“ApeCoin ($APE) exhibits a potential recovery rally despite a volatile market, while BTC20, a ‘greener’ version of Bitcoin leveraging proof-of-stake, aims to create a new wave of holders with passive income generation. The sustainability of BTC20 may outlive original Bitcoin.”

Search Results for: ONUS

FTX Scandal: Unpacking the Billion-Dollar Accusations and the Cryptocurrency Exchange’s Struggles

An executive team led by John Ray levelled a charge against former key executives of the now-defunct cryptocurrency exchange, FTX, to recover over $1 billion allegedly misused. Charges include splurging customer funds on luxury items, political donations, and speculative investments. Interestingly, FTX’s former CEO and co-founder are accused of using customer funds to purchase Robinhood shares worth nearly $546 million.

Bankruptcy, Scandal and Alleged Fraud: Tracing FTX’s $1 Billion Saga

The insolvent cryptocurrency exchange FTX alleges that former executives, including founder Sam Bankman-Fried, fraudulently transferred over $1 billion in cash and shares. The claims touch on the misuse of FTX’s resources for personal gain and assert that over $725 million in equity was wrongly issued, with no intention to follow usual purchase processes.

Legal Controversy Surrounds FTX: Privacy, Justice, and the Future of Blockchain

The U.S. Department of Justice has accused ex-FTX CEO, Sam Bankman-Fried, of leaking private documents. These actions led to boosted media scrutiny potentially disrupting a fair trial process. The event reflects the need for stringent crypto industry regulations to ensure blockchain potential without compromising integrity and security.

Ankr and Matter Labs Unite for zkSync Era Nodes on Microsoft Azure: A Major Blockchain Leap

Ankr and Matter Labs collaboratively launched zkSync Era Nodes and Hyperchain blockchain solutions on Microsoft Azure Marketplace, enhancing Ethereum’s Layer-2 scaling protocol. It enables businesses and Web3 projects to connect and build applications on zkSync Era, including bespoke blockchain application.

Rising Crypto Contender Chimpzee: A Green Revolution or High-Risk Gamble?

“Chimpzee’s robust model stitches financial possibilities with environmental rejuvenation, highlighting deforestation and climate change issues and directly funding solutions. Utilising Web3 technology, it offers innovative earning prototypes but also faces challenges such as market volatility and the high-risk nature of crypto investments.”

Unraveling the Celsius Bankruptcy: A $25 Million Stakeholders’ Settlement Drama in Crypto Realm

Amidst cryptocurrency lender Celsius’ bankruptcy proceedings, a settlement plan has found an agreement to distribute $25 million from the sale of self-custody platform GK8 to Galaxy Digital among the lender, creditors, and Series B holders. Despite dissent among stakeholders, the majority plans to distribute $1 million among preferred shareholders.

EU’s New Data Act: Justifiable Concern for Blockchain Sphere or Unfounded Fear?

The EU’s new Data Act draft has stirred up concerns in the blockchain sector, as it appears to ignore industry-specific issues and could potentially deem most smart contracts invalid. The legislation emphasizes on the “vendors” of these automated programs, causing fear among lobbyists as it could imply endless accountability in decentralized frameworks with no single seller.

How Ecoterra Is Blending Blockchain & Sustainability: Promises and Challenges

Ecoterra, an eco-friendly crypto project, achieved $5.9 million in presale investment, aiming to address climate change, forest depletion, and waste management. It employs blockchain technology and a recycle-to-earn model to incentivize eco-friendly activities, rewarding participants with $ECOTERRA tokens. It also offers carbon offset programs and a recycled material marketplace.

The Eco-friendly Blockchain Initiative Chimpzee: A Review of Its Allure and Risks

The eco-friendly blockchain project Chimpzee has garnered attention in the crypto market, raising over $729,000 in a token presale, thanks to its potential real-world utility for environmental conservation. Its distinct features include an online shop, NFT marketplace, and a game, all of which contribute to environmental causes alongside enabling crypto earnings.

Survival of the Fittest: ApeCoin Struggles Versus Chimpzee’s Rise in Crypto Market

The ApeCoin (APE) struggles amidst a dip in the crypto market, failing to break its 21-Day Moving Average and trading around $2.20 per token. NFT market confidence has been affected, with prominent investors expressing unease, particularly with the recently launched Azuki NFT collection. Meanwhile, Chimpzee crypto has gained interest, offering investors potential profits and exclusive perks along with environmental impact, emphasizing both profit and planet preservation.

Surfing the Meme Coin Wave: The Rise of Thug Life Token and Its Potential in the Crypto World

The newly launched ‘baller’s meme coin’, Thug Life Token, has already gathered over $300,000 via a pre-sale of its THUG token. Its unique branding, echoing the enduring Thug Life culture, and investor-friendly policies could drive potential for exponential growth.

Riding the Crypto Rollercoaster: Surviving Dips with Toncoin and Golteum’s Promising Safe Havens

Golteum (GLTM), a platform nested within the Golteum ecosystem, mitigates risks inherent in fluctuating crypto assets through seamless crypto trading and simplified ownership of precious metals. Backed by Fireblocks Web3 engine, GLTM promises solid technology and easy execution in transactions like tokenization of precious metals.

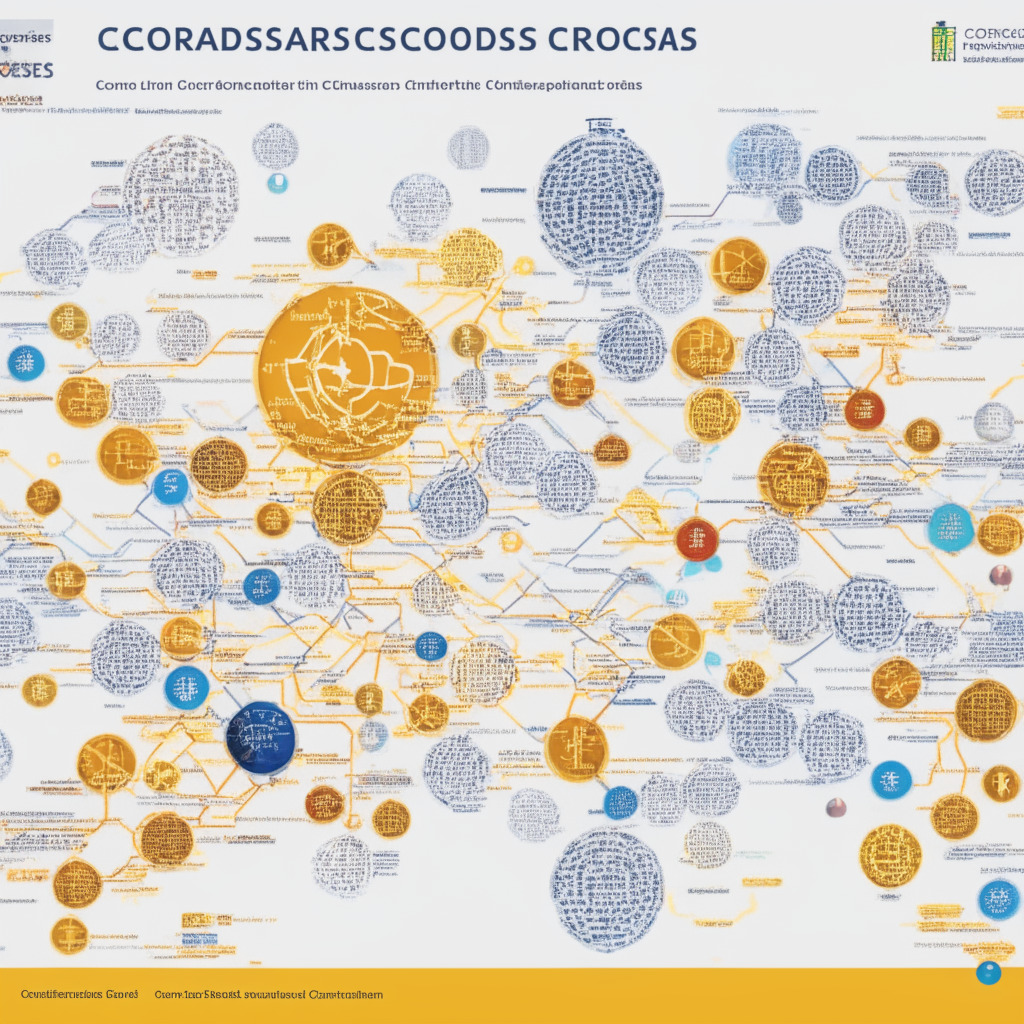

Navigating the Crypto Regulatory Maze: Global Framework vs Local Advantages

The crypto industry faces a crossroads due to evolving worldwide regulations, with companies reassessing their positions and seeking crypto-friendly jurisdictions. However, the lack of a global regulatory framework hinders market growth and stability, prompting calls for a coordinated effort to establish global standards and support beneficial innovation.

FCA Leadership Shift: Impact on Crypto Regulation and Industry Future

Binu Paul, former head of digital assets at the FCA, leaves the organization after nine months, and Victoria McLoughlin steps in as interim Head of Market Interventions for digital assets. This leadership change occurs amid the FCA’s intense focus on regulating the emerging crypto industry and enforcing stricter advertising rules for crypto services. McLoughlin’s experience at the FCA signals a continued stable approach to cryptoasset regulation.

NFTs in Cross the Ages: Changing Card Game Dynamics or Unfair Advantage?

Cross the Ages, a free-to-play mobile card game, allows users to mint cards as NFTs on the Immutable X blockchain. With unique mechanics centered around deck-building and strategy, this game offers an NFT-driven gaming experience without sacrificing free gameplay. The game combines NFTs and CCGs, while letting players decide their level of blockchain interaction.

Crypto Betting On Missing Submarine Search: Ethical Dilemmas in Blockchain Technology

The OceanGate Titan submarine’s disappearance has led to crypto enthusiasts placing bets on Polymarket, raising concerns about the ethics of gambling on people’s lives. This highlights the darker side of blockchain technology, emphasizing the need for responsible use.

Ripple’s Singapore License Approval: A Lesson in Regulatory Clarity for Crypto Growth

Ripple Labs receives In-Principle Approval for a Major Payments Institution License from the Monetary Authority of Singapore (MAS), citing their clear guidelines for digital assets. Regulatory clarity is crucial for innovation and growth in the blockchain and cryptocurrency sectors, and Singapore’s approach could potentially inspire other countries.

US Lawmakers Target Banking Failures: Impact on Crypto and Blockchain Industries

In response to major banks’ failures, US lawmakers from the House Financial Services Committee have introduced a series of bills, although not specifically mentioning crypto or blockchain. The future of regulations surrounding banks and their potential impact on the cryptocurrency and blockchain industries remain uncertain, with past lawmakers expressing optimism on stablecoin bills.

Crypto Payments in French Malls: A Step Towards Mainstream Adoption or Hurdle to Progress?

French real estate firm Apsys partners with domestic crypto payment provider Lyzi, allowing customers to use cryptocurrency for digital gift cards at multiple shopping malls. This collaboration is part of France’s growing interest in adopting and integrating cryptocurrency into daily transactions.

Tate Brothers Scandal: A Wake-up Call for Crypto Regulation and Community Responsibility

The Tate brothers’ involvement in alleged human trafficking and organized crime raises concerns about digital asset misuse, emphasizing the need for robust regulatory measures and vigilance within the crypto community to uphold the technology’s core values and ensure its transformative potential isn’t overshadowed by malicious actions.

IMF’s Vision for a Global CBDC System: Revolutionizing Cross-Border Payments

IMF’s Tobias Adrian proposes a global central bank digital currency (CBDC) system called “XC” platform, aiming to address issues such as high costs and slow processing in cross-border payments. Utilizing a trusted global ledger, the system enables efficient international transactions without introducing middleware cryptocurrencies, while automating contracts and maintaining central banks’ control over reserve allocation.

Celebrity-Backed Santo Spirits NFT Loyalty Program: Innovative Marketing or Unnecessary Detraction?

Guy Fieri and Sammy Hagar launch an NFT-based loyalty program for their Santo Spirits brand, utilizing blockchain technology for fan engagement and community building. The innovative strategy combines celebrity, spirits, and technology, reflecting the growing potential of NFTs in various industries.

The Shift from Centralized to Decentralized Exchanges: Challenges and Opportunities

The shift from centralized exchanges (CEXs) to decentralized exchanges (DEXs) is gaining momentum, with growing interest in DEXs potentially upending the status quo and opening up the full potential of the Web3 economy. As cross-chain technology matures, users are likely to recognize that a DEX world may offer secure, transparent, and user-friendly transactions without relying on a centralized entity.

UK FCA Cracks Down on Crypto Ads: New Regulations and Their Impact on the Market

The UK’s Financial Conduct Authority (FCA) plans to implement stringent regulations on crypto advertising, requiring “clear risk warnings” and prohibiting incentives. This comes as part of the country’s post-Brexit financial strategy, incorporating crypto into UK-regulated financial activities. Crypto companies must also ensure promotions are fair and non-misleading to follow these guidelines.

Constructive SEC Talks & Crypto Compliance: Balancing Innovation with Securities Laws

Crypto firms engage in constructive discussions with the SEC, focusing on aligning their business models with existing regulations. The SEC’s recent legal actions against crypto firms emphasize the importance of compliance, transparency, and proper disclosures to protect investors and maintain trust in the industry.

SEC Crackdown on Coinbase and Binance: Striving for Regulation or Hindering Innovation?

The SEC moves against Coinbase and Binance highlight the need for increased regulation in the cryptocurrency landscape. Such actions pave the way for transparency and trust, promoting investor confidence and ensuring fair trading practices, despite concerns of stifling innovation.

Neutral Technologies: Debunking Crypto Crime Myths and Promoting Balanced Discussions

Crypto, like cash, has no intent and is neutral in its use. Misleading claims suggesting that banning crypto would end illegal activities are unfounded. Balanced discussions and regulation, instead of prohibition, can better address criminal activities facilitated by any mode of value exchange.

MakerDAO Drops USDP: DeFi Stability Concerns & Avenues To Maximize Revenues

MakerDAO’s community vote unanimously decided to eliminate the $500 million USDP stablecoin from its reserves, impacting Paxos and raising concerns about the stability of some stablecoins within the crypto ecosystem. The decision aims to increase revenues and improve the protocol’s capital efficiency.

Multichain Drama: Arrest Rumors, Locked Servers, and Suspended Services Unravel Crypto Startup

Crypto startup Multichain faces challenges after rumors of team members’ arrests and loss of communication with their CEO, Zhaojun. With affected cross-chain services, uncertainty surrounds users’ fund accessibility and private key control. Connection to recent arrests in China remains unconfirmed.

Multichain’s Missing CEO: Decentralization Debate Rages Amid Arrest Rumors and Technical Issues

Cross-chain protocol Multichain faces challenges as the team cannot locate its CEO, leading to arrest rumors in China. Technical issues and delayed transactions ensue across multiple cross-chain bridges, highlighting the protocol’s dependence on a single person, contradicting decentralization principles.

Multichain’s Suspension: Impact on Crypto Trust and Ensuring Decentralization Success

Multichain, one of the largest bridging protocols, suspends cross-chain routes due to inability to contact CEO Zhaojun, exposing trust and accountability issues in the crypto space. This highlights the vulnerability when key personnel hold significant power over essential infrastructure and emphasizes the importance of decentralized networks in maintaining stability and reliability within the crypto landscape.