Uniswap Foundation has proposed on-chain funding of $62 million. The funds are to support operations and research grants, despite experiencing a $1.29 million loss. This move highlights the challenges in the blockchain sector between progressing innovation and maintaining financial stability.

Search Results for: Cointelegraph Research

Cryptocurrency: Between the Tides of Progress and Doubt – An In-depth Look at Trials, Tribulations, and Transformations

“Bankman-Fried, former CEO of FTX, faces fraud charges relating to his tenures at FTX and Alameda Research. Meanwhile, in Hong Kong, Hashkey becomes the first to receive a retail crypto license, with trading restricted to professional investors. Blockchain’s future balances advancement and skepticism.”

Bitcoin’s Balancing Act: A Sudden Surge to $30,000 and the Need for Vigilance

The cryptocurrency market is seeing a price trajectory rise, with one analyst projecting Bitcoin to reach $30,000 in October. The ongoing bullish sentiment is driving analysts to predict a potential breakout. However, risks remain due to market volatility, underpinning the importance of thorough research before making investment decisions.

Expanding the Stablecoin Universe: Circle’s EURC Now on Stellar Network

Stablecoin issuer Circle has introduced a new version of its euro-backed stablecoin, EURC, now available on the Stellar network. This innovation offers users the ability to handle business via blockchain networks in local currencies. However, converting blockchain transactions into local currencies remains complicated, highlighting the integration challenges that the blockchain community faces.

Unveiling France’s AI Ambitions: Iliad’s $106m Investment and the Future of European AI

French telecom firm Iliad is investing around $106 million USD in the local artificial intelligence (AI) sector, creating a laboratory for cutting-edge AI research in Paris. The lab will design general AI while possibly making use of Europe’s ‘most powerful cloud-native Ai supercomputer’ created by NVIDIA.

Understanding the Dark Winter of Bitcoin: Waning Interest, Trust, and Transparency Concerns

Daily Bitcoin trading volumes have notably decreased, similar to 2018’s lows, as per CryptoQuant data. Prevailing uncertainty, partly from the US Central Bank’s interest rate actions, is spurring a Bitcoin holding trend. Despite challenges, the resolute belief in blockchain and cryptocurrencies reflects the crypto ecosystem’s resilience and adaptability.

Crypto Regulatory Claims: The Bitspay Controversy and its Impact on User Trust

“The crypto firm Bitspay, alleged to have falsely claimed to be regulated in Estonia, has erased its fraudulent license data, shaking trust in the crypto community. This incident questions the credibility of other cryptocurrency platforms’ regulatory status, underscoring the importance of regular verifications and rigorous checks.”

Trials and Turbulence: Navigating Legal and Security Challenges in Crypto Landscape

“Sam Bankman-Fried (SBF) is facing legal battles involving the U.S. Department of Justice, hampered by incarceration. His counsel argues for SBF’s unique insights in preparing the defense strategy. His case highlights complexities in the digital currency landscape, emphasizing the need for vigilance, adaptability, and expert help.”

Navigating the Uncertain Waters: BTC Struggles Amid the Rising US Dollar

Bitcoin struggles to maintain the $26K mark amid a strengthened US Dollar, indicating instability in the crypto market. The growing strength of the US dollar could potentially challenge Bitcoin and other cryptocurrencies. However, a potential cooldown in the dollar’s strength may provide room for Bitcoin and other cryptos to recover.

Massive Ethereum Movements: Buterin’s Wallet Activity Sparks Market Speculation

“A series of large Ethereum transactions linked to Vitalik Buterin have been detected, including a 400 ETH transfer to Coinbase. These deposits, ranging over 10 days and amounting to nearly $3.94 million, have sparked speculation about a potential sell-off and its impact on the ETH price.”

Chainlink’s Signature Change: A Decentralization Dilemma Stirring Trust and Security Concerns

Chainlink recently made an unannounced change to its multi-signature wallet. The number of signatures required for transactions was reduced, which raised concerns about the decentralization risk of the blockchain platform. Despite clarifications from Chainlink, the skepticism remains and highlights the often unresolved trade-off between absolute decentralization and absolute security in the blockchain world.

Navigating the Crypto Landscape in Dubai: A Guide to Buying Bitcoin and Understanding Risks

Dubai is rapidly embracing digital revolution, proving its support for the expanding crypto market, offering access to many exchanges and a tax-free structure for crypto trades. Although cryptocurrencies aren’t recognized as legal tender, no law prevents purchasing, owning, or trading them, coupled with some level of regulation for investor protection. However, the volatility and risks inherent in the digital currency world call for cautious investment behavior.

Coinbase Obtain AML Compliance in Spain: Striking Balance between Global Expansion and Regulatory Challenges

Coinbase has secured an Anti-Money Laundering compliance registration from Spain’s central bank, enabling crypto services in the country. As Coinbase expands globally, it faces possible complications from varying regulatory frameworks and is urged to prioritize asset security as skeptical holders consider withdrawing assets.

Mastering Bollinger Bands: The Pros and Cons for Crypto Traders

“Bollinger Bands are a technical analysis tool used for tracking price volatility in cryptocurrency trading. They’re composed of three lines that predict potential reversal points, helping traders make informed decisions. However, they’re not always reliable, especially in low volatility markets, and should be used alongside other indicators.”

Navigating the Whirlwind: Crypto Market Dynamics amid Unpredictable Coin Movements

“Despite volatile movements in crypto markets, major coins like BTC and ETH have managed largely to stay above critical support levels. With traders caught between optimism and caution, the coming days may witness a showdown between buying and selling pressures.”

Predicting the Impending Bitcoin Dip: A Possible Blessing or a Brewing Storm?

“Bitcoin’s disappointing performance has stirred speculations of a dip towards $20,000, amidst fears of a ‘death cross’ between certain moving averages. However, some anticipate these conditions could herald Bitcoin’s next bull market, emphasizing the importance of thorough research before investment.”

Navigating Crypto Regulations: A Tactical Balance in Market Stability and Technological Innovation

The European Parliamentary Research Service (EPRS) suggests regulators from non-EU regions need to impose stricter controls on cryptocurrency for market stability. Heavy reliance on non-EU nations’ policies for the EU’s fiscal system is cited as a concern. Regulatory uncertainty in the US and changes in the UK’s crypto-assets identification are highlighted. The balance between innovation and regulation is imperative for the protection of investors, market and the ongoing creativity of the crypto industry.

Bitcoin: Unraveling the Mystery of its Origin – An NSA Bioweapon or a Cipher-Punk Invention?

Nic Carter suggests Bitcoin may be a monetary bioweapon that escaped from a NSA lab. This theory points to a paper from 1996 discussing Bitcoin-like systems with anonymous transactions, written by NSA employees. While some believe Bitcoin’s creation involved both NSA enthusiasts and cipher punks, the mystery adds to Bitcoin’s allure.

China’s Capital Flight: The Potential Bitcoin Boom and the Changing Ethereum Landscape

“In the wake of China’s significant capital flight and a weakening Yuan, the Bitcoin market may see a surge as investors search for alternatives to the feeble domestic market. Despite China’s strict capital controls, crypto may emerge as a lucrative option. However, prevailing uncertainties about the present impact of capital flight on Bitcoin, compared to 2017, remain. Industry changes in the Ethereum universe with the sunsetting of toolkits, Ganache and Truffle, also reflect this blockchain uncertainty.”

From Ethereum’s Nostalgia to MetaMask Snaps: A New Dawn for Developers

Ethereum is witnessing the end of an era with Truffle and Ganache’s sunsetting. However, a new dawn lies ahead with MetaMask Snaps. These changes reflect Ethereum’s ability to evolve and adjust to new opportunities and challenges while promising an exciting future for developers.

Understanding the Federal Judge’s Ruling and Blockchain Regulation in the FTX CEO’s Case

The federal judge ruled in favor of the DoJ against seven witnesses testifying for ex-FTX CEO, Sam Bankman-Fried (SBF), facing charges related to alleged misuse of user funds. This ruling raises questions on the regulation of blockchain technologies, showcasing a tug-of-war between innovators and regulatory bodies.

US Central Bank Digital Currency: Speed of Transaction vs Privacy Concerns

“The United States House Financial Services Committee is considering further restrictions on a central bank digital currency (CBDC). Critics argue that a CBDC would centralize control, contradicting the philosophy behind cryptocurrency, and posing potential privacy risks. Despite some progress, the future of a U.S. CBDC remains uncertain.”

Unraveling the Panic: Bitcoin’s Short-term Holders Confront Market Volatility

“Cryptocurrency markets are volatile with 97.5% of short-term Bitcoin holders facing losses due to dwindling market support. However, sentiments about the future are mixed: some anticipate falling levels while other optimists foresee a price increase in Q4. Glassnode’s research reveals a widespread sense of panic, but underscores that despite inherent risks, cryptocurrency markets can be exceedingly rewarding.”

FTX’s CEO Legal Battle: Shaking Trust in Crypto World & Future Of Regulation

“The former CEO of FTX, Sam Bankman-Fried, faces criminal charges related to alleged misuse of user funds, a situation that casts significant uncertainty on the crypto realm. This case raises questions about trust in cryptocurrency systems, regulation complexities, and the measures needed to maintain a balance within this volatile digital landscape.”

Decentralized Finance (DeFi): Embracing Breakthrough or Hastening Regulatory Recklessness?

“In a significant endorsement of decentralized finance (DeFi), Coinbase’s CEO, Brian Armstrong, promotes the need for conducive regulation, facilitating DeFi development rather than punitive enforcement. His stand reflects DeFi’s growing recognition within mainstream finance, but also stresses on avoiding over-regulation that could stifle technological advancement.”

Bitcoin to $250,000 by 2024? A Deep Dive into Crypto Prospects and Predictions

BitQuant, an influential voice in the crypto world, recently predicted a new all-time high for Bitcoin, foreseeing it hitting a considerable $250,000 per token after the next halving. However, this optimistic view is met with skepticism and more conservative predictions from other market participants.

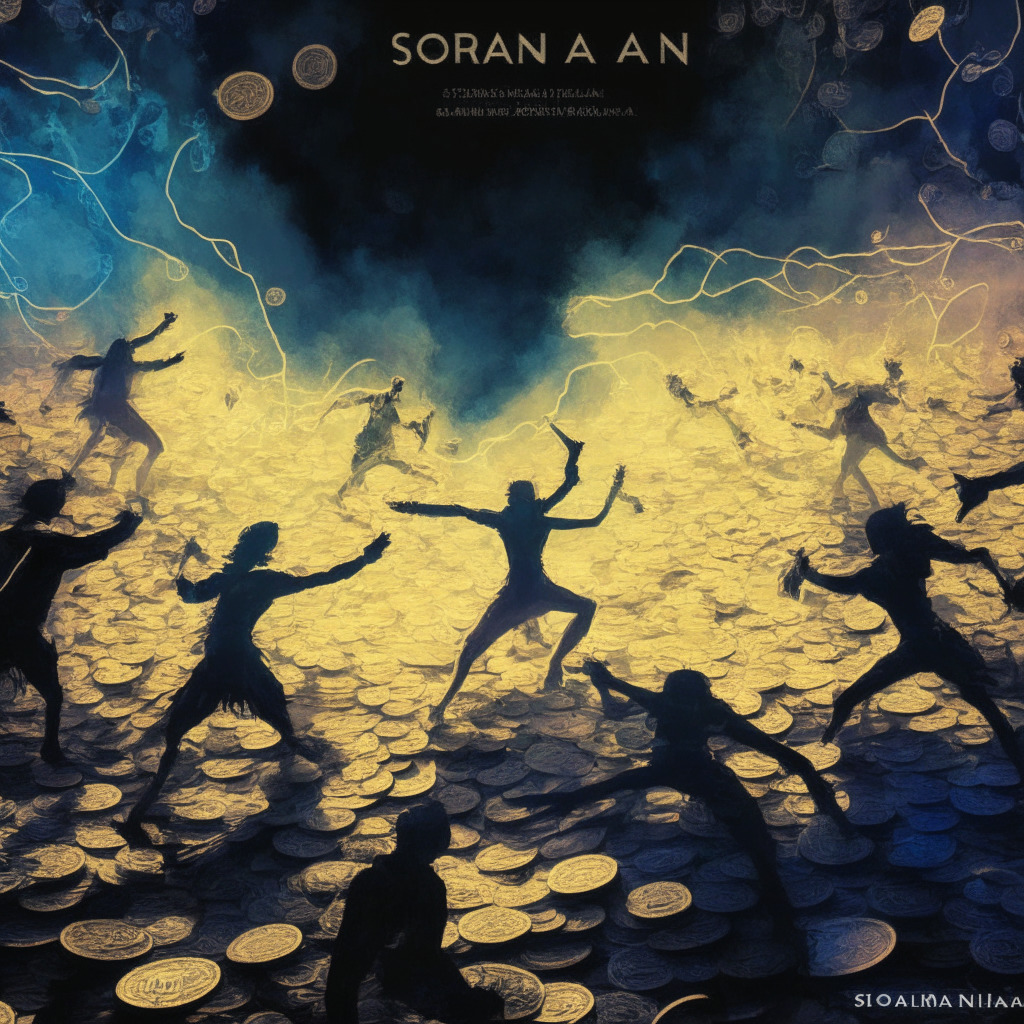

Navigating the Tug-of-War: Analyzing Solana’s Post-Court Surge and Crypto Market Volatility

The recent sale of insolvent FTX’s digital assets, including a 55.75 million Solana coin stake, has led to unexpected market dynamics with SOL’s price increasing post-sale. Misinformation resulted in panic, but savvy investors found a profitable opportunity. This underlines the upside potential when one understands the complete landscape of asset liquidity and scheduled selloffs, demonstrating how closer inspection can reverse perceived cons into pros in crypto markets.

Balancing Act: Europe’s AI Ambition, Between Technological Advancement and Ethical Governance

President Ursula von der Leyen’s recent State of the Union address spotlighted EU’s resolve in enhancing AI technology. Within this endeavor, she proposed a “new global framework for AI”, comprising of guardrails, governance, and guiding innovation. The initiative aims at promoting responsible AI development and includes a project to expedite European supercomputer access for AI startups. Despite optimism, challenges of balancing rapid technological advancement and ethical considerations loom large.

Wyoming Stablecoin: Game Changer for Federal Reserve or Risk to Monetary Stability?

“The Wyoming Stable Token Act introduces the concept of state-based unique stablecoins, raising questions about their potential to disrupt the Federal Reserve’s authority or revolutionize digital transactions. The future of such state-specific cryptocurrencies is entwined with the ongoing evolution of digital currencies.”

AI Revolution or New Tech Bubble? Goldman Sachs Predicts Major Investment Shift towards AI

Goldman Sachs views the boom of Artificial Intelligence (AI) as not a bubble, but the beginning of an AI revolution. The firm predicts global AI investments to reach $200 billion by 2025, attributing this expected surge to the expansive economic opportunities offered by generative AI. Despite this optimism, cautious investment approach has been advised.

Unmasking the Crypto Mirage: Wash Trading Threatening Market Trust and Stability

Solidus Labs signals market manipulation in the crypto scene, with over 20,000 tokens allegedly subject to wash trading on decentralized exchanges. They highlight the need for regulatory oversight to establish stability and credibility in an industry currently prone to manipulation and distorted metrics.

Suspicious $27M Crypto Movement from CoinEx: Hack or Inside Job?

“$27M worth of crypto was moved from CoinEx hot wallet to an unrecorded Ethereum account, raising suspicions of a potential security breach or inside job. The incident raises questions about the efficacy of current cybersecurity measures in the digital currency sphere.”