Antonio Juliano, founder of dYdX, suggests crypto developers should shift their focus from the convoluted U.S. regulatory environment to friendlier overseas markets for the next five to ten years. His perspective sheds light on the industry perception that U.S. lacks definitive digital asset regulations. However, views differ, with some believing that despite current regulatory obscurity, pioneers can seek clarity and establish a safe, legal operating ground in the U.S.

Search Results for: Securities and Futures Commission

Visa and Mastercard Sever Ties with Binance: A Shake-up or Just a Ripple in the Crypto Market?

“Payment giants Visa and Mastercard have distanced themselves from Binance amid ongoing regulatory challenges for the leading crypto exchange. Despite this, industry experts predict modest impact on Binance’s market share. The situation illustrates how institutional caution could affect the cryptocurrency market’s future.”

Advancements and Dilemmas: Crypto Regulation in Hong Kong Shapes Future of Blockchain

“In Hong Kong, platforms HashKey and OSL have obtained licenses to offer Bitcoin and Ether retail trading. This marks a first for crypto exchanges in the area, albeit with restrictions on investment amounts. However, the lack of diverse investment products and potential compliance issues might inhibit the crypto industry’s growth. The necessity of regulations yet the need for market independence spark discussion on the future of crypto.”

Cryptocurrency Disruption: Diving Deeper into Futures, Influences and Legal Ambiguities

The report by JPMorgan suggests the open interest in Bitcoin futures at the CME is nearing the end of its cycle, indicating an optimistic approach to the near-term impact on crypto markets with a limited downside. The SEC’s ongoing Ripple case, market dynamics, and tech assets adjustments are influencing market fluctuations. The future course for digital assets will be shaped by macroeconomics, regulatory developments, and industry-specific events.

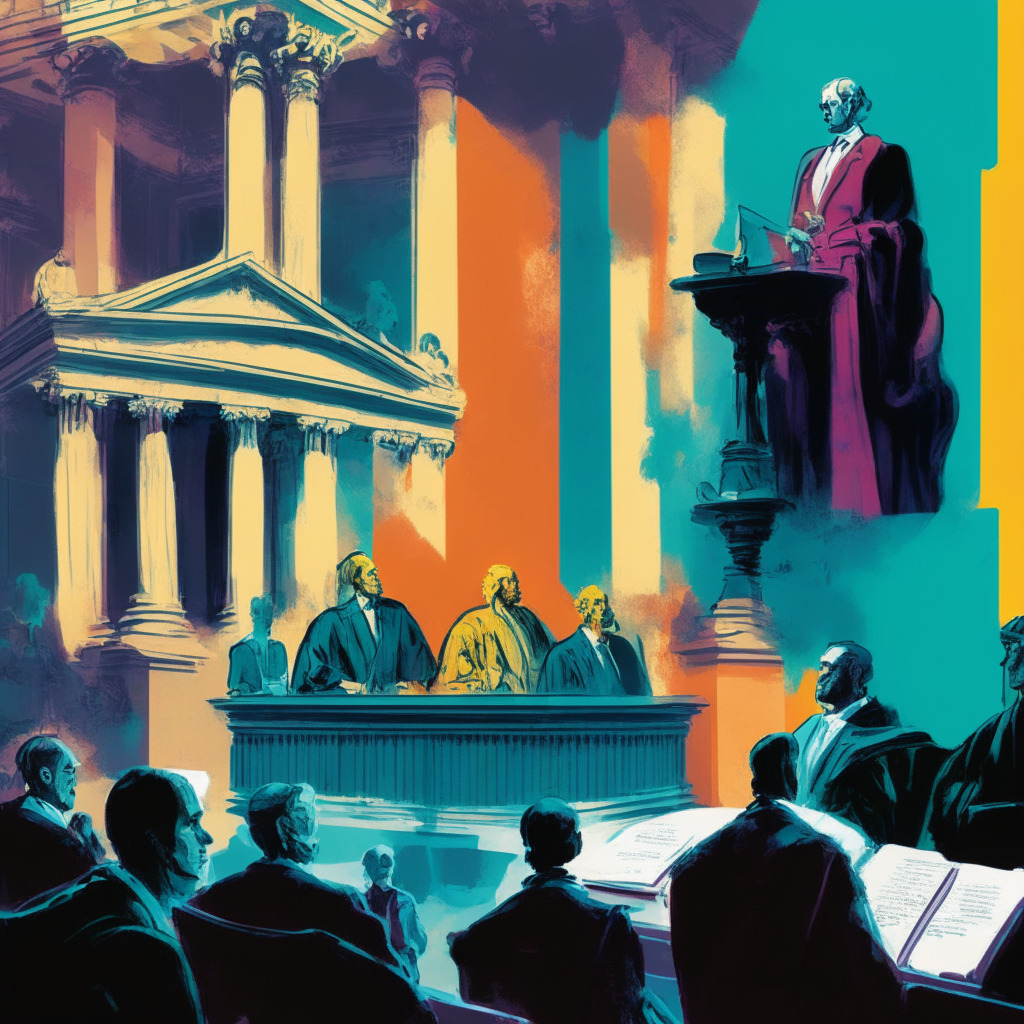

Navigating the Regulatory Jungle: Unraveling US Cryptocurrency Rules and Impacts on Market Dynamics

CoinRoutes CEO Dave Weisberger discusses the complexity of cryptocurrency regulation in the United States, criticizing the use of outdated structures for new technologies. He argues for a requisite evolution of regulatory approach, without stifling innovation, warning of the potential loss of American competitiveness in the rapidly expanding crypto industry.

Navigating Stormy Waters: Binance, Sanctions and the Quest for Cryptocurrency Regulation

“Binance, a leading cryptocurrency exchange, faces allegations of facilitating transfers to sanctioned Russian lenders. The platform allegedly allowed P2P transactions via institutions like Rosbank and Tinkoff Bank without setting trading limits. Additionally, Binance is tangled in legal issues with regulators like the CFTC and SEC, intensifying concerns around regulatory compliance in crypto transactions.”

Regulatory Compliance and Crypto Exchange: Binance, Checkout.com, and the Premature Contract Termination

“Binance, the world’s largest cryptocurrency exchange, faced contract termination from payment processing giant Checkout.com due to regulatory concerns. Checkout had facilitated billions in crypto transactions for Binance. This termination underscores the impact of regulatory scrutiny on even the most lucrative partnerships within the crypto industry.”

Rollercoaster Crypto Week: SEC Clashes, Price Tumbles, and Emerging Global Acceptance

This week in the crypto world saw a tumultuous phase as the SEC continues its litigation against Ripple Labs, while Bitcoin and Ethereum prices took a plunge. However, there are signs of hope as the EU welcomes its first Bitcoin ETF, and Coinbase gets regulatory approval for offering Bitcoin and Ethereum futures contracts.

SEC’s Anticipated Approval of Ether Futures ETFs: A Leap or a Stumble for Crypto?

The SEC’s expected approval of multiple Ether futures ETFs signals a significant shift in crypto regulation. However, with the potential risk posed to individual investors by crypto volatility, the outcome remains uncertain. The decision sets the stage for an exciting and transformative year for the crypto industry amidst intense discussions about the impact on the sector and investors.

Coinbase’s Step into Crypto Futures Trading: A Myriad of Opportunities and Challenges

“Coinbase recently received approval to offer crypto futures trading, signaling a testament to the durability of the cryptocurrency sector in the US. JMP Securities sees it as a step towards more regulatory clarity and a significant growth opportunity for Coinbase.”

Plummeting Crypto Market: Causes, Upcoming Developments, and An Unpredictable Future

“The crypto market, led by Bitcoin’s 7% plunge, experiences significant sell-off, with $1 billion liquidations. Factors include variations in market structure and increasing liquidations. Meanwhile, creditors of insolvent Celsius may expect to recover 67%-85% of their holdings. U.S regulators may soon greenlight ether futures ETFs for final approval.”

Emerging Ether Futures ETFs: A New Crypto Dawn or Blind Optimism?

The U.S. Securities and Exchange Commission (SEC) may give approval to Ether (ETH) futures ETFs, signaling a shift in regulatory stance towards cryptocurrency. However, while this introduces new investment opportunities, it doesn’t guarantee investor protection or diminish the crypto market’s volatility. Therefore, investors must independently understand the risks and rewards.

Shifting Tides of Cryptocurrency: Shibarium’s Shaky Launch and Coinbase’s Future Opportunities

“The cryptocurrency market recently suffered a steep value drop in SHIB, BONE, and LEASH tokens due to suspected technical issues in the newly launched Shibarium network. Despite anticipated increases pre-launch, SHIB, BONE, and LEASH experienced decreases of over 8%, 14%, and 23% respectively.”

Coinbase’s Leap into Futures Trading: A Revolutionary Stride or Regulatory Hurdle?

Coinbase, a major cryptocurrency exchange, has secured approval from the National Futures Association to offer cryptocurrency futures trading in the United States. This will allow Coinbase to launch futures contracts for Bitcoin and Ether, potentially making the U.S. a global leader in digital innovation. Despite facing legal disputes with the SEC, the company remains committed to contributing to the crypto industry.

Valkyrie Files for Ether Futures ETF: Assessing the Impact on Cryptocurrency Market Stability

“Valkyrie, an asset management firm, has applied for an Ether futures exchange-traded fund (ETF) with the US SEC. An Ethereum-based futures ETF could provide investors a regulated, potentially less volatile method to gain exposure to Ethereum, although concerns about market volatility and speculation persist.”

Understanding Bitcoin ETFs: Lessons from Canada’s Crypto Integration Success Story

BlackRock’s recent registration of a Bitcoin ETF reignites interest and controversy about incorporating volatile cryptocurrency into traditional finance. Reflecting on Canada’s successful integration of Bitcoin ETFs, it’s clear that ETFs carry benefits for a broader audience, beyond hardcore crypto enthusiasts. The potential of ETF security against fraudulent activities and cyber threats is significant. The surge in Bitcoin investments is tied to user-friendly mobile exchanges, suggesting investors value Bitcoin-backed financial products in the mainstream finance system.

Regulatory Thumbs-Up: Coinbase Gets NFA Approval to Trade Crypto Futures

Coinbase has received approval from the National Futures Association (NFA) to provide crypto futures investment opportunities for qualifying US customers. This development signifies a critical advancement in cryptocurrency regulation and integration into mainstream finance, reinforcing institutional trust in the volatile crypto market. However, ongoing legal disputes with the SEC are important to consider in future regulatory developments.

Between a Rock and a Hard Place: The Unclear Crypto Regulation Battlefield in the US

“Cody Carbone, VP of Policy at the Chamber of Digital Commerce, criticizes the SEC’s approach to the crypto industry as ‘unconstitutionally aggressive’, adding ambiguity and threatening constitutional values. The undecided jurisdiction of digital asset regulation adds to the industry’s risk. The SEC’s alleged attempts to control crypto without proper legislation is a major concern.”

The Prospective Approval of Crypto ETFs: A Tug of War between Regulators and Market Participants

The SEC’s decision on the approval of a spot cryptocurrency ETF has sparked interest among crypto and traditional investors. Several firms, including BlackRock, have submitted Bitcoin ETF applications currently under SEC review. This road to approval is complex and time-consuming, potentially leading to wait periods until early 2024. Blockchain future lies in this tug-of-war between crypto market accessibility and maintaining financial market integrity.

Former SEC Chairman’s Unexpected Endorsement for Spot Bitcoin ETF: Implications and Risks

Former SEC chairman, Jay Clayton endorses a spot Bitcoin Exchange Traded Fund (ETF), citing the evolved Bitcoin trading atmosphere and increased global retail participation. The spot Bitcoin ETF, dissimilar to Bitcoin futures ETF, tracks Bitcoin’s real-time price and could invite a potential market rally.

Cryptocurrency under Fire: Navigating the Hurdles of increasing Regulatory Scrutiny and Fraud Allegations

“The realm of cryptocurrencies is in troubled waters with ongoing legal proceedings by the CFTC against four individuals from Fundsz for fraudulent activity. However, while these proceedings could mark a significant stride in cryptocurrency regulation, they may create a hostile environment for legitimate businesses, thus potentially hindering the acceptance and growth of the crypto world.”

U.S Crypto Regulation: Balancing Innovation, Market Expansion and Legislative Oversight

Grayscale’s CEO expresses concerns about U.S. regulations potentially hindering innovation in the crypto sector. Hopes lie on recent legislation effort from Congress for clearer rules. However, concerns over the SEC’s ambiguous methodology for Bitcoin ETFs approval persist, questioning the sustainability of such products in the changing market.

Redefining Boundaries: SEC, Coinbase Lawsuit, and the Call for Crypto Regulation Reformation

U.S. Senator Cynthia Lummis and crypto experts assert that the SEC’s examination of crypto trading platforms, like Coinbase, as unregistered securities exceeds their jurisdiction. The SEC’s authority question, they believe, should rest with Congress. Much debate exists around immediacy and breadth of crypto regulation, with an emphasis on establishing comprehensive, globally mindful approaches to build trust in the market.

SEC’s ETF Decision Delays: Impact on Bitcoin, BlackRock, and Fidelity Explained

The SEC’s delay over a decision on a Bitcoin ETF is causing anticipation, with implications for major Wall Street players like BlackRock and Fidelity. Currently, eight applications are awaiting approval, representing over $15 trillion globally managed assets. This mass approval could reduce chances of market manipulation, possibly introducing over $70 billion in liquidity to the Bitcoin market.

Bitcoin Futures Rise Amid Trading Slump: Puzzling Decryption of Market Trend & Investor Sentiment

“Bitcoin’s futures open interest is reaching levels not seen since 2023, while the BTC trading volume slumps. Factors contributing include setbacks in Bitcoin exchange-traded funds approval and potential legal actions against Binance. Macroeconomic forces and reluctance to take on riskier positions due to potential economic downturn also impact investor confidence.”

Exploring HKVAX’s Approval and the Evolution of Crypto Regulation in Hong Kong

HKVAX, a Hong Kong-based Virtual Asset Exchange, has received ‘approval in principle’ from the Hong Kong Securities and Futures Commission to operate their asset trading platform under local securities laws. This includes providing a digital asset trading platform dealing with securities and delivering automated trading services to both institute investors and retail users. This approval comes as regulators form a new licensing system for virtual asset service providers to protect investors.

U.S. Justice Department vs Binance: Predicting Ripple Effects on Bitcoin Prices in the Face of Scandal

“The U.S. Department of Justice is considering fraud charges against Binance, potentially impacting the crypto market. Regardless of the outcome, experts suggest the market, due to its resilience and increasing utility, could weather the storm. However, possible Binance asset drain could trigger a market crash, while the outcome could affect Bitcoin’s value trajectory by year-end.”

Hong Kong’s Ambitious Leap Towards Becoming an International Crypto Hub: Opportunities and Challenges

“Hong Kong has begun issuing licenses to crypto companies like OSL and HashKey under new rules, expanding the city’s crypto market past professional traders. Despite interest from over 80 companies, skepticism and the complexities of adequately addressing domains like non-fungible tokens and decentralized finance hinder significant financial commitment and decisive investments.”

Hong Kong’s Leap into Crypto Landscape: A Regulated Paradise or a Volatile Nightmare?

Hong Kong grants a retail trading license to the HashKey platform, reflecting its readiness to become a crypto hub in Asia. The move expands digital assets access to retail investors. Notably, auditing firms KPMG and EY will ensure operational transparency, underlining Hong Kong’s focus on secure crypto regulations.

Revolutionizing Hong Kong’s Crypto Space: The Rise of Retail Trading and Regulatory Challenges

Hong Kong’s crypto trading landscape is changing as HashKey, a licensed exchange, begins offering services to non-institutional investors. Acquiring two licenses from the local Securities and Futures Commission, HashKey paves the way for retail and automated crypto trading services, aiming for increased transparency and improved investor confidence. However, the new advances underscore the need for careful regulation and safety measures in digital finance.

Bold Leap to the Crypto Future: Direxion’s Bitcoin Ether Strategy ETF and the Regulatory Hurdles Ahead

“Direxion, a renowned ETF issuer, has proposed the Bitcoin Ether Strategy ETF, a blend of Bitcoin and Ether futures. Despite historical rejections by the SEC, Direxion and other companies are optimistic about their ETF applications, anticipating a possible breakthrough for regulated crypto trading.”

Ethereum Futures ETFs: An Opportunity or Pitfall for Asset Managers?

“Six leading asset managers await a decision from the US Securities and Exchange Commission (SEC) regarding their submitted Ethereum (ETH) futures ETFs. However, regulatory uncertainties and the volatile nature of cryptocurrency markets pose challenges. In the favorable case of approval, the first ETH futures could lead to a surge in cryptocurrency investments.”