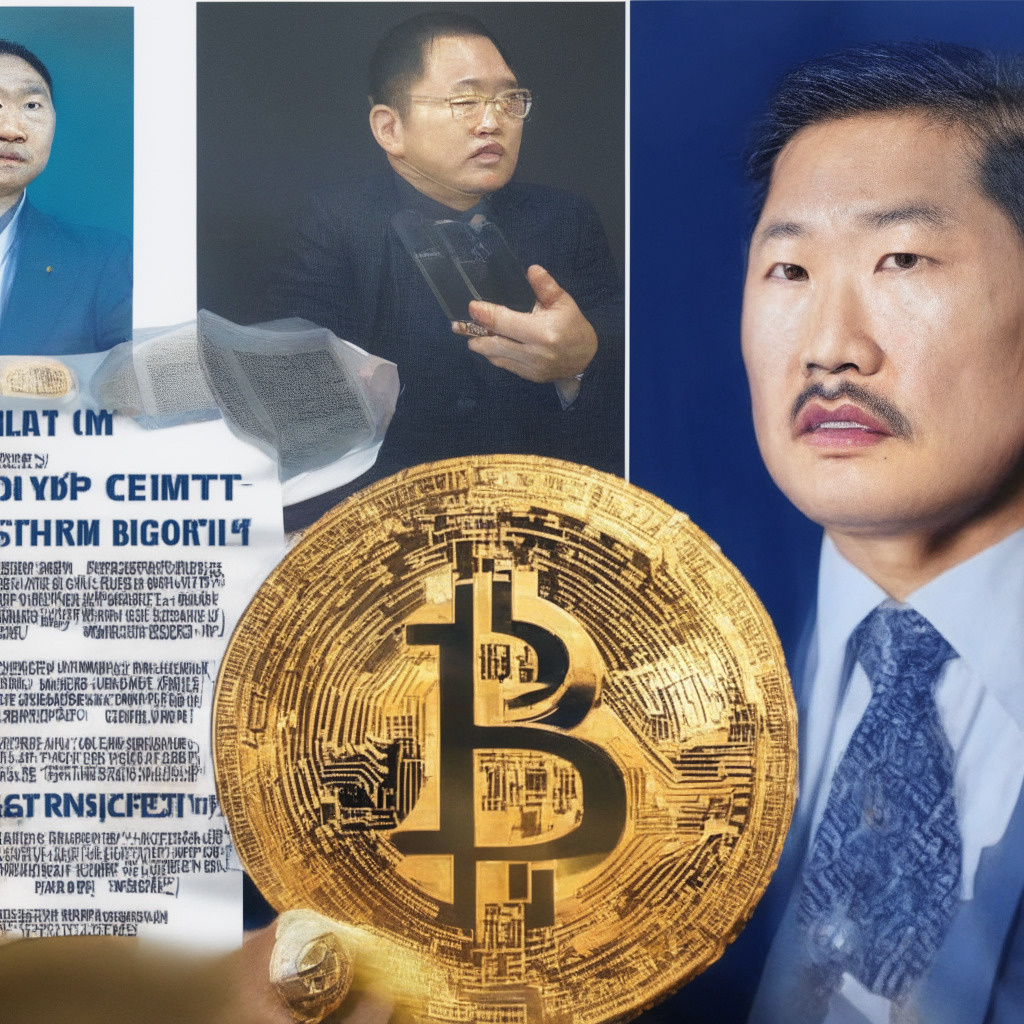

Shin Hyun-Seong, Terraform Labs’ co-founder, faces indictment in South Korea related to illicit profits from the sale of Terra and Luna cryptocurrencies. The prosecution asserts Shin manipulated transactions, spread false information about the project, and sold coins just before a market crash, resulting in substantial unlawful earnings and raising crucial questions for the future of crypto industry.

Search Results for: trust

Navigating the Turbulent Waters of Crypto: Mainstream Uptake vs Trust Deficit Challenges

“BlackRock’s CEO shows unexpected enthusiasm for Bitcoin, highlighting a leap in mainstream acceptance. Contrasting, Gemini’s trust issues reveal potential systemic issues within crypto. Despite high-profile incidents, Binance’s CEO predicts a Bitcoin bull run. Meanwhile, scrutiny grows over top crypto exchanges amid low employee morale concerns.”

FTX and the Fallen Deal with Taylor Swift: A Tale of Trust and Transparency in Blockchain

Revelations suggest that the now-defunct cryptocurrency exchange FTX pulled out of a $100 million tour sponsorship deal with Taylor Swift. Amidst liquidity crises and failure to fulfill customer deposits, former CEO Sam Bankman-Fried faces charges of misusing customer funds for personal investments. Despite bankruptcy proceedings, FTX shows ‘substantial progress’ in financial recovery, yet unresolved issues question blockchain technology’s promised trust and transparency.

Gemini Vs Genesis: A Tale of Trust, Transparency and Regulatory Challenges in Crypto Sphere

“The Gemini-Genesis incident emphasizes transparency importance in crypto financial transactions and exposes vulnerabilities in the current regulatory framework. This reflects the balancing act between progressing financial freedom and respecting monetary regulations in a world where the stakes are high.”

Argus Protocol’s Success: Reflecting Institutional Trust in Blockchain Finance and DeFi

“In a significant development for blockchain finance, the Argus protocol, launched by crypto custodian Cobo, saw institutional customer funds exceed $100 million within seven days of release. This highlights growing institutional interest in decentralized finance (DeFi) and secure token storage.”

Crypto in Crosshairs: Financial Turmoil at Prime Trust Ignites Regulatory Concerns

“Prime Trust, a crypto custodian, potentially faces takeover by the Nevada state due to significant financial struggles, including owing customers over $80 million it cannot cover. This raises concerns about the digital asset market’s financial health and spotlights challenges in maintaining a balance between promoting crypto-based innovation and ensuring financial safety.”

Crypto Custody Crisis: Lessons from BitGo and Prime Trust Fallout

“BitGo’s acquisition of Prime Trust is halted after Nevada’s Financial Institutions Division puts restrictions on Prime Trust due to a deteriorating financial state. Prime Trust is currently under scrutiny over potentially owing $85 million in fiat and $69.5 million in cryptocurrency to clients. This situation raises questions about the reliability of custodial services in the cryptocurrency sector.”

Navigating the Friedberg Controversy: A Test of Trust and Transparency in Crypto World

“The Friedberg case raises significant questions about oversight and ethics in the crypto industry. Allegations against him include fraudulent transfers, aiding in misappropriation of user funds, and a breach of fiduciary duty. The case might grossly impact cryptocurrency regulation and perception.”

Blockchain Future: Trustless Environment vs. Environmental Impact & Market Volatility

Blockchain technology promotes transparency, security, and decentralization, revolutionizing various sectors like finance, healthcare, and supply chains. However, challenges like environmental impact, regulation issues, and market volatility must be addressed for its potential benefits to fully emerge.

Recovering $7 Billion from FTX Exchange: Progress, Trust, and the Road Ahead

Debtors recovered about $7 billion from FTX exchange, though still short of $8.7 billion owed to customers. The process of tracking assets was challenging due to commingling and misuse of customer deposits, revealing mismanagement and raising concerns about safety of cryptocurrency exchanges.

Bankrupt Celsius, Wintermute, and the Wash Trading Allegations: Trust Issues in Crypto Markets

Creditors of bankrupt lending firm Celsius have amended their lawsuit to include trading firm Wintermute, alleging they assisted Celsius in wash trading. This implicates both firms in improper market making activities, raising questions about transparency, trust, and safety within the blockchain and cryptocurrency markets, potentially emphasizing the need for increased regulation and oversight.

Bankrupt Celsius Accused of Wash Trading: Impact on Crypto Transparency and Trust

Creditors have accused crypto market maker Wintermute of facilitating “wash trading” to manipulate CEL token prices for the bankrupt cryptocurrency lending platform Celsius. The allegations highlight the potential manipulation of trading volumes in the crypto market, emphasizing the need for transparency, trust, and regulatory measures to ensure market safety and stability.

BitGo-Prime Trust Deal Collapse: Impacts on Crypto Industry and Payment Partners

BitGo’s sudden cancellation of Prime Trust acquisition leaves the struggling company searching for alternative solutions amidst bankruptcy challenges, withdrawal suspensions, and legal disputes. The fate of Prime Trust remains uncertain, impacting the crypto market, customers, and partners.

TrueUSD Under Attack: Prime Trust Insolvency Sparks Short Frenzy and Skepticism

After Prime Trust insolvency, traders are shorting stablecoin TrueUSD (TUSD) despite TUSD denying exposure to Prime Trust. TUSD’s Curve Pool reserves hit 61% and short bets continue to rise. Investors must carefully assess risks surrounding TUSD’s connection to Prime Trust and its ability to maintain its $1 peg before making decisions.

Crypto Custodian Prime Trust’s Crisis: Market Trust at Risk and Regulatory Reform Needs

Crypto custodian Prime Trust is reportedly “critically deficient,” facing a cease and desist order from the Nevada Department of Business and Industry, due to a “shortfall of customer funds.” The firm’s financial situation has “considerably deteriorated,” leading to inability to honor customer withdrawals and raising concerns for customers’ assets and investments.

Navigating Stablecoin Challenges: TrueUSD’s Resilience Amid Prime Trust Troubles

TrueUSD announced its TUSD stablecoin has no exposure to the troubled Prime Trust, which halted all fiat and crypto deposits and withdrawals. Despite a temporary halt in minting activities, TrueUSD maintains multiple partnerships and “USD rails” for continuity of service, highlighting the importance of stablecoin issuers’ resilience to disruptions and the need for transparency and safeguards within the digital asset space.

Collapsed BitGo-Prime Trust Deal: A Red Flag for Crypto Banking Stability?

The collapse of the acquisition between BitGo and Prime Trust highlights inherent risks and instability in the crypto banking industry. With setbacks generating significant concern about the stability and regulatory standing of crypto banks, investors and participants must remain vigilant and cautious when dealing with related ventures.

Terminated BitGo-Prime Trust Acquisition: Unraveling the Mystery and Impact on Crypto Future

Wallet infrastructure provider BitGo announced the sudden termination of its acquisition of fintech infrastructure provider Prime Trust, only two weeks after revealing its non-binding letter of intent. This development follows rumors about a possible cease and desist order received by Prime Trust and its payments subsidiary Banq filing for bankruptcy protection.

BitGo-Prime Trust Acquisition Collapse: Lessons and Future of Crypto Mergers

BitGo terminated its plans to acquire Prime Trust, a US-based crypto company, citing ongoing issues with Prime Trust’s deposits. This development raises questions about the future of mergers and acquisitions in the crypto industry, highlighting the importance of regulation and oversight for the sector’s stability and growth.

Haru Invest Struggles: A Stark Reminder on Trust, Transparency, and Caution in Blockchain World

South Korean crypto yield platform Haru Invest is terminating contracts of over 100 employees, following its suspension of withdrawals and deposits due to service partner issues. The company’s struggle to maintain normal operations led to this decision, raising concerns among crypto enthusiasts and users regarding platform stability and user trust.

AI Safety Legislation: Balancing Innovation and Public Trust in the Era of Artificial Intelligence

US Senate Majority Leader Chuck Schumer plans to call for comprehensive legislation regarding AI safety measures, emphasizing bipartisan action from Congress. Addressing safe innovation, privacy, biases, and misinformation, Schumer aims to ensure responsible and secure AI development while maintaining public trust in the technology.

Grayscale Bitcoin Trust Soars Amid BlackRock ETF Filing: Pros and Cons of Market Competition

Grayscale Bitcoin Trust (GBTC) trading activity soared following BlackRock’s Bitcoin ETF filing, with its share price skyrocketing by 11.40%. As more financial institutions apply for spot-Bitcoin ETFs, Grayscale’s market dominance could be at risk amid competition and substantial fees imposed on traders.

Unlocking the Power of Layer-1 Marketing in the Blockchain World: Building Trust and Loyalty

A solid marketing strategy for blockchain projects begins with establishing a strong brand identity, or layer-1, encompassing values, ideas, narratives, and visuals. Integrating essential characteristics like decentralization, immutability, transparency, and longevity can lead to long-term success and valuable connections with the target audience.

Crypto Community Rallies to Fund Investigator’s Defamation Defense: Trust vs Legal Influence

The crypto community, including Binance and Justin Sun, has donated over $1 million in stablecoins and tokens to blockchain investigator ZachXBT for his legal defense against defamation charges filed by NFT trader MachiBigBrother. The case highlights the importance of independent investigators, the strong bond within the crypto community, and the potential risks crowdfunding might bring to legal proceedings.

Tether Account Deactivations: Investigating the Mystery and Its Impact on Crypto Trust

Tether Holdings deactivates 29 major cryptocurrency firm accounts, including MoonPay, BlockFi, CMS Holdings, and Galois Capital, without disclosing explicit reasons. The NYAG investigation reveals this, sparking concerns about transparency and communication in the growing crypto space.

Big Eyes Coin Debacle: Lessons in Trust, Loss, and Crypto Scams

The Big Eyes coin ($BIG) experienced a massive price drop immediately after listing on Uniswap, leading to severe losses for investors and raising questions about the project’s legitimacy. With comparisons to potential ‘rug pulls’, the community weighs its future amid additional red flags and a current low market cap of approximately $1 million.

NFT Trader Sues Blockchain Detective: Legal Battle Highlights Trust & Accountability Issues

NFT trader MachiBigBrother sues blockchain detective ZachXBT for defamation, claiming reputational and monetary harm. This high-profile legal battle raises questions about independent investigators’ role in the crypto space and potential consequences of their findings, influencing future investigations and community-driven oversight.

BlackRock’s iShares Bitcoin Trust: ETF or Trust? Liquidity Boost vs Market Concerns

BlackRock’s iShares unit has filed for a spot Bitcoin ETF, potentially impacting exchanges and paper bitcoin concepts. The approval of this iShares Bitcoin Trust could alleviate liquidity issues and challenge existing marketplaces, while also raising questions about the growth of paper bitcoin and its implications on the overall market.

Grayscale Bitcoin Trust Discount Shrinks: BlackRock’s ETF Impact and the Crypto Investment Future

Grayscale Bitcoin Trust (GBTC) experienced a reduction in its discount following BlackRock’s filing for a bitcoin ETF, surging by over 8%. While GBTC’s discount hovers around 40%, and Grayscale is involved in a legal dispute with the SEC, BlackRock’s ETF application may potentially lead to significant changes in the investment landscape for crypto enthusiasts.

Navigating Cryptocurrency News: Reliability, Market Impact, and the Role of Trust

Cryptocurrency enthusiasts emphasize the importance of accurate and reliable information for maintaining trust and credibility in the rapidly evolving market. News sources play a crucial role, but occasional errors can lead to doubt and speculation. It’s essential for readers to exercise caution, cross-verifying information for informed decisions, and supporting a transparent cryptocurrency ecosystem.

Terraform Labs Co-Founder’s Legal Woes: A Turning Point for Crypto Industry Trust and Regulations

Terraform Labs co-founder Do Kwon faces legal troubles in Montenegro over document forgery allegations. His prolonged detainment and potential extradition to South Korea has the global crypto community concerned about its impact on the legitimacy and stability of the emerging crypto industry.

iShares Bitcoin Trust ETF: A Path to Mainstream Acceptance or Centralization Risk?

BlackRock’s iShares unit submitted an application to establish a spot bitcoin ETF, known as the iShares Bitcoin Trust. If approved by the SEC, it could pave the way for mainstream acceptance, widespread investor interest, and increased trust in digital assets while accelerating the push for a blockchain-based economy.