In an open letter to President Kassym-Jomart Tokayev, Kazakhstan-based digital asset miners, including eight major entities, urgently request a decrease in energy prices. They warn of industry-wide dessertion caused by untenable fees and increasing operational challenges, threatening an extinction of the country’s thriving mining ecosystem.

Search Results for: Crypto Business

Cryptocurrency Regulation and Wealth Outflow: The South Korean Dilemma

Korbit’s research suggests the reported value of international digital assets declared to the South Korean National Tax Service may be exaggerated during regulation procedures. Many corporations could be retaining their crypto assets without means to distribute them wider, especially after the 2017 ICO boom.

Kazakhstan’s Crypto Woes: Mining Dilemmas and National Resource Strains

“Crypto miners in Kazakhstan, the third-largest global market for Bitcoin mining hash rate, warn of extinction due to high energy prices. This situation highlights the balance between promoting growth in the crypto industry and its role in contributing to national resources and taxes.”

Navigating the Future of Payments: Visa’s $100M AI Venture & Crypto Integration

“Visa plans to invest $100 million in generative AI ventures, a technology that can generate various content forms and add dynamism to the industry. The firm’s AI-based solutions have been effective in fraud prevention, highlighting AI’s critical role in enhancing payment systems. However, successful AI implementation requires a robust regulatory framework.”

Blockchain Analytics Firm Chainalysis Axes 25% Workforce amid Crypto Market Downturn

“In response to market downturns and decreased commercial demand, blockchain analytics firm Chainalysis is laying off 150 employees. The firm plans to shift focus from the commercial market to authorities, hoping to assure steady revenue. Amid declining Bitcoin prices and reduced interest in blockchain, the firm’s future lies in catering to government requirements in creating a safe and regulated environment.”

Crypto Banking Risks Exposed: Unpacking the Silvergate Bank Collapse and the Future of Fintech

Silvergate Bank’s demise, largely due to over-reliance on high-risk cryptocurrency deposits and internal managerial faults, raises questions about the risk exposure involved in being a single-industry lender. Amidst this, the crypto lender, Celsius Network, plans a recovery with a reorganisation plan, a move which is closely watched by regulators and businesses banking on crypto.

Revitalizing Cryptocurrency Platforms: A Look at Celsius Network’s Restructuring Efforts

“Celsius Network, a crypto entity facing legal proceedings, aims to repay its customers by year-end with a blend of Ethereum and Bitcoin worth $2.03 billion and stock in an emerging offshoot company. A success would represent a rare instance of a failed crypto platform’s revival through a Chapter 11 bankruptcy case, pointing to groundbreaking possibilities in crypto’s future.”

Growth Pains or Market Crash? Chainalysis Layoffs and the Struggling Crypto Market

Chainalysis, a leading blockchain analytics firm, has laid off another 15% of its employees due to deteriorating market conditions. Despite these lay-offs, the company remains optimistic about long-term success, focusing on optimizing expenses and fostering trust in blockchain among governmental and financial institutions. The current bearish market atmosphere, however, is also impacting the reception and demand for new products like futures ETFs.

Crypto Regulation: Singapore’s Strides Forward with MPI Licenses to GSR Markets and Coinbase

The Monetary Authority of Singapore (MAS) granted GSR Markets, a crypto liquidity provider, a Major Payment Institution license. GSR, like Coinbase, can now provide crypto and fiat-linked services to Singaporean entities and residents, expanding crypto regulation. Despite potential challenges, including transaction irreversibility and crypto’s inherent volatility, Singapore’s balance of fostering innovation while ensuring safety allows over 700 Web3 companies to thrive, indicating a significant crypto future for finance.

Mental Health in Cryptocurrency: FTX Founder’s Struggles Ignite Industry Discourse

“The revelations about FTX founder Sam Bankman-Fried’s struggle with mental health issues and his approach to them within his company sparks a debate about the crypto industry’s stance on mental health. As industry pioneers become the faces of their enterprises, their personal narratives become inherently tied to their businesses, making the handling of mental health challenges a crucial business as well as a moral imperative.”

Singapore’s Crypto Haven Status: An Alluring Opportunity or a Regulatory Minefield?

GSR Markets, a subsidiary of cryptocurrency market maker GSR, has secured in-principal approval for a Major Payment Institution (MPI) license from the Monetary Authority of Singapore. This may speed up the adoption of Web 3.0 and boost business investments in the APAC region, while demonstrating Singapore’s favorable stance toward cryptocurrencies.

Crypto Security Alert: $700M Lost in Q3 2023, Reflecting on Weaknesses in Blockchain Safety

“The third quarter of 2023 witnessed a loss of about $700 million in digital assets due to 184 security incidents, according to a report by CertiK. Major causes included private key breaches, exit scams, and oracle manipulation, underscoring blockchain security imperfections. Despite these challenges, the industry continues to evolve with focus on increasing security standards.”

Crypto King’s Failed $5 Billion Bid to Block Trump’s Political Return: A Suspect Love Affair with Power

“In a shocking revelation, FTX founder considered offering $5 billion to dissuade former U.S. President Donald Trump from re-running. This idea fell apart due to FTX’s financial crisis. Now, significant fraud charges against FTX’s founder await trial, causing huge uncertainty in the crypto industry.”

Institutional Adoption and Regulatory Clarity: A Double-Edged Sword for the Crypto World?

“Institutional involvement in the crypto world is pressing for straight answers from regulators on aspects like taxation and compliance. This need for regulatory clarity, driven by greater institutional adoption, brings more than just capital into the sector – it ultimately ushers in regulatory certainty, even as the industry continues to tussle with regulators.”

Unearthing the JPEX Crypto Scandal: A Cautionary Tale for Investors and Regulators

“In the ongoing JPEX crypto exchange scandal, authorities have apprehended more suspects, taking the total to eighteen. As the investigation unfolds, significant wealth has been seized, and unauthorized Visa cards labeled ‘JPEX’ have been discovered. The scandal underscores the challenges of regulating emerging crypto exchanges and serves as a warning to investors about the need for diligence.”

Crypto Titans Fall: Analyzing 3AC’s Downfall and What it Means for Crypto Regulations

“Su Zhu, founder of the now bankrupt Three Arrows Capital was arrested trying to flee Singapore. His arrest results from a court order due to contempt of court, leading to a four-month prison sentence. Zhu and business partner Kyle Davies had been evading the crypto hedge fund’s liquidators and authorities following its collapse.”

Google Cloud Joins Polygon PoS Network: Boost to Cryptosphere or Threat to Decentralization?

Google’s entry into the Polygon PoS network could lift the blockchain’s credibility and promote mainstream adoption. But worries about centralization arise, potentially favoring powerful players over blockchain’s spirit of decentralization. With Google Cloud as a validator, maintaining a balance between corporate involvement and the founding principles of decentralization is essential.

Crypto Giant’s Fall: Regulating for Safety or Stifling Innovation?

The arrest of 3AC’s co-founder, Su Zhu, following the fund’s dramatic collapse, evidences the power regulators hold over cryptocurrency activities. For some, it confirms the need for regulatory frameworks in the volatile crypto world, protecting against violations and malpractice, whilst critics argue against measures that could stifle crypto market innovation.

US vs Europe: CoinShares Stakes its Claim on American Cryptocurrency Regulation Prospects

European cryptocurrency investment firm CoinShares disputes the notion that the U.S. lags in cryptocurrency adoption and regulation. CoinShares argues that due to U.S regulators evaluating digital assets similarly to traditional asset classes, the U.S. is a leader in digital asset development. The company also references the integration of emerging and traditional financial players as evidence of this.

Crypto Exodus: Why Gemini and Binance Abandon the Netherlands and What’s Next

“New York-based crypto exchange, Gemini, is ending its operations in the Netherlands due to inability to meet the regulatory requirements. However, it plans to return once it aligns with the new crypto-asset rules under the Markets in Crypto-Assets Regulation (MiCA).”

Exploring Russia’s Pivot to Crypto: Boosting Trade Ties or Cannibalizing Traditional Banking?

Russian entrepreneurs aim to use “digital assets” and a “unified digital currency” for trade with BRICS and other nations. The idea of utilizing digital financial assets (DFAs), which may encompass digitized commodities, CBDCs, digital securities, cryptoassets, and stablecoins, in international payments is garnering attention. The possibility of creating a unified digital currency for cross-border transactions is also being evaluated.

Revolutionizing Crypto Trading: A Call for Enhanced Regulation and Standards in the Crypto-sphere

The World Federation of Exchanges (WFE) suggests stronger regulation to boost the credibility and safety of crypto-asset trading platforms (CTPs). However, concerns linger as practices like CTPs trading against their customers exist. Interestingly, the WFE is inclined towards embedding transparency through regulation, hence flagging the need for standards and regulation in the crypto markets.

Valkyrie’s Daring Move into Ether Futures Amidst SEC Delays: A Shake-up in Crypto ETF Scenario

“Valkyrie plans to offer Ether futures exposure to US investors amidst SEC’s delays on Bitcoin ETF. The firm intends to rename its Bitcoin Strategy ETF to include Ether, although SEC approval is pending. This move surfaces as several firms, including Valkyrie, await approval for spot crypto ETFs.”

Navigating the Surge in AI: Evaluating Business Intelligence Platform AlphaSense

AlphaSense, an AI platform focused on business intelligence and search, has raised its valuation from $1.7 billion to $2.5 billion. The firm offers insights-as-a-service, delivering perceptive business and finance analytics, with its tailored approach promising more specific insights in the crypto and blockchain world. Despite the high-risk, high reward nature of the AI sector, AlphaSense plans to strategically position itself in the B2B generative AI sector.

CEO Deny Puts Spot on Blockchain Future: Crypto-Lending Brings Risk and Reward

Former FTX CEO, Sam Bankman-Fried, has been denied temporary release ahead of his trial, with concerns about him being a flight risk. Meanwhile, BTC lending platform, Ledn, introduces an Ethereum yield product, highlighting the interplay between regulation and innovation in blockchain.

Cracking Down on Crypto Frauds: The JPEX Exchange Scam and Next Steps for Hong Kong’s Market

Hong Kong authorities detained 12 individuals linked to the JPEX cryptocurrency exchange scam, seizing $9.8 million in digital currency among other assets. The incident has thrown a spotlight on regulatory actions, raising concerns about the readiness of security and regulatory firms to tackle such scams, emphasising the importance of “transparent and clear” information from crypto firms to investors, and the need for robust security measures to protect users’ interests. Only two trading services in Hong Kong have successfully acquired the license to operate as retail cryptocurrency trading.

Crypto Collision: As Binance Hits Regulation Wall, Is a New Era Dawning for Cryptocurrencies?

“The decentralised nature of cryptocurrencies is colliding with regulatory restrictions, as evidenced by Binance’s recent challenges. Big payment providers like Paysafe are halting operations, reflecting the global shift in the crypto industry towards greater regulatory scrutiny. However, it remains unclear whether this increased regulation will help or hinder the market’s organic growth.”

Fraud in Cryptoworld: The Need for Stronger Regulations and the Road to Trust

“Recent charges against IcomTech’s CEO underscore the need for robust regulation in the crypto world. The company, an alleged counterfeit crypto mining business, collapsed in 2019, with investors unable to withdraw their profits. While this gloomy picture may paint a grim future for blockchain, new regulations can provide a safety net that nurtures innovation and ensures fair play.”

Regulatory Tug-of-War: The SEC, Blockchain, and the Struggle to Control Crypto Assets

“SAB 121, the SEC’s new regulatory bulletin concerning crypto assets, faces criticism and controversy. Issued without involving key industry bodies, this document has stirred skepticism due to its broad implications for digital asset custody, inherent risks, and the broader crypto space.”

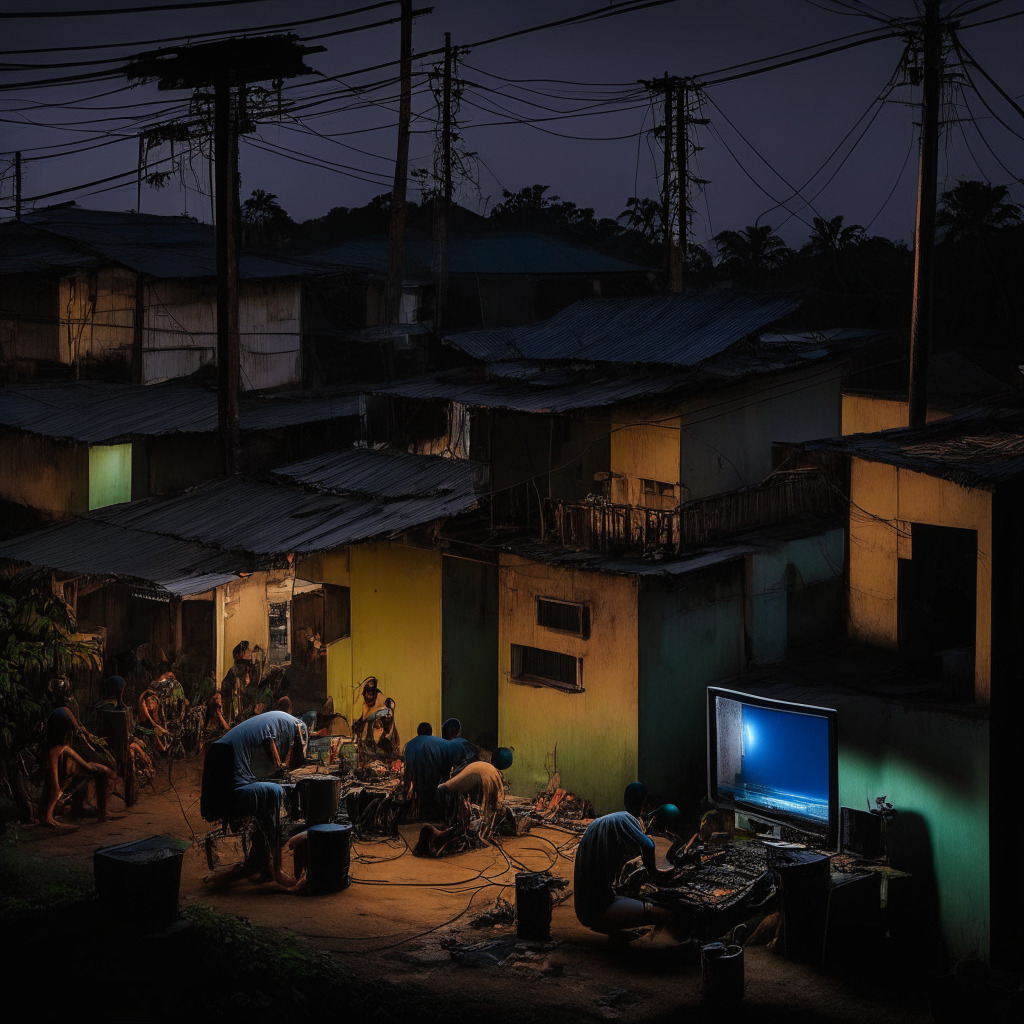

Illegal Crypto Mining in Sarawak: A Double-Edged Sword of Technological Advancement and Risk

“Illegal crypto mining operations in the residential areas of Sarawak, Malaysia, have resulted in recurrent power disruptions. Investigations revealed 74 unauthorised cryptocurrency mining servers connected to direct tapping cables, risking short circuits, fires, and even loss of life. Unrecorded consumption caused substantial economic damage, prompting utility firms, police, and anti-corruption agencies to develop new electricity theft detection methods.”

Binance’s Exit and CommEx’s Entrance: The Mysterious Shift of Crypto Operations in Russia

“Binance has exited Russia, selling to newcomer CommEx. Despite little detail about CommEx’s origins, it is registered in Seychelles serving CIS and Asian clientele. Its initial focus is on P2P transactions in Russia with goals to rapidly expand as a cryptocurrency exchange.”

Unmasking the Grim Scandal: JPEX Crypto Fraud and the Controversial Stand of Chase UK

Hong Kong’s security chief, Chris Tang Ping-keung, pledges swift action in the JPEX crypto exchange fraud case involving over 2300 victims with losses exceeding $175 million. This incident brings into focus the need for stringent regulations and transparent operation in the largely volatile digital currency market.