Australia’s big four bank, ANZ, has successfully conducted a test transaction with Web3 services platform, Chainlink, marking a significant move towards embracing tokenized assets. Utilizing Chainlink’s Cross-Chain Interoperability Protocol (CCIP), ANZ simulates the purchase of a tokenized asset adopting a ‘test-and-learn’ approach.

Search Results for: Australia

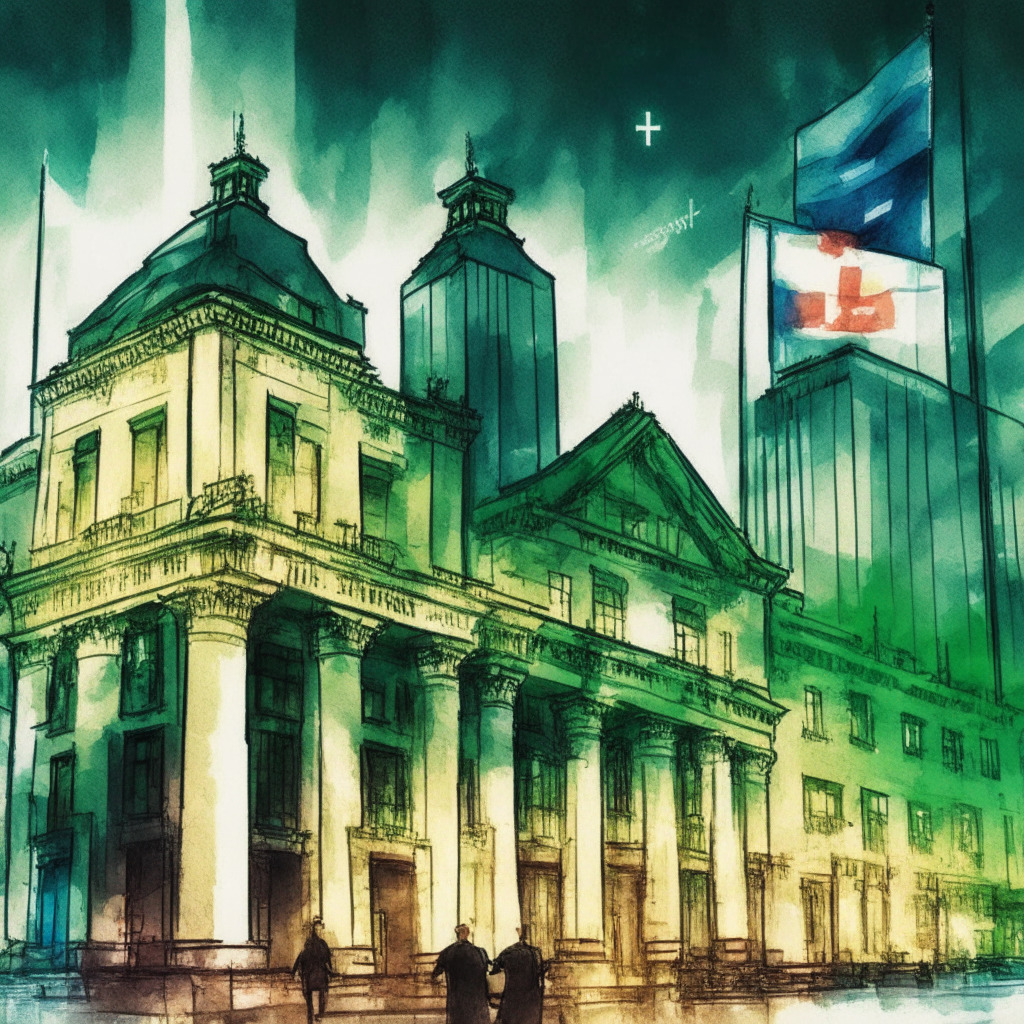

Swift’s CBDC Connector: Revolutionizing Digital Currency Interaction and Challenging Traditional Norms

Swift, the global financial messaging network, has partnered with three central banks to beta test a cross-border transaction solution for CBDCs. The focus is on interoperability between different digital currencies and current fiat-based systems. Swift’s CBDC innovations are designed to prevent digital islands and establish safe links between existing and future payment systems.

Crypto Readiness Score: Analyzing World’s Crypto Hotspots and the Quest for Top Ranks

“Hong Kong retains its position as the most crypto-ready destination with a Cryptocurrency Readiness Score (CRS) of 8.36. Other notable players include Switzerland and the USA. India, emerging as the second-largest crypto market, highlights the dynamic and promising future of crypto technology.”

ANZ’s Leap into Crypto with A$DC: Groundbreaking Future or Controlled Volatility?

ANZ, a leading Australian bank, recently successfully executed a test transaction for A$DC, its bank-issued stablecoin, on Chainlink’s CCIP. This move shows the potential of blockchain technology in transforming the banking industry and reflects the tension among financial institutions over customer exposure to digital currencies.

Leadership Exodus at Binance US: The Impact of Regulatory Scrutiny on Crypto Giants

Binance US, a major cryptocurrency exchange, has seen multiple high-profile departures amid increasing regulatory scrutiny from the U.S. Securities and Exchange Commission (SEC). Accusations against the company include operating unauthorized platforms and violating commodities laws. These challenges alongside a significant drop in U.S. market share place Binance US at a crucial crossroads.

Navigating Celebrity Endorsements in Cryptocurrency: A Tale of Risk and Opportunity

“Australian F1 star Daniel Ricciardo and Olympic snowboarder Scotty James grappled with doubts when endorsing crypto exchange OKX, especially after the FTX debacle. Despite initial hesitations, they built trust over time through active steps taken by OKX to educate them about cryptocurrency.”

Unraveling the Blockchain Drama: The W&K Info Defense vs. Craig Wright Saga Continues

A U.S. court denied a request by W&K Info Defense to impose criminal sanctions on Craig Wright for incorrectly filling a vital financial disclosure statement. While rejecting the request, they permitted some civil sanctions to proceed. Concerns were raised about incomplete disclosure of Wright’s financial details, including bitcoin holdings.

The Unfolding Narrative: Crypto’s Potential Influence on the 2024 US Elections

“Cryptocurrency could significantly influence the 2024 United States elections, asserts Brian Armstrong, CEO of Coinbase. Underestimating the crypto voting block could be risky for candidates given the increase in global crypto adoption and impending regulations. Armstrong highlighted that crypto-friendly legislation could pique the interest of mainstream voters, making crypto a hot-button issue in the presidential race.”

Regulating Crypto and AI: Balancing Technological Innovation with Global Cooperation

“The G20 nations emphasize the need for responsible growth and use of AI, recognizing the potential of crypto assets and digital currencies in fostering a digital world. They propose a global crypto framework to navigate challenges like data protection, potential biases, and human oversight, advocating for a more homogeneous approach in the disjointed global landscape.”

Coinbase’s Global Game Plan: Tapping into Foreign Markets Despite US Regulatory Tensions

Coinbase, a global digital asset exchange, plans to expand its operations into Canada, the UK, Australia, Brazil, Singapore, and the European Union, prioritizing these markets due to more progressive digital asset regulations. This decision came after acknowledging restrictive regulations in the US market as a significant impediment. Key strategies for expansion include partnering with banks, payment service providers, and increasing local community engagement.

Navigating the Global Ambitions of Coinbase: Expansion, Investments, and Hurdles Ahead

“Coinbase’s ‘Go Broad, Go Deep’ global expansion includes acquiring licenses and enhancing market presence in regulatory clear countries like Europe, Canada, Brazil, Singapore, and Australia. It added six new projects to its Base Ecosystem Fund while cryptocurrency startup LBRY battles a legal charge brought by the SEC.”

Bitcoin’s Lethargic Performance versus Coinbase’s Ambitious Expansion: Key Factors Defining Crypto’s Future

“Bitcoin’s lethargic performance contrasts with Coinbase’s new international expansion plans. Responding to uncertainty in U.S. regulations, Coinbase targets significant financial jurisdictions with clear crypto rules. Meanwhile, upcoming changes in accounting standards could affect the perceived value of Bitcoin-heavy companies like MicroStrategy.”

Coinbase Expansion: Pursuing Global Reach Amid Regulatory Ambiguity

“Cryptocurrency exchange Coinbase is eyeing international expansion, with focus on UK, EU, Canada, Brazil, Singapore, and Australia. Despite initial doubts, the company is strategically positioning itself as a trusted brand in Europe ahead of crucial 2024 elections and plans to introduce derivatives to new markets.”

Coinbase’s New Expansion: A Strategic Move or Industry Pressure?

Coinbase, a top crypto exchange, aims to expand to non-U.S. markets, prioritizing countries with clearer crypto regulations. The company’s strategy includes acquiring licenses, setting operations, and registering in these markets. It points to a lack of crypto-forward regulation in the U.S., potentially impacting its influence in the crypto field.

Mass Exodus at Binance: A Cause for Concern or Routine Transition?

“In 2023, ten key executives exited Binance, fueled by Helen Hai, the Executive Vice President. This departure wave comes amidst an escalating regulatory landscape, raising concerns within the crypto community about the company’s future and operational impact, especially considering Binance’s dubious regulatory status in several countries.”

Crypto Millionaires’ Paradise: Singapore Rises as Global Crypto-Friendly Haven

Singapore and the United Arab Emirates have emerged as top destinations for crypto millionaires due to their favorable tax policies on cryptocurrency-related ventures. The global cryptocurrency market is booming, with 425 million people owning some form of digital currencies, and certain individuals even possessing crypto fortunes surpassing the $100 million mark. This growth is prompting traders, investors, and entrepreneurs to seek secure locations to protect their digital assets.

Tether’s Ascent: Top Holder of US Treasury Bills and What That Means for Crypto

“Tether, one of the world’s leading buyers of US Treasury bills, has increased its holdings to $72.5 billion. Despite the complexities expansion brings, this represents the growing mainstream acceptance of digital currencies and their incorporation into the traditional financial world.”

Swyftx’s ‘Learn and Earn’ Initiative: A Catalyst for Crypto Literacy or a Risky Lure?

Swyftx, an Australian tech venture, has begun a ‘Learn and Earn’ program to encourage understanding of the crypto-market, with rewards for participants. However, the initiative could inadvertently encourage naive investment. Nevertheless, with courses designed to identify scams, Swyftx aims to improve crypto literacy and discernment in a market filled with digital currencies and potential frauds.

Bitcoin’s Rough September: The Impact of Regulatory Delays and Inflation Worries

Bitcoin’s value declines amidst regulatory delays and macroeconomic concerns linked to a rising US budget deficit. Despite regulatory setbacks, positive outlook on a potential Bitcoin ETF remains. Australian “Digital Assets (Market Regulation) Bill 2023” undergoes examination, aiming to balance innovation and consumer safety in the digital asset ecosystem.

Swyftx’s Earn and Learn Initiative: A Futile Effort or a Step Towards Secure Crypto Future?

Australian crypto exchange Swyftx has launched an “Earn and Learn” initiative that rewards users for completing courses about common cryptocurrency scams. This program is part of an effort to increase crypto knowledge and safety, and reduce individuals’ vulnerability to crypto fraud. Despite criticism, the exchange believes that education is key to safer and more informed participation in the volatile crypto market.

Navigating SEC’s Stance: The Hopeful Resurgence of U.S. Cryptocurrency Industry

The resurgence in the U.S. cryptocurrency industry is driven by key victories by Ripple and Grayscale against the SEC. The shift is largely due to initial clarity from state authorities, conflicting regulatory statements from SEC and CFTC. Amid this, recent positive court filings and decisions may inject fresh liquidity into the market and encourage institutional investments.

Binance And its Formula 1 Collaboration: A High-Speed Chase Towards Mainstream Relevance & Regulatory Challenges

“Binance, in collaboration with racing driver Pierre Gasly, is hosting an art competition, where the winner’s design will feature on Gasly’s helmet during the 2023 Abu Dhabi Formula 1 Grand Prix. This initiative encourages creative engagement and community interaction among Binance users and F1 fans alike.”

Second Chance for US Crypto Regulations: A Comparative Study of Global Trends

“The US digital asset industry may revive as courts counter the perceived hostility of the authorities. Digital asset lawyer, Jeremy McLaughlin, suggests recent cases weakening SEC’s argument might spark industry resurgence. However, he noted the challenges of such contentious landscape.”

AI Vs Public Trust: The Battle for Ethics in Technology Advancements

“In the rapidly developing AI industry, customer trust is increasingly challenging to attain. Salesforce’s consumer survey indicates growing concerns over unethical AI applications; in fact, willingness to use AI has declined since last year. As the technology continuously evolves, public perception caught between efficiency and ethics will undoubtedly shape AI’s future trajectory.”

A Rollercoaster Crypto Week: Triumphs, Tribulations, and the Quest for Unchartered Territories

“In a dynamic crypto week marked by revenue surges, privacy breaches, and promising tech advancements, we also see virtual activism in Metaverse, innovative crypto-related services, and increasing institutional embrace of digital assets. However, challenges persist with regulatory complexities and cyber threats.”

NFTs and the Creative Revolution: Tracing the Success of VR Artist Giant Swan amidst OpenSea’s Royalties Controversy

“In an era dominated by digital aesthetics, Non-Fungible Tokens (NFTs) have soared, offering artists unparalleled creative freedom. Particularly noteworthy is the Australian VR artist, Giant Swan, the first to put a 3D object on-chain. This innovation allows direct artist-collector sales, a leap forward from traditional social media trades. However, OpenSea’s choice to make creator royalties on secondary sales optional creates a significant challenge for creators striving for rightful compensation in an ever-evolving economy.”

MakerDAO’s Investment Risk: Parsing the Pros and Cons of Blockchain Credit Platforms

An upcoming default on tokenized loans threatens blockchain-based platform, MakerDAO’s $1.84 million investment. A borrower from the credit pool, currently in a court dispute, is on the edge of liquidation, raising questions about the robustness of blockchain credit platforms.

Navigating the Tokenization Wave: Growing Value and Unique Challenges in Blockchain-based Assets

Tokenization uses blockchain to monetize tangible and intangible assets, making them tradable and transparent. Despite cryptos’ ridicule for lack of tangible value, blockchain’s potential to transform assets is increasing. There’s even exploration of derivative, swap, and fixed income security systems. Companies like Pendle Finance and Dinari are demonstrating this potential, while concerns rise about tokenizing user engagement. Elsewhere, Central African Republic is aiming to tokenize its fiat money, a move that could inspire other countries.

Navigating the Crypto Winds: The Highs, Lows and Ambiguities in Blockchain’s Future

“Unstoppable Domains has unveiled Unstoppable Messaging, a product of the Web3 messaging network XMTP. Meanwhile, Binance.US has paired with MoonPay to allow customers to convert USD into tether (USDT) amidst their comeback from a dollar deposit suspension. Despite advancements, cybersecurity challenges persist in the blockchain world.”

Sudden Exodus from Crypto-Backed Funds: Market Tremors or Necessary Adjustment?

Concerns over the SEC’s potential lack of approval for a Bitcoin ETF have triggered significant changes in the crypto sector, with $55 million recently withdrawn from crypto-backed investment funds. Bitcoin-backed funds saw a $42 million withdrawal, funds linked to Ethereum lost $9 million in value, and funds connected to Binance’s BNB token experienced no noteworthy capital flow despite a challenging week. This market turbulence has spurred ongoing debate about the future and stability of cryptocurrencies.

World Mobile’s Decentralized Service Expansion: Democratizing Internet Access with Blockchain and AI

World Mobile, a decentralized mobile internet provider, has expanded its services via Google Play, allowing users in select countries to leverage blockchain for cost-effective internet access. This blockchain-based project promotes telecom sharing economy and integrates AI solutions for enhanced customer service, thereby democratizing technology and wealth access.

Digital Assets vs. Taxation: Balancing Act of Decentralization and Financial Fairness

“The South Korean city of Cheongju is planning to confiscate digital currencies from local tax evaders. Governments worldwide are concerned about the misuse of digital currencies for tax evasion. However, applying standard tax structures to decentralized currencies has received criticism from crypto enthusiasts.”