“U.S. regulatory body, CFTC, has charged DeFi protocols Opyn, 0x, and Deridex for conducting illegal derivatives trading via blockchain protocols and smart contracts. The protocols have accepted the penalties, implying cooperation for a swift resolution. The response raises questions about the future handling of similar DeFi controversies.”

Search Results for: RAC

SEC Crackdown vs Blockchain Evolution: LBRY’s Legal Tussle and Its Impacts on Crypto Industry

LBRY blockchain firm, initially ceding to the SEC’s ruling that it operated unregistered crypto asset securities, has filed an appeal. This verdict and ongoing regulatory friction highlight challenges in balancing innovation encouragement with investor protection in the emerging blockchain field.

Navigating Polkadot 2.0: A Revolutionary Shift for Developer Attraction & DOT Token Economy

Polkadot’s innovative roadmap, Polkadot 2.0, aims to reimagine resource allocation to foster efficiency and inclusivity. It introduces ‘elastic cores’ for flexible computational capabilities and ensures coretime allocation aligns with developers’ evolving needs. Improved availability and budget-friendliness could potentially increase DOT tokens’ market value, while fees from coretime sales support Polkadot’s Treasury.

Cryptocurrency in the Political Arena: Impact on the US Presidential Race

The upcoming US presidential race sees prominent “crypto candidate” Ron DeSantis in competition with other pro-crypto candidates. Amid this, the potential influence of Donald Trump’s crypto assets for 2024 raises intriguing questions for the future of cryptocurrency in the US.

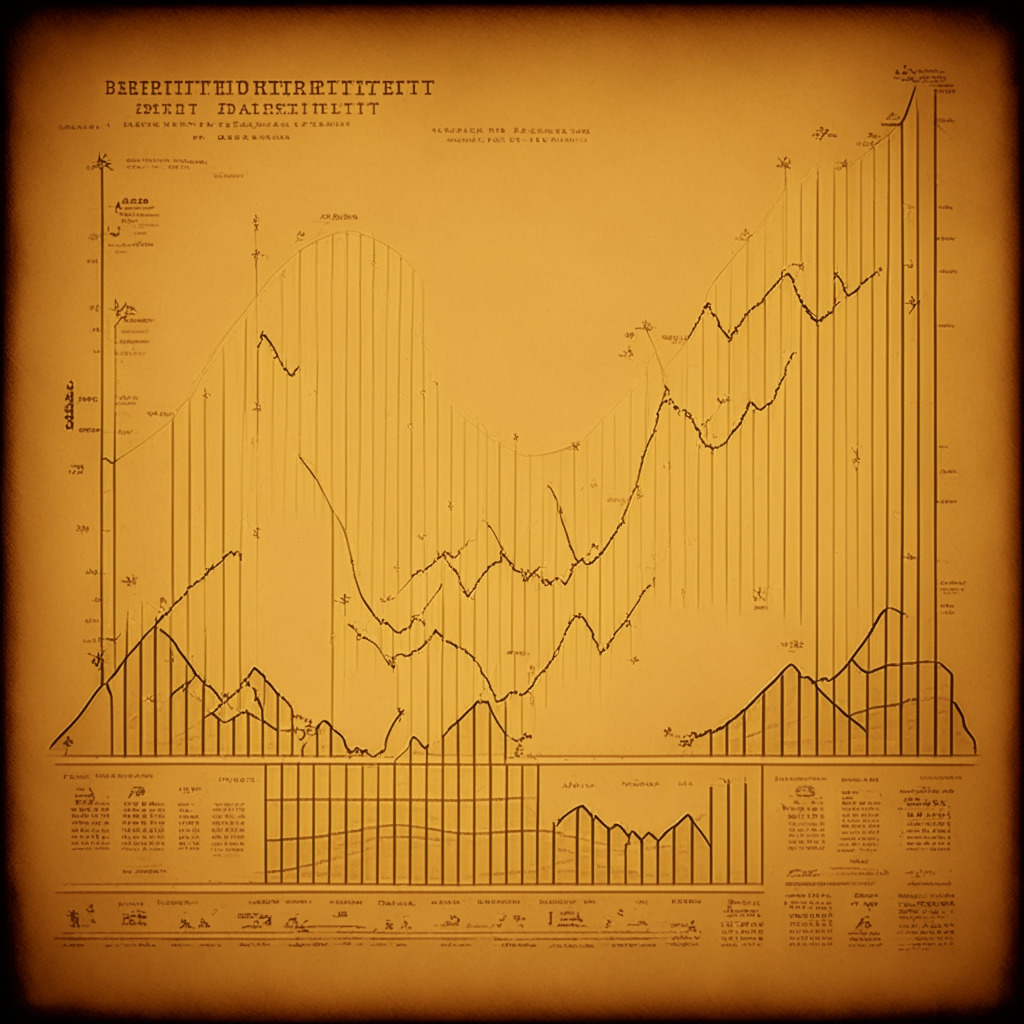

Crypto Market Contraction: The Fall in Spot and Derivatives Trading Volume Unveiled

“August saw an 11.5% contraction in the combined crypto spot and derivatives trading volume to $2.09 trillion, indicating a market largely driven by speculation. Spot market activity fell to its lowest level since March 2019, further confirming these concerns.”

Blockchain Literacy in Nigeria: A Struggle Amidst Linguistic Diversity and Regulatory Obstacles

Despite the growing blockchain and crypto awareness in Nigeria, key challenges remain around public education. Linguistic diversity poses difficulties in a country where over 500 languages are spoken. A disconnection between local banks and crypto-exchange firms further complicates the landscape. Nevertheless, Nigeria is proactive in overcoming these hurdles by implementing language-friendly education strategies about blockchain technology.

The US: Falling Behind In The Blockchain Race? Evaluating Current Policies and Ambitions

Chris Larsen, Ripple Labs’ Chair, criticized the current Biden administration’s approach to cryptocurrency policy, suggesting its ambiguity has caused confusion within the sector. Larsen also argued that current policies push the industry offshore, naming Dubai, Singapore, and London as emerging global blockchain capitals. Meanwhile, the race for the first US spot Ethereum ETF is heating up.

Bitcoin vs. Ethereum: The Race Tightens Amid Market Lull and Regulatory Rumbles

“The crypto market leader, Binance, remains dominant despite regulatory concerns, with its bitcoin-tether pair contributing up to 86% of global transactions. Meanwhile, crypto analytics firm K33 predicts ETH will outpace Bitcoin in the next two months, while SOMA Finance is set to introduce the first legally issued digital security.”

From Spook Shock to Fresh Start: Tracing the Crypto Market’s Recovery and Future Prospects

Justin Sun, founder of Tron, predicts a bullish future for the crypto market at the recent Korea Blockchain Week 2023. Noting past market shocks, he expresses certainty about a new industry cycle in the next two years. Despite concerns over tightening regulations, Sun believes cryptographic technology remains a global priority with god momentum behind dollar-pegged stablecoins in Asia and the resurgence of Hong Kong’s role in the crypto landscape.

Swyftx’s ‘Learn and Earn’ Initiative: A Catalyst for Crypto Literacy or a Risky Lure?

Swyftx, an Australian tech venture, has begun a ‘Learn and Earn’ program to encourage understanding of the crypto-market, with rewards for participants. However, the initiative could inadvertently encourage naive investment. Nevertheless, with courses designed to identify scams, Swyftx aims to improve crypto literacy and discernment in a market filled with digital currencies and potential frauds.

Dogecoin’s Future: Will the Meme Token Gain Traction or Fade Away?

“Despite a slight market dip, Dogecoin (DOGE) showed potential stability with a 2% gain in the last 24 hours. However, its overall gains remain modest and investors remain uncertain. Developments like DOGE-based swaps on Robinhood and potential Twitter integration could boost its adoption, yet the road ahead is still unclear due to a potentially oversaturated meme-token market.”

Binance Amidst Turmoil: Resilience or Cracks in the Armor? Analyzing High-Profile Departures and Regulatory Scrutiny in Crypto’s Behemoth

Binance’s global head of product, Mayur Kamat, steps down after guiding the company through significant user base growth. His exit follows a series of other high-profile resignations within Binance, amidst reports of mass job cuts and ongoing investigations by U.S authorities.

Race to SEC Approval: The Spot-Traded Bitcoin ETF Drama Unfolds

The digital asset landscape is witnessing intense activity regarding the approval of the first spot-traded Bitcoin ETF by the U.S. Securities and Exchange Commission. Notwithstanding setbacks and concerns around investor protection, the increasing interest among major institutions suggests the possibility of approval could be nearing. The SEC’s decision is anticipated by early 2024.

Ethereum Supreme Court: A Solution for DeFi’s Contract Disputes or a Threat to Small Protocols?

Matter Labs CEO, Alex Gluchowski proposes an “Ethereum Supreme Court” for dealing with recurring smart contract disputes in DeFi. His vision involves a blockchain-based court system, similar to real-world judiciaries, to provide resolution for contract-related disagreements, particularly focusing on enhancing measures to handle unforeseen vulnerabilities and emergencies in Layer 2 implementations.

Revising Crypto History: Runefelt’s Battle between Reality and Attraction Law

Crypto influencer Carl “The Moon” Runefelt, previously claimed to be a co-founder of cryptocurrency payment platform Kasta, but now insists that he was simply an investor. His sudden change of stance about his involvement and re-purported non-operational role, sparks questions about reliability in the volatile and fast-paced crypto industry.

Warren Buffett vs. Bitcoin: Is the Oracle of Omaha’s Strategy Outdated in the Crypto Age?

“Even though Bitcoin saw a price surge of 683% in the year following Buffett’s critical comments on non-productive commodities, Bitcoin’s performance unmatched the returns from Berkshire Hathaway’s pertinent stock holdings. The consistent outperformance of Bitcoin’s price against Berkshire Hathway’s shares encourages investors to view Bitcoin as a viable alternative store of value.”

Blockchain Philanthropy: Celebrities Embrace Crypto for Charity, Balancing Potential and Skepticism

Celebrities Oprah Winfrey and Dwayne Johnson have integrated cryptocurrency into the People’s Fund of Maui, a philanthropic effort aiding wildfire victims. The fund embraces various digital currencies, including Bitcoin and Ethereum, in a move towards mainstream adoption, although concerns persist about the crypto market’s volatility and potential misuse.

Bitcoin City Attraction: Balancing International Appeal with Social Impact and Economic Integration

American Bitcoin enthusiast, Corbin Keegan, has reportedly relocated to Conchagua, future site of El Salvador’s continuing Bitcoin City project. However, Keegan’s relocation has highlighted potential dilemmas like integration of cryptocurrency into daily life and the risk of new residents bringing undesirable attributes.

High-Profile Departure from Binance: Tracing the Ripple Effect in the Blockchain Cosmos

Leon Foong, former head of Binance Asia-Pacific, is reportedly leaving the leading cryptocurrency exchange amidst its burgeoning expansion and regulatory challenges. Despite such high-profile departures, Binance CEO Changpeng Zhao actively advances towards his 200M-user goal in Asia-Pacific, undeterred by the regulatory struggles. Binance’s future, thus, remains an exciting puzzle wrapped in uncertainty.

Rise of the Underdog: Borroe ($ROE) Challenges Dogecoin and Solana in Crypto Race

Borroe ($ROE), a new contender in the cryptocurrency market is gathering a following; it promises a revolutionary approach to revenue financing with secure, easily accessible loans backed by future invoices. The forecasted growth is remarkable with projections of a threefold value increase.

Embracing the Un-chartered: The Digital Euro and its Road to Acceptance

Stefan Berger, architect of the EU’s Markets in Crypto Assets regulation (MiCA), is leading legislation for a digital euro. Despite controversy and skepticism among colleagues, Berger believes that the transition to digital currencies like the Central Bank Digital Currency (CBDC) could usher in autonomy and innovation. However, the success of this transition hinges on public trust. The EU remains undecided about the formal issue of the CBDC, with the proposal’s outcome influenced by political environment and law amendments.

Falling from Grace: An Insider Look at Sam Bankman-Fried’s Legal Battle and its Implications on Crypto Market Regulation

“The U.S. DOJ requests dismissal of defense’s claims of misleading counsel for ex-crypto magnate, Sam Bankman-Fried, in his fraud case. They allege Bankman-Fried misled Silvergate Bank for company advantages and misused customer funds. He faces charges for diverting over $100M from FTX for personal and political gain.”

Jamaican Cab Drivers Embrace Jam-Dex: Relevance, Challenges and Potential Outcomes

Jamaican cab drivers are optimistic about the nation’s Central Bank Digital Currency, “Jam-Dex”, aiming to revolutionize public transportation by eliminating cash and its associated security concerns. Despite a lukewarm public response, proponents believe Jam-Dex could significantly improve daily transactions if successfully adopted by customers.

Bridging the Cryptocurrency Education Gap: Unveiling the Crypto Literacy Scale

“The University of Cincinnati has developed a Crypto Literacy Scale (CLS) to standardize knowledge about cryptocurrencies and related technology. This initiative, “Measuring Crypto Literacy”, aims to bridge the gap between traditional financial literacy and understanding of cryptocurrencies’ intricate workings, promoting safer and more informed engagements in the blockchain world.”

Future of Financial Forecasting: Embracing AI in Modern Finance with yPredict

“yPredict aims to revolutionize financial forecasting using AI-powered predictive tools and blockchain technology. It leverages ARIMA and LSTM models to predict Ethereum prices and reveal potential future price trajectories, offering a range of services for traders and AI/ML developers.”

Bitcoin’s Race to $100,000: An Optimistic Prophecy or Fantasy Among Fraught Skepticism?

“Hut 8 VP, Sue Ennis, predicts Bitcoin could reach $100,000 by snaring 2%-5% of gold’s market cap. Despite political turbulence and Bitcoin’s dismal performance, she maintains that diversifying mining revenue and approval of a Bitcoin ETF could drive Bitcoin’s surge.”

Surge in Blockchain Betting Forecasts a Potential Dark Horse in 2024 Presidential Race

“Bitcoin-friendly entrepreneur Vivek Ramaswamy emerges as a formidable contender in the 2024 U.S. Republican presidential nomination. Blockchain-based betting platforms indicate his growing popularity, signifying possible cryptocurrency and blockchain acceptance in political scenarios. Though legally limited, this technology may revolutionize gauging public sentiment.”

Bitcoin Velocity Dips: Stagnation or Whales Playing it Cool? Ripple SEs Legal Distractions

Bitcoin’s velocity, reflecting how swiftly BTC moves around the network, has hit a slowing point, indicating a stagnant Bitcoin supply at around $26,000. This could suggest that large Bitcoin holders maintain their holdings rather than selling, sparking a debate in the market. The slowdown also has implications for other cryptocurrencies, particularly Ripple Labs, currently under the scrutiny of the Security and Exchange Commission.

Regulatory Tightrope in Crypto: Worldcoin’s Controversial Practices VS Digital Euro’s Promise

“The Worldcoin project, known for its retinal scans to differentiate humans from bots, is under scrutiny for potential violations of regulations, including data privacy and security threats. This situation highlights the necessity for balanced regulatory adherence as the crypto-space evolves, emphasizing consumer protection. On a separate note, the introduction of the digital euro could harmoniously coexist with private payment solutions, addressing cross-border payment issues and increasing accessibility.”

AI in Cryptocurrency: The Oracle of Modern Finance or a Risky Bet?

“The financial sector is embracing AI crypto platforms like yPredict for accurate forecasting of volatile cryptocurrency markets using science-backed algorithms and machine learning. However, investments in such technologies carry inherent risks. yPredict’s offerings include a prediction marketplace and analytical tools using the ARIMA model and LSTM tool for accurate price forecasts.”

NFTs and the Creative Revolution: Tracing the Success of VR Artist Giant Swan amidst OpenSea’s Royalties Controversy

“In an era dominated by digital aesthetics, Non-Fungible Tokens (NFTs) have soared, offering artists unparalleled creative freedom. Particularly noteworthy is the Australian VR artist, Giant Swan, the first to put a 3D object on-chain. This innovation allows direct artist-collector sales, a leap forward from traditional social media trades. However, OpenSea’s choice to make creator royalties on secondary sales optional creates a significant challenge for creators striving for rightful compensation in an ever-evolving economy.”

China’s Crypto Crackdown: A Tale of State Control vs Private Blockchain Ventures

China’s escalating efforts to eliminate private cryptocurrency activities are causing deep concern among blockchain firms. Measures taken by authorities include offering bounties for information leading to arrests and asset seizures of private crypto ventures – sparking fear amongst operators and sparking a mass exodus among Chinese Web3 founders. At the same time, state-sanctioned blockchain initiatives are flourishing, underscoring a dualistic approach by the Chinese authorities.