“Interlay recently unveiled its Minimum Viable Product (MVP), the Build on Bitcoin (BOB) solution, designed to link Ethereum blockchain advancements with Bitcoin’s user community. BOB will enable decentralized application development, leveraging Rust smart contracts compatible with Bitcoin legacy libraries, while also supporting Ethereum Virtual Machine. Despite concerns from some Bitcoin advocates, the Interlay team remains optimistic about broadening Bitcoin’s applicability.”

Search Results for: Hop Protocol

Decentralizing E-commerce: Analyzing the Revolutionary Potential of Bison Relay v0.1.8

The introduction of Bison Relay v0.1.8, a decentralized e-commerce system by Decred, is poised to transform digital retail dynamics. With features for enhanced user experience, this platform promotes increased control, improved privacy, and strengthened security in the online retail realm, potentially redefining the e-commerce landscape.

Crypto Chaos: The Rising Tension and Uncertainty Surrounding PEPE’s Future

Memecoin PEPE has seen an 80% decline in value because of rumors of a potential “rug-pull” by its developers. After changing token transfer rules, they moved $16 million worth of PEPE to exchanges, leading some to predict a crash. However, increased buying and oversold indicators point towards a possible market rebound.

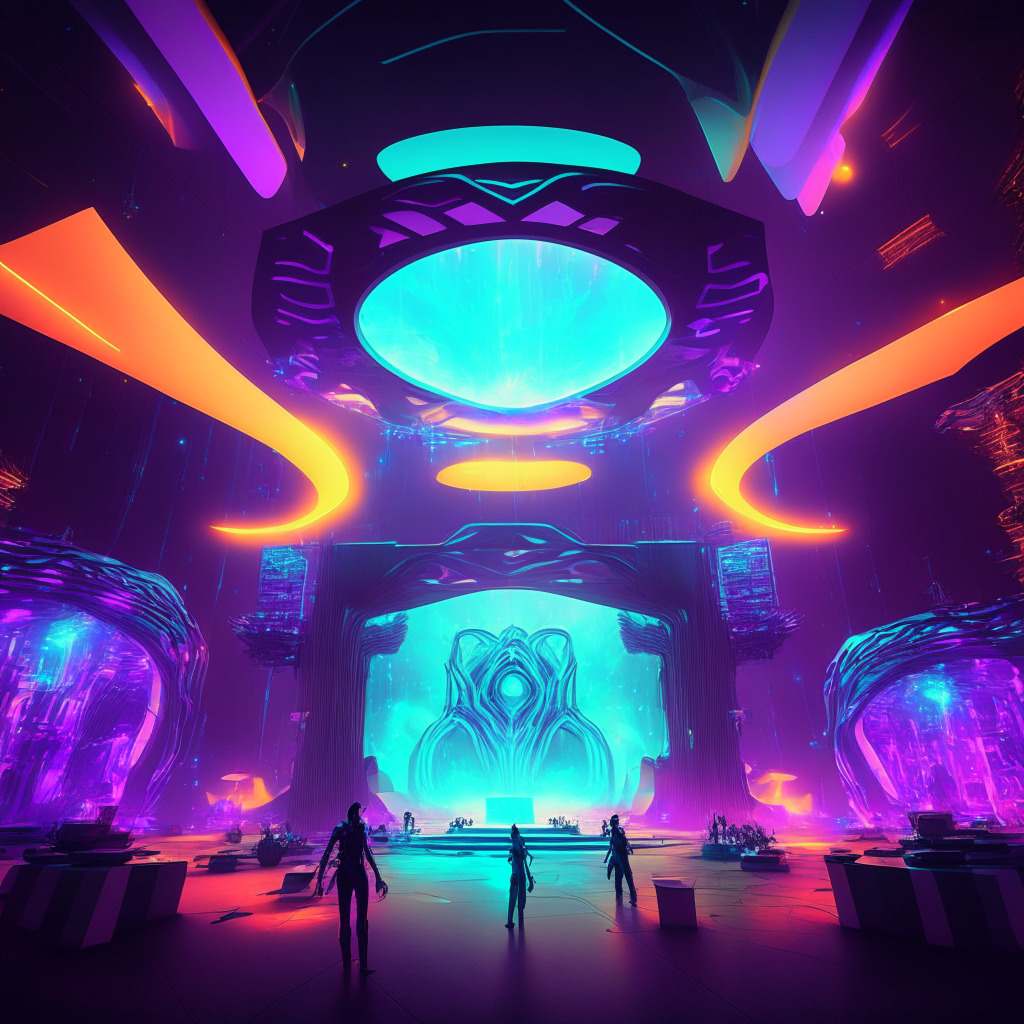

Managing Events in the Metaverse: Navigating Complexity and Optimizing Potential

“The fusion of virtual reality with physical reality gives birth to the metaverse: a communal virtual space hosting augmented reality (AR), virtual reality (VR), and more. Events in the metaverse promise interactions that transcend boundaries and offer an immersive digital experience, yet pose unique complexities and risks.”

The Closing of Clockwork: A Reality Check for Blockchain Ambitions or a Miscalculation of Market Potential?

“Clockwork, a Solana-based startup, announced its closure, citing limited commercial upside. Despite the promising goal of revolutionizing blockchain with payroll technology, the project was halted. However, founder Nick Garfield has encouraged users to fork the code, potentially spawning multiple new projects.”

Bitcoin’s Chilly Wave: Market Effects, Reactions and Future Predictions Amid Federal Reserve Statements

The cryptocurrency market plunged as Bitcoin fell below $26,000, triggered by U.S. Federal Reserve Chair’s statements on countering inflation and possible rate hikes. Leading altcoin Solana also dipped 3%, and MKR saw a 4% decrease due to fears of a loan default. However, despite the gloomy outlook, experts like Sacha Ghebali believe the market could see an upturn if a spot bitcoin ETF is approved, offering a possible crypto market recovery.

Bitcoin’s Rise Amid Market Rally: Balancing Crypto Rewards and Risks

“Bitcoin sees a substantial boost, correlating with traditional stock market rallies. Despite this, the bankruptcy of crypto exchange FTX serves as a reminder of market volatility and risk. Meanwhile, the DeFi sector shows bullish trends, offering traders legitimate and potentially highly profitable alternatives.”

Navigating The Crypto High Seas: The Impact of the UK’s Travel Rule Implementation

The U.K. is implementing “the travel rule”, a law aiming to curb money laundering in crypto, from September 1. This brings challenges for crypto firms, as they navigate variations in regulation across borders and gather data on customer’s overseas interactions.

Nvidia’s AI Dominance: Potential Boom or Over-Dependence Risk Amidst Crypto Scams?

“The sharp rise in Nvidia’s share prices can be attributed to increasing demand for AI chips. The company separates itself from competitors like Intel and Micron Technologies by focusing on research and development in AI technology. However, as this sector continues to grow, scams target consumers of this technology, underscoring the need for stronger regulations and safety protocols.”

Strategizing Amid Market Whipsaws: Crypto Upsurges and Potential Pitfalls

“Bitcoin rose more than 3% to above $26,600, demonstrating resilience after last week’s sharp fall. Close on its heels, Ether marked a 3.5% advance. Altcoin giants like Ada from Cardano, DOT from Polkadot, and BNB from Binance too mirrored these gains with rises ranging between 3%-5%.”

Solana’s Bullish Run: Potential for 10x or Regulatory Roadblocks?

The Solana (SOL) cryptocurrency is showing strong momentum, driven partly by the integration of Solana Pay with Shopify Inc. However, its future course is uncertain, contingent on broader market trends and potential US regulatory changes. Despite this, Solana’s potential for significant upside expansion as a decentralized application platform remains promising.

Quantstamp’s Economic Exploit Analysis: Revolutionizing Blockchain Security or Just Prolonging the Inevitable?

Blockchain security firm Quantstamp introduces the Economic Exploit Analysis service to counter increasing flash loan attacks. This service, developed with the University of Toronto, identifies potential breaches before they wreak havoc, helping to protect DeFi protocols from being exploited and drained by hackers.

Unpacking the Surge of Base: Advancements, Drawbacks, and the Upcoming Blockchain Revolution

“Base, a layer 2 blockchain, surprisingly outperforms Ethereum with an unprecedented average of 15.88 TPS. Friend.tech powered investor surge, despite potential regulatory hurdles, contributed to Base’s astonishing 156% growth. This fast-paced development, however, raises concerns about potential scalability issues.”

Cryptocurrency Market Displaying Unusual Calm: A Closer Examination of Recent Developments

“Major cryptocurrencies experienced a sluggish weekend with altcoins showing muted price actions, with Bitcoin holding firm over $26,000 and Ether near its Sunday mark of $1,670. Notably, Xrp saw a 2% loss while Litecoin increased by a comparable amount. Shiba Inu also fell, further impacted by a failed launch of its Ethereum layer 2 network, Shibarium, trapping $1.7 million worth of tokens. However, altcoins like Optimism and Rollbit Coin registered profits, with Bitcoin investors remaining hopeful.”

Dinari Revolution: Embracing Blockchain Stock Tokenization Against Regulatory Challenges

“Dinari, a blockchain-based stock trading platform, has gained preliminary regulatory approval to tokenize stocks. This is a significant step forward in asset tokenization. Dinari’s plans are to simulate the US stock market within securities laws criteria.”

Dissecting the Buzz Around Friend.tech: A New High in Crypto or Regulatory Overstep?

Friend.tech, a social tokenization protocol, shows promising revenue generation within the crypto sphere. With Friend.tech, personalities can issue shares for exclusive group chats, amassing around $709,000 in ether revenue in a day. Besides its appealing growth, the platform raises questions regarding over-economic focus and regulatory oversight.

Jada AI: A Game Changer in Blockchain & AI or a Technical Hurdle too High?

Jada AI, a revolutionary project using AI in a blockchain-based environment, aims to change decision-making and scale operations, allowing AI computations to be executed within the network. With investors onboard, it’s reinforcing trust in blockchain through transparency, while navigating data privacy and cybersecurity challenges.

Scaling Ethereum: The Pros and Cons of zkEVM Linea Rollup Solution

“The successful launch of zkEVM Linea, a scaling solution for the Ethereum ecosystem, has securely bridged $26 million in ETH. This rollup offers lower transaction costs and higher throughput for decentralized applications (DApps), presenting an immense potential within the Ethereum ecosystem.”

Crypto ETF Boom: Riding the Wave of Innovation Amidst Regulatory Hurdles and Security Concerns

The future of crypto ETFs is looking promising with regulatory approval expected in the US, potentially accounting for 10% of Bitcoin’s market value in three years. However, concerns over regulatory challenges and security persist, emphasizing the need for maturity and resilience in crypto markets.

Promising Rise of RUNE and Competition from Emerging Altcoins

“RUNE, a decentralized liquidity protocol token, has seen a significant 46% growth, fuelled by increased protocol use. The growth of THORChain’s liquidity pools directly impacts RUNE’s value due to its over-collateralization structure. However, high-volatility in crypto arena necessitates a prepared mindset when investing.”

Visa Maneuvers into Ethereum’s Ecosystem: Streamlining Transactions or Threatening Decentralization?

Visa has tested a method for paying on-chain gas expenses with traditional currency through card transactions, aimed at simplifying blockchain technology. Their solution uses Ethereum’s ERC-4337 standard, allowing smart contracts to cover gas fees, potentially making blockchain interactions more accessible for everyday users. However, concerns are raised about maintaining blockchain’s decentralized ethos.

Coinbase’s New Wave: Base Network and the Debate on Blockchain Adoption Necessity

Coinbase’s layer-2 blockchain network, Base, has seen a remarkable increase in users since its launch, with 30% reportedly being newcomers to blockchain. Despite skepticism, Base presents a promising conduit for users into Web3 protocols because of Coinbase’s huge user base. The readiness of such networks may pose risks to new adopters due to their inherent complexity and potential risks. The necessity of digital currencies is called into question, particularly in regions with a well-established banking system.

Unlocking Trillions with Asset Tokenisation: A Balance of Potential and Risk

“This week in blockchain featured a focus on tokenisation of real-world assets, a promising industry potentially worth $5 trillion. However, concerns of standardisation in finance could hinder growth. Ralf Kubli, Casper Association board member, advocates for better quality and transparency of information in financial asset tokenisation to avoid replicating conditions that led to the Great Financial Crisis. “

Blockchain vs. Banks: The Unseen War on Crypto in Adult Entertainment Industry

“Digital currency and adult entertainment sectors face increasing scrutiny from regulators, influencing crypto platforms to implement rigid KYC and AML protocols. This leads to professionals being blacklisted, and platforms like SpankPay and WetSpace struggling to secure banking partnerships.”

U.S. Justice Department vs Binance: Predicting Ripple Effects on Bitcoin Prices in the Face of Scandal

“The U.S. Department of Justice is considering fraud charges against Binance, potentially impacting the crypto market. Regardless of the outcome, experts suggest the market, due to its resilience and increasing utility, could weather the storm. However, possible Binance asset drain could trigger a market crash, while the outcome could affect Bitcoin’s value trajectory by year-end.”

The SEC’s Covert Crusade Against US Crypto: Potential Collapse or Global Shift?

The U.S. Securities and Exchange Commission’s (SEC) changes in regulatory policies could be sabotaging the resurgence of the blockchain industry. The new rules, perceived by some as covert attempts to regulate crypto out of existence, have led to startups moving offshore and riskier investments for U.S. investors. The shift towards a more merit-based regulatory role by the SEC threatens to restrict financial open-source software and could disqualify operators like Fidelity Digital Assets from acting as custodians.

Centralization vs Decentralization: The Battle for our Digital Existence

“In an era where digital advancement accelerates, centralized platforms like Twitter, now “X”, threaten user safety, privacy, and control. They replicate China’s WeChat convenience, but also its control over autonomy and data. However, blockchain and cryptography offer routes towards decentralized, user-controlled digital existence.”

Navigating Stormy Seas: MicroStrategy’s Bitcoin Journey From Chaos To Profit

In the past year, Michael Saylor, MicroStrategy’s executive chairman, has adopted a risky strategy, pouring the company’s cash into Bitcoin. Despite significant drops in Bitcoin’s value and initial losses, the company has seen rebounds and Saylor remains committed to this venture, even outperforming powerhouse tech companies like Apple and Google in stock price gains. The future is uncertain, but Saylor is confident in this cryptocurrency investment.

Worldcoin: A New Era of Digital Identity or a Privacy Nightmare? Debating the Pros and Cons

Worldcoin, a novel blockchain technology, offers a unique digital ID through an iris scan, potentially opening up universal basic income opportunities. However, concerns about data privacy, verification issues, and the bleak market for AI tools pose significant challenges. While predicting its success is uncertain, its development signals a ripe opportunity with both risks and rewards.

Blockchains Balancing Act: Security Vulnerabilities and Technological Progression in Light of Curve Finance Hack

A hacker who drained several pools on Curve Finance returned approximately 5,495 Ether (ETH), worth around $10 million. This surprising development happened after an agreement wherein the hacker received a bounty. This raises questions around blockchain security, revealing its vulnerabilities but also demonstrating its resilience in what JPEG’d’s team refers to as a “white-hat rescue.”

Curve Finance’s CRV Stolen Funds: A Tale of Recoveries, Risks and Potential Returns

The recent 7% rally of Curve Finance’s native token, CRV, is linked to the return of stolen funds by a hacker who had drained more than $50 million from multiple DeFi protocols. Although anticipation for full funds return has risen, the heist has highlighted vulnerabilities in decentralized investor fund security, shaking confidence, and posing a potential obstacle for CRV’s future growth.

Revolut Suspends Crypto Services in US: Analysis and Implications of a Directional Shift

Digital bank Revolut is discontinuing its cryptocurrency offerings to U.S. customers due to the “unpredictable regulatory landscape”. The decision only impacts less than 1% of Revolut’s global crypto customer base. Meanwhile, the company is seeking alternative channels to reinstate its crypto services in the U.S. market.