A Brooklyn bathhouse uses Bitcoin mining rigs to warm its spa, generating heat as a byproduct which is captured for heating pools. While a potential avenue for sustainable mining, concerns remain over the overall environmental impact of the cryptocurrency industry.

Search Results for: Coin Center

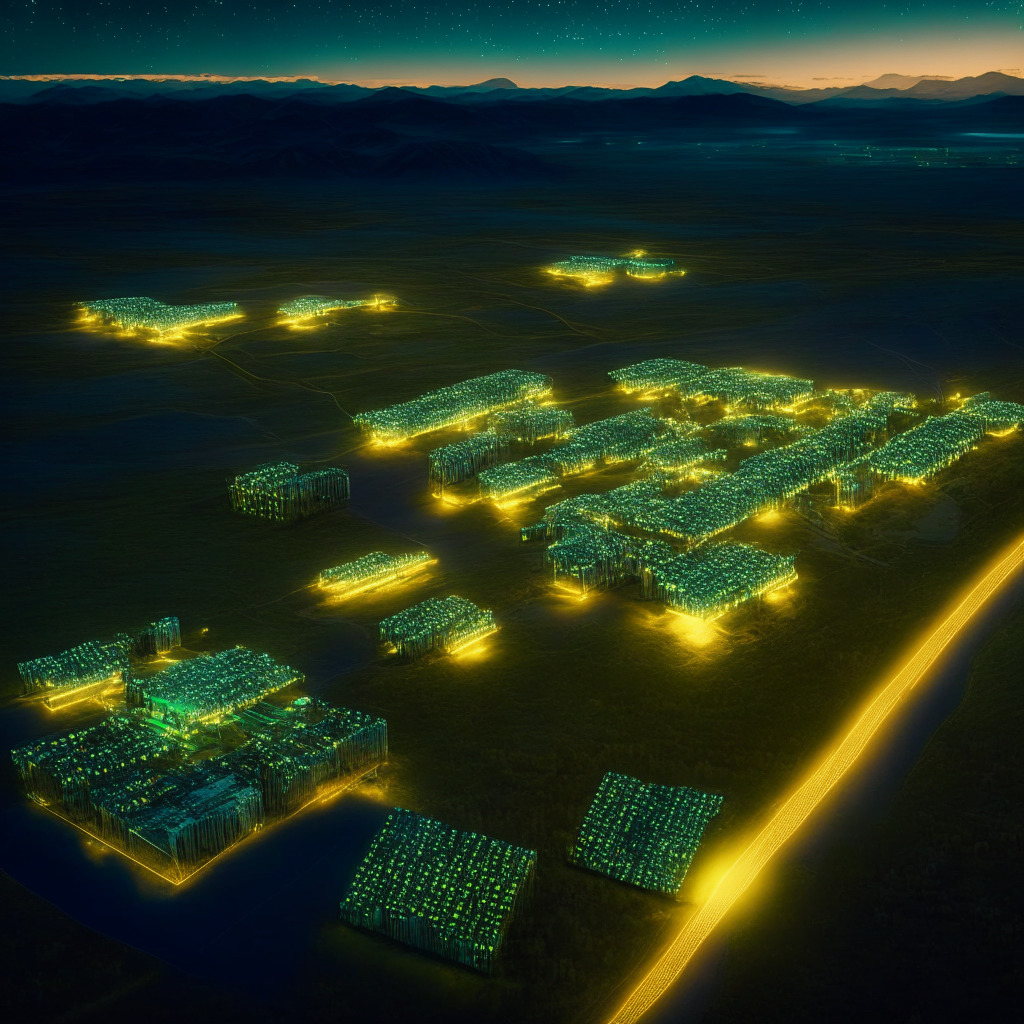

Merging Giants: Hut 8 Mining & US Bitcoin Corp to Form $990M North American Crypto Powerhouse

Bitcoin miners Hut 8 Mining and U.S. Bitcoin Corp plan to merge, creating a $990 million North American crypto mining giant, Hut 8 Corp. The merger aims to expand revenue, adopt a diversified business model, and capitalize on their financial position.

Iris Energy’s AI Expansion: Boon or Bane for Crypto Mining and Data Center Industries?

Iris Energy plans to increase its Bitcoin mining capacity by over 63% and transition to high-performance computing (HPC) data center strategy by early 2024. This move is fueled by growing AI data center demands, highlighting a trend among crypto miners who are expanding into AI cloud services.

Iris Energy’s Hash Rate Expansion: Investing in Data Centers and Venturing into AI

NASDAQ-listed Bitcoin mining firm Iris Energy aims to increase its hash rate capacity by 63% to 9.1 EH/s by early 2024, utilizing its 80MW data center in Texas. The company’s shares surged 21% following the announcement, reflecting a growing interest in the blockchain industry. Iris Energy also explores opportunities in energy-intensive compute applications such as AI.

Exploring the Fusion of AI and Bitcoin Mining: Opportunities and Hurdles in High-Performance Computing

Iris Energy aims to integrate high-performance computing with bitcoin mining, in line with the growing interest in AI. The AI-driven data center space is predicted to grow to $76 billion by 2028, and companies like Iris Energy see potential in combining these technology domains despite the challenges they may face.

Arkon Energy’s US Expansion: Renewables, Bitcoin Mining Growth, and Industry Challenges

Arkon Energy plans to expand its operations to the US after acquiring a site in Ohio and raising $26 million in capital. The new facility aims to provide bitcoin mining firms with server hosting services, creating a predictable revenue stream in the challenging crypto market. Amid uncertainties, Arkon’s innovative adaptation offers growth opportunities for industry stakeholders.

Crypto Outflows Slow Down: BlackRock ETF Impact and Resilient Altcoins

Investors pulled $5.1 million from digital asset funds last week, marking the ninth consecutive week of outflows. The BlackRock Bitcoin ETF bid may have brought stability to the market. Grayscale dominated weekly inflows, while Ethereum-tracking products experienced outflows. Investors show a mix of optimism and caution, closely monitoring regulatory developments.

Bitcoin’s Cautious Sideways Trend: On-Chain Analysis and Market Sentiments Unveiled

Bitcoin markets remain steady, with traders cautiously awaiting new direction cues and focusing on macro factors and market sentiment. On-chain analysis reveals key support levels, while Grayscale Bitcoin Trust attempts to narrow its discount versus the BTC spot price. Recent events have impacted the Crypto Fear & Greed Index, with developments closely watched in the coming weeks.

SEC vs Coinbase: Clash of Crypto Regulation and Innovation’s Unwritten Future

The SEC and Coinbase’s legal showdown revolves around the former’s focus on enforcing existing law, and the latter’s concerns about shaping the unwritten future through innovation and competitiveness. The central issue is the differing battlegrounds each side wishes to fight on, as the path towards mutual understanding remains uncertain.

BlackRock’s Bitcoin ETF Dilemma: Spot vs Futures & the Ongoing Battle with SEC

BlackRock is reportedly preparing to file for a Bitcoin ETF application, while the SEC’s contrasting treatment of Bitcoin spot and futures ETFs sparks questions. Grayscale’s ongoing lawsuit against the SEC could serve as a critical turning point for the cryptocurrency industry, as the future of Bitcoin ETFs hangs in the balance.

Doge Rush: Thriving Beyond Meme Coins with Play-to-Earn & Crypto Prize Arena

Doge Rush differentiates itself from other meme coins like Dogecoin and Shiba Inu by integrating a play-to-earn ecosystem, high-quality gaming experiences, and a rewarding token system. The $DR token’s utilities within this gaming ecosystem make it a sought-after investment, offering a blend of speculation and utility.

Dubai: The Emerging Epicenter of Crypto Innovation and Regulation

OKX Middle East receives an MVP Preparatory license from Dubai Virtual Assets Regulatory Authority, preparing for its license to become operational. The exchange plans to offer spot, derivatives, and fiat services, and recognizes Dubai’s comprehensive regulation standards as crucial to their regional strategy.

Stablecoin Stability: MakerDAO’s Shift to Spark Protocol and Lessons from the USDC Depreciation

MakerDAO is switching to the Spark Protocol to improve DeFi liquidity and stablecoin resilience after the recent USDC depeg. Through direct deposits on automated market makers, the protocol offers better rates and aims to enhance MakerDAO’s stability mechanisms and functionality across various layer-2 protocols.

Can a $100 Investment in Shiba Inu Make You a Millionaire? Exploring Meme Coin Potential

Meme coins like Shiba Inu have provided lucrative returns in the past, but skepticism surrounds their potential moving forward. Becoming a millionaire with a $100 SHIB investment appears unlikely, given its current price and market cap. However, smaller market-cap projects like Wall Street Memes (WSM) offer potentially massive returns, but caution and thorough research are advised before investing.

Economic News Takes Center Stage: Impact on Crypto and Financial Markets

The upcoming week shifts focus from crypto-specific events to economic news, with critical events like the US Consumer Price Index release, Federal Open Market Committee’s June meeting results, and the European Central Bank’s rate hike decision expected to significantly impact both cryptocurrency and traditional markets.

SEC Lawsuits, FTX Bankruptcy, and BitGo Acquisition: Market Impact on Bitcoin and Ethereum

Bitcoin and Ethereum face significant developments impacting price predictions due to the US SEC lawsuit, bankruptcy of FTX exchange, and BitGo’s acquisition deal. As clear regulation and reliable custody services are crucial, cryptocurrency prices remain sensitive to market changes.

ARK Invest Backs Coinbase Amid SEC Lawsuit: A Call for Regulatory Clarity in Crypto Space

Cathie Woods’ ARK Invest expands its holdings of Coinbase shares despite the firm’s high-profile SEC lawsuit. This highlights the ongoing struggles between crypto companies and regulators, emphasizing the need for clear guidance, cooperation, and open communication for industry growth and development.

Binance vs Coinbase Lawsuits: Debating Crypto Securities, Regulations, and Legal Battles

The SEC filed lawsuits against Binance and Coinbase, focusing on registration violations, fraud, and market manipulation allegations. Both exchanges disagree with the claims, and the legal battles may center on digital asset classification as securities, making compliance crucial for future operations.

Aave’s GHO Stablecoin: Innovative Benefits vs Decentralization Risks on Ethereum Mainnet Launch

Aave’s innovative stablecoin, gho (GHO), nears Ethereum mainnet launch with proposals for V3 Ethereum Facilitator and FlashMinter Facilitator. Backed by a basket of cryptocurrencies, gho aims for decentralization, passive income opportunities, and benefits for Aave’s decentralized autonomous organization (DAO) while confronting potential risks.

Coinbase Faces Multi-State Regulatory Scrutiny: Impact on Crypto Space and Innovation

Cryptocurrency exchange Coinbase faces regulatory scrutiny, receiving a Show Cause Order from the Alabama Securities and Exchange Commission and ten other states for allegedly violating securities laws. The SEC accuses Coinbase of acting as an unregistered exchange, broker, and clearing agency, offering staking programs without proper registration. Increased regulation could foster transparency, but also impact innovation and investment in the crypto sector.

Bitcoin Breakout and Regulatory Clarity: Balancing Innovation, Growth, and Global Competition

Bitcoin’s recent breakout highlights the importance of regulatory clarity for its continued success. Strict US crypto regulations push innovation elsewhere, while countries like the UK, UAE, Brazil, Japan, EU, Australia, and Singapore establish their own cryptocurrency centers. Achieving regulatory clarity can support innovation, industry growth, and mitigate risks, maintaining the US as a global leader in cryptocurrency innovation.

Elon Musk Faces Lawsuit Over Dogecoin: Insider Trading Debate and Crypto Regulation Battle

In a class action lawsuit against Elon Musk, plaintiffs allege market manipulation of Dogecoin (DOGE) and Bitcoin (BTC), insider trading, and fiduciary relationship creation. The case raises debates on cryptocurrency regulation, oversight, investor protection, and court jurisdiction under the Exchange Act.

Texas Bitcoin Mining Boom: Supportive Legislation and State-Level Tug of War

Texas embraces bitcoin mining as legislators pass supportive bills, SB 1929 and HB 591, solidifying the state’s position as a premier destination for the industry. However, future federal-level regulation remains uncertain, with individual states currently leading policy development.

2024 Presidential Election: Crypto Regulation Takes Center Stage in Debates

The 2024 US presidential election could witness discussions on crypto market regulation taking center stage, impacting the US’s position as a global crypto hub. Prospective candidates like Ron DeSantis and Robert F. Kennedy Jr. openly support digital asset trading freedom, while JP Morgan CEO Jamie Dimon’s potential candidacy raises questions about cryptocurrency’s role in the American financial landscape.

BIT Mining Shifts Focus from Ethereum to Dogecoin and Litecoin: A Wise Move?

BIT Mining, once reliant on Ethereum for self-mining revenue, has shifted focus to Dogecoin and Litecoin after Ethereum transitioned from proof of work to proof of stake. The miner reported $72.9 million in revenue for the last quarter but experienced a 75% drop YoY.

Sabre56’s Bold Shift: From Bitcoin Consulting to Hosting Services and Its Impact

Sabre56 plans to shift from consulting on Bitcoin mining projects to offering hosting services for industry firms over seven years. This strategic move addresses the need for reliable, large-scale hosting services in the Bitcoin mining industry, emphasizing Sabre56’s focus on providing scalable solutions in a dynamic market.

Bitcoin’s $28,000 Challenge & Projects Poised for 1000% Growth in 2023

Bitcoin eyes $28,000 as Wall Street Memes ($WSM) and ECOTERRA projects show potential for over 1000% growth in 2023, focusing on social media presence, decentralization, environmental sustainability, and brand collaborations to drive adoption and success.

Bitcoin’s Future: $23,000 Dive or Steady Recovery? A Complex Crypto Market Analysis

Bitcoin’s recent spike above $28,000 has begun to fade, with downside targets at $23,000. Traders remain wary of a full correction, while others warn against dismissing the recent uptick. The current market situation presents a complex picture for Bitcoin traders and enthusiasts, with various interpretations of future movements.

2024 Presidential Race: Crypto Policies Take Center Stage and Impact on Voters’ Choice

The 2024 U.S. presidential race sees candidates like Ron DeSantis, Robert F. Kennedy Jr., and Vivek Ramaswamy supporting cryptocurrencies, expressing their belief in financial freedom and innovation. However, the balance between promoting crypto and ensuring safety remains crucial, making the 2024 elections a litmus test for crypto in the U.S. political landscape.

Coinone Bribery Scandal: Balancing Crypto Innovation and Market Integrity

A former Coinone executive, Mr. Jeon, admitted to taking $1.51 million in bribes for listing virtual assets on the platform. This case highlights the need for robust legal frameworks, transparency, ethics, and balances in the cryptocurrency industry to combat potential pitfalls and ensure market integrity.

Worldcoin’s Iris Scanning: Ensuring Uniqueness or Compromising Privacy?

OpenAI CEO Sam Altman has secured $115 million in Series C funding for Worldcoin, a cryptocurrency project focused on the Worldcoin token and decentralized World ID. The project aims to distribute tokens based on individuals’ unique statuses, using iris scans for identity verification. However, privacy concerns and potential safety risks have drawn criticism.

Worldcoin’s Astonishing $115M Funding Round: Opportunities, Risks, and the Crypto Black Market

Worldcoin, a decentralized open-source protocol co-founded by OpenAI CEO Sam Altman, recently raised $115 million in a Series C funding round led by Blockchain Capital. The project focuses on the World ID and Worldcoin token, aiming to revolutionize the crypto ecosystem while addressing user security and privacy concerns.