRP prices dip, turning traders’ attention to a potential Federal Reserve rate hike. The rise and fall of XRP shows a relationship with the U.S. dollar index. Any increase in rates often pushes traders away from high-cap cryptos, increasing the value of the U.S. dollar. From a 75% gain on July 13, XRP’s price has since plummeted by 28%.

Investor’s Crypto Switch: From Bitcoin Dominance to Rising Altcoin Attraction.

“Last week highlighted a shift in the cryptocurrency market as investors pivoted from Bitcoin to smaller cryptocurrencies such as Ether and Ripple’s XRP. This shift was partly due to increased confidence in altcoins following XRP’s partial victory over the U.S. Securities and Exchange Commission. Investments in ETH-focused products soared, along with remarkable surges in XRP funds.”

Binance’s Possible Wash Trading Conundrum Tangles with Bitcoin Amid China’s Economic Trouble

“The Bitcoin market experienced a jolt due to Binance’s possible involvement in wash trading, and China’s uncertain economic recovery. The Wall Street Journal reported an internal communication of Binance’s CEO suggesting that $70,000 worth of BTC trading could be wash trading. Additionally, China’s official intimation lacked assurance of economic stimuli, causing BTC prices to stumble.”

Federal Reserve’s CBDC Hunt: A Financial Death Star or Leap Towards Progress?

“The San Francisco Federal Reserve Bank’s job posting for a “senior crypto architect” has sparked criticism. There are concerns CBDCs could be misused as tools for coercion and control. Representatives like Warren Davidson contend CBDCs should prioritize being a stable store of value and an efficient means of exchange, rather than being used for surveillance and control.”

Worldcoin’s Launch: Exploring its Innovative Tokenomics amid Technical Setbacks

The WLD project has launched their mainnet, revealing unique tokenomics and an innovative “iris-scanning Orb”. However, technical problems have overshadowed the launch. WLD supply will max at 10 billion tokens for 15 years, with initial circulation at 143 million. Yet, surprising complexities of network development led to a controversial increase in insiders’ token allocation. While tokens share for users are pre-minted, they’re locked for 15 years, highlighting long-term stability intent.

Navigating the Balance Beam of Ambiguity: Crypto Regulations and the Ripple Effect

“An established regulatory framework is crucial for blockchain’s mainstream acceptance and institutional integration. However, recent US court rulings, like Ripple Labs case, haven’t provided clear implications, making the path to comprehensive regulation and understanding of digital assets complex.”

Sweeping Legislations and the Future of Crypto: Balancing Innovation, Regulation, and Decentralization

“The upcoming legislations aim to provide regulatory clarity for cryptocurrencies, blockchain, and stablecoins. This could streamline integration of blockchain into traditional business models while assuring investor protection. However, this might challenge the decentralization aspect that cryptocurrencies stand for, leading to an uncertain blockchain future.”

Unveiling Crypto’s Legal Conundrum: Individual Privacy vs Public Discourse

“Former CEO of FTX, Sam Bankman-Fried, faces a gag order in an ongoing trial, raising questions about legal transparency and public discourse in the world of cryptocurrency. Meanwhile, a case involving South Korean platform, Delio, highlights concerns about enforceability of regulatory decisions within the industry’s decentralised and anonymous framework.”

Unveiling Worldcoin’s WLD Token: Landmark Success or Regulatory Nightmare?

Sam Altman’s crypto venture, Worldcoin, plans to unveil its WLD token and primary network source. Their recent $115 million Series C funding showcases the need for proof of personhood for genuine privacy and decentralization in the growing AI-centric society.

Rally Against CBDCs: Freedom Fighters or Innovation Obstructors?

U.S. Republican Representative, Warren Davidson, has appealed to Congress to ban Central Bank Digital Currencies (CBDCs), equating their creation to “building the financial equivalent of the Death Star.” Davidson argues that CBDCs convert money into a tool for coercion and control, rather than a stable store of value. Counterarguments maintain that CBDCs represent the natural evolution of digitizing finance. The debate underscores the need for well-regulated, informed approaches to digital finance’s future.

Stellar’s Skyrocketing Worth: An Optimistic Forecast or Looming Correction?

“Stellar and Ripple cryptocurrencies show a trend of moving in near-perfect tandem, driven by their intertwined development history. Despite recent surges, Stellar still lags behind its peak price by around 20%. With its relative strength index at overbought levels, Stellar could face a sharp price correction. Thorough research and preparedness are emphasized in this high-risk investment climate.”

The Future of XRP Amidst Possible SEC Appeal: Threat or Opportunity?

Recent discussions about a possible U.S. SEC appeal against a ruling favoring XRP holders have caused concerns among cryptocurrency enthusiasts. Attorney John Deaton allays fears, indicating the SEC appeal might not significantly threaten XRP holders. Despite potential appeal taking two years, Deaton remains optimistic about the win’s significance for XRP and Ripple.

XRP’s Staggering Rise: Toppling Bitcoin or Bound for a Fall?

“XRP’s surprising climb to the top four cryptocurrencies sparked speculation about its potential to overshadow Bitcoin. A U.S. court ruling, which declared XRP tokens not constituting investment contracts, has boosted its reputation. However, potential appeal from the SEC introduces market value unpredictability.”

Regulatory Uncertainty, DeFi Accountability, and Cryptocurrency-backed Dollar: A Crypto Crossroads

Regulation discussions remain a pressing issue in the cryptocurrency space. With the SEC undecided on Ripple’s ruling, a newly-introduced U.S Senate bill targeting decentralized finance (DeFi), and proposals of Bitcoin being utilized to strengthen the U.S dollar, the future of cryptocurrency is fascinatingly unpredictable.

Ripple’s Strategic Move to UK: Promising Regulatory Clarity or Risky New Challenge?

“Ripple is seeking to establish a firm footing in the UK, applying for registration as a crypto asset firm with the UK’s Financial Conduct Authority. This move comes after Ripple’s partial legal victory in the US concerning the classification of its XRP token. However, potential UK legislation targeting illegal crypto usage poses new challenges.”

AI Safety: Industry Giants Pledge, Challenges Lie Ahead, Future Perspectives Unfold

“Major artificial intelligence firms, including Google, Microsoft, and OpenAI have pledged towards creating a future where AI is secure, transparent, and safe for users. This commitment encompasses pre-release security testing, investing in cybersecurity, establishing threat safeguards, enabling third-party vulnerability reporting, and navigating global regulatory frameworks.”

Crypto Market Dynamics: A Tale of Resilience amid the Uncertainty

Bitcoin and Ether have maintained their market positions despite a subdued trading atmosphere, while other cryptocurrencies experienced fluctuation. Experts keep a close watch on Federal Reserve interest rate hikes and the bitcoin options expiration. Uncertainty about institutional capital potential leaves the crypto-market unpredictable. Future trends could be influenced by unexpected events.

Binance’s Benefit Cut Strategy amid SEC Clashes and Ripple’s Optimism for XRP Adoption in Banks

“Binance is adjusting staffing benefits amidst regulatory pressures and rumors of downsizing. Ripple expects U.S banks to adopt XRP for cross-border transactions following a court ruling. Legal issues plague Marathon Digital, while venture capitalists make a comeback in funding crypto startups despite market uncertainties.”

DeFi’s Dance with Decentralization: Innovation or Compromise?

“The DeFi space is dynamically evolving, with claims that centralized exchanges may become gateways for DeFi. However, this may lead to potential centralization, contrasting DeFi principles. Furthermore, the new US Senate bill has stirred anxiety in the DeFi community, emphasizing the need for balanced regulations.”