In a significant development, USD Coin (USDC) has expanded to Base and Optimism networks, allowing Coinbase and Circle account holders to directly transfer their USDC stablecoin to Base. However, the new native USDC struggles with full integration across networks, causing user confusion and scepticism. The future of this decentralized currency hinges on balancing innovation, competition, and user convenience.

Search Results for: intel

Navigating the Tightrope: China’s Crypto Clampdown and the Global Blockchain Future

“80 Chinese accounts promoting cryptocurrency were shut down on Sina Weibo, raising concerns about blockchain freedoms. These accounts, with 8 million followers, were part of ongoing crackdowns following China’s 2021 cryptocurrency ban with primary objective of protecting property safety.”

Coinbase Upsizes Debt Repurchase Amid Financial Uncertainty: A Bold Move or a Risky Bet?

Coinbase has increased its debt repurchase initiative to $180 million indicating financial strength, despite reporting a net loss of $430 million in Q1 2022. Meanwhile, Visa expands its support for USDC settlements on Solana blockchain, potentially revolutionizing cross-border transactions despite potential risks.

Tether’s Ascent: Top Holder of US Treasury Bills and What That Means for Crypto

“Tether, one of the world’s leading buyers of US Treasury bills, has increased its holdings to $72.5 billion. Despite the complexities expansion brings, this represents the growing mainstream acceptance of digital currencies and their incorporation into the traditional financial world.”

El Salvador’s Bitcoin Venture: Crypto Education in Schools Amidst Security and Regulation Concerns

El Salvador is incorporating Bitcoin learning programs into school curricula by 2024, in partnership with non-profit organization, My First Bitcoin (MFB), and the Education Ministry. A pilot to provide Bitcoin “base knowledge” starts September 7 with 150 teachers. The move promises a significant stride towards a crypto-literate world but also presents challenges including possible fraud and lack of uniform regulations.

Navigating the Cryptosphere: The Courting of Controversy and Confidence by Crypto Lawyer Heaver

Irina Heaver, a prominent crypto lawyer, faces scrutiny and threats due to her outspoken critique of certain altcoins and their founders. Despite these challenges, Heaver insists on informing her followers about potential lawsuits in the crypto industry and exposing questionable projects.

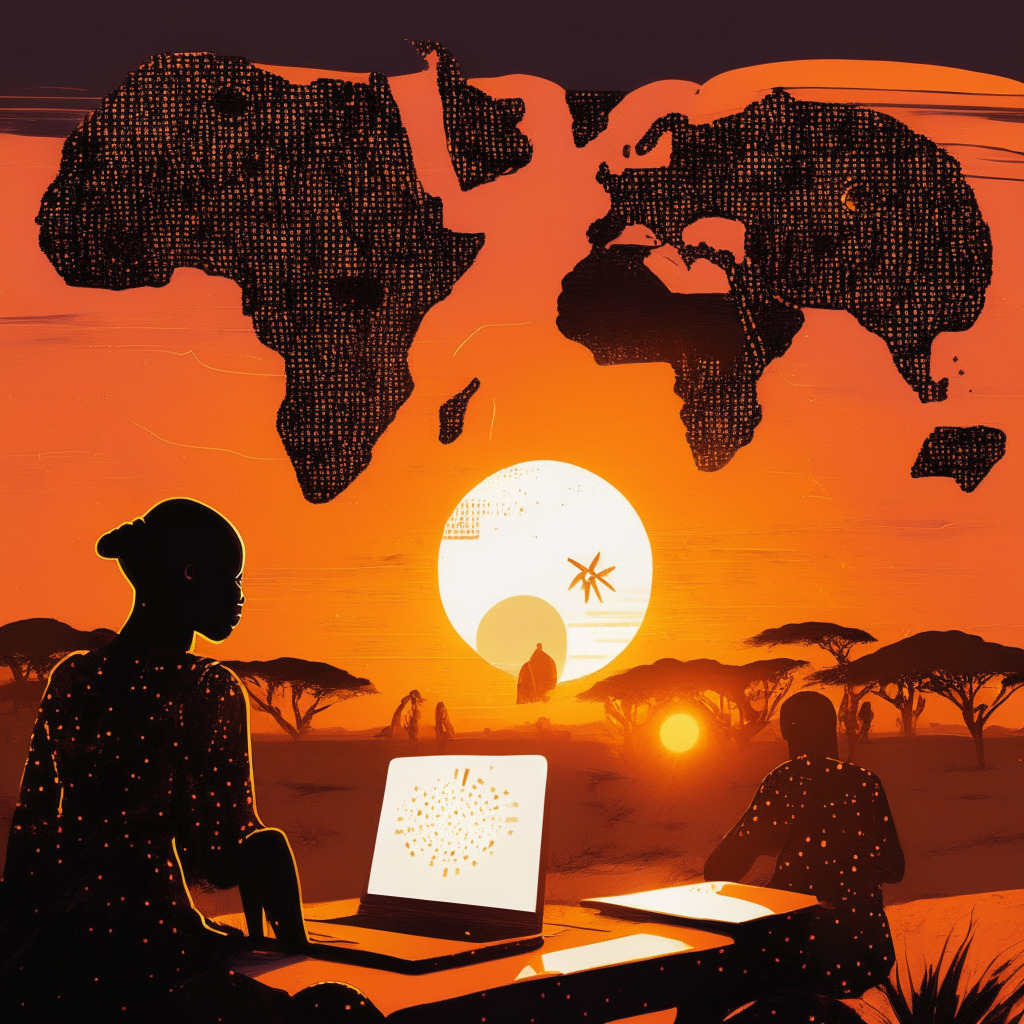

₿trust Acquisition of Qala: A Turning Point for Bitcoin Development in Africa or Cause for Concern?

₿trust, a non-profit backed by Twitter co-founder Jack Dorsey, recently acquired Qala, a body aiming to enhance Bitcoin and Lightning engineers’ skills in Africa. The integration aligns with ₿Trust’s mission to stimulate Bitcoin open-source developers’ learning globally, particularly in the Global South, potentially changing the region’s involvement in Bitcoin development.

Navigating the Uncertain Waters of AI Progress and Blockchain Fluctuations

“Baidu, China’s tech powerhouse, has released over 70 AI models with over 1 billion parameters each. Recent models show up to a 50% improvement in efficiency. However, the rapid expansion of AI technology raises concerns about misuse and privacy.”

Decoding the Complex World of Blockchain through Solana’s Lens: Real-World Solutions and Challenges

Raj Gokal, co-founder of blockchain protocol Solana, is addressing blockchain scalability through decentralized physical infrastructure networks (DEPIN). He emphasizes well-thought-out factors to create a scalable blockchain system. Despite challenges in industries such as real estate, Solana is working towards stable and reliable Web3 infrastructure, critical for institutional adoption. As industry practices evolve, the blockchain future becomes increasingly tangible.

DeFi Drama: The Synapse-Nima Capital Incident and Crypto Bankruptcy Profit Surge

“In an unexpected move, Nima Capital’s withdrawal of liquidity from the DeFi cross-chain bridge Synapse caused a dramatic decrease in the value of SYN tokens, causing uproar in the crypto community. Despite this, Synapse reassures users of their platform’s security system integrity. Additionally, the escalating complexity of cryptocurrency bankruptcy cases is resulting in a staggering profit for legal practitioners.”

Lawyers, Accountants, and Consultants: The Unforeseen Winners in Crypto Bankruptcy Cases

“In the volatile, uncertain world of cryptocurrency, it isn’t the mining companies or exchanges that are most profitable, but the lawyers, accountants, and consultants, whose wealth originates from the industry’s instability. Its high legal, accounting, and consultancy fees, reaching $700 million in 2022-23, result from complex, time-consuming bankruptcy cases.”

Boosting Web3 Startups: Cronos Lab’s Accelerator Program Amid Security Concerns

“Cronos Labs has launched a recruitment phase for its $100M accelerator program, aiming to support early-stage projects that promote the adoption of decentralized applications (DApps). However, this strategy can inadvertently lure scammers using government-owned website URLs to dupe victims and access their crypto wallet holdings.”

Ethereum-based Wallet Scams: The Dark Side of Crypto Convenience or Heightened Awareness Call?

“Scammers exploit MetaMask’s reputation by redirecting users to fake websites via official government website URLs. Unwary users link their MetaMask wallets to these hoax sites, inadvertently giving fraudsters control over their assets. Despite MetaMask’s efforts, such scams have left crypto enthusiasts questioning their holdings’ security.”

Rethinking Crypto Taxation: Japan’s Blockchain Future Amidst Regulatory Complexities

Japan’s Financial Services Agency is looking to change its tax code related to digital assets, potentially eliminating annual tax on unrealized cryptocurrency gains. Advocates argue this could stimulate business and aid blockchain startups, but critics cite possible manipulation and volatility.

Federal Reserve Impacts on Bullish BTC and Ethereum’s Centralization Struggles

Arthur Hayes, former CEO and co-founder of Bitmex, anticipates a response to the BTC bull market within six to twelve months. This expectation is connected to the Federal Reserve’s $25 billion program meant to stabilize the U.S. banking system. Meanwhile, Ethereum faces challenges around the centralization of nodes and scalability.

Ethereum’s Tug of War: Struggling Between Node Centralization and Ultimate Scalability

Ethereum is battling with the issue of node centralization, with much of its network activity verification reliant on centralized services like AWS. Ethereum’s co-founder, Vitalik Buterin, has indicated that true decentralization, achievable through “statelessness” and operability on affordable hardware, is a key part of Ethereum’s long-term roadmap, despite the technical challenges anticipated.

Swyftx’s Earn and Learn Initiative: A Futile Effort or a Step Towards Secure Crypto Future?

Australian crypto exchange Swyftx has launched an “Earn and Learn” initiative that rewards users for completing courses about common cryptocurrency scams. This program is part of an effort to increase crypto knowledge and safety, and reduce individuals’ vulnerability to crypto fraud. Despite criticism, the exchange believes that education is key to safer and more informed participation in the volatile crypto market.

The Micro Revolution in Bitcoin Mining: Pocket-Sized Devices Against Industry Secrecy

Micro Bitcoin mining devices are small, cost-effective tools that aim to defy the secrecy and exclusivity associated with Bitcoin mining. Bitmaker’s devices, costing around $3, offer accessibility and transparency, fostering understanding and community participation in cryptocurrency despite limited profitability. These innovations symbolize a step towards democratization and decentralization in the crypto world.

AI-Powered Scams: The New Era of Cyber Threats Plaguing the Crypto World

“Artificial intelligence (AI) is driving increasingly sophisticated digital scams threatening cryptocurrency organizations, warns Richard Ma, co-founder of Web3 security firm, Quantstamp. By mimicking corporate functions and engaging in credible dialogues, AI aids in successfully executing large-scale scams, particularly posing a high risk for the crypto sectors. Constant vigilance and secure internal communication platforms are key for cybersecurity.”

Solana’s Irresistible Appeal: Bucking the Crypto Outflow Trend Despite Stagnant Prices

“Despite broader crypto market outflows, Solana has sustained consistent inflows for the past nine weeks. While promising developments provide a bullish sentiment, a disconnection between investment inflows and price performance presents a sobering counter-narrative. Risks exist within the crypto spaces, such as hacking episodes.”

Harnessing the Power: The Intersection of AI and Cryptocurrency in Cronos Labs’ $100M Program

“Cronos Labs is looking for eight innovative crypto startups to join their $100 million accelerator program, aiming to marry artificial intelligence (AI) with crypto. Blockchain developers are leveraging the growing interest in AI to accelerate the growth of the digital economy, projecting AI and cryptocurrency as the next critical turning point.”

Unraveling The Stake Crypto Casino Hack: Speedy Recovery vs Security Concerns

Stake, a crypto casino, recently experienced a high-profile hack, with an alleged $41M stolen from its hot wallets. Despite this, Stake resumed all services in under five hours, raising questions about transparency during security breaches and adequacy of current security protocols.

The European Digital Euro: Monetary Sovereignty Amidst Rising Private Sector Dominance

“The digital euro, a central bank digital currency (CBDC) proposed by the European Commission, is seen as a new paradigm for preserving monetary sovereignty. It would ensure Europeans maintain access to a public payment option, countering the dominance by private payment services’ standalone solutions. However, its implementation requires a balance between fostering innovation and preserving economic stability.”

Grayscale’s Bitcoin ETF Approval: A Pivotal Moment or a Narrow Victory?

The U.S. Court of Appeals Circuit Judge has granted Grayscale Investments’ request to convert its Bitcoin Trust into a listed Bitcoin exchange-traded fund (ETF). But as the industry hails the decision as a victory, it’s worth questioning the real implications for the crypto industry and the broader acceptance of crypto ETFs in the future.

Decoding Future Taxes: Is the Metaverse A New Tax Haven or a Revolutionary Taxation System?

“Harvard legal scholar, Christine Kim argues the metaverse should be taxed immediately, as significant wealth is generated by users through real economic activities. Kim proposes immediate taxation and two enforcement methods: platforms withholding taxes or a ‘residence taxation’ module for users.”

Navigating the Bull-Bear Tug of War: A Dive into Crypto Market Performance

The latest crypto market analysis shows a mixed performance with Bitcoin exhibiting a marginal loss and Ethereum showing a lack of demand. Despite obstacles, Bitcoin’s dormant supply hit a new high, whereas Binance Coin depicts a bearish trend. Contrastingly, XRP attempts a strong rebound, while Cardano and Dogecoin display indecisiveness and cling respectively to specific support levels.

Singapore Elections: Uncertainty Looms over Future of Blockchain and Crypto Regulation

“Singapore’s presidential elections with Tharman Shanmugaratnam at the helm raises questions about forthcoming digital assets and blockchain policies. Known for his cautious stance on cryptocurrencies, its impact on Singapore’s relatively open approach to cryptocurrencies is uncertain.”

Approaching $22,000 BTC Amid Bearish Derivatives and Uncertain Regulations

“Recent data on Bitcoin futures highlights a potential correction to a $22,000 BTC. This is amid bearish derivate trends and U.S. regulatory uncertainties including postponed BTC ETFs and potential indictment of leading cryptocurrency exchanges Binance and Coinbase by the DOJ.”

Navigating the AI Wave in Crypto Trading: The Rise of ChatBots and User Trust Issues

“Cryptocurrency exchange Bybit recently introduced ‘TradeGPT’, an artificial intelligence (AI) trading assistant that provides insights using platform market data. The tool utilizes both the ChatGPT language model and Bybit’s ToolsGPT for real-time market analysis and user Q&A assistance, intending to educate users in the complex crypto-sphere.”

Overhauling Australia’s Crypto Bill: Innovation Boon or Investment Bane?

The Australian Senate has delayed Senator Andrew Bragg’s Digital Assets Bill for amendments, including the exclusion of certain tokens. While these modifications might shape a clearer regulatory framework, concerns arise about potential negative impacts on Australia’s crypto industry, including stifling innovation and deterring investors.

Race to SEC Approval: The Spot-Traded Bitcoin ETF Drama Unfolds

The digital asset landscape is witnessing intense activity regarding the approval of the first spot-traded Bitcoin ETF by the U.S. Securities and Exchange Commission. Notwithstanding setbacks and concerns around investor protection, the increasing interest among major institutions suggests the possibility of approval could be nearing. The SEC’s decision is anticipated by early 2024.

UK’s Vision for Global AI Safety: Tackling Risks and Encouraging Development

The UK government focuses on the risks and policy support for AI at the upcoming global AI safety summit. The discussions will address the risks posed by AI systems, fostering AI development for public good, and establishing international consensus on AI safety.